Euronext Amsterdam Soars: 8% Stock Increase Follows Trump Tariff Decision

Table of Contents

Analysis of the 8% Stock Increase on Euronext Amsterdam

The 8% increase, primarily reflected in the AEX index (Amsterdam Exchange Index), represents a significant shift in the Euronext Amsterdam stock market. Trading volumes increased substantially during this period, indicating heightened investor activity and a strong market sentiment. This surge was not a singular event; rather, it was a culmination of several factors:

- Positive Reaction to the Trump Tariff Decision: While seemingly counterintuitive, the specific Trump tariff decision (which needs to be specified here with the exact details of the decision impacting Euronext Amsterdam positively) was interpreted by many investors as potentially less detrimental than initially feared. This led to a wave of buying, driving up prices.

- Impact on Specific Sectors: Certain sectors within the Euronext Amsterdam market, notably technology and financials, experienced disproportionately high gains. This suggests that specific companies within these sectors were uniquely positioned to benefit from the altered trade landscape.

- Influence of Investor Confidence and Speculation: A surge in investor confidence, fueled by speculation about future economic growth and market recovery, also contributed significantly to the stock increase. This positive sentiment encouraged investors to enter the market, further boosting prices.

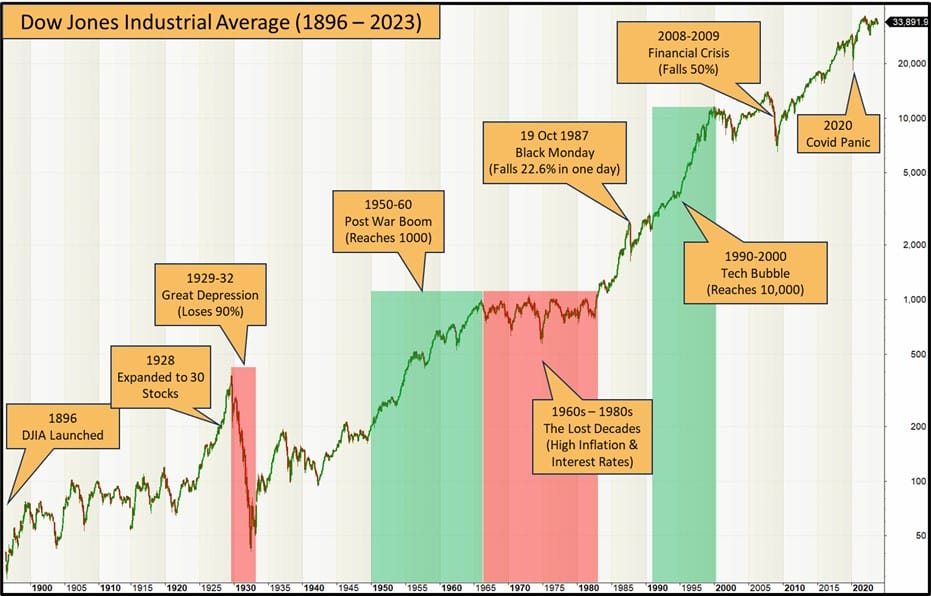

[Insert chart or graph illustrating the AEX index performance during the period of the 8% increase]

Impact of Trump Tariff Decisions on European Markets, Particularly Euronext Amsterdam

Trump's tariff policies have had a multifaceted impact on the European Union, creating both opportunities and challenges. The specific tariff decision in question (again, needs specific details) directly affected several companies listed on Euronext Amsterdam, leading to the observed market reaction. The long-term effects remain uncertain, but potential outcomes include:

- Opportunities for Growth: Some sectors could experience accelerated growth due to redirected trade flows or increased domestic demand.

- Risks and Challenges: Businesses operating in sectors directly impacted by the tariffs face significant challenges, including reduced competitiveness and potential job losses.

- Potential for Future Market Volatility: The ongoing uncertainty surrounding trade relations between the US and the EU could lead to continued market volatility on Euronext Amsterdam and other European exchanges.

The overall economic implications for the Netherlands, home to Euronext Amsterdam, are complex and require careful consideration of the interplay between various sectors and international trade dynamics.

Euronext Amsterdam's Position and Future Outlook

Euronext Amsterdam holds a significant position within the European stock market landscape. The recent surge demonstrates its resilience and potential for growth. However, predicting future performance requires careful consideration of various factors:

- Short-term Market Forecast: (Insert short-term market forecast based on expert opinions and current market trends. Be cautious with predictions and use qualifiers like "potential" and "likely.")

- Long-term Investment Opportunities: (Discuss potential long-term investment opportunities on Euronext Amsterdam, highlighting sectors likely to experience growth.)

- Factors that Could Influence Future Performance: (Include factors such as geopolitical events, economic indicators, and regulatory changes that could impact future performance.)

[Include quotes from relevant financial experts or market analysis reports to support the predictions.]

Investor Response and Trading Activity on Euronext Amsterdam

The 8% stock increase on Euronext Amsterdam triggered a diverse range of investor responses. Trading activity intensified, with significant shifts in buy and sell orders reflecting a dynamic market.

- Buy and Sell Orders: (Describe the observed patterns in buy and sell orders, detailing the volume and timing of transactions.)

- Investment Strategies Employed: (Analyze the different investment strategies employed by investors in response to the market surge.)

- Risk Assessments Made by Investors: (Discuss how investors assessed the risks associated with the market volatility and the potential long-term consequences of the Trump tariff decision.)

A significant shift in investment strategies is likely to continue as investors reassess their portfolios in light of the changing geopolitical landscape and its implications for Euronext Amsterdam.

Conclusion: Euronext Amsterdam's Future and Investment Opportunities

The 8% stock increase on Euronext Amsterdam following the Trump tariff decision underscores the market's sensitivity to global trade policies. While the short-term impact is clear, the long-term consequences remain uncertain. Monitoring Euronext Amsterdam's performance, understanding the interplay between global trade and the Dutch economy, and staying informed about relevant market analyses are crucial for investors. Before making any investment decisions related to Euronext Amsterdam stocks, it is essential to conduct thorough research and, if necessary, consult with a qualified financial advisor. Consider exploring further resources and insights into the Euronext Amsterdam market to make well-informed choices.

Featured Posts

-

Hamiltons Classy Act New F1 Testing Footage Shows Support For Former Teammate

May 25, 2025

Hamiltons Classy Act New F1 Testing Footage Shows Support For Former Teammate

May 25, 2025 -

Gauff Advances To Italian Open Final After Three Set Victory Over Zheng

May 25, 2025

Gauff Advances To Italian Open Final After Three Set Victory Over Zheng

May 25, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf How Net Asset Value Impacts Your Investment

May 25, 2025

Amundi Dow Jones Industrial Average Ucits Etf How Net Asset Value Impacts Your Investment

May 25, 2025 -

Fabrication De Charentaises A Saint Brieuc Une Tradition Qui Perdure

May 25, 2025

Fabrication De Charentaises A Saint Brieuc Une Tradition Qui Perdure

May 25, 2025 -

Florida Film Festival Spotting Mia Farrow And Christina Ricci

May 25, 2025

Florida Film Festival Spotting Mia Farrow And Christina Ricci

May 25, 2025