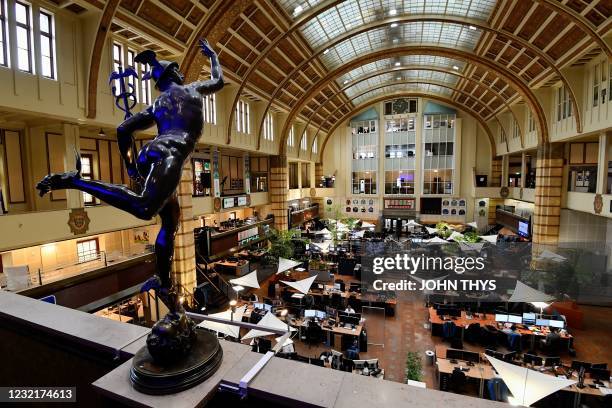

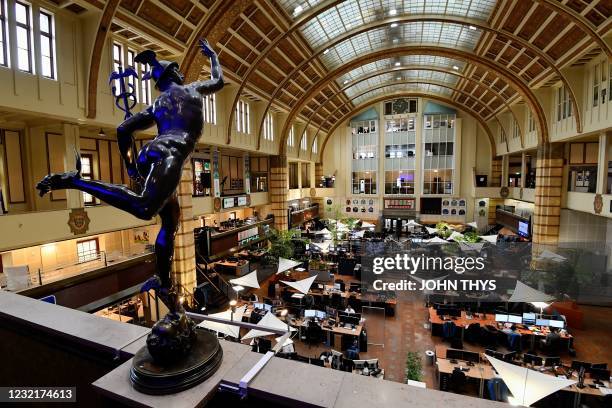

Euronext Amsterdam Stock Market: 8% Surge Following Trump's Tariff Decision

Table of Contents

Trump's Tariff Decision and its Immediate Impact on Euronext Amsterdam

President Trump's decision, while needing specific details inserted here (e.g., "the announcement of a temporary suspension of tariffs on certain steel imports from the EU"), had an immediate and dramatic effect on the Euronext Amsterdam. The 8% surge occurred within hours of the announcement, demonstrating the market's rapid responsiveness to such news. This reaction highlights the high level of market volatility currently present.

- Specific Tariff Decision: [Insert details of the specific tariff decision here. Be precise and link to credible news sources.]

- Immediate Reaction: The Euronext Amsterdam index experienced an 8% increase within [ timeframe, e.g., the first hour of trading] following the announcement. This was a significant and largely unexpected jump.

- Sectoral Gains: The technology and financial sectors experienced some of the most significant gains, suggesting investor confidence in these particular areas. [Insert specific examples of companies and their percentage increases if available].

- Market Sentiment: Initial market sentiment was overwhelmingly positive, indicating relief and optimism amongst investors. However, the long-term implications require further analysis.

Analyzing the Reasons Behind the Euronext Amsterdam Surge

The surge in the Euronext Amsterdam wasn't solely a reaction to the tariff decision itself; rather, it was a complex interplay of factors.

- Anticipation and Relief: There was significant anticipation leading up to the decision, with investors holding their breath. The decision, if perceived as positive (e.g., a lessening of trade tensions), likely resulted in a wave of relief buying.

- Impact on Specific Industries: Industries directly impacted by tariffs (e.g., steel, manufacturing) likely saw disproportionate gains. Conversely, sectors indirectly affected might have seen more moderate increases or even declines. [Provide specific examples]

- Short-Term or Long-Term Trend?: It is too early to definitively determine whether this 8% surge is a short-term market correction or a signal of a longer-term trend. Continued monitoring of market activity and economic indicators is essential.

The Broader Implications for the European Economy and Global Markets

The Euronext Amsterdam surge didn't happen in isolation; it had significant implications for the broader European economy and global markets.

- Ripple Effects on Other European Markets: The positive sentiment from the Euronext Amsterdam spilled over to other European stock markets, although the extent varied depending on the individual market's composition and sensitivity to US trade policy.

- Impact on EU-US Trade Relations: The tariff decision's long-term consequences for EU-US trade relations remain uncertain. It could signify a temporary de-escalation or could merely be a tactical maneuver.

- Global Economic Stability and Investor Confidence: While this event may appear positive, it doesn't eliminate underlying uncertainties. The broader global economic climate, geopolitical factors, and future policy decisions will continue to shape investor confidence.

- Investment Opportunities and Risks: Investors must carefully assess both the opportunities and risks presented by this situation. While the immediate surge was positive, prolonged uncertainty remains.

Long-Term Outlook for Euronext Amsterdam and Investment Strategies

Predicting the future of the Euronext Amsterdam is inherently challenging, but a cautiously optimistic outlook seems plausible, depending on continued positive US-EU relations.

- Market Forecast: [Insert cautiously optimistic/pessimistic forecast, supported by credible sources and economic indicators. Be specific, mentioning potential growth sectors].

- Investment Strategies: Investors should consider a diversified portfolio, allocating investments across various sectors and geographies to mitigate risk. Research and due diligence are key.

- Risk Assessment: While the short-term outlook may seem positive, investors should still perform thorough risk assessments. Geopolitical risks, changes in interest rates, and unexpected economic shocks could impact the market.

- Diversification and Risk Management: Diversification is essential to manage risk. Investors should also consider hedging strategies to protect against potential market downturns.

Conclusion

The 8% surge in the Euronext Amsterdam stock market following President Trump's tariff decision highlights the significant impact of political and economic events on global markets. While the immediate reaction was positive, understanding the underlying reasons and potential long-term implications is crucial for investors. The Euronext Amsterdam's volatility underscores the need for careful monitoring and strategic investment planning.

Call to Action: Stay informed about developments in the Euronext Amsterdam and global markets to make informed investment decisions. Continue following our analysis of the Euronext Amsterdam stock market for the latest updates and insights on navigating this dynamic environment. Learn more about investing in the Euronext Amsterdam market today!

Featured Posts

-

Na Uitstel Trump Aex Herstel En Winsten Voor Alle Fondsen

May 24, 2025

Na Uitstel Trump Aex Herstel En Winsten Voor Alle Fondsen

May 24, 2025 -

Major Losses Continue At Amsterdam Stock Exchange

May 24, 2025

Major Losses Continue At Amsterdam Stock Exchange

May 24, 2025 -

Net Asset Value Nav Of Amundi Msci World Ex United States Ucits Etf Acc Explained

May 24, 2025

Net Asset Value Nav Of Amundi Msci World Ex United States Ucits Etf Acc Explained

May 24, 2025 -

Emergency Services Respond To Overturned Vehicle On M56 Motorway

May 24, 2025

Emergency Services Respond To Overturned Vehicle On M56 Motorway

May 24, 2025 -

Relx Ai Strategie Zorgt Voor Sterke Groei Zelfs In Economisch Moeilijke Tijden

May 24, 2025

Relx Ai Strategie Zorgt Voor Sterke Groei Zelfs In Economisch Moeilijke Tijden

May 24, 2025

Latest Posts

-

Understanding High Stock Market Valuations Bof As Investor Guidance

May 24, 2025

Understanding High Stock Market Valuations Bof As Investor Guidance

May 24, 2025 -

The Thames Water Case Executive Bonuses And The Water Crisis

May 24, 2025

The Thames Water Case Executive Bonuses And The Water Crisis

May 24, 2025 -

Dismissing Stock Market Valuation Concerns Insights From Bof A

May 24, 2025

Dismissing Stock Market Valuation Concerns Insights From Bof A

May 24, 2025 -

Are Thames Water Executive Bonuses Justified A Critical Analysis

May 24, 2025

Are Thames Water Executive Bonuses Justified A Critical Analysis

May 24, 2025 -

The Thames Water Bonus Controversy Examining Executive Compensation

May 24, 2025

The Thames Water Bonus Controversy Examining Executive Compensation

May 24, 2025