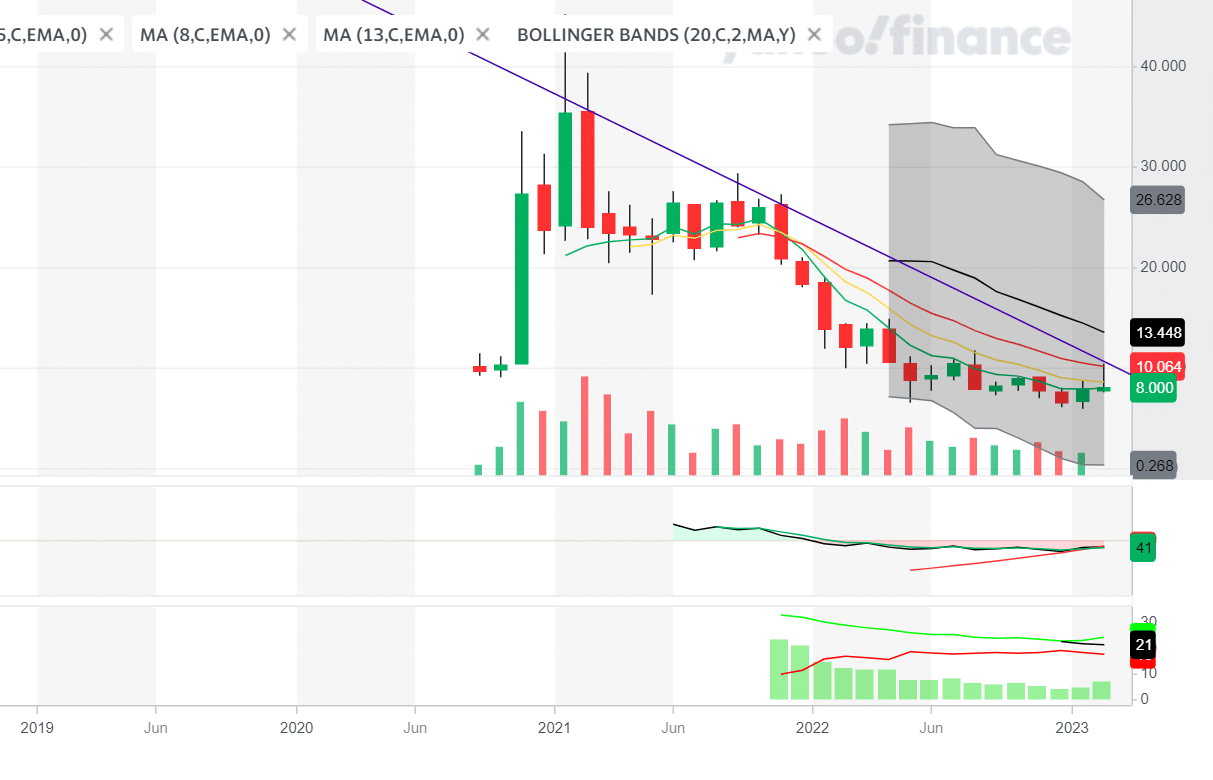

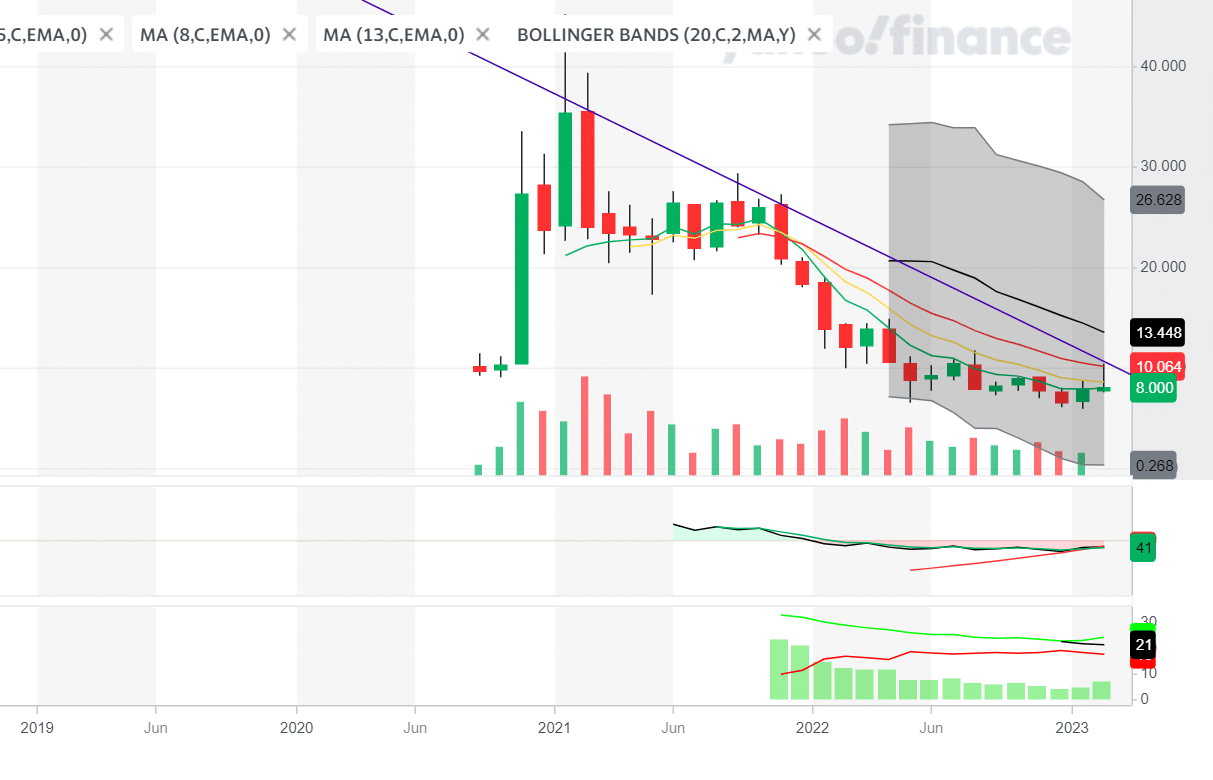

Palantir Stock Down 30%: Is This A Buying Opportunity?

Table of Contents

Analyzing the Reasons Behind Palantir's Stock Decline

Several factors contributed to the recent drop in Palantir's stock price. Understanding these is crucial before considering any investment.

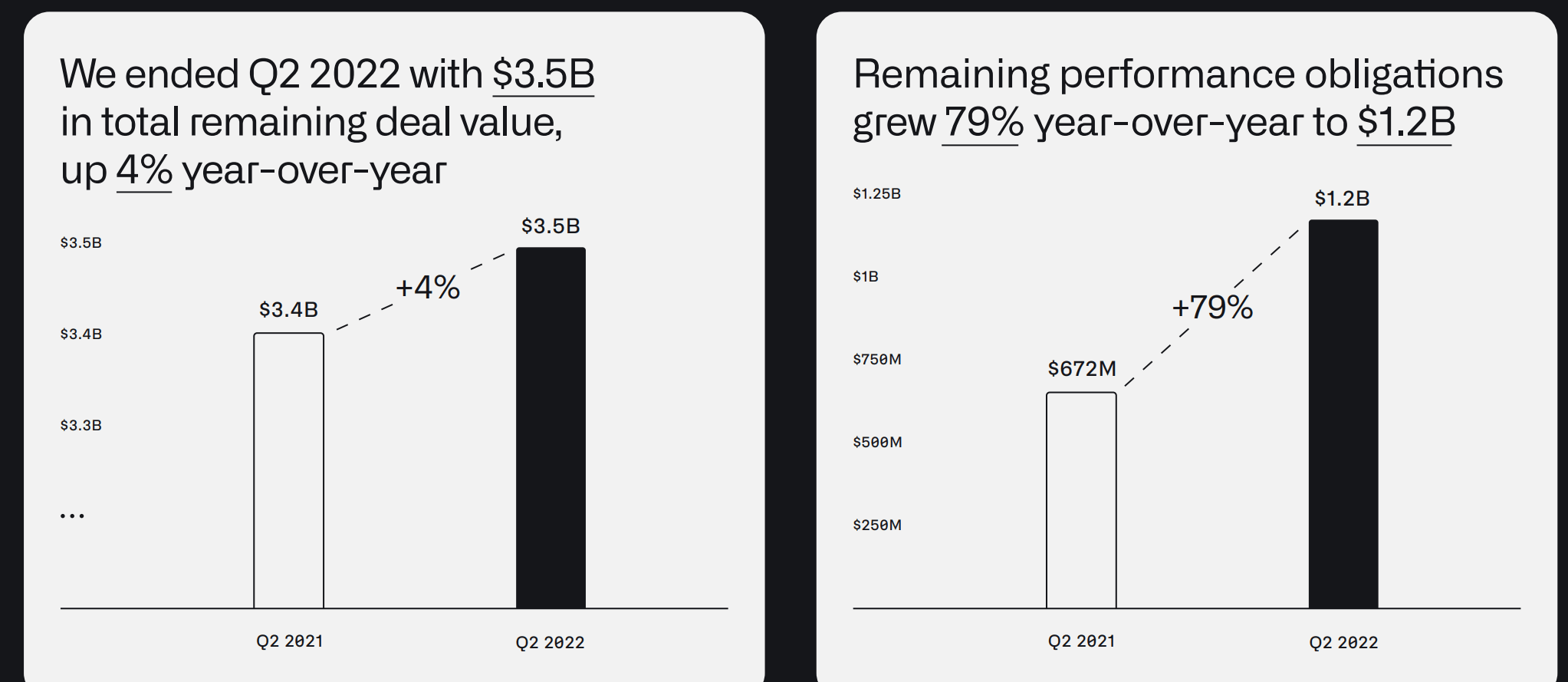

Weak Q2 Earnings and Revenue Miss

Palantir's Q2 2024 earnings report revealed weaker-than-expected results, triggering a sell-off. Revenue growth fell short of analyst projections, signaling potential challenges in securing new contracts and maintaining its growth trajectory. This negative surprise significantly impacted investor sentiment, leading to a sharp decline in the PLTR stock price.

- Key takeaways from the Q2 report: Lower-than-anticipated revenue, slower-than-projected customer acquisition, and potentially revised growth forecasts for the remainder of the year.

- Impact on investor sentiment: The missed expectations fueled concerns about Palantir's ability to sustain its growth, prompting many investors to sell their shares, increasing stock market volatility.

Macroeconomic Factors and Market Uncertainty

The broader macroeconomic environment has also played a role. Rising interest rates, persistent inflation, and overall market uncertainty have created a bearish sentiment across the tech sector. Palantir, as a growth stock, is particularly vulnerable to these macroeconomic headwinds. Investors are increasingly shifting towards more conservative investments, impacting demand for growth stocks like PLTR.

- Impact of rising interest rates: Higher interest rates increase borrowing costs for companies, potentially hindering Palantir's expansion plans and reducing its attractiveness to investors.

- Inflationary pressures: Inflation erodes profit margins and can lead to decreased consumer spending, indirectly impacting the demand for Palantir's services.

Competition and Market Saturation Concerns

Palantir operates in a competitive market, facing established players and emerging competitors offering similar data analytics and software solutions. Concerns about market saturation and the increasing intensity of competition have added to the bearish sentiment surrounding PLTR stock. Maintaining its market share against these competitors presents an ongoing challenge.

- Key competitors: Companies offering similar data analytics and AI-powered solutions pose a threat to Palantir's market position.

- Market saturation impact: Increased competition can lead to price wars and reduced profit margins, potentially impacting Palantir's future revenue growth.

Is This Dip a Buying Opportunity for Palantir Stock?

The significant drop in Palantir's stock price raises the question: is this a buying opportunity? The answer isn't straightforward and depends on your risk tolerance and investment horizon.

Arguments for Buying Palantir at a Lower Price

Despite the recent challenges, several arguments suggest that this could be a strategic entry point for long-term investors.

- Long-term growth potential: Palantir operates in a rapidly expanding data analytics market, with enormous potential for future growth. Its innovative technology continues to attract government and commercial clients.

- Government contracts: Palantir holds significant government contracts, providing a stable revenue stream and reducing reliance on volatile commercial markets.

- Strategic partnerships: Collaborations with other tech giants could unlock new market opportunities and boost revenue growth.

Arguments Against Buying Palantir at This Time

However, it's essential to acknowledge the risks involved.

- Profitability concerns: Palantir has yet to achieve consistent profitability, a concern for many investors.

- Volatile stock price: PLTR stock remains highly volatile, making it a risky investment, especially in a bear market.

- Alternative investment options: Diversification is key. Explore other investment opportunities before committing significant capital to a single, volatile stock.

Assessing the Risk and Reward of Investing in Palantir

Investing in Palantir at its current price involves both significant risks and potential rewards.

- Pros: Discounted price, long-term growth potential, strong government contracts.

- Cons: Volatility, profitability concerns, intense competition.

Your decision should depend on your risk tolerance and investment timeframe. A long-term perspective might favor investing in Palantir's potential, while short-term investors may prefer less volatile options. Consider your overall portfolio diversification strategy.

Conclusion: Making Informed Decisions about Palantir Stock

The recent decline in Palantir stock presents a complex scenario. While the discounted price and long-term growth potential are tempting, the risks associated with its volatile nature and profitability concerns cannot be ignored. Before making any investment decisions regarding Palantir stock (PLTR) or any other investment, thorough due diligence is paramount. Carefully weigh the potential risks and rewards, considering your individual risk tolerance and investment goals. Conduct your own research and consult with a financial advisor to make informed decisions about your investment portfolio. Remember, this analysis is not financial advice.

Featured Posts

-

The Effects Of Trumps Executive Orders On Transgender People

May 10, 2025

The Effects Of Trumps Executive Orders On Transgender People

May 10, 2025 -

Democratizing Stock Investment The Jazz Cash K Trade Partnership

May 10, 2025

Democratizing Stock Investment The Jazz Cash K Trade Partnership

May 10, 2025 -

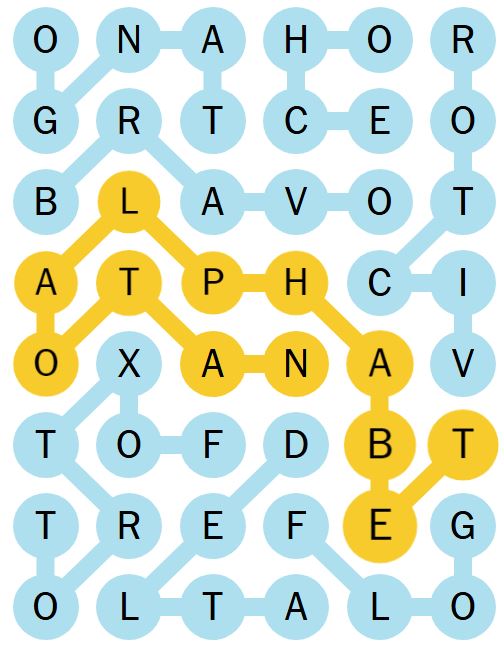

April 12th Nyt Strands Puzzle 405 Hints And Solutions

May 10, 2025

April 12th Nyt Strands Puzzle 405 Hints And Solutions

May 10, 2025 -

Should You Invest In Palantir Stock Ahead Of May 5th Earnings

May 10, 2025

Should You Invest In Palantir Stock Ahead Of May 5th Earnings

May 10, 2025 -

Get Elizabeth Arden Skincare On A Budget

May 10, 2025

Get Elizabeth Arden Skincare On A Budget

May 10, 2025