Should You Invest In Palantir Stock Ahead Of May 5th Earnings?

Table of Contents

Analyzing Palantir's Recent Performance and Future Outlook

To determine whether investing in Palantir stock before May 5th is advisable, we must first assess the company's recent performance and forecast its future trajectory.

Revenue Growth and Profitability

Palantir's recent financial reports reveal a mixed bag. While revenue has shown consistent growth, profitability remains a key area of focus. Analyzing key performance indicators (KPIs) such as revenue growth rate, operating margins, and free cash flow is crucial. Comparing these figures to industry benchmarks like other big data analytics companies provides valuable context.

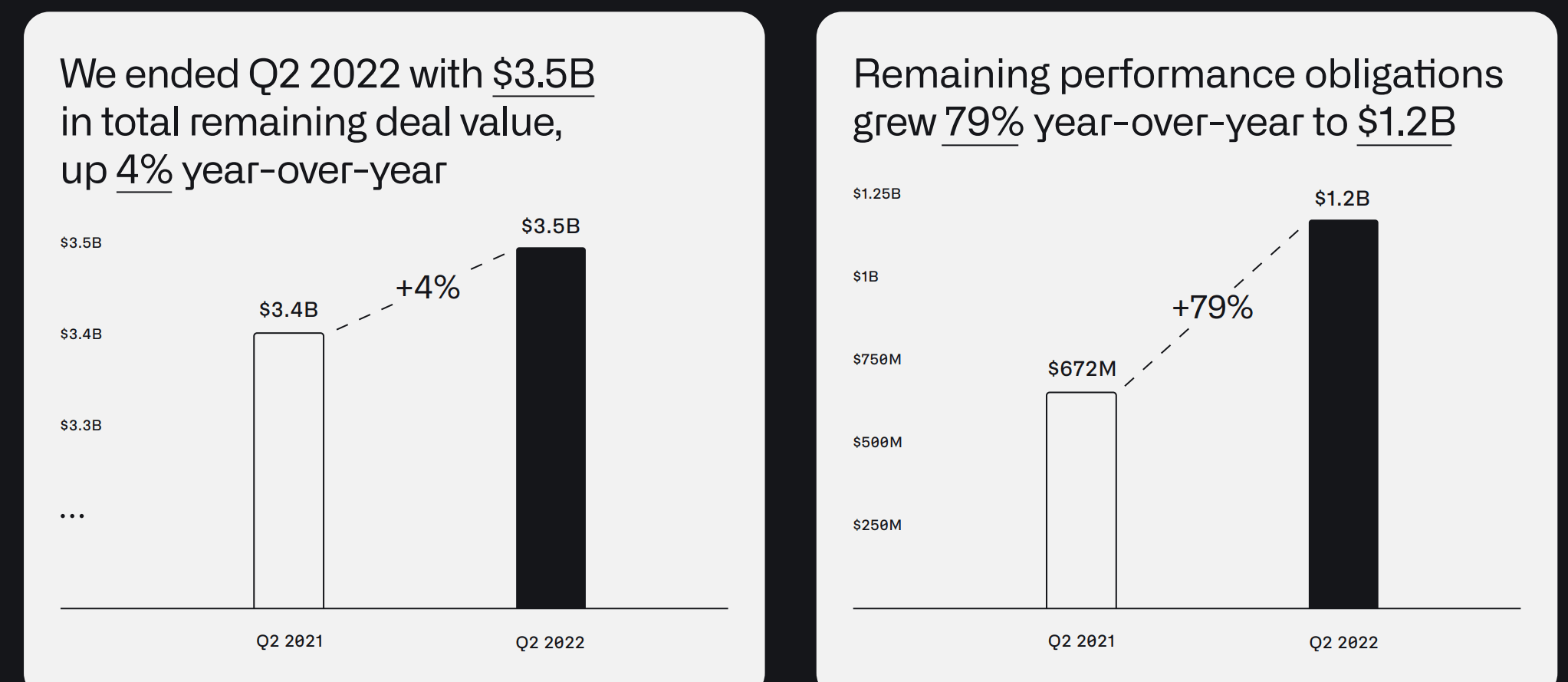

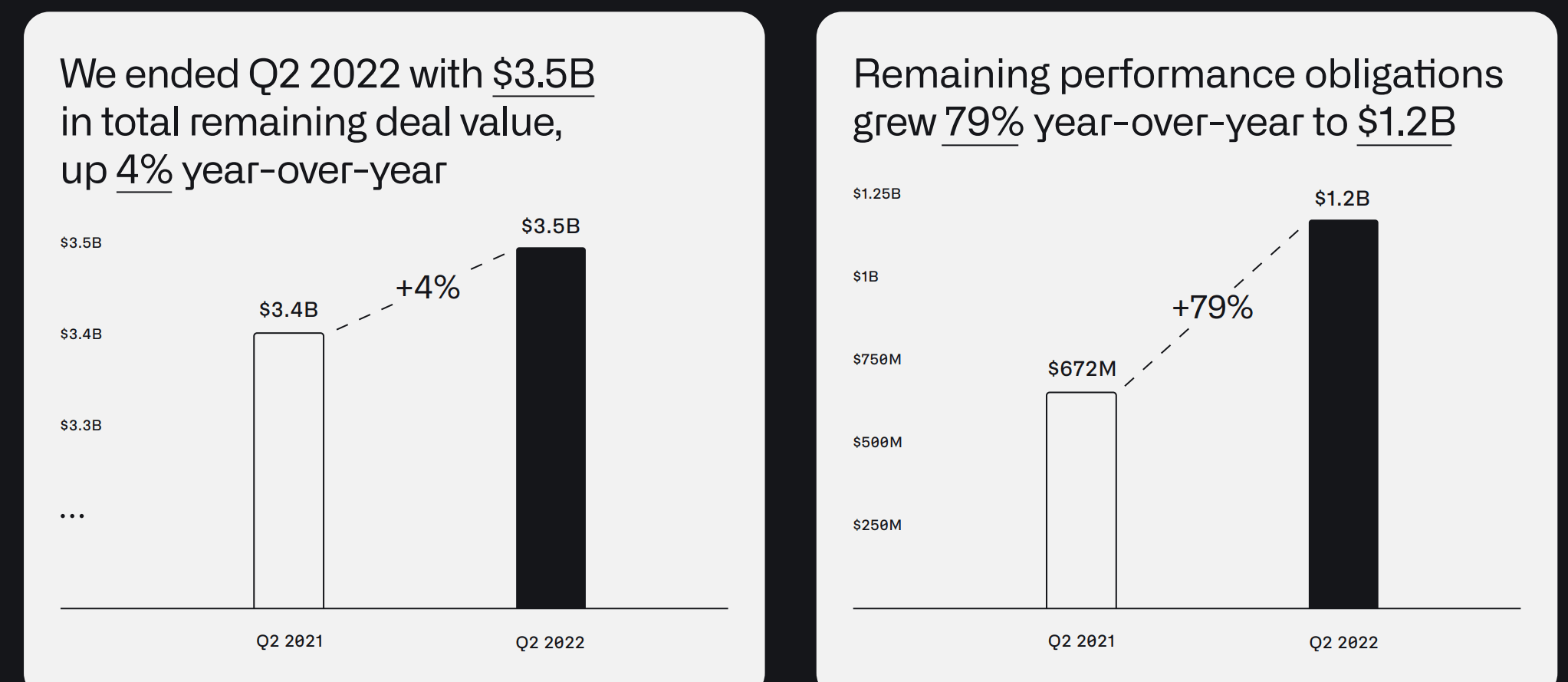

- Revenue Growth: Examining the year-over-year and quarter-over-quarter revenue growth rates will illuminate Palantir's growth trajectory. Significant increases suggest positive momentum, while slowing growth may raise concerns.

- Profitability: Analyzing Palantir's operating margin and net income will highlight its path to profitability. A consistent increase in margins indicates improved efficiency and cost management.

- Key Contracts: The announcement of significant new contracts, particularly large government contracts or substantial commercial wins, can significantly impact Palantir's future revenue projections and investor confidence. Monitoring the pipeline of potential deals is essential. The impact of any new partnerships on Palantir revenue should also be considered.

Analyzing Palantir's financial performance requires a holistic view of these factors. The May 5th earnings report will provide crucial updates on Palantir revenue and profitability, offering valuable insights into the company's financial health and growth prospects.

Market Position and Competition

Palantir operates in a competitive big data and analytics market. Key competitors include established players and emerging startups, each vying for market share. Assessing Palantir's competitive advantage requires careful consideration of its unique selling propositions (USPs) and overall market position.

- Competitive Landscape: Examining the strengths and weaknesses of Palantir's main competitors—considering their market capitalization, revenue, and technological capabilities—is crucial for understanding Palantir's position within the industry.

- Palantir's USP: Identifying what differentiates Palantir from its rivals, such as its advanced data integration capabilities, highly-skilled workforce, or specialized government sector expertise, can highlight its competitive edge and potential for future growth.

- Market Share: Tracking Palantir's market share and its growth rate against its competitors offers a clear indication of its success in capturing market share.

Government Contracts and Commercial Growth

Palantir's revenue historically relied heavily on government contracts. While this sector remains important, the company's increasing focus on commercial growth is a critical factor to consider.

- Government Contract Dependence: Analyzing the percentage of Palantir's revenue derived from government contracts reveals the potential risks associated with reliance on this sector. Geopolitical instability or changes in government spending could impact future revenue.

- Commercial Sector Expansion: Tracking Palantir's progress in expanding its commercial customer base is crucial. Success in this area demonstrates the company's ability to diversify its revenue streams and reduce its reliance on government contracts. Further, the pace of this growth provides insights into future revenue potential.

- Risk Assessment: A balanced assessment of the risks and opportunities associated with both government and commercial sectors is vital for any investor looking to buy Palantir stock.

Factors to Consider Before Investing in Palantir Stock

Before making any investment decisions, several other factors deserve careful consideration.

Market Sentiment and Analyst Predictions

Understanding the current market sentiment towards Palantir stock is essential. Analyst ratings and price targets offer a diverse range of opinions, while news and events can significantly impact the Palantir stock price.

- Analyst Ratings: Reviewing analyst ratings, buy/sell recommendations, and price targets from reputable financial institutions provides insights into the collective opinion of market experts.

- Market Sentiment: Gauging overall investor sentiment—whether optimistic or pessimistic—can help predict potential price fluctuations.

- News Impact: Major news announcements, regulatory changes, or unexpected events can cause substantial price volatility in Palantir stock.

Risk Assessment and Potential Downsides

Investing in Palantir stock carries inherent risks. It is important to consider potential downsides before making a decision.

- Competition: Intense competition within the big data analytics market poses a risk to Palantir's market share and profitability.

- Government Contract Risk: Dependence on government contracts exposes Palantir to changes in government spending and geopolitical events.

- Market Volatility: The technology sector is known for its volatility, and Palantir stock price can fluctuate significantly based on market sentiment and news.

- Profitability Concerns: Palantir's path to consistent profitability remains a key concern for many investors.

Alternative Investment Options

Before committing to Palantir stock, consider alternative investment options within the big data and analytics sector or broader technology markets. Comparing Palantir with similar companies allows for a more informed investment decision.

- Competitor Analysis: Evaluating other players in the big data analytics market provides insights into alternative investment opportunities.

- Diversification: Diversification of your portfolio is crucial to mitigate risk.

Conclusion: Making Informed Decisions About Palantir Stock

Investing in Palantir stock before the May 5th earnings report requires a careful assessment of its recent performance, future outlook, and associated risks. While Palantir shows growth potential in both government and commercial sectors, the reliance on government contracts and the competitive landscape present significant challenges. Analyst predictions provide a range of perspectives, while market sentiment and potential volatility must also be factored into your decision. Before making any investment decisions regarding Palantir stock ahead of the May 5th earnings, conduct your own thorough research and consider consulting with a financial advisor. Stay informed about Palantir's May 5th earnings and continue to monitor the Palantir stock price for potential investment opportunities.

Featured Posts

-

Transgender Experiences Under Trump Administration Policies

May 10, 2025

Transgender Experiences Under Trump Administration Policies

May 10, 2025 -

Deutsche Bank Dbk Strategic Expansion Into The Defense Finance Market

May 10, 2025

Deutsche Bank Dbk Strategic Expansion Into The Defense Finance Market

May 10, 2025 -

Nottingham Attack Survivor Speaks Out Heartbreaking Plea After Triple Killing

May 10, 2025

Nottingham Attack Survivor Speaks Out Heartbreaking Plea After Triple Killing

May 10, 2025 -

Trumps Trade Policy The Impact Of Potential Tariffs On Commercial Aviation

May 10, 2025

Trumps Trade Policy The Impact Of Potential Tariffs On Commercial Aviation

May 10, 2025 -

Invest Smart A Guide To The Countrys Rising Business Hotspots

May 10, 2025

Invest Smart A Guide To The Countrys Rising Business Hotspots

May 10, 2025