Falling Iron Ore Prices: Analyzing China's Steel Output Reduction Strategy

Table of Contents

China's Steel Output Reduction: A Multi-Pronged Approach

China's decision to decrease steel production is driven by a complex interplay of environmental concerns, economic realities, and targeted government policies.

Environmental Regulations and Carbon Emission Targets

China's commitment to achieving its carbon neutrality goals is significantly impacting its steel industry. The country is implementing stringent environmental regulations aimed at reducing carbon emissions from steel mills. This includes stricter limits on particulate matter and sulfur dioxide emissions, pushing steel producers to adopt cleaner technologies and production methods. The burgeoning carbon trading scheme further incentivizes emissions reduction by putting a price on carbon, increasing the cost of steel production for companies that fail to meet stringent standards.

- Examples of specific environmental regulations: Implementation of Ultra-Low Emission standards (ULE), stricter discharge limits for wastewater, and increased monitoring of air quality around steel plants.

- Penalties for non-compliance: Hefty fines, temporary or permanent shutdowns of facilities, and even criminal charges for severe violations.

- Targets for emissions reduction: Ambitious goals set for reducing carbon intensity in the steel sector, aligning with China's broader climate commitments.

Economic Slowdown and Reduced Infrastructure Spending

China's economic slowdown, particularly its real estate sector crisis, has significantly reduced demand for steel. Large-scale infrastructure projects, a major driver of steel consumption, are being scaled back or postponed, directly impacting the demand for steel products. The slowdown in the real estate market, marked by decreased construction activity, further exacerbates this decreased demand.

- Statistics on GDP growth: A noticeable decline in recent GDP growth rates compared to previous years.

- Infrastructure projects: A decrease in the number of new large-scale infrastructure projects initiated.

- Real estate sales: A significant drop in real estate sales, reflecting a cooling housing market.

- Steel consumption: A corresponding decline in apparent steel consumption as a result of reduced demand.

Government Policies and Production Quotas

The Chinese government has implemented several direct policies to control steel production. This includes imposing production quotas on steel mills, limiting their output to meet specific targets. While some incentives exist to encourage the adoption of greener technologies, the primary focus remains on limiting overall production volume.

- Examples of specific government policies: Introduction of production quotas, stricter licensing requirements for new steel plants, and the prioritization of high-quality, value-added steel products.

- Details of production quotas: Specific tonnage limits imposed on individual steel mills or regions, often adjusted based on economic and environmental conditions.

- Financial incentives: Subsidies or tax breaks for steel mills investing in cleaner technologies and energy efficiency improvements.

The Impact of Reduced Steel Output on Iron Ore Prices

The relationship between China's reduced steel output and the fall in iron ore prices is direct and significant.

Supply and Demand Dynamics

Lower steel production directly translates to decreased demand for iron ore, the primary raw material in steelmaking. This reduction in demand, coupled with relatively stable iron ore supply, has created a surplus in the market, leading to a significant price drop. While global supply and transportation costs also play a role, the dominant factor remains the diminished demand from China, the world's largest steel producer.

- Statistics on iron ore production: Data illustrating global iron ore production levels and regional distribution.

- Consumption: Analysis of iron ore consumption patterns, highlighting the reduction in demand from China.

- Price fluctuations: Charts illustrating the recent significant decline in iron ore prices.

Implications for Iron Ore Producers

Falling iron ore prices pose significant challenges for iron ore producers worldwide. Many companies are facing reduced profits and are forced to implement cost-cutting measures, including workforce reductions and operational efficiency improvements. Industry consolidation, through mergers and acquisitions, is a likely outcome as smaller, less efficient producers struggle to survive.

- Examples of companies impacted: Major iron ore producers and their financial performance in the face of falling prices.

- Strategies for cost reduction: Measures taken by companies to reduce operating costs and improve profitability.

- Potential industry consolidation: Analysis of potential mergers and acquisitions in the iron ore industry as companies seek to gain scale and efficiency.

Looking Ahead: Future Trends in Iron Ore Prices and Chinese Steel Production

Predicting future trends in the iron ore and steel markets requires careful consideration of several factors.

Predictions for Steel Demand and Production

While a complete reversal of China's steel reduction strategy is unlikely, the pace of reduction and future demand remain uncertain. Several factors, including the recovery of the real estate sector and the ongoing development of green steel technologies, will influence future steel production. Experts predict a continued, albeit slower, decrease in steel production in the short term, with the long-term outlook depending on the success of China's green initiatives.

- Expert opinions: Analysis of forecasts from leading industry analysts regarding future steel production.

- Forecasts from industry analysts: Numerical projections for steel production volume and growth rates.

- Potential scenarios: Exploration of different possible scenarios, considering various economic and environmental factors.

Implications for Global Markets

Changes in China's steel production have far-reaching consequences for global markets. Other steel-producing countries will feel the impact of reduced demand and increased competition. Related industries, such as construction and manufacturing, will also experience knock-on effects. The global steel market is likely to experience a period of readjustment, with both opportunities and challenges for players worldwide.

- Impact on other steel-producing nations: Analysis of the effects on steel producers in other countries, including Brazil, Australia, and India.

- Knock-on effects on related industries: Examination of the impact on sectors such as construction, infrastructure development, and manufacturing.

Conclusion: Navigating the Shifting Landscape of Iron Ore and Steel

China's multifaceted approach to reducing steel output, driven by environmental concerns and economic realities, has resulted in a significant drop in iron ore prices. This has created both challenges and opportunities for players across the global iron ore and steel markets. Understanding China's policies and their impact on iron ore prices is crucial for navigating this evolving landscape. To stay informed about future developments, subscribe to industry newsletters, follow leading experts, and regularly check for updates on iron ore prices and China's steel production strategies. Further research into the specific environmental regulations and their effectiveness in China’s steel sector would provide a more detailed understanding of the current market dynamics.

Featured Posts

-

Prodolzhenie Snegopadov V Yaroslavskoy Oblasti Chto Nuzhno Znat

May 09, 2025

Prodolzhenie Snegopadov V Yaroslavskoy Oblasti Chto Nuzhno Znat

May 09, 2025 -

Celebrity Antiques Road Trip Where To Find Past Episodes And More

May 09, 2025

Celebrity Antiques Road Trip Where To Find Past Episodes And More

May 09, 2025 -

Former Becker Sentencing Judge Heads Nottingham Attacks Investigation

May 09, 2025

Former Becker Sentencing Judge Heads Nottingham Attacks Investigation

May 09, 2025 -

Champions League Inters Shock Win Against Bayern Munich

May 09, 2025

Champions League Inters Shock Win Against Bayern Munich

May 09, 2025 -

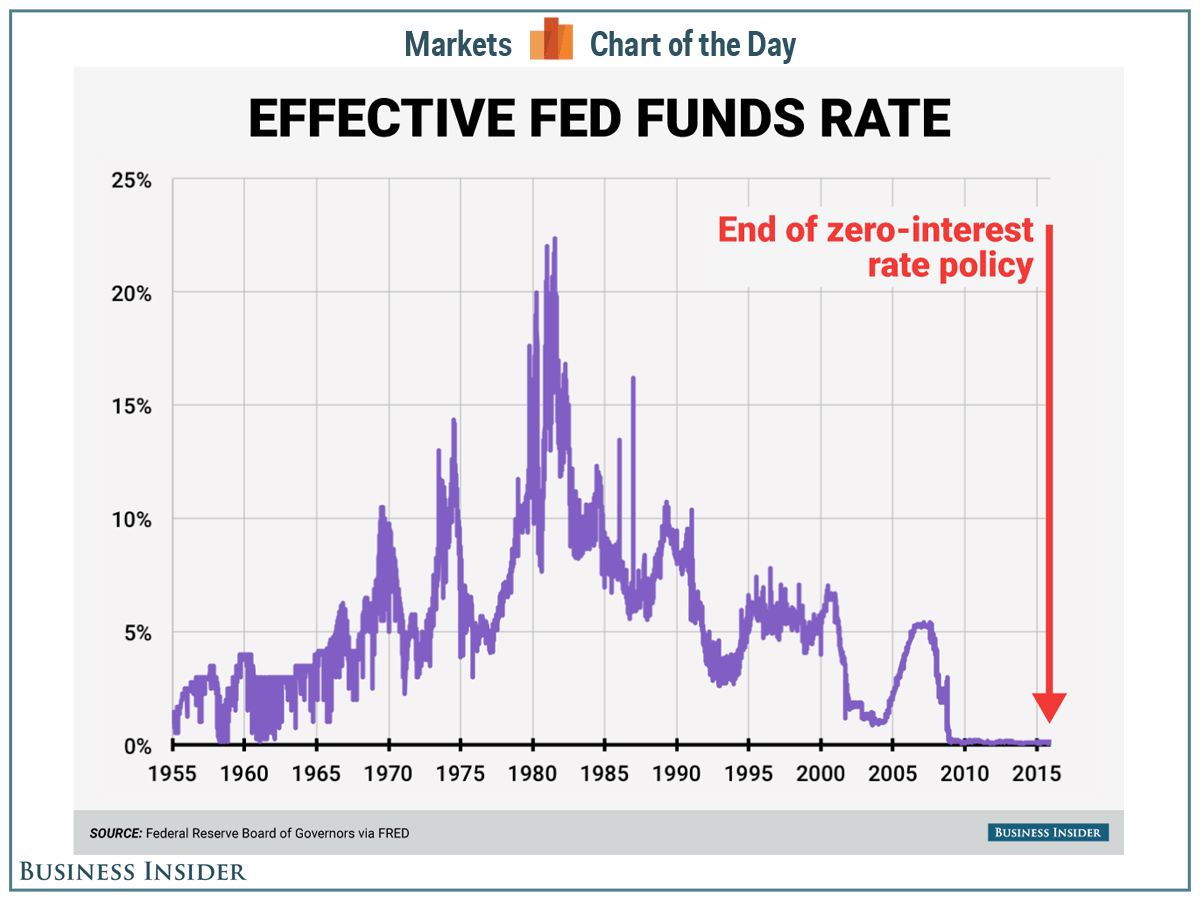

U S Federal Reserve Decision Interest Rates Unchanged Due To Economic Uncertainty

May 09, 2025

U S Federal Reserve Decision Interest Rates Unchanged Due To Economic Uncertainty

May 09, 2025