Frankfurt Stock Exchange: DAX Ends Trading Below 24,000

Table of Contents

Factors Contributing to the DAX Decline

Several interconnected factors contributed to the DAX's fall below 24,000. Understanding these nuances is crucial for navigating the current market landscape.

Global Economic Uncertainty

The global economic climate plays a significant role in the DAX's performance. Persistent inflation, aggressive interest rate hikes by central banks worldwide (including the European Central Bank), and the ongoing war in Ukraine have created a climate of uncertainty. These factors weigh heavily on investor sentiment and fuel market volatility, directly impacting the DAX.

- High Inflation: Persistent inflation erodes purchasing power and increases business costs, impacting corporate profits and investor confidence.

- Rising Interest Rates: Higher interest rates increase borrowing costs for businesses, dampening investment and slowing economic growth.

- Geopolitical Instability: The war in Ukraine continues to disrupt global supply chains, increase energy prices, and create widespread economic uncertainty. This has a knock-on effect on the German economy, heavily reliant on international trade.

- Recession Fears: Concerns about a potential global recession are adding to the negative sentiment, prompting investors to adopt a more cautious approach.

Inflationary Pressures in Germany

Germany, like many other nations, is grappling with high inflation. This directly impacts consumer spending and corporate profitability, two key drivers of the DAX's performance. High energy costs, in particular, are squeezing businesses and households alike.

- Reduced Consumer Spending: High inflation reduces disposable income, leading to decreased consumer spending, impacting companies reliant on domestic consumption.

- Squeezed Corporate Profits: Increased input costs, coupled with reduced demand, are impacting corporate profit margins, leading to lower stock valuations.

Energy Crisis and its Ripple Effect

The ongoing energy crisis in Europe, exacerbated by the war in Ukraine, is having a particularly severe impact on the German economy. Germany's heavy reliance on Russian energy has left it vulnerable to supply disruptions and price volatility. This energy crisis directly affects numerous DAX-listed companies.

- Increased Energy Costs: Soaring energy prices increase production costs for businesses, impacting their profitability and competitiveness.

- Supply Chain Disruptions: Energy shortages can lead to production slowdowns or shutdowns, further disrupting supply chains.

Specific Company Performances

The underperformance of several key DAX companies significantly contributed to the overall index decline. For example, [mention specific company names and their stock tickers, e.g., Volkswagen (VOW3), Siemens (SIE), etc.] have seen share prices fall due to [mention specific reasons, e.g., supply chain issues, weak demand, etc.]. Analyzing individual company performance provides a more granular understanding of the broader market trend.

Technical Analysis

Technical analysis indicates that the DAX breached key support levels, signaling a potential further decline. [Mention relevant technical indicators like moving averages or support/resistance levels, if applicable]. This supports the observed downward trend in the DAX.

Impact on Investors and the German Economy

The DAX's decline has significant implications for investors and the German economy as a whole.

Investor Sentiment

Investor sentiment has become noticeably more cautious. The decline in the DAX reflects a loss of confidence in the German economy and the broader European market. This uncertainty is prompting investors to reassess their portfolios and potentially reduce their exposure to riskier assets.

Potential for Further Decline

The potential for a further decline in the DAX remains a significant concern. Continued global economic uncertainty and persistent inflationary pressures could further depress market sentiment. Experts offer differing opinions, with some predicting a more prolonged downturn while others anticipate a potential rebound.

Economic Implications

A sustained decline in the DAX could have significant consequences for the German economy. Reduced investor confidence may lead to decreased investment, slower economic growth, and potentially higher unemployment.

Government Response

The German government is likely to implement measures to mitigate the impact of the economic downturn. [Mention any government interventions or announced economic stimulus packages].

Analyst Opinions and Future Outlook

Financial analysts and economists offer diverse views on the future trajectory of the DAX.

Expert Predictions

Some experts predict a continued decline in the short-term, citing ongoing global economic challenges and persistent inflationary pressures. Others believe that the DAX has reached a bottom and anticipate a gradual recovery, citing potential factors like government interventions and easing inflationary pressures.

Potential Recovery Scenarios

Several factors could potentially trigger a recovery in the DAX, including: a resolution to the war in Ukraine, easing of inflationary pressures, a stronger-than-expected economic recovery, and positive corporate earnings reports.

Investment Strategies

Investors should consider diversifying their portfolios to mitigate risk and adjust their investment strategies based on their risk tolerance and long-term investment goals. This is not financial advice. Consult with a qualified financial advisor for personalized guidance.

Conclusion: Navigating the Frankfurt Stock Exchange DAX Dip

The DAX's fall below 24,000 on [Insert Date] highlights the complex interplay of global and domestic factors impacting the German stock market. Global economic uncertainty, high inflation in Germany, and the ongoing energy crisis have all contributed to the decline. The potential implications for investors and the German economy are significant, warranting careful monitoring of market trends and developments. While risks remain, opportunities also exist for astute investors. The DAX forecast remains uncertain, with experts offering divergent opinions. For a comprehensive understanding of the Frankfurt Stock Exchange outlook and German market analysis, staying informed through reputable financial news sources such as the Financial Times, Bloomberg, and Reuters is crucial. Continue to monitor the DAX performance closely to make informed decisions about your investments.

Featured Posts

-

Live Updates Pedestrian Accident On Princess Road Emergency Response

May 24, 2025

Live Updates Pedestrian Accident On Princess Road Emergency Response

May 24, 2025 -

Understanding The Net Asset Value Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist

May 24, 2025

Understanding The Net Asset Value Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist

May 24, 2025 -

Planned M62 Westbound Closure For Resurfacing Manchester To Warrington

May 24, 2025

Planned M62 Westbound Closure For Resurfacing Manchester To Warrington

May 24, 2025 -

Lady Gaga And Michael Polansky Hand In Hand At Snl Afterparty

May 24, 2025

Lady Gaga And Michael Polansky Hand In Hand At Snl Afterparty

May 24, 2025 -

Kyle And Teddis Heated Confrontation Dog Walker Dispute

May 24, 2025

Kyle And Teddis Heated Confrontation Dog Walker Dispute

May 24, 2025

Latest Posts

-

O Chem Povestvuet Publikatsiya Gryozy Lyubvi Ili Ilicha V Trude

May 24, 2025

O Chem Povestvuet Publikatsiya Gryozy Lyubvi Ili Ilicha V Trude

May 24, 2025 -

Analiz Stati Gryozy Lyubvi Ili Ilicha Iz Gazety Trud

May 24, 2025

Analiz Stati Gryozy Lyubvi Ili Ilicha Iz Gazety Trud

May 24, 2025 -

Razbor Publikatsii Gryozy Lyubvi Ili Ilicha V Trude

May 24, 2025

Razbor Publikatsii Gryozy Lyubvi Ili Ilicha V Trude

May 24, 2025 -

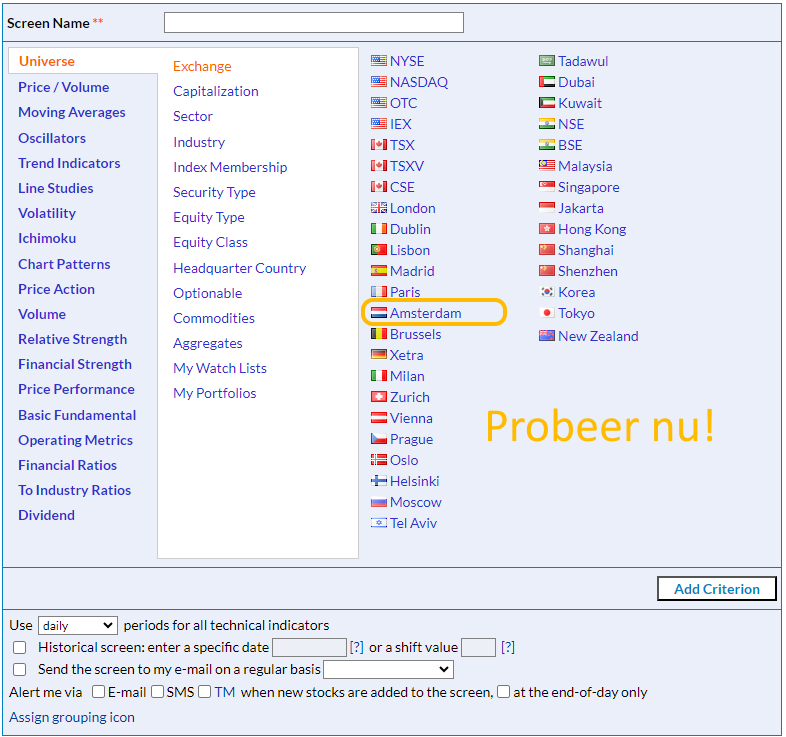

Analysis 8 Increase In Euronext Amsterdam Stocks After Trumps Tariff Decision

May 24, 2025

Analysis 8 Increase In Euronext Amsterdam Stocks After Trumps Tariff Decision

May 24, 2025 -

Ilya Ilich I Ego Gryozy Lyubvi Gazeta Trud

May 24, 2025

Ilya Ilich I Ego Gryozy Lyubvi Gazeta Trud

May 24, 2025