Jeanine Pirro's Stock Market Warning: Ignore The Market For The Next Few Weeks?

Table of Contents

Understanding Jeanine Pirro's Concerns

Jeanine Pirro's market warning isn't presented in a vacuum. Her analysis stems from a confluence of factors she perceives as potentially destabilizing. While specific details of her exact statements may vary depending on the source, her concerns generally revolve around several key areas:

-

High Inflation and Potential Recession: Pirro, like many financial commentators, expresses concern over persistent inflation and the potential for a recession. She likely points to rising interest rates and their impact on consumer spending and business investment.

-

Geopolitical Instability: Global events, such as the ongoing war in Ukraine and escalating tensions in other regions, contribute to market uncertainty. These geopolitical risks can significantly impact investor sentiment and market volatility.

-

Upcoming Economic Reports: The release of key economic indicators, like inflation figures or employment data, can cause significant market swings. Pirro's warning may be partially based on anticipation of potentially negative news in upcoming reports.

Jeanine Pirro analysis, therefore, suggests a period of heightened caution. She highlights potential risks such as:

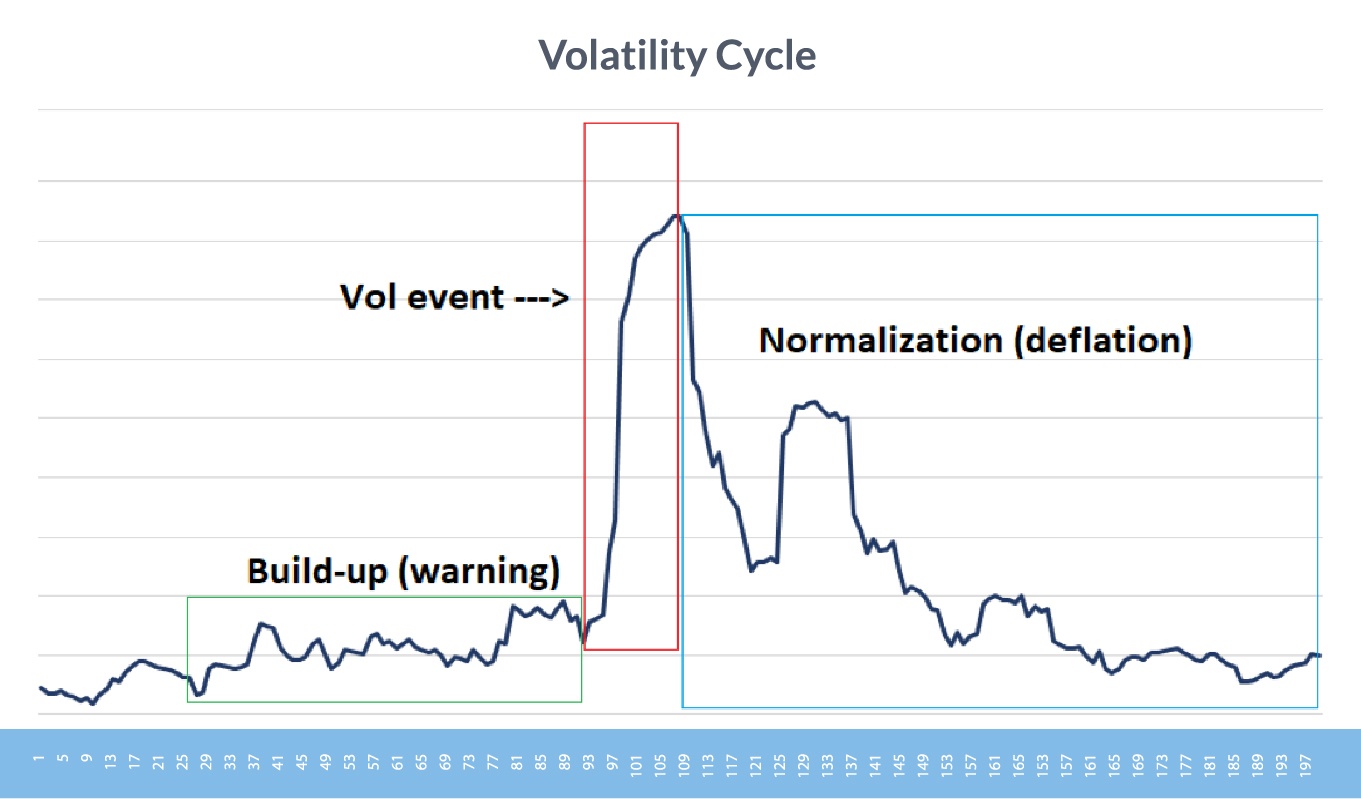

- Increased market volatility

- A potential market correction or downturn

- Erosion of investment value

Analyzing the Current Market Conditions

While understanding Jeanine Pirro's concerns is crucial, it's equally important to objectively assess the current stock market situation. A comprehensive stock market analysis requires examining various economic indicators:

-

Inflation Rates: Current inflation rates are a key factor influencing investor behavior and central bank policy. High inflation erodes purchasing power and can lead to increased interest rates.

-

Unemployment Figures: Employment data provides insight into the health of the economy. Rising unemployment can signal a weakening economy and put downward pressure on the market.

-

Interest Rates: Interest rate hikes by central banks aim to combat inflation, but they can also slow economic growth and impact investment returns.

It's essential to note that opinions on the market diverge. While Pirro expresses caution, other financial experts may hold contrasting viewpoints. A comparison of economic forecasts reveals a range of predictions, from moderate growth to a potential recession.

-

Optimistic Forecasts: Some experts point to signs of resilience in the economy, suggesting a less severe downturn than feared.

-

Pessimistic Forecasts: Others highlight the risks associated with high inflation and geopolitical uncertainty, predicting a more significant market correction.

Alternative Investment Strategies

For investors who choose to heed Pirro's warning and adopt a more cautious approach, several investment strategies exist:

-

Bonds: Bonds generally offer lower returns than stocks but are considered less volatile, providing stability during market uncertainty.

-

Precious Metals: Gold and silver are often seen as safe haven assets, potentially preserving value during periods of economic instability. However, precious metal prices can also fluctuate significantly.

-

Real Estate Investment: Real estate can offer long-term growth potential and serve as a hedge against inflation. However, it's important to note the illiquidity of real estate compared to stocks.

Effective risk management requires diversification. Spreading investments across different asset classes reduces the impact of losses in any single investment. The pros and cons of each alternative investment should be carefully weighed based on individual risk tolerance and financial goals.

The Importance of Individual Due Diligence

It's crucial to emphasize that blindly following any single opinion, including Jeanine Pirro's, is unwise. Making informed investment decisions requires thorough due diligence and consideration of individual circumstances.

-

Research: Conduct independent research to understand the current market conditions and the potential implications of various investment strategies.

-

Risk Tolerance: Assess your own risk tolerance. Are you comfortable with potentially higher returns that come with higher risk, or do you prefer a more conservative approach?

-

Financial Advisor: Consulting a qualified financial advisor is strongly recommended. They can provide personalized advice based on your individual needs, risk tolerance, and financial goals.

Following these steps ensures you make informed decisions aligned with your personal financial situation.

Conclusion: Weighing Jeanine Pirro's Stock Market Warning

Jeanine Pirro's stock market warning highlights legitimate concerns about inflation, geopolitical instability, and potential economic downturns. However, it's vital to analyze the current market conditions objectively, considering various expert opinions and economic indicators. While alternative investment strategies offer potential protection during market uncertainty, individual due diligence remains paramount. Don't ignore the market without careful consideration; understand Jeanine Pirro's stock market warning and make informed choices. Conduct thorough research and consult with a financial advisor before making any significant investment decisions based on any single source’s market analysis. Remember that responsible investment strategies tailored to your individual circumstances are key to navigating market volatility.

Featured Posts

-

Police Bodycam Captures Dramatic Rescue Of Toddler Choking On Tomato

May 10, 2025

Police Bodycam Captures Dramatic Rescue Of Toddler Choking On Tomato

May 10, 2025 -

Pakistan Stock Exchange Offline Analysis Of Current Market Volatility

May 10, 2025

Pakistan Stock Exchange Offline Analysis Of Current Market Volatility

May 10, 2025 -

Understanding The Value Proposition Of Middle Managers Benefits For Companies And Staff

May 10, 2025

Understanding The Value Proposition Of Middle Managers Benefits For Companies And Staff

May 10, 2025 -

Jeanine Pirros North Idaho Trip What To Expect From The Conservative Talk Show Host

May 10, 2025

Jeanine Pirros North Idaho Trip What To Expect From The Conservative Talk Show Host

May 10, 2025 -

Elizabeth Hurleys Maldives Bikini Vacation Sun Sand And Style

May 10, 2025

Elizabeth Hurleys Maldives Bikini Vacation Sun Sand And Style

May 10, 2025