Elon Musk, Tesla, And Dogecoin: A Market Analysis Of Recent Losses

Table of Contents

Tesla's Stock Performance Dip: Factors Contributing to the Decline

Tesla's stock price has shown significant fluctuations recently, prompting concern among investors. Several factors contribute to this decline.

-

Macroeconomic Headwinds: Global inflation, rising interest rates, and persistent fears of a recession have negatively impacted the overall stock market, and Tesla is not immune. Increased borrowing costs make electric vehicles (EVs) more expensive, potentially dampening demand.

-

Elon Musk's Actions: Elon Musk's controversial Twitter acquisition and subsequent management decisions, coupled with his frequent and sometimes erratic tweets, have created uncertainty and negatively affected investor confidence in Tesla. His involvement in other ventures also potentially diverts resources and attention away from Tesla's core business.

-

Intensifying EV Competition: The electric vehicle market is becoming increasingly competitive, with established automakers and new entrants vying for market share. This increased competition puts pressure on Tesla's pricing strategy and profitability.

-

Specific Examples:

- Tesla's recent production delays and delivery issues have impacted investor sentiment.

- Reports of quality control issues and recalls have added to the negative news flow.

- The significant drop in Tesla's market capitalization reflects the severity of the stock price decline.

-

Expert Opinions: Many analysts have revised their price targets for Tesla stock downwards, reflecting the prevailing uncertainty surrounding the company's future performance.

Dogecoin's Price Volatility and Musk's Influence

Dogecoin, a meme-based cryptocurrency, has experienced extreme price volatility, largely influenced by Elon Musk's pronouncements.

-

Musk's Tweets and Dogecoin's Price: Musk's tweets mentioning Dogecoin have historically triggered significant price swings, demonstrating the cryptocurrency's susceptibility to market manipulation and the outsized influence of a single individual.

-

Speculative Nature: Dogecoin lacks intrinsic value and is primarily driven by speculation and hype. This makes it extremely vulnerable to shifts in sentiment and market trends.

-

Broader Crypto Market Trends: The overall cryptocurrency market's performance significantly impacts Dogecoin's price. Bearish market trends generally lead to Dogecoin price declines.

-

Specific Examples:

- Several instances demonstrate how Musk's positive tweets led to Dogecoin price surges, while negative comments caused sharp drops.

- Statistical analysis reveals a strong correlation between Musk's Twitter activity and Dogecoin's price movements.

- Compared to other cryptocurrencies, Dogecoin has exhibited significantly higher volatility.

- Regulatory uncertainty surrounding cryptocurrencies adds to the risks associated with investing in Dogecoin.

The Interconnectedness of Tesla, Dogecoin, and Elon Musk's Brand

The fortunes of Tesla and Dogecoin are inextricably linked to Elon Musk's personal brand and reputation.

-

Brand Loyalty and Investor Confidence: Investor confidence in Tesla and Dogecoin is heavily reliant on positive sentiment towards Elon Musk. Negative news concerning one area often spills over and affects the others.

-

Impact of Musk's Actions: Musk's actions significantly influence investor sentiment towards both Tesla and Dogecoin. His controversial decisions can trigger sell-offs in both assets.

-

Diversification Strategies: Investors holding Tesla stock and Dogecoin face significant risks due to this concentration. Diversifying investments across various asset classes is crucial to mitigate potential losses.

-

Specific Examples:

- Negative publicity surrounding Musk's Twitter activities directly impacted both Tesla's stock price and Dogecoin's value.

- The interconnectedness highlights the risks of concentrating investments in assets heavily reliant on a single individual's reputation and actions.

- Investors should consider diversifying their portfolios to reduce risk.

Conclusion: Navigating the Future of Tesla, Dogecoin, and Elon Musk's Investments

Our analysis reveals the significant influence of Elon Musk on both Tesla's stock performance and Dogecoin's price volatility. The recent market downturn highlights the risks associated with investments heavily tied to a single individual and the importance of understanding market dynamics. Diversifying your portfolio is crucial for mitigating potential losses. Learn more about mitigating risks in the volatile market of Elon Musk, Tesla, and Dogecoin. Thorough research and a cautious approach are vital before investing in any asset tied to Elon Musk's ventures. Informed decision-making is paramount when considering investments in Tesla stock, Dogecoin, or other assets impacted by Elon Musk's market influence. Tesla stock analysis, Dogecoin investment risks, Elon Musk market impact.

Featured Posts

-

Europa League Preview Brobbeys Power A Key Factor

May 10, 2025

Europa League Preview Brobbeys Power A Key Factor

May 10, 2025 -

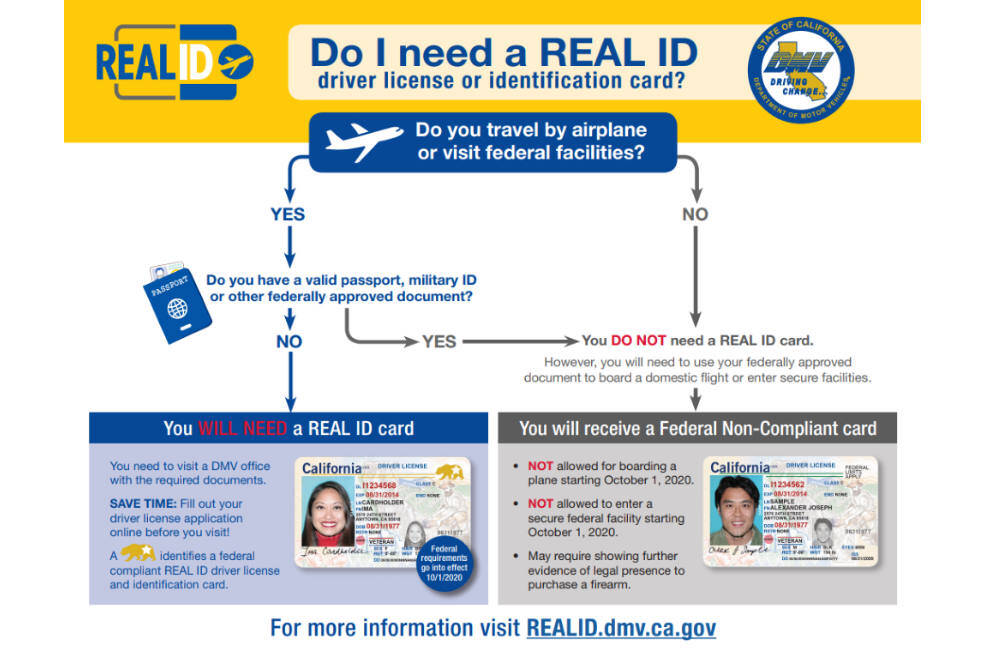

Real Id Act Impacts On Your Summer Travel Plans

May 10, 2025

Real Id Act Impacts On Your Summer Travel Plans

May 10, 2025 -

Jeanine Pirros Stock Market Warning Ignore The Market For The Next Few Weeks

May 10, 2025

Jeanine Pirros Stock Market Warning Ignore The Market For The Next Few Weeks

May 10, 2025 -

Melanie Griffith And Siblings Join Dakota Johnson At Materialist Screening

May 10, 2025

Melanie Griffith And Siblings Join Dakota Johnson At Materialist Screening

May 10, 2025 -

Netflix I Stivn King Ochakvaniyata Za Noviya Rimeyk

May 10, 2025

Netflix I Stivn King Ochakvaniyata Za Noviya Rimeyk

May 10, 2025