Dogecoin And Tesla Stock: Examining The Correlation With Elon Musk

Table of Contents

Elon Musk's Influence on Dogecoin and Tesla Stock

Elon Musk's impact on both Dogecoin and Tesla's stock price is undeniable. His actions, particularly his social media activity, significantly influence market sentiment and drive price volatility.

Tweets and Social Media Power

Musk's tweets, often cryptic or humorous, have repeatedly sent shockwaves through both the cryptocurrency and stock markets. A single tweet can trigger massive price swings in both Dogecoin and Tesla stock, demonstrating the immense power of his social media influence.

- Examples: His April 2021 tweet calling Dogecoin a "hustle" initially caused a price drop, but subsequent positive tweets dramatically reversed the trend. Similarly, mentions of Dogecoin in relation to Tesla's acceptance of the cryptocurrency as payment resulted in significant price increases for both assets.

- Regulatory Implications: The SEC and other regulatory bodies are increasingly scrutinizing the impact of social media on market manipulation. Musk's influence raises significant concerns about fair market practices and the potential for insider trading allegations.

- Psychological Factors: Investors often react emotionally to Musk's pronouncements, leading to herd behavior and amplified price fluctuations. Fear of missing out (FOMO) plays a significant role in driving speculative trading, particularly in volatile assets like Dogecoin.

Tesla's Acceptance of Dogecoin

Tesla's brief acceptance of Dogecoin as a payment method for certain merchandise in early 2021 created a significant ripple effect. While short-lived, this decision highlighted the intertwined fates of the cryptocurrency and Tesla stock.

- Policy Details: Tesla allowed customers to purchase some merchandise using Dogecoin for a limited period.

- Market Reaction: The announcement initially caused a surge in both Dogecoin and Tesla stock prices, showcasing the market's immediate response to Musk's actions and Tesla's involvement with cryptocurrency. However, the subsequent reversal of the policy led to price corrections.

- Comparison to Other Cryptos: Unlike Bitcoin or Ethereum, which have been accepted by a wider range of businesses, Dogecoin's acceptance by Tesla was a unique event heavily influenced by Musk's personal endorsement.

Understanding the Correlation (or Lack Thereof)

While a perceived correlation exists between Dogecoin and Tesla stock, determining a statistically significant relationship requires careful analysis.

Statistical Analysis of Price Movements

Studies examining the correlation between Dogecoin and Tesla stock price movements often yield mixed results.

- Correlation Coefficients: While some analyses show a positive correlation during specific periods, the correlation coefficient is rarely consistently high, suggesting the relationship is not consistently strong. The correlation is often weak or even non-existent outside periods of direct Musk-related news.

- Limitations of Correlation Analysis: Correlation does not equal causation. While price movements may coincide, other factors independently influence both assets.

- Other Influencing Factors: Broader market trends, regulatory changes affecting cryptocurrencies, and general investor sentiment all play a role in price fluctuations beyond Musk's influence.

Market Sentiment and Investor Behavior

Shared investor sentiment and speculative trading are key contributors to the perceived correlation.

- Herd Behavior: Investors often mimic each other's actions, leading to amplified price movements in both Dogecoin and Tesla stock.

- Fear of Missing Out (FOMO): FOMO drives many investors to buy assets they might not otherwise consider, contributing to price bubbles.

- Risk Tolerance: Investors in both Dogecoin and Tesla stock tend to have a higher risk tolerance, willing to accept significant price volatility for the potential of high returns.

The Risks of Investing Based on Perceived Correlations

Investing based solely on the perceived correlation between Dogecoin and Tesla stock is highly risky.

Volatility and Uncertainty

Both Dogecoin and Tesla stock are notoriously volatile assets. Price swings can be dramatic and unpredictable, particularly in response to Elon Musk's actions.

- Significant Price Drops: Both assets have experienced substantial price drops, demonstrating the inherent risk involved.

- Diversification: Diversifying investments across different asset classes is crucial to mitigate risk.

- Thorough Research: Before investing in any asset, thorough research is essential to understand the underlying risks and potential rewards.

Regulatory Scrutiny and Future Outlook

Increased regulatory scrutiny of Elon Musk's influence on the markets is highly probable. This could significantly impact both Dogecoin and Tesla stock in the future.

- Regulatory Changes: Regulations regarding cryptocurrency trading and the use of social media to influence markets are likely to evolve.

- Future Relationship Prediction: The future relationship between Dogecoin and Tesla stock remains uncertain. A decrease in Musk's public pronouncements on Dogecoin could significantly reduce the perceived correlation.

- Alternative Scenarios: The relationship could weaken if Musk's influence wanes or if Dogecoin fails to gain wider acceptance as a payment method or investment.

Conclusion

The relationship between Dogecoin and Tesla stock, largely driven by Elon Musk's actions, presents a fascinating case study in the complexities of modern finance and the power of social media. While a perceived correlation exists, investing based solely on this relationship is extremely risky due to its extreme volatility and dependence on a single individual's influence. Investors should always conduct thorough research, diversify their portfolios, and carefully consider the associated risks before investing in either Dogecoin or Tesla stock. Understanding the nuances of this relationship is crucial for navigating the volatile world of cryptocurrency and stock market investments. Learn more about the intricate interplay between Dogecoin and Tesla stock, and make informed investment decisions.

Featured Posts

-

Elon Musks Fortune Explodes Teslas Success And Dogecoin Departure

May 10, 2025

Elon Musks Fortune Explodes Teslas Success And Dogecoin Departure

May 10, 2025 -

Cocaine At The White House Secret Service Completes Investigation

May 10, 2025

Cocaine At The White House Secret Service Completes Investigation

May 10, 2025 -

Complete A Stephen King Series In Under 5 Hours Streaming Now

May 10, 2025

Complete A Stephen King Series In Under 5 Hours Streaming Now

May 10, 2025 -

Sudden Shift White House Withdraws Nomination Chooses Maha Influencer For Surgeon General

May 10, 2025

Sudden Shift White House Withdraws Nomination Chooses Maha Influencer For Surgeon General

May 10, 2025 -

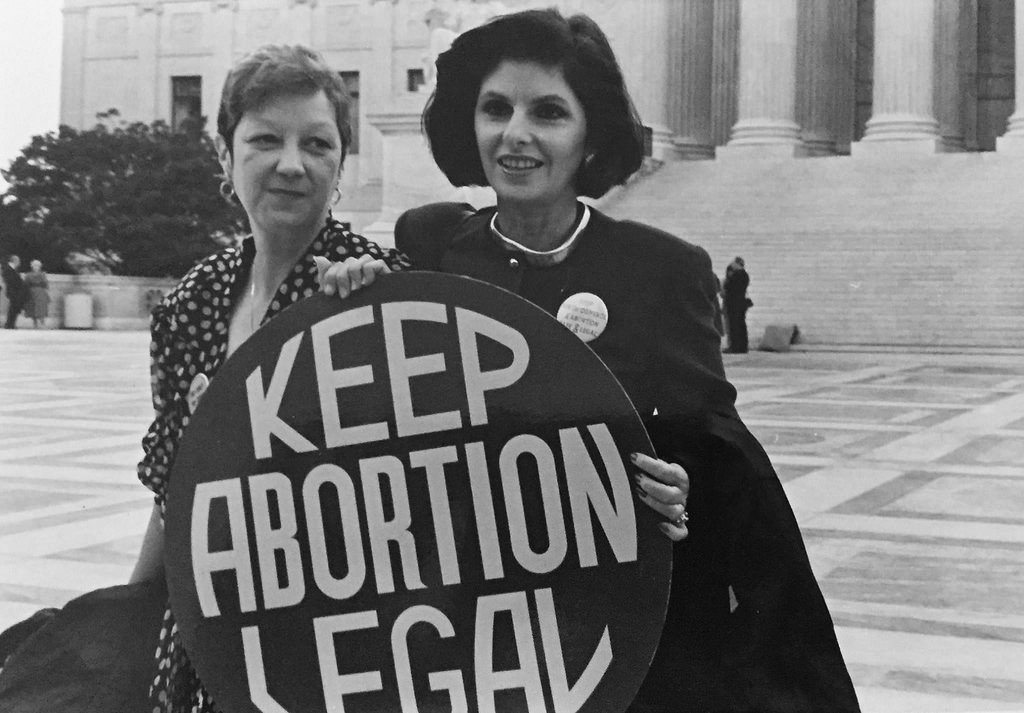

Over The Counter Birth Control Implications For Reproductive Healthcare After Roe V Wade

May 10, 2025

Over The Counter Birth Control Implications For Reproductive Healthcare After Roe V Wade

May 10, 2025