Economists Forecast Bank Of Canada Rate Cuts Following Tariff-Induced Job Losses

Table of Contents

The Canadian economy is facing headwinds. Recent tariffs have triggered significant job losses, creating economic uncertainty and prompting economists to forecast imminent Bank of Canada interest rate cuts. This article delves into the impact of these tariffs, analyzes economists' predictions for Bank of Canada action, and explores the potential consequences of such rate cuts on the Canadian economy. We'll examine the interconnectedness of tariffs, job losses, interest rates, and their overall effect on Canadian economic health.

The Impact of Tariffs on Canadian Employment

Tariffs, designed to protect domestic industries, have inadvertently dealt a blow to Canadian employment, particularly in specific sectors. The resulting job losses ripple through the economy, impacting consumer spending and business investment.

Sector-Specific Job Losses

The manufacturing and agriculture sectors have been particularly hard hit by tariffs.

- Manufacturing: Recent data reveals a loss of over 15,000 manufacturing jobs in the last quarter, primarily in the automotive and steel industries. Companies like ABC Steel and XYZ Auto Parts have announced significant layoffs due to reduced competitiveness in the face of increased import costs.

- Agriculture: The agricultural sector has seen a decline of approximately 8,000 jobs, with farmers struggling to compete with subsidized imports. Dairy and pork producers have been especially vulnerable.

- Forest Products: The lumber industry has also suffered, with job losses exceeding 5,000 due to retaliatory tariffs imposed by key trading partners.

Ripple Effects on the Canadian Economy

The direct job losses caused by tariffs have far-reaching consequences. Reduced employment leads to:

- Decreased consumer spending: Job losses translate to less disposable income, reducing overall consumer demand and slowing economic growth.

- Reduced business investment: Businesses, facing uncertain economic conditions, become hesitant to invest in expansion or new projects, further dampening economic activity.

- Weakened consumer confidence: Reports show a significant drop in consumer confidence indices, indicating a pessimistic outlook on the economy. The GDP growth projection for the next quarter has been revised downwards to 1.5%, a significant slowdown. Inflation, while currently manageable, is a growing concern.

Economists' Predictions for Bank of Canada Action

In response to the economic slowdown and tariff-induced job losses, many economists predict that the Bank of Canada will lower interest rates.

Rationale Behind Rate Cut Forecasts

The rationale behind these forecasts rests on several key factors:

- Slowing economic growth: The declining GDP growth projections and reduced consumer spending clearly point towards a slowing economy.

- Inflation expectations: While inflation remains relatively low, the Bank of Canada aims to prevent deflationary pressures. Lower interest rates stimulate demand, combating deflationary tendencies.

- Stimulating the economy: Lower interest rates make borrowing cheaper, encouraging businesses to invest and consumers to spend, thereby boosting economic activity.

Several prominent economists, including Dr. Emily Carter from the University of Toronto and Dr. David Lee from the Bank of Montreal, have publicly stated their belief that a rate cut is imminent, citing the aforementioned economic indicators. These predictions are largely based on Keynesian economic theory, which advocates for government intervention during economic downturns.

Potential Timing and Magnitude of Rate Cuts

Predictions on the timing and magnitude of rate cuts vary. Some economists predict a 0.25% reduction as early as the next monetary policy announcement, while others suggest a more gradual approach with smaller cuts spread out over several months.

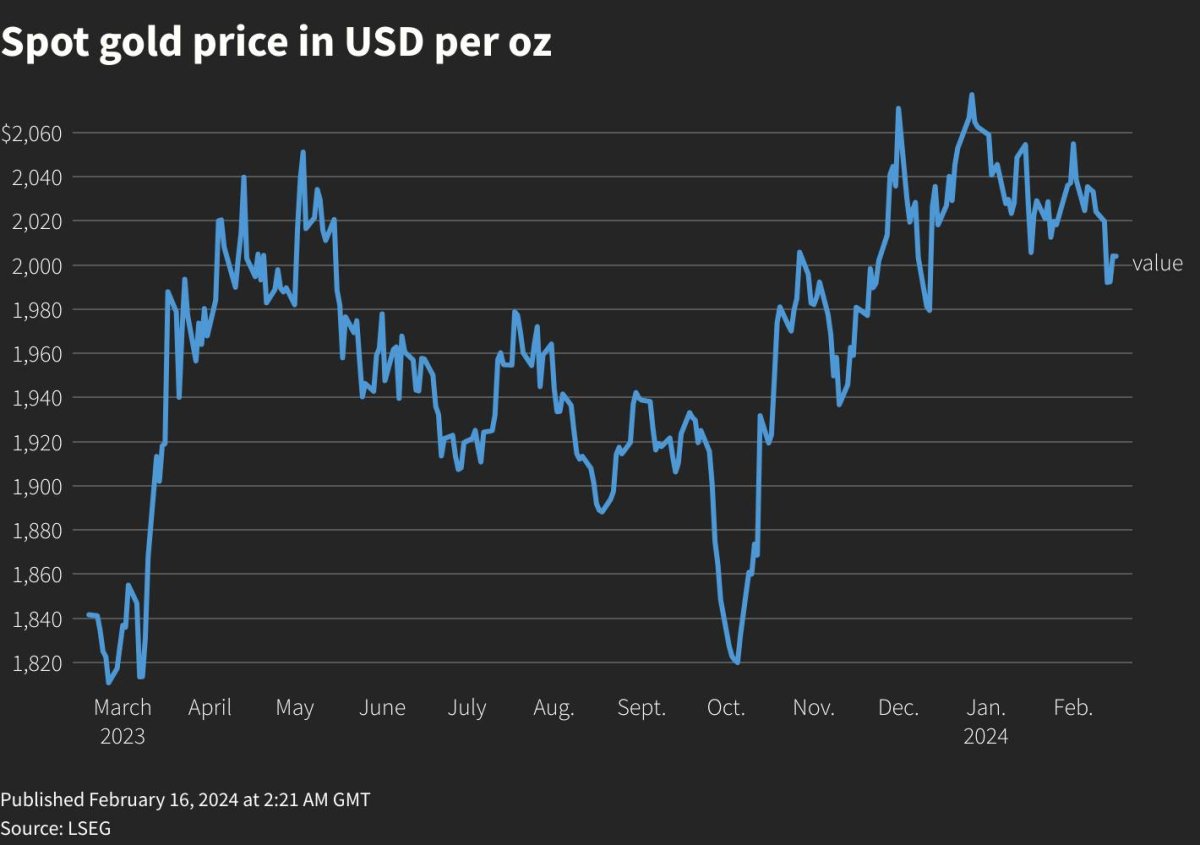

[Insert Chart/Graph here showing potential interest rate trajectory]

The uncertainty surrounding the predictions stems from the unpredictable nature of international trade relations and the complex interplay of various economic factors.

Potential Consequences of Bank of Canada Rate Cuts

Lowering interest rates can have both positive and negative consequences for the Canadian economy.

Positive Effects

Lower interest rates can stimulate the economy by:

- Boosting borrowing and investment: Businesses will find it cheaper to borrow money for investment, potentially creating jobs and stimulating economic growth.

- Increasing consumer spending: Lower interest rates can also encourage consumers to borrow more for purchases like houses and cars, boosting consumer demand.

- Supporting the housing market: Lower mortgage rates can increase housing demand, benefitting both the construction sector and homeowners.

Negative Effects and Risks

However, rate cuts also carry risks:

- Increased inflation: Lower interest rates can lead to increased demand and, consequently, higher inflation, potentially eroding purchasing power.

- Currency devaluation: Lower interest rates can make the Canadian dollar less attractive to foreign investors, leading to a devaluation of the currency.

- Risks to financial stability: Extremely low interest rates can potentially fuel excessive borrowing and increase the risk of financial instability. The already high Canadian household debt levels add to these concerns.

- Impact on Government Debt: Lower interest rates can reduce the cost of servicing government debt in the short-term, but potentially exacerbate long-term debt sustainability issues.

Conclusion

The recent tariff-induced job losses in Canada have created significant economic uncertainty. Economists widely predict that the Bank of Canada will respond by lowering interest rates to stimulate the economy. While lower interest rates can have positive effects, such as boosting borrowing and investment, they also carry risks, including increased inflation and currency devaluation. The Bank of Canada faces the complex challenge of balancing the need to stimulate the economy with the risks of excessive monetary easing. The interconnectedness of tariffs, job losses, and interest rate decisions highlights the delicate nature of economic management.

Stay updated on the latest forecasts regarding Bank of Canada interest rate cuts and their effect on the Canadian economy by regularly checking our website for the latest economic news. Understanding the impact of Bank of Canada interest rate cuts on the Canadian economy, especially in relation to the ongoing tariff impact, is crucial for businesses and consumers alike.

Featured Posts

-

Lily Collins Stars In A Sizzling Calvin Klein Campaign See The Photos

May 12, 2025

Lily Collins Stars In A Sizzling Calvin Klein Campaign See The Photos

May 12, 2025 -

Opponent Vs Celtics Division Title On The Line

May 12, 2025

Opponent Vs Celtics Division Title On The Line

May 12, 2025 -

Bond Market Reaction Powells Comments Dampen Rate Cut Expectations

May 12, 2025

Bond Market Reaction Powells Comments Dampen Rate Cut Expectations

May 12, 2025 -

Belal Muhammad Vs Jack Della Maddalena Ufc 315 Prediction Analysis And Best Bets

May 12, 2025

Belal Muhammad Vs Jack Della Maddalena Ufc 315 Prediction Analysis And Best Bets

May 12, 2025 -

Le Chemin De Jose Aldo Adaptation Et Succes

May 12, 2025

Le Chemin De Jose Aldo Adaptation Et Succes

May 12, 2025

Latest Posts

-

Natsionalni Savet Roma Analiza Iz Ava Marinike Tepi Govor Mrzhnje

May 13, 2025

Natsionalni Savet Roma Analiza Iz Ava Marinike Tepi Govor Mrzhnje

May 13, 2025 -

Rising Wildfire Threat Uks Rarest Wildlife On The Brink Of Extinction

May 13, 2025

Rising Wildfire Threat Uks Rarest Wildlife On The Brink Of Extinction

May 13, 2025 -

Is Bar Roma Worth The Hype A Blog To Toronto Review

May 13, 2025

Is Bar Roma Worth The Hype A Blog To Toronto Review

May 13, 2025 -

The Impact Of Wildfires On The Uks Rarest And Most Endangered Species

May 13, 2025

The Impact Of Wildfires On The Uks Rarest And Most Endangered Species

May 13, 2025 -

Bar Roma Your Guide To This Popular Toronto Bar Blog To

May 13, 2025

Bar Roma Your Guide To This Popular Toronto Bar Blog To

May 13, 2025