Gibraltar Industries (NASDAQ: ROCK) Earnings Report: Predictions And Impacts

Table of Contents

Analyzing Gibraltar Industries' Recent Performance and Trends

Gibraltar Industries' recent performance will be a key focus of the upcoming earnings report. Analyzing past trends allows for more informed predictions about future performance. Let's delve into the key aspects of their recent financial performance.

Revenue Growth Projections

Examining Gibraltar Industries' recent quarterly and annual revenue figures reveals important trends. Factors like new product launches, robust market demand, and prevailing economic conditions significantly influence revenue growth.

[Insert chart/graph showing revenue growth over the past few quarters/years].

Based on the strong demand for solar mounting systems and continued growth in infrastructure spending, we predict a revenue increase of [Insert Percentage]% for the upcoming quarter. This prediction accounts for potential regional variations in market performance, as certain geographic regions may exhibit stronger growth than others.

- Increased demand for solar mounting systems: The increasing adoption of renewable energy sources fuels demand for Gibraltar Industries' solar mounting solutions.

- Growth in infrastructure spending: Government investments and private sector initiatives in infrastructure projects positively impact sales of related products.

- Strong performance in specific geographic regions: Specific regions might show stronger growth due to factors like favorable regulatory environments or robust construction activity.

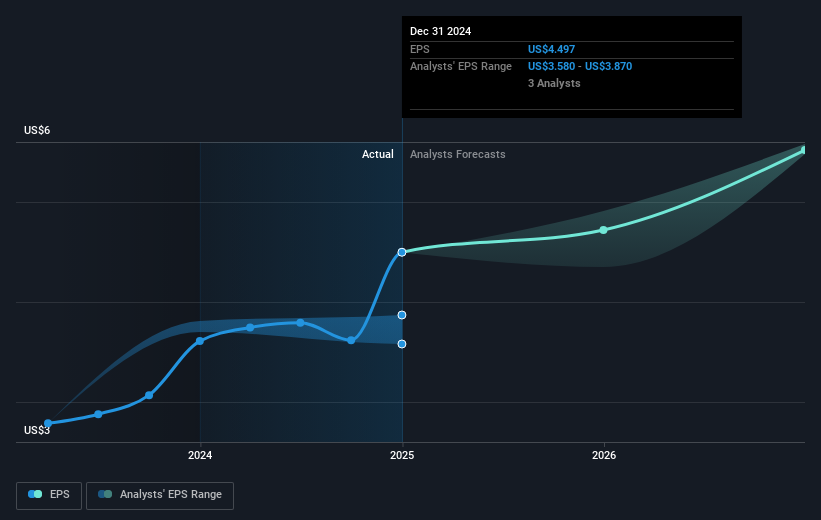

Profitability and Margin Analysis

Profitability is another critical factor. Analyzing gross profit margins and operating income helps understand the efficiency and effectiveness of Gibraltar Industries' operations. Raw material costs, manufacturing efficiency, and pricing strategies are major factors influencing profitability.

[Insert chart/graph showing gross profit margins and operating income trends].

Comparing profitability metrics to previous quarters and competitors provides valuable context. Based on previous trends and considering the impact of inflation on raw material costs, we predict a [Insert Percentage]% increase/decrease in operating income. However, potential efficiency gains from process improvements and strategic pricing adjustments might mitigate the impact of rising costs.

- Impact of inflation on raw material costs: Rising inflation can squeeze profit margins if not offset by pricing strategies.

- Efficiency gains from process improvements: Operational improvements can lead to cost savings and increased profitability.

- Pricing strategies to maintain margins: Effective pricing strategies are crucial for maintaining profitability in a dynamic market.

Key Financial Ratios & Indicators

Analyzing key financial ratios provides a comprehensive assessment of Gibraltar Industries' financial health. Ratios such as debt-to-equity, current ratio, and return on equity offer valuable insights into the company's financial strength and risk profile.

- Debt levels and their impact on future growth: High debt levels might constrain future investments and expansion.

- Cash flow generation and reinvestment potential: Strong cash flow indicates the company's ability to reinvest in growth initiatives.

- Return on invested capital analysis: This ratio reveals how effectively Gibraltar Industries uses its capital to generate profits.

Comparing these ratios to industry peers offers context and helps assess Gibraltar Industries' relative financial performance. These ratios will significantly influence investor sentiment surrounding the earnings report.

External Factors Impacting Gibraltar Industries' Earnings

Several external factors significantly impact Gibraltar Industries' financial performance. Understanding these factors is crucial for accurate earnings predictions.

Macroeconomic Conditions

The broader macroeconomic environment significantly influences Gibraltar Industries' performance. Inflation, recessionary fears, interest rates, and supply chain disruptions all play a role.

- Inflationary pressures on raw materials: Rising inflation increases the cost of raw materials, impacting profitability.

- Impact of rising interest rates on capital expenditure: Higher interest rates increase borrowing costs, potentially affecting investment plans.

- Potential for supply chain improvements: Improvements in the global supply chain could alleviate cost pressures and improve production efficiency.

Industry-Specific Trends

Trends within the building products and industrial infrastructure sectors directly influence Gibraltar Industries' performance. Government regulations, competition, and market demand all contribute to the company’s success or challenges.

- Growth prospects in renewable energy infrastructure: The increasing adoption of renewable energy sources presents significant growth opportunities.

- Demand for sustainable building materials: The growing emphasis on sustainability drives demand for environmentally friendly building products.

- Competitive pressures from major players: Competition from established players in the industry can impact market share and profitability.

Implications of the Earnings Report for Investors

The earnings report holds significant implications for investors considering Gibraltar Industries (NASDAQ: ROCK) stock.

Stock Price Predictions

Based on our analysis of recent performance and external factors, we predict a range of potential stock price movements following the earnings report. A positive surprise could lead to a price increase of [Insert Percentage]%, while a negative surprise could result in a decrease of [Insert Percentage]%. This prediction is subject to market volatility and unforeseen events.

Investment Strategies

Potential investment strategies depend on individual risk tolerance and investment goals. Investors with a higher risk tolerance might consider buying ROCK stock if the earnings report surpasses expectations. A conservative approach might involve holding existing positions or waiting for clearer market signals. Selling might be considered if the results significantly disappoint.

Long-Term Growth Potential

Gibraltar Industries possesses long-term growth potential driven by its position in growing markets. The ongoing demand for building products, coupled with the company's strategic initiatives, suggests promising long-term prospects. However, continued monitoring of macroeconomic conditions and competitive pressures remains essential.

Conclusion

Gibraltar Industries’ upcoming earnings report will have significant implications for investors. By analyzing recent performance, external factors, and key financial metrics, we can develop more informed predictions about the report’s effect on ROCK stock. While uncertainties remain, a thorough understanding of these factors allows investors to make strategic decisions regarding their investment in Gibraltar Industries (NASDAQ: ROCK). Remember to conduct thorough independent research before making any investment decisions. Stay informed on the Gibraltar Industries (NASDAQ: ROCK) earnings report and continue to monitor the company's performance for long-term investment success. Understanding the nuances of Gibraltar Industries' financial performance and the factors influencing its stock price is crucial for successful investment.

Featured Posts

-

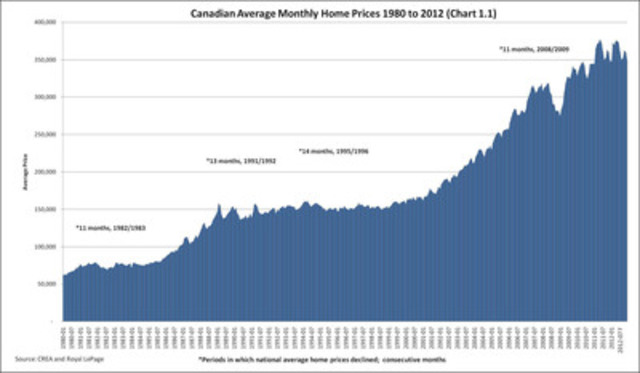

Canadas Housing Market The Impact Of Sub 3 Mortgage Rates

May 13, 2025

Canadas Housing Market The Impact Of Sub 3 Mortgage Rates

May 13, 2025 -

Doom The Dark Ages Waiting Room Playlist Your Soundtrack For Impending Doom

May 13, 2025

Doom The Dark Ages Waiting Room Playlist Your Soundtrack For Impending Doom

May 13, 2025 -

Byds Brazilian Strategy Capitalizing On Fords Market Weakness

May 13, 2025

Byds Brazilian Strategy Capitalizing On Fords Market Weakness

May 13, 2025 -

Nba Tankathon Miami Heat Fans Off Season Obsession

May 13, 2025

Nba Tankathon Miami Heat Fans Off Season Obsession

May 13, 2025 -

Ac Milan Atalanta Guia Completa Para Ver El Partido De Gimenez

May 13, 2025

Ac Milan Atalanta Guia Completa Para Ver El Partido De Gimenez

May 13, 2025

Latest Posts

-

Venezia Y Atalanta Igualan A Cero Un Partido Sin Goles

May 13, 2025

Venezia Y Atalanta Igualan A Cero Un Partido Sin Goles

May 13, 2025 -

Gimenez Juega Ac Milan Vs Atalanta Fecha Hora Y Donde Ver

May 13, 2025

Gimenez Juega Ac Milan Vs Atalanta Fecha Hora Y Donde Ver

May 13, 2025 -

Empate Sin Goles Entre Atalanta Y Venezia Analisis Del Partido

May 13, 2025

Empate Sin Goles Entre Atalanta Y Venezia Analisis Del Partido

May 13, 2025 -

Serie A Ac Milan Vs Atalanta Horario Y Transmision Del Partido De Gimenez

May 13, 2025

Serie A Ac Milan Vs Atalanta Horario Y Transmision Del Partido De Gimenez

May 13, 2025 -

Sin Goles Atalanta Y Venezia Se Reparten Los Puntos

May 13, 2025

Sin Goles Atalanta Y Venezia Se Reparten Los Puntos

May 13, 2025