Elevated Economic Uncertainty: Inflation And Job Losses

Table of Contents

Understanding the Inflationary Spiral

Defining Inflation and its Causes

Inflation, simply put, is a general increase in the prices of goods and services in an economy over a period of time. Several types of inflation exist, including demand-pull inflation (driven by increased consumer demand) and cost-push inflation (driven by rising production costs). Several factors contribute to this current inflationary environment:

- Supply chain disruptions: Global supply chains remain strained, leading to shortages and higher prices for various goods.

- Increased energy prices: The cost of energy, a crucial input for many industries, has surged significantly, impacting production costs and consumer prices.

- Expansionary monetary policies: While intended to stimulate economic growth, some argue that overly loose monetary policies have contributed to inflationary pressures.

These factors create a dangerous feedback loop. For example:

- Rising gas prices increase transportation costs for businesses, leading to higher prices for consumers.

- Increased food costs reduce disposable income, impacting consumer spending and potentially leading to further price increases.

- This cycle, where rising prices lead to further price increases, is known as an inflationary spiral.

The Impact of Inflation on Consumers and Businesses

Inflation significantly erodes purchasing power. Consumers find their money buys less, leading to reduced consumer spending. Businesses face the challenge of managing rising costs while maintaining profitability. The impact varies across income brackets:

- Lower-income households: Are disproportionately affected as a larger percentage of their income is spent on essential goods and services whose prices are rising.

- Higher-income households: While also impacted, they generally have more financial resources to cushion the blow.

Businesses employ various strategies to mitigate inflationary pressures:

- Price adjustments: Passing increased costs onto consumers through higher prices.

- Cost-cutting measures: Reducing operational expenses to maintain profit margins.

- Increased efficiency: Optimizing processes to reduce waste and improve productivity.

The Link Between Inflation and Job Losses

Inflation's Impact on Employment

High inflation leads to decreased consumer demand as purchasing power diminishes. This forces businesses to cut costs, often resulting in layoffs, hiring freezes, and reduced investment. Central bank policies play a crucial role:

- Decreased consumer spending directly translates into reduced production needs and, consequently, job losses.

- Sectors heavily reliant on consumer discretionary spending (e.g., restaurants, retail) are particularly vulnerable to unemployment increases.

Central banks often raise interest rates to combat inflation, but this can have unintended consequences for employment:

The Role of Interest Rate Hikes

Central banks increase interest rates to cool down the economy and curb inflation. However, higher interest rates increase borrowing costs for businesses:

- Higher interest rates make it more expensive for businesses to borrow money for investments, expansion, and hiring.

- Reduced business investment can lead to slower economic growth and potential job losses, even potentially causing a recession if rate hikes are too aggressive.

Mitigating Economic Uncertainty: Strategies for Individuals and Businesses

Strategies for Individuals

Navigating this economic climate requires proactive financial management:

- Budgeting: Creating and sticking to a detailed budget is crucial to track expenses and manage spending effectively during inflationary periods.

- Saving: Building an emergency fund to cover unexpected expenses is vital.

- Investing wisely: Diversifying investments across different asset classes can help mitigate risk. Consider inflation-protected securities.

Strategies for Businesses

Businesses need to adapt and implement strategies to weather the storm:

- Cost-cutting: Identifying and eliminating unnecessary expenses while maintaining essential operations. This might involve streamlining processes, negotiating better deals with suppliers, or improving energy efficiency.

- Diversification: Expanding into new markets or product lines to reduce reliance on any single source of revenue.

- Employee retention: Investing in employee training, providing competitive compensation and benefits, and fostering a positive work environment to retain valuable employees.

Addressing Elevated Economic Uncertainty: A Path Forward

The strong correlation between inflation and job losses significantly contributes to elevated economic uncertainty. Understanding these dynamics is crucial for both individuals and businesses. Individuals must proactively manage their finances, while businesses need to adapt their strategies to maintain profitability and protect their workforce.

To navigate this challenging period, stay informed about economic trends by following reputable financial news sources and consulting with financial advisors. Develop robust strategies to mitigate the risks associated with inflation and job losses. By actively participating in shaping a more resilient economic future, we can better withstand periods of elevated economic uncertainty. For further resources on managing elevated economic uncertainty, inflation, and job losses, consult your financial advisor or explore resources from reputable economic institutions.

Featured Posts

-

El Episodio De Run Bts Con Jin Una Aventura De Accion

May 30, 2025

El Episodio De Run Bts Con Jin Una Aventura De Accion

May 30, 2025 -

Will Live Music Stocks Continue Their Slide On Friday

May 30, 2025

Will Live Music Stocks Continue Their Slide On Friday

May 30, 2025 -

Is A Single Unknown Respiratory Virus The Cause Of Kawasaki Disease New Data Suggests A Link

May 30, 2025

Is A Single Unknown Respiratory Virus The Cause Of Kawasaki Disease New Data Suggests A Link

May 30, 2025 -

Cape Cod Red Tide Emergency What You Need To Know

May 30, 2025

Cape Cod Red Tide Emergency What You Need To Know

May 30, 2025 -

Guillermo Del Toros Frankenstein A Horror Film The Directors Verdict

May 30, 2025

Guillermo Del Toros Frankenstein A Horror Film The Directors Verdict

May 30, 2025

Latest Posts

-

The Factors Behind Thompsons Monte Carlo Failure

May 31, 2025

The Factors Behind Thompsons Monte Carlo Failure

May 31, 2025 -

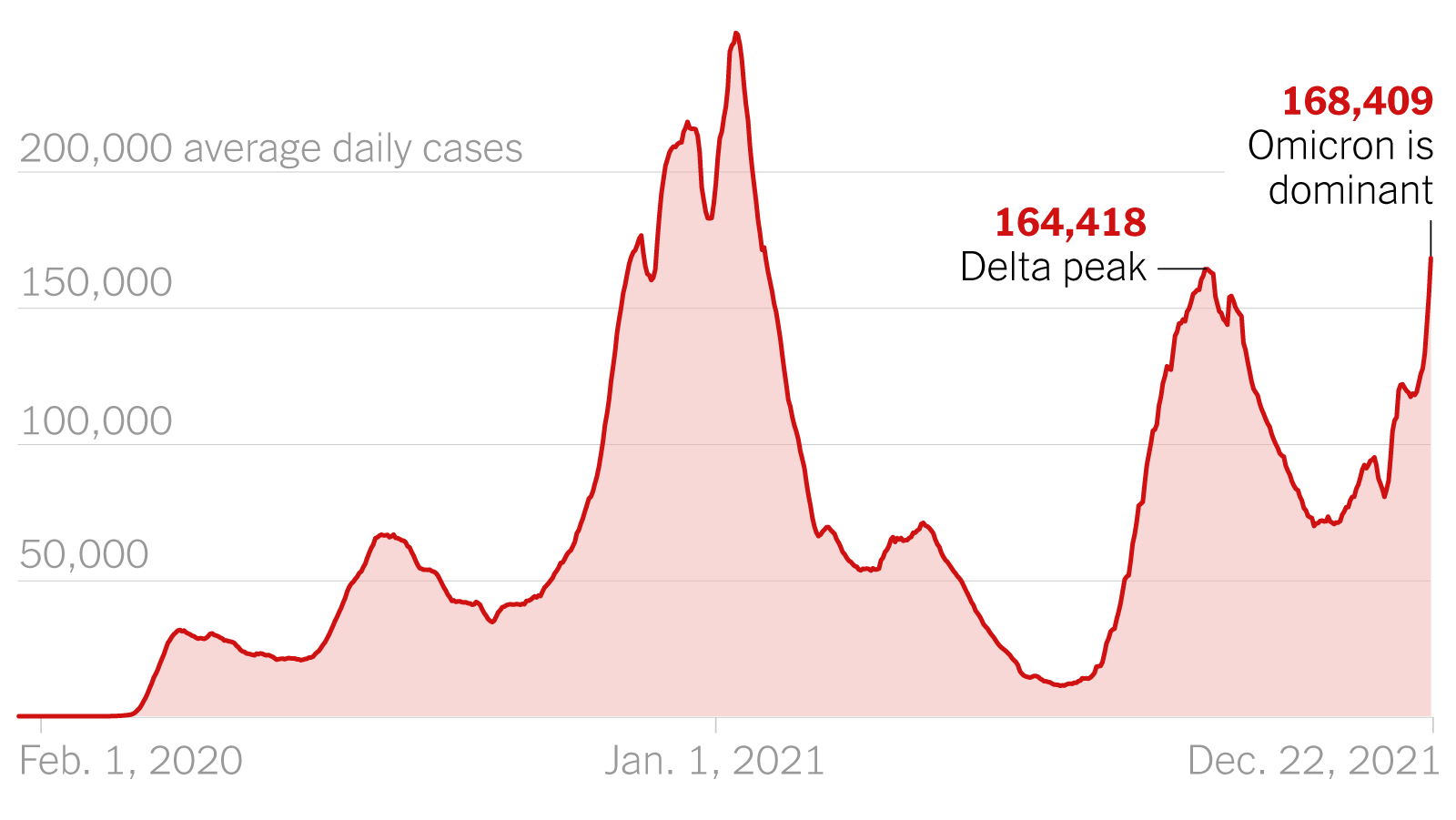

New Covid 19 Variant What We Know About The Recent Case Surge

May 31, 2025

New Covid 19 Variant What We Know About The Recent Case Surge

May 31, 2025 -

A Look At Thompsons Losses In Monte Carlo

May 31, 2025

A Look At Thompsons Losses In Monte Carlo

May 31, 2025 -

Analysis The Link Between A New Covid 19 Variant And Increased Infections

May 31, 2025

Analysis The Link Between A New Covid 19 Variant And Increased Infections

May 31, 2025 -

Thompsons Monte Carlo Challenges A Comprehensive Review

May 31, 2025

Thompsons Monte Carlo Challenges A Comprehensive Review

May 31, 2025