German DAX Soars: Potential Threats From A Wall Street Recovery

Table of Contents

The Current State of the German DAX

The German DAX, a leading indicator of the German economy, has shown remarkable resilience in recent months. Factors contributing to this growth include strong export performance, driven by a recovering global economy, and easing inflation concerns in Europe. This positive momentum has propelled many DAX-listed companies to record highs.

-

Key Sectors Driving Growth: The automotive sector, a cornerstone of the German economy, has seen a resurgence, boosted by increased demand for electric vehicles and a relaxation of supply chain bottlenecks. The technology sector has also contributed significantly, with companies benefiting from the ongoing digital transformation.

-

Supporting Statistics: Data from the German Federal Statistical Office shows a steady increase in industrial production and consumer spending, providing a solid foundation for the DAX's rise. Furthermore, positive corporate earnings reports from several DAX giants have reinforced investor confidence.

-

Economic Indicators: Falling inflation rates and improving employment figures have created a more optimistic outlook, bolstering investor sentiment and driving further investment in the German market, positively impacting the German DAX performance.

The Looming Threat of a Wall Street Recovery

While a strong US economy is generally positive for the global market, a recovering Wall Street presents potential headwinds for the German DAX. A strengthening US dollar, a common byproduct of a robust US economy, directly impacts German exports.

-

Strong Dollar, Weak Euro: A strong US dollar makes German goods more expensive for international buyers, potentially reducing demand and impacting export-oriented DAX companies. This inverse relationship between a strong dollar and the euro's value is a significant factor to consider.

-

Capital Flight: A booming US economy might entice investors to shift their capital from European markets, including Germany, to seek higher returns in the US. This capital flight could put downward pressure on the DAX.

-

Impact on DAX Companies: Companies heavily reliant on US exports, such as luxury goods manufacturers and certain automotive companies, could be disproportionately affected by a strengthening dollar and decreased US consumer demand.

Sector-Specific Vulnerabilities within the German DAX

Certain sectors within the German DAX are particularly vulnerable to a Wall Street recovery. These vulnerabilities stem from their dependence on specific market dynamics and consumer behavior.

-

Luxury Goods: German luxury brands, known for their high prices, may face reduced demand from US consumers if the dollar strengthens significantly. This could lead to price adjustments or reduced profitability.

-

Automakers: German automakers heavily reliant on the US market could see a decline in sales due to increased competition from domestic US manufacturers and price sensitivity caused by currency fluctuations.

-

Specific Examples: Companies like BMW, Mercedes-Benz, and several luxury goods manufacturers could face significant headwinds if the US dollar appreciates against the euro. Increased competition and reduced export demand could negatively impact their share prices and overall DAX performance.

Geopolitical Factors and their Influence on the German DAX

Geopolitical instability, particularly the ongoing war in Ukraine, continues to cast a shadow over the German economy and, consequently, the German DAX.

-

Energy Dependence: Germany's dependence on Russian energy has made it particularly vulnerable to energy price volatility. The war in Ukraine has exacerbated this vulnerability, leading to higher energy costs and impacting industrial production.

-

Supply Chain Disruptions: The ongoing conflict has caused widespread supply chain disruptions, further adding to inflationary pressures and hindering economic growth.

-

Inflation and Consumer Spending: High inflation rates erode consumer purchasing power, potentially dampening demand for German goods and services and leading to decreased consumer spending. This downward pressure on consumption can negatively influence the German DAX.

Conclusion

The German DAX's recent surge is impressive, but a recovering Wall Street presents considerable challenges. The strengthening US dollar, potential capital flight, and sector-specific vulnerabilities, particularly within the luxury goods and automotive sectors, pose significant threats. Furthermore, the geopolitical landscape, marked by the war in Ukraine and its consequences on energy prices and supply chains, adds further complexity. Investors must closely monitor these developments.

Call to Action: Stay informed about the fluctuations of the German DAX and the complex interplay between the European and US economies. Understanding these dynamics is crucial for successful investment strategies involving the German DAX and its constituent companies. Continue researching the German DAX, analyzing its individual components, and assessing related macroeconomic factors to make informed investment decisions.

Featured Posts

-

Accessibility In Games Feeling The Pinch Of Industry Cutbacks

May 24, 2025

Accessibility In Games Feeling The Pinch Of Industry Cutbacks

May 24, 2025 -

Legendas F1 Motor Egyedi Porsche Koezuti Modell

May 24, 2025

Legendas F1 Motor Egyedi Porsche Koezuti Modell

May 24, 2025 -

The Kyle Walker Annie Kilner Controversy Examining The Poisoning Claims

May 24, 2025

The Kyle Walker Annie Kilner Controversy Examining The Poisoning Claims

May 24, 2025 -

Serious Accident On Princess Road Live Updates From The Scene

May 24, 2025

Serious Accident On Princess Road Live Updates From The Scene

May 24, 2025 -

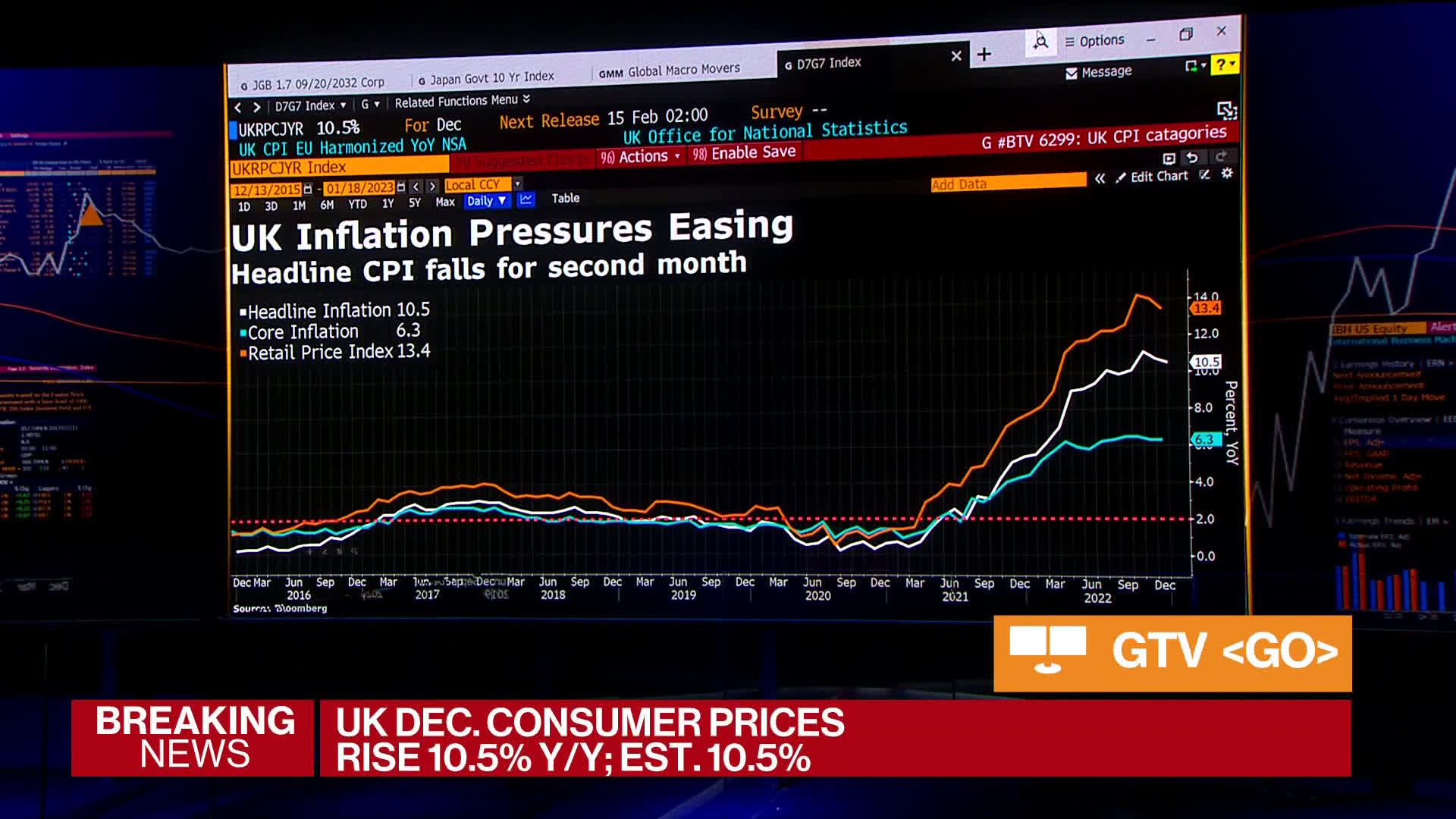

Uk Inflation Slows Pound Strengthens As Boe Rate Cut Bets Diminish

May 24, 2025

Uk Inflation Slows Pound Strengthens As Boe Rate Cut Bets Diminish

May 24, 2025

Latest Posts

-

Memorial Day Weekend 2025 Beach Forecast Ocean City Rehoboth And Sandy Point

May 24, 2025

Memorial Day Weekend 2025 Beach Forecast Ocean City Rehoboth And Sandy Point

May 24, 2025 -

Memorial Day Weekend 2025 Ocean City Rehoboth And Sandy Point Beach Forecast

May 24, 2025

Memorial Day Weekend 2025 Ocean City Rehoboth And Sandy Point Beach Forecast

May 24, 2025 -

Official Kermit The Frog Confirmed For Umds 2025 Graduation Ceremony

May 24, 2025

Official Kermit The Frog Confirmed For Umds 2025 Graduation Ceremony

May 24, 2025 -

Hi Ho Kermit University Of Maryland Names Commencement Speaker For 2025

May 24, 2025

Hi Ho Kermit University Of Maryland Names Commencement Speaker For 2025

May 24, 2025 -

Famous Amphibian Delivers Inspiring Commencement Address At University Of Maryland

May 24, 2025

Famous Amphibian Delivers Inspiring Commencement Address At University Of Maryland

May 24, 2025