Fremantle's Q1 Revenue Falls 5.6% Amidst Buyer Budget Cuts

Table of Contents

Deep Dive into Fremantle's Q1 Revenue Figures

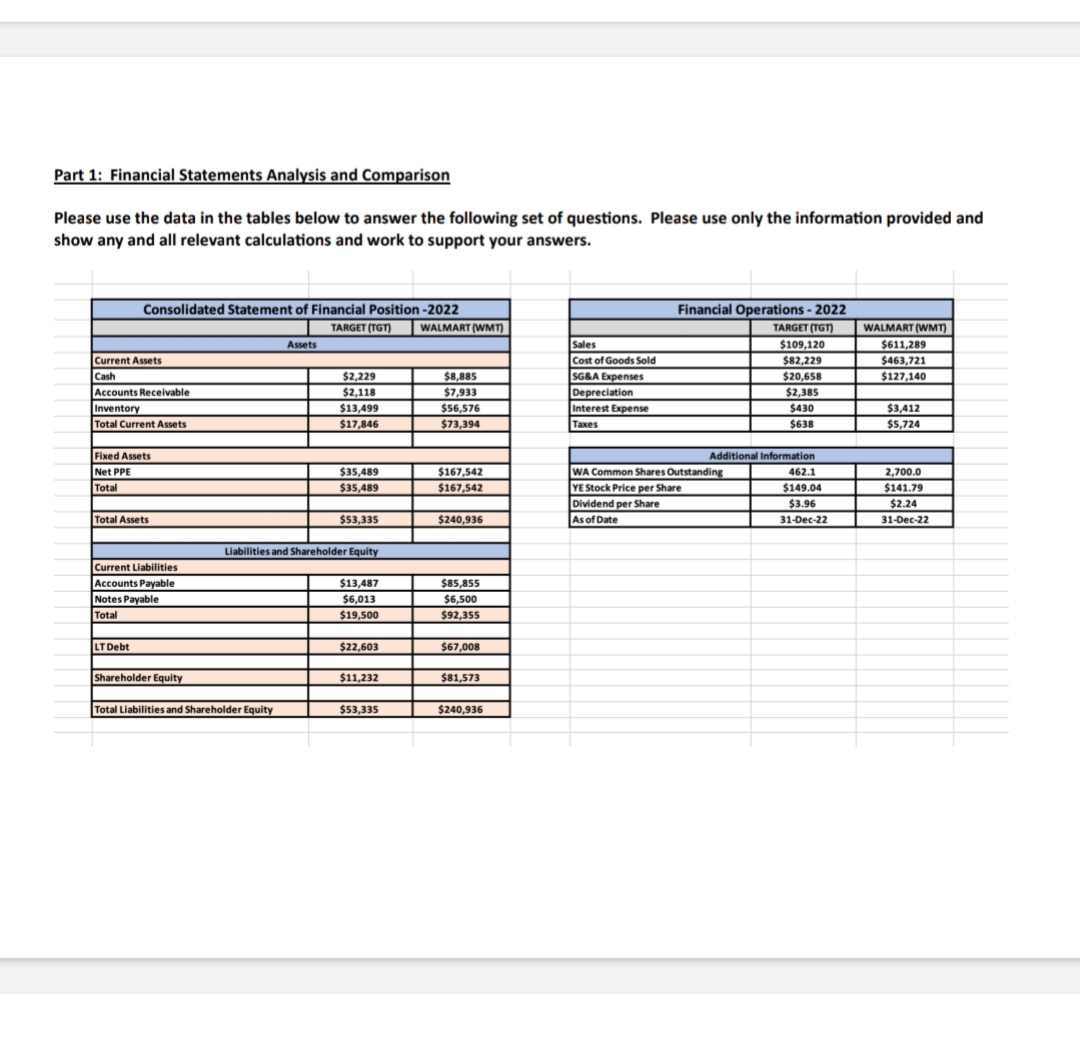

Fremantle's Q1 revenue for [Insert Year] totaled [Insert Exact Revenue Figure], representing a 5.6% decrease compared to the [Insert Exact Revenue Figure] generated in Q1 of [Insert Previous Year]. This drop signals a significant challenge to the company's overall financial health and necessitates a close examination of its various revenue streams.

The following chart visually represents the revenue decline:

[Insert Chart/Graph Here – Clearly showing Q1 revenue for both years.]

A breakdown of revenue streams reveals the following:

- Television: Experienced a [Percentage]% decrease, primarily due to [Specific Reason].

- Film: Showed a [Percentage]% decline, attributed to [Specific Reason].

- Digital: While showing [Percentage]% growth, this was insufficient to offset losses in other sectors.

While the overall picture is concerning, it's important to note that [Mention any positive aspects, e.g., a specific show performed exceptionally well, a new partnership was formed].

The Impact of Buyer Budget Cuts on Fremantle's Performance

The primary driver behind Fremantle's revenue decrease is the widespread implementation of budget cuts by major buyers of entertainment content. Key players, including major broadcasters and streaming platforms like [List Specific Examples, e.g., Netflix, HBO, etc.], significantly reduced their spending on new programming.

Several factors contributed to these budget cuts:

- Economic Downturn: The current economic climate has forced many companies to re-evaluate their spending priorities.

- Shifting Market Trends: The streaming wars have intensified competition, leading to a more cautious approach to content acquisition.

- Subscription Fatigue: Consumers are increasingly cutting back on streaming subscriptions, impacting the revenue streams of platforms.

The effects of these budget cuts on Fremantle's projects are evident:

- Several productions have been postponed or canceled altogether.

- Licensing fees have been significantly reduced for existing content.

- Future project planning is hampered by the uncertainty surrounding buyer budgets.

Fremantle's Strategic Response to the Revenue Decline

In response to the revenue shortfall, Fremantle is actively implementing several strategic initiatives:

- Cost-cutting measures, including [Specific examples, e.g., streamlining production processes, reducing overhead].

- New content creation initiatives focusing on [Specific genres or formats].

- Exploration of new markets and distribution channels, particularly in [Specific regions or platforms].

- A strong focus on cost-effective production models without compromising quality.

- Strengthening relationships with existing buyers and actively seeking new partnerships.

Industry-Wide Implications of Fremantle's Q1 Results

Fremantle's Q1 performance reflects a broader trend within the entertainment industry. Buyer budget cuts are not unique to Fremantle; many production companies are facing similar challenges. This trend has significant implications:

- Other production companies are experiencing similar revenue declines and project cancellations.

- Content commissioning practices are likely to become more conservative and risk-averse.

- The future of the entertainment market hinges on adapting to these economic realities and finding new, sustainable models.

Conclusion: Navigating the Challenges: The Future of Fremantle's Revenue

Fremantle's Q1 revenue decline underscores the significant impact of buyer budget cuts on the entertainment industry. The company's strategic response, while promising, requires time to yield results. The broader implications for the industry are substantial, necessitating adaptation and innovation. Stay tuned for updates on Fremantle's performance and how the company navigates these challenges to restore its revenue stream. Follow us for continued analysis of Fremantle's financial performance and the evolving entertainment landscape.

Featured Posts

-

Cocaine Found At White House Secret Service Announces Conclusion Of Investigation

May 21, 2025

Cocaine Found At White House Secret Service Announces Conclusion Of Investigation

May 21, 2025 -

Understanding The Humor And Heart Of The Goldbergs

May 21, 2025

Understanding The Humor And Heart Of The Goldbergs

May 21, 2025 -

Wwes Tyler Bate His Triumphant Television Comeback

May 21, 2025

Wwes Tyler Bate His Triumphant Television Comeback

May 21, 2025 -

Juergen Klopp Real Madrid In Yeni Teknik Direktoerue Olabilir Mi

May 21, 2025

Juergen Klopp Real Madrid In Yeni Teknik Direktoerue Olabilir Mi

May 21, 2025 -

John Cena And Randy Orton A Potential Dream Match Bayleys Injury Status

May 21, 2025

John Cena And Randy Orton A Potential Dream Match Bayleys Injury Status

May 21, 2025

Latest Posts

-

Huizenmarktprognose Abn Amro Stijgende Prijzen Dalende Rente

May 22, 2025

Huizenmarktprognose Abn Amro Stijgende Prijzen Dalende Rente

May 22, 2025 -

Optimalisatie Van Uw Kamerbrief Certificaten Verkoopprogramma Bij Abn Amro

May 22, 2025

Optimalisatie Van Uw Kamerbrief Certificaten Verkoopprogramma Bij Abn Amro

May 22, 2025 -

Abn Amro Rentedaling En Verwachte Huizenprijsstijging

May 22, 2025

Abn Amro Rentedaling En Verwachte Huizenprijsstijging

May 22, 2025 -

De Afhankelijkheid Van Goedkope Arbeidsmigranten In De Nederlandse Voedingsindustrie Een Abn Amro Perspectief

May 22, 2025

De Afhankelijkheid Van Goedkope Arbeidsmigranten In De Nederlandse Voedingsindustrie Een Abn Amro Perspectief

May 22, 2025 -

Effectief Verkoop Van Abn Amro Kamerbrief Certificaten Een Praktische Handleiding

May 22, 2025

Effectief Verkoop Van Abn Amro Kamerbrief Certificaten Een Praktische Handleiding

May 22, 2025