Global Risk Rally: Stocks Surge On U.S.-China Trade Deal

Table of Contents

The U.S.-China Trade Deal: A Catalyst for Global Growth

The recently announced U.S.-China trade deal marks a crucial step towards de-escalating trade tensions between the world's two largest economies. While the specifics remain complex, the deal addresses several key concerns that have plagued global trade for years. It aims to reduce trade imbalances, protect intellectual property rights, and increase market access for both American and Chinese businesses. This agreement acts as a significant catalyst for global growth by fostering increased trade and investment.

- Reduced Tariffs on Specific Goods: The agreement involves the reduction or removal of tariffs on a wide range of goods, easing the burden on businesses and consumers alike. This lowers costs and stimulates demand.

- Increased Market Access: Both U.S. and Chinese companies gain improved access to each other's markets, fostering competition and economic expansion. This unlocks new opportunities for growth and innovation.

- Commitment to Intellectual Property Protection: Stronger protection of intellectual property rights is a critical component, encouraging innovation and investment, particularly in technology sectors. This safeguards the creative and technological advancements of businesses.

- Agreements on Agricultural Products and Technology: Specific agreements covering agricultural products and technology transfer aim to further balance trade and boost economic activity in these vital sectors. This facilitates collaboration and reduces trade friction.

Impact on Global Stock Markets: A Risk-On Sentiment

The announcement of the U.S.-China trade deal triggered an immediate and significant positive reaction in global stock markets. Investors, embracing a "risk-on" sentiment, flocked to equities, driving up prices across various sectors. Technology and industrial stocks, particularly sensitive to trade relations, saw some of the most substantial gains.

- Major Stock Indices Gains: The Dow Jones Industrial Average, the S&P 500, and the Nasdaq Composite all experienced considerable gains, reflecting a surge in investor confidence.

- Increased Trading Volumes: Higher trading volumes further indicate increased investor participation and confidence in the market's future performance.

- Strengthening of Emerging Market Currencies: Emerging market currencies strengthened as investors sought opportunities in these potentially high-growth economies.

- Rise in Commodity Prices: Commodity prices also saw an upward trend, mirroring the overall improved sentiment and increased demand.

Geopolitical Implications and Long-Term Outlook: U.S.-China Trade Relations

The U.S.-China trade deal holds significant geopolitical implications. Reduced trade tensions could lead to improved international relations and increased cooperation on global issues. This potential for cooperation is a positive sign for fostering greater stability in the global political environment.

- Reduced Trade Tensions: The deal marks a significant step towards reducing trade tensions and promoting a more stable and predictable global trading system.

- Potential for Further Trade Agreements: The success of this agreement could pave the way for further trade agreements and collaborations between the two nations and other countries.

- Ongoing Concerns: However, certain concerns remain, including issues related to specific trade practices and intellectual property protection. These need to be continually monitored.

- Long-Term Prospects for Sustained Growth: While challenges remain, the deal offers positive long-term prospects for sustained economic growth and international cooperation.

Investment Strategies in a Post-Trade Deal World

The current market environment, characterized by a global risk rally, presents both opportunities and challenges for investors. Capitalizing on this requires a well-defined strategy that incorporates diversification and risk management.

- Investing in Companies Benefiting from Increased Trade: Identifying companies poised to benefit from increased trade flows and market access is key. This can encompass various sectors.

- Considering Exposure to Emerging Markets: Emerging markets are expected to benefit significantly from improved global trade, offering attractive investment opportunities.

- Reviewing Portfolio Allocations: Investors should review their existing portfolio allocations and make necessary adjustments to align with the new market realities.

- Seeking Professional Financial Advice: Consulting with a qualified financial advisor is crucial for navigating the complexities of the current market and developing a personalized investment strategy.

Conclusion: Navigating the Global Risk Rally After the U.S.-China Trade Deal

The U.S.-China trade deal has undeniably spurred a global risk rally, positively impacting stock markets and investor sentiment. Understanding this global risk rally and its influence on investment strategies is paramount for investors. The deal offers significant long-term potential for economic growth and global cooperation, but ongoing monitoring of trade relations and market conditions is crucial. By analyzing the U.S.-China trade deal's impact and capitalizing on the post-trade deal market, investors can navigate the current environment effectively. Stay informed about developments in U.S.-China trade relations and make informed investment decisions based on the evolving market conditions. For further insights into global market trends, [link to relevant resource].

Featured Posts

-

Emma Raducanu And Coach Separate After Two Weeks

May 14, 2025

Emma Raducanu And Coach Separate After Two Weeks

May 14, 2025 -

How Much Will Bellingham Cost Chelsea And Tottenhams Transfer Dilemma

May 14, 2025

How Much Will Bellingham Cost Chelsea And Tottenhams Transfer Dilemma

May 14, 2025 -

Tommy Furys Bold Stage Appearance A Look Back

May 14, 2025

Tommy Furys Bold Stage Appearance A Look Back

May 14, 2025 -

Top 10 Iwi Assets Now Worth 8 2 Billion Growth Report Released

May 14, 2025

Top 10 Iwi Assets Now Worth 8 2 Billion Growth Report Released

May 14, 2025 -

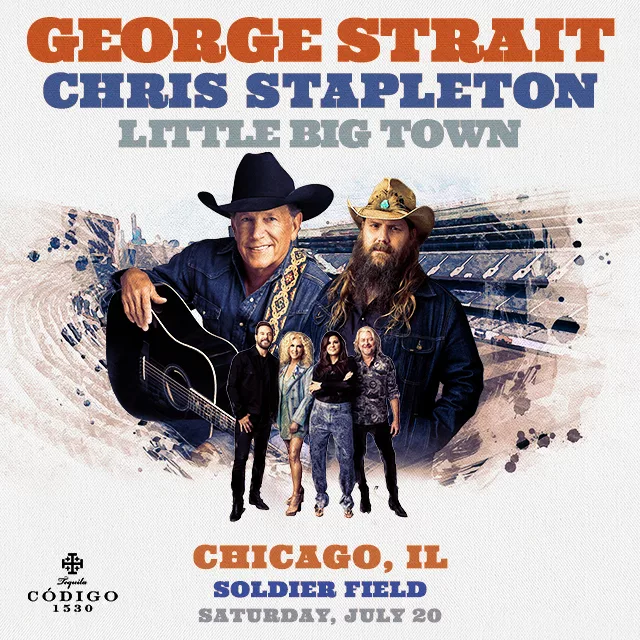

George Strait And Chris Stapletons 2025 Stadium Tour Full Dates And Venues

May 14, 2025

George Strait And Chris Stapletons 2025 Stadium Tour Full Dates And Venues

May 14, 2025

Latest Posts

-

Molly Mae Hague And Tommy Fury The Latest News And Fan Discussion

May 14, 2025

Molly Mae Hague And Tommy Fury The Latest News And Fan Discussion

May 14, 2025 -

Fans React Tommy Furys News And Molly Mae Hagues Interest

May 14, 2025

Fans React Tommy Furys News And Molly Mae Hagues Interest

May 14, 2025 -

Tommy Fury And Molly Mae Hague Parallel Strategies For Sharing Personal News

May 14, 2025

Tommy Fury And Molly Mae Hague Parallel Strategies For Sharing Personal News

May 14, 2025 -

Tommy Furys Bold Stage Appearance A Look Back

May 14, 2025

Tommy Furys Bold Stage Appearance A Look Back

May 14, 2025 -

Tommy Fury Update Molly Mae Hagues Response To His Confession

May 14, 2025

Tommy Fury Update Molly Mae Hagues Response To His Confession

May 14, 2025