Fluctuations In Elon Musk's Net Worth: The US Economic Context

Table of Contents

The Impact of Tesla Stock Performance

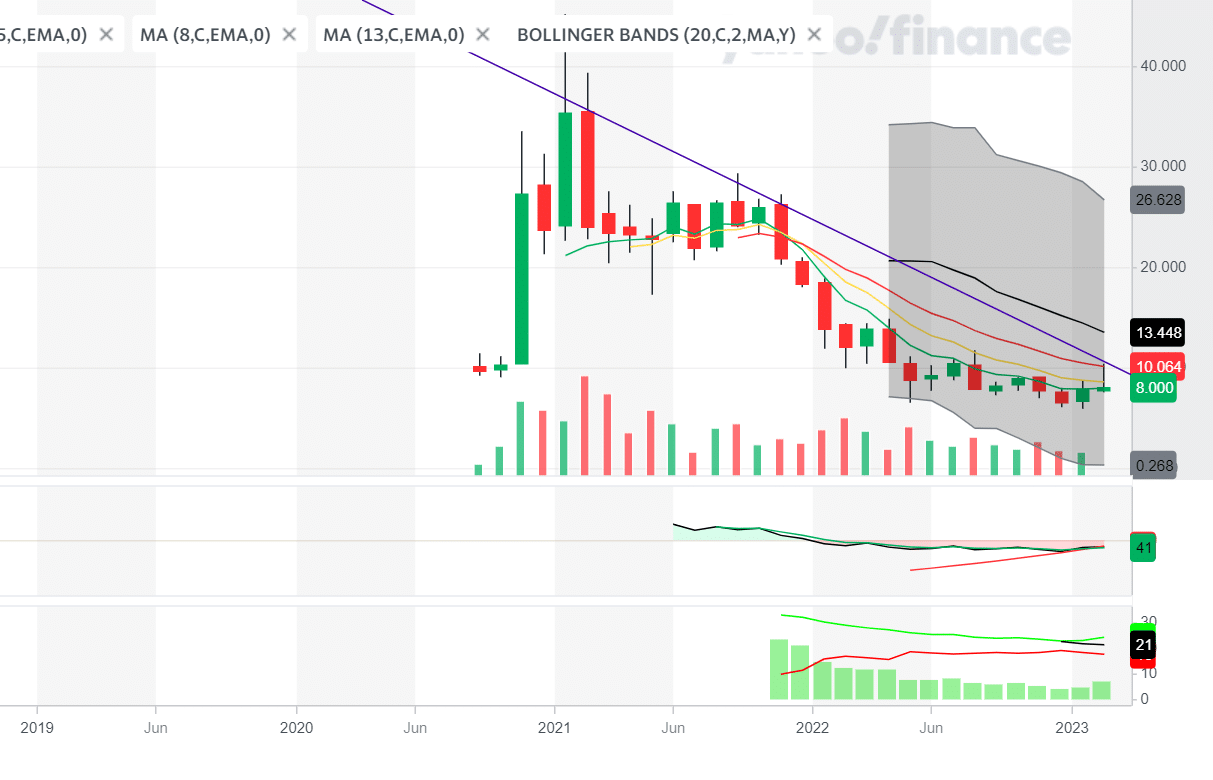

A substantial portion of Elon Musk's net worth is directly tied to Tesla's stock price. This makes understanding Tesla's performance crucial for comprehending the fluctuations in Musk's wealth. Changes in investor sentiment, competition within the electric vehicle (EV) market, and broader economic conditions heavily influence Tesla's market cap and consequently, Musk's billions.

-

Tesla stock price volatility directly correlates with Musk's net worth. A rise in Tesla's stock price translates directly into a significant increase in Musk's personal wealth, and vice-versa. This direct correlation makes Tesla's stock performance a primary driver of his overall net worth.

-

Positive economic forecasts often boost Tesla's stock, increasing Musk's wealth. When the US economy shows signs of strength, investor confidence tends to rise, leading to increased investment in growth stocks like Tesla. This positive sentiment translates into higher stock prices and a corresponding increase in Musk's net worth.

-

Negative economic news or industry-specific challenges can significantly decrease Tesla's value and Musk's net worth. Conversely, negative economic news, such as recessionary fears or increased interest rates, can dampen investor enthusiasm, causing Tesla's stock price to fall and reducing Musk's wealth. Similarly, increased competition within the EV market can also impact Tesla's market share and stock price.

-

Analysis of Tesla's financial reports and market share is crucial for understanding this relationship. By carefully monitoring Tesla's financial performance, sales figures, and market position relative to competitors, we gain a clearer picture of the factors driving Tesla's stock price and, subsequently, the changes in Musk's net worth.

SpaceX's Role and Future Projections

While less directly impacted by daily market fluctuations than Tesla, SpaceX, Musk's aerospace company, represents another significant pillar supporting his immense wealth. SpaceX's valuation is heavily influenced by future contracts, successful launches, and advancements in space exploration. This makes understanding SpaceX's trajectory vital for comprehending the long-term trends in Musk's net worth.

-

SpaceX's future success in securing government and private contracts will significantly influence Musk's wealth. Large-scale contracts with NASA or other government agencies, as well as lucrative private sector partnerships, can dramatically increase SpaceX's valuation.

-

The growth of the private space industry will significantly impact SpaceX's valuation. As the private space industry expands, SpaceX's position as a leader in this sector contributes to its growth potential and, consequently, its contribution to Musk's net worth.

-

Investments in new SpaceX ventures, like Starlink, contribute to overall net worth growth. The success of Starlink, SpaceX's satellite internet constellation, for example, adds another layer of valuation to the company, enhancing its overall worth and positively impacting Musk's net worth.

Macroeconomic Factors and their Influence

Broader macroeconomic trends significantly impact Elon Musk's net worth. Factors such as inflation, interest rates, and the overall health of the US economy influence consumer spending, investor confidence, and the stock market – all of which directly impact Tesla and SpaceX's performance.

-

High inflation can decrease consumer demand for luxury goods like Tesla vehicles. Inflationary pressures can reduce consumer spending on discretionary items, including high-priced electric vehicles, potentially impacting Tesla's sales and, consequently, its stock price.

-

Increased interest rates can make borrowing more expensive, impacting both Tesla and SpaceX's operations. Higher interest rates increase the cost of borrowing for both companies, affecting their expansion plans and potentially impacting their profitability.

-

A recession could lead to a significant decrease in investor confidence, affecting stock prices. Economic downturns typically lead to decreased investor confidence, causing a sell-off in the stock market, including Tesla stock, which directly impacts Musk's net worth.

-

Understanding the Federal Reserve's monetary policy is key to predicting market shifts. The Federal Reserve's actions on interest rates and other monetary policy tools significantly influence the overall economic climate and, therefore, the performance of Tesla and SpaceX.

The Psychological Impact on Market Sentiment

Elon Musk's public persona and statements significantly impact market sentiment concerning his companies. His tweets, media appearances, and public actions can trigger significant stock price fluctuations, illustrating the complex relationship between personality and financial markets.

-

Elon Musk's public pronouncements can directly influence Tesla's stock price. His tweets, announcements, and interviews can generate significant market volatility, either boosting or harming Tesla's stock price depending on the content and tone.

-

Negative media coverage can impact investor confidence. Negative publicity surrounding Musk or his companies can negatively affect investor sentiment and lead to a decrease in Tesla's stock price.

-

Public perception of Musk plays a significant role in market valuations. The overall perception of Musk's leadership and the future prospects of his companies significantly influence investor decisions and market valuations.

-

Social media's amplification effect exacerbates this influence. The rapid spread of information through social media amplifies the impact of Musk's public statements, contributing to the heightened volatility of Tesla's stock price.

Conclusion

Elon Musk's net worth isn't just a measure of individual entrepreneurial success; it's a complex barometer of the US economy's health. Fluctuations in his wealth are deeply intertwined with the performance of Tesla and SpaceX, and the broader macroeconomic environment, including inflation, interest rates, and investor sentiment, significantly impacted by Musk himself. Understanding these interdependencies provides valuable insights into the multifaceted nature of wealth creation in the modern era. To stay informed about future fluctuations in Elon Musk's net worth and their relation to the US economic landscape, continue to follow financial news and economic indicators closely. Monitoring Elon Musk's net worth remains a compelling way to understand the interplay between individual success and the broader US economic context.

Featured Posts

-

Podpisanie Oboronnogo Soglasheniya Makronom I Tuskom 9 Maya Analiz I Prognozy

May 10, 2025

Podpisanie Oboronnogo Soglasheniya Makronom I Tuskom 9 Maya Analiz I Prognozy

May 10, 2025 -

West Ham Face 25m Financial Challenge Potential Solutions Explored

May 10, 2025

West Ham Face 25m Financial Challenge Potential Solutions Explored

May 10, 2025 -

Palantir Stock Down 30 Is This A Buying Opportunity

May 10, 2025

Palantir Stock Down 30 Is This A Buying Opportunity

May 10, 2025 -

Wynne Evans Receives Backing After Allegations Surface

May 10, 2025

Wynne Evans Receives Backing After Allegations Surface

May 10, 2025 -

Stephen Kings 2025 Will The Monkey Be A Low Point But A High Year Overall

May 10, 2025

Stephen Kings 2025 Will The Monkey Be A Low Point But A High Year Overall

May 10, 2025