Dutch Investor's $65 Billion Stake Raises Concerns For US Money Managers

Table of Contents

Market Dominance and Competitive Pressure

The Dutch Investor's $65 billion stake has the potential to significantly alter the competitive landscape for US money managers. Such a substantial investment grants the Dutch investor considerable market share, potentially leading to increased market dominance across various sectors.

-

Impact on Specific Sectors: The technology and financial sectors are likely to experience the most immediate and significant effects. The sheer scale of the investment could allow the Dutch investor to outbid US competitors for acquisitions and talent, leading to consolidation and a reduction in the number of independent players.

-

Acquisition Strategies: We can anticipate the Dutch investor employing various strategies to acquire market share, including strategic acquisitions of existing firms, aggressive expansion into new markets, and potentially, the creation of new, disruptive technologies.

-

Displacement of Smaller Firms: Smaller US firms with less financial capital could find themselves struggling to compete effectively, leading to potential mergers, acquisitions, or even bankruptcies. This could result in a shift in market power, concentrating wealth and control in fewer hands. The competitive advantage gained by the Dutch investor through this massive investment presents a serious challenge to the existing structure of US money management.

Regulatory Scrutiny and Potential Antitrust Concerns

An investment of this magnitude is unlikely to escape regulatory scrutiny. The Dutch Investor's $65 Billion Stake is certain to draw the attention of antitrust agencies, particularly the Federal Trade Commission (FTC) and the Department of Justice (DOJ).

-

Potential Antitrust Violations: Concerns may arise regarding potential violations of antitrust laws if the investment leads to undue market concentration, stifling competition, and potentially harming consumers.

-

Regulatory Landscape: The FTC and DOJ will likely scrutinize the transaction for any anti-competitive practices, potentially delaying or even blocking the investment if deemed harmful to market competition. Strict compliance with existing regulations will be critical for the Dutch investor.

-

Investment Restrictions: The regulatory process could involve extensive investigations, hearings, and negotiations, potentially resulting in restrictions on the investor's activities or even a partial divestiture of assets. The potential for delays or restrictions adds another layer of uncertainty to the situation.

Impact on US Jobs and the Economy

The economic impact of the Dutch Investor's $65 billion stake is a complex issue with both potential positives and negatives.

-

Potential Job Losses: Job losses in affected sectors are a possibility, particularly if the investor prioritizes efficiency over workforce expansion. Consolidation and automation are likely to play significant roles.

-

Impact on Economic Growth: While the initial investment may boost certain sectors, the long-term effects on economic growth and competitiveness require careful consideration. A shift in market power towards a foreign entity could raise concerns about national economic sovereignty.

-

Potential Job Creation: Conversely, the investment could also lead to job creation through new projects, innovations, and expansion into new markets. The net effect on employment remains to be seen. Careful analysis of both job losses and potential job creation is needed to fully understand the economic consequences.

Long-Term Implications and Strategic Responses

The long-term implications of this substantial investment for the US financial landscape are far-reaching.

-

Responses from US Money Managers: US money managers will need to develop robust long-term strategies to counter the increased competition. This could involve focusing on niche markets, developing innovative products and services, or pursuing strategic alliances and mergers.

-

Market Adaptation: Adaptation to the changing market dynamics will be crucial. This requires agility, innovation, and a willingness to embrace new technologies and business models.

-

Future Investments: The Dutch Investor's $65 Billion Stake could set a precedent, potentially attracting further investments from Dutch and other international investors. This will intensify competition and reshape the US financial sector. A strategic, forward-thinking approach is essential for US companies to navigate this evolving landscape.

Conclusion: Addressing Concerns Over the Dutch Investor's $65 Billion Stake

The Dutch Investor's $65 billion stake presents a complex scenario with significant implications for US money managers and the broader economy. The potential for increased market dominance, regulatory scrutiny, and alterations in the job market and overall economic competitiveness are central concerns. The key takeaways are the potential for significant shifts in market power, the need for robust regulatory oversight, and the necessity for proactive adaptation from US firms. Stay informed about the ongoing developments surrounding this significant Dutch Investor's $65 Billion Stake and its implications for the future of US money management. Regularly check reputable financial news sources for updates on this evolving situation.

Featured Posts

-

Le Samsung Galaxy S25 Ultra 256 Go Un Top Produit A Ce Prix

May 28, 2025

Le Samsung Galaxy S25 Ultra 256 Go Un Top Produit A Ce Prix

May 28, 2025 -

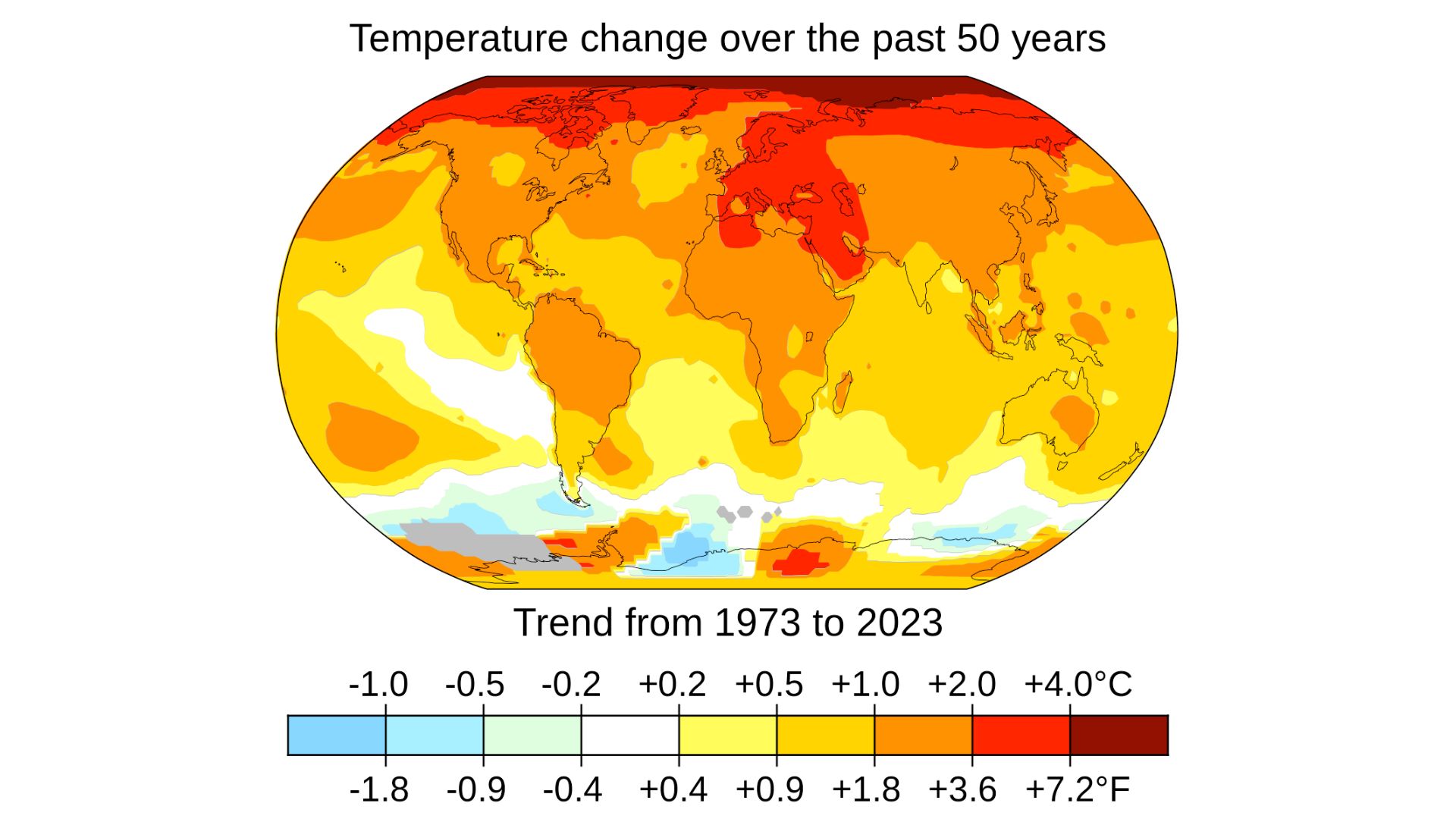

Climate Whiplash A Report On The Growing Threat To Urban Areas Globally

May 28, 2025

Climate Whiplash A Report On The Growing Threat To Urban Areas Globally

May 28, 2025 -

Promo Vente Flash Galaxy S25 Ultra 256 Go Note 5 Etoiles

May 28, 2025

Promo Vente Flash Galaxy S25 Ultra 256 Go Note 5 Etoiles

May 28, 2025 -

Prakiraan Cuaca Jawa Barat 23 April 2024 Hujan Di Bandung Hingga Sore

May 28, 2025

Prakiraan Cuaca Jawa Barat 23 April 2024 Hujan Di Bandung Hingga Sore

May 28, 2025 -

Cuaca Bali Besok Peringatan Hujan Deras Di Denpasar

May 28, 2025

Cuaca Bali Besok Peringatan Hujan Deras Di Denpasar

May 28, 2025

Latest Posts

-

Up To 30 Off Enjoy A Lavish Hotel Stay This Spring

May 31, 2025

Up To 30 Off Enjoy A Lavish Hotel Stay This Spring

May 31, 2025 -

Book Now And Save 30 Off Lavish Spring Hotel Stays

May 31, 2025

Book Now And Save 30 Off Lavish Spring Hotel Stays

May 31, 2025 -

The Reality Of Ai Navigating The Challenges Of Responsible Ai Development

May 31, 2025

The Reality Of Ai Navigating The Challenges Of Responsible Ai Development

May 31, 2025 -

Luxury Hotel Spring Break 30 Off Your Stay

May 31, 2025

Luxury Hotel Spring Break 30 Off Your Stay

May 31, 2025 -

Why Ai Doesnt Learn And How This Impacts Responsible Ai Practices

May 31, 2025

Why Ai Doesnt Learn And How This Impacts Responsible Ai Practices

May 31, 2025