Escaping The Trap Of Limited Funds: A Step-by-Step Plan

Table of Contents

Creating a Realistic Budget: The Foundation of Financial Freedom

A realistic budget is the cornerstone of financial freedom. Understanding where your money goes is the first step towards controlling it. Tracking your expenses allows you to identify areas of overspending and prioritize your financial goals. Several budgeting methods can help you achieve this:

- The 50/30/20 Rule: Allocate 50% of your income to needs (housing, food, transportation), 30% to wants (entertainment, dining out), and 20% to savings and debt repayment.

- Zero-Based Budgeting: Assign every dollar of your income to a specific category, ensuring your expenses equal your income.

- Envelope System: Allocate cash to different expense categories in separate envelopes, making it easier to visualize and manage spending.

To create your budget:

- Use budgeting apps (Mint, YNAB, Personal Capital) or spreadsheets to track your expenses.

- Categorize your expenses (housing, food, utilities, transportation, entertainment, etc.).

- Identify areas where you can potentially cut back on spending.

- Track your expenses diligently for at least a month to gain a clear picture of your spending habits. Consistent expense tracking is crucial for personal finance success. Effective budgeting tips often involve using budgeting apps to streamline the process.

Smart Saving Strategies: Building Your Financial Cushion

Saving money is crucial for building a financial cushion and achieving your goals. Whether it's an emergency fund, a down payment on a house, or retirement savings, establishing clear saving goals is essential. Several strategies can help you save effectively:

- Automatic Transfers: Set up automatic transfers from your checking account to your savings account each month, even if it's a small amount.

- Saving Challenges: Participate in saving challenges, such as the 52-week challenge, to build momentum and stay motivated.

Here are some additional tips for maximizing your savings:

- Start small and gradually increase your savings as your income grows.

- Utilize high-yield savings accounts to earn a higher interest rate on your savings.

- Once you've built a solid emergency fund (ideally 3-6 months of living expenses), explore investment options to grow your money. Consider investment strategies that align with your risk tolerance and financial goals.

- Automate your savings to make it effortless and consistent. This makes saving less of a conscious effort and more of a system. Saving money tips often emphasize automation.

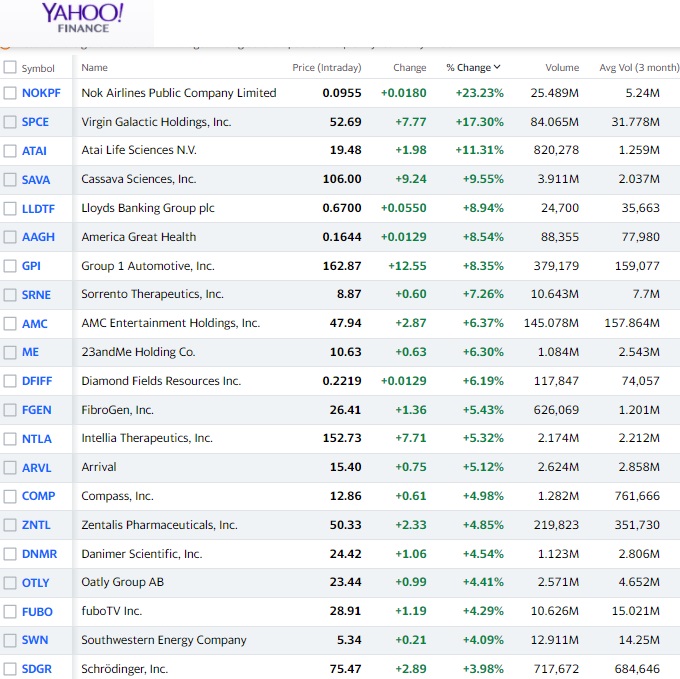

Increasing Your Income: Exploring Additional Revenue Streams

Increasing your income can significantly improve your financial situation and accelerate your progress toward escaping the trap of limited funds. Consider these options:

- Side Hustles: Explore various side hustle ideas, such as driving for a ride-sharing app, participating in online surveys, selling crafts online, or offering freelance services based on your skills.

- Freelance Work: Leverage your skills to find freelance work on platforms like Upwork or Fiverr.

- Negotiating a Raise: Research industry salaries and present a compelling case for a raise to your employer.

- Upskilling/Reskilling: Invest in yourself by learning new skills to increase your earning potential and open doors to higher-paying jobs.

By actively pursuing increase income opportunities and diversifying your revenue streams, you'll be well on your way to greater financial stability. Remember to research thoroughly and choose options aligned with your skills and passions. The key is identifying what you can make money online doing, effectively building a reliable additional income stream.

Managing Debt Effectively: Breaking Free from Financial Obligations

Debt can significantly hinder your financial progress. To manage debt effectively, you'll need a plan:

- Debt Snowball Method: Pay off your smallest debt first to build momentum and motivation, then move on to the next smallest.

- Debt Avalanche Method: Prioritize paying off the debt with the highest interest rate first to minimize the total interest paid.

Here's what to do to manage and pay off debt:

- Create a detailed debt repayment plan, outlining your payment strategy and timelines.

- Prioritize high-interest debts to save money on interest payments.

- Negotiate with creditors for lower interest rates or more manageable payment plans. This might involve debt consolidation. Debt reduction strategies often involve negotiation.

- Avoid accumulating new debt while working to pay off existing debt.

Effective debt management is vital to escape the trap of limited funds. Understanding interest rates and fees is essential for making informed decisions.

Conclusion: Take Control of Your Finances and Escape the Trap

Escaping the trap of limited funds requires a multi-pronged approach. By creating a realistic budget, implementing smart saving strategies, exploring ways to increase your income, and managing your debt effectively, you can significantly improve your financial situation. Consistent effort and planning are key. Start building your financial future today by creating a realistic budget and exploring ways to escape the trap of limited funds. Your journey to financial freedom starts now!

Featured Posts

-

Young Entrepreneurs Journey Building A Food Business In Louth And Beyond

May 21, 2025

Young Entrepreneurs Journey Building A Food Business In Louth And Beyond

May 21, 2025 -

Ex Tory Councillors Wifes Tweet Appeal Await The Verdict On Racial Hatred Charges

May 21, 2025

Ex Tory Councillors Wifes Tweet Appeal Await The Verdict On Racial Hatred Charges

May 21, 2025 -

The Uncertain Future Of Clean Energy Navigating Opposition And Expansion

May 21, 2025

The Uncertain Future Of Clean Energy Navigating Opposition And Expansion

May 21, 2025 -

Understanding Cassis Blackcurrant A Deep Dive Into Its Unique Properties

May 21, 2025

Understanding Cassis Blackcurrant A Deep Dive Into Its Unique Properties

May 21, 2025 -

Bbc Antiques Roadshow Leads To Arrest Of American Couple In The Uk

May 21, 2025

Bbc Antiques Roadshow Leads To Arrest Of American Couple In The Uk

May 21, 2025

Latest Posts

-

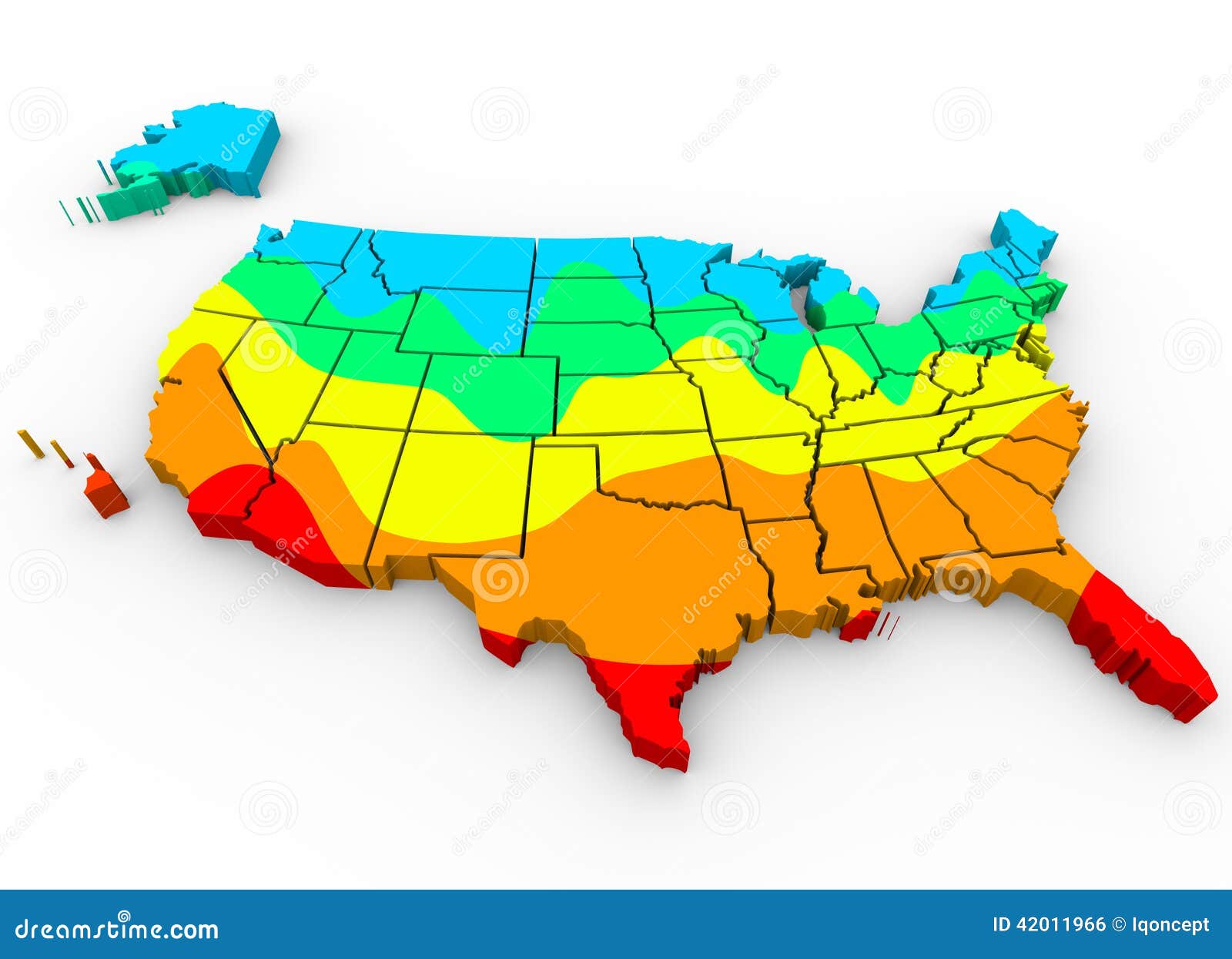

Growth Opportunities Mapping The Countrys Evolving Business Hot Spots

May 21, 2025

Growth Opportunities Mapping The Countrys Evolving Business Hot Spots

May 21, 2025 -

Understanding The Countrys Shifting Business Landscape

May 21, 2025

Understanding The Countrys Shifting Business Landscape

May 21, 2025 -

Exploring New Business Opportunities A Map Of The Countrys Hottest Areas

May 21, 2025

Exploring New Business Opportunities A Map Of The Countrys Hottest Areas

May 21, 2025 -

The Countrys Top Business Hot Spots Where To Invest Now

May 21, 2025

The Countrys Top Business Hot Spots Where To Invest Now

May 21, 2025 -

The Challenge Of Bringing Factory Jobs Back To The Us Workforce And Reality

May 21, 2025

The Challenge Of Bringing Factory Jobs Back To The Us Workforce And Reality

May 21, 2025