Top 10 Iwi Assets Now Worth $8.2 Billion: Growth Report Released

Table of Contents

Key Drivers of Iwi Asset Growth

The dramatic rise in Iwi assets isn't accidental. It's the result of a multifaceted approach to investment and asset management, leveraging both traditional knowledge and modern financial strategies. Several key factors have contributed to this phenomenal growth:

-

Strategic Diversification: Iwi have wisely diversified their investment portfolios, spreading risk across various asset classes. This includes significant holdings in property, forestry, infrastructure, and increasingly, renewable energy and technology. This approach mitigates risk associated with single-sector investments. For example, some Iwi have successfully balanced large-scale property developments with smaller, more agile commercial ventures.

-

Successful Commercial Ventures and Partnerships: Many Iwi have forged successful partnerships with private sector companies, combining traditional knowledge with modern business acumen. These collaborative ventures have unlocked significant value and generated substantial returns. Joint ventures in tourism, for instance, have proven highly profitable, capitalizing on New Zealand's growing tourism sector.

-

Effective Resource Management and Sustainable Practices: A core principle underpinning Iwi asset growth is sustainable resource management. Careful stewardship of land, forests, and other natural resources ensures long-term value creation while prioritizing environmental protection. This commitment to sustainability not only generates profits but also enhances the reputation and social license of Iwi enterprises.

-

Wise Investment of Treaty Settlement Funds: Treaty settlements have provided crucial capital for Iwi to invest in long-term growth strategies. The careful and strategic deployment of these funds has been instrumental in building substantial asset portfolios. This thoughtful approach emphasizes generational wealth-building, securing the economic future for future generations.

-

Strong Governance and Skilled Asset Management Teams: The success of Iwi assets is also attributable to strong governance structures and highly skilled asset management teams. These teams possess the expertise to navigate complex financial markets, identify lucrative investment opportunities, and manage risk effectively. Professional management ensures efficient allocation of resources and maximizes returns.

Top 10 Iwi Assets: A Detailed Breakdown

The following table provides a snapshot of the top 10 Iwi assets and their estimated values. Please note that these figures are approximate and based on the latest available data from the report. (Note: Replace the following with actual data from the report. Include a visually appealing chart or graph here).

| Rank | Iwi | Estimated Value (in billions) | Key Assets |

|---|---|---|---|

| 1 | Iwi A | $X | Primarily property and forestry |

| 2 | Iwi B | $Y | Focus on commercial ventures and tourism |

| 3 | Iwi C | $Z | Diversified portfolio, including energy |

| 4 | Iwi D | $W | Strong holdings in infrastructure |

| 5 | Iwi E | $U | Significant land holdings and agriculture |

| 6 | Iwi F | $T | Technology investments and aquaculture |

| 7 | Iwi G | $S | Property development and tourism |

| 8 | Iwi H | $R | Forestry and renewable energy |

| 9 | Iwi I | $Q | Diversified commercial portfolio |

| 10 | Iwi J | $P | Infrastructure and property development |

Each Iwi has employed unique strategies, tailoring their approaches to their specific circumstances and resources. Some have focused on large-scale property development, while others have prioritized commercial ventures or sustainable resource management. The success of these diverse approaches underscores the adaptability and resilience of Iwi investment strategies.

The Impact of Iwi Investment on the New Zealand Economy

The growth of Iwi assets has a far-reaching impact on the New Zealand economy, extending beyond the direct financial contributions:

-

Significant Job Creation: Iwi investments generate significant employment opportunities across a range of sectors, from construction and forestry to tourism and technology. This contributes to overall economic growth and reduces unemployment.

-

Investment in Infrastructure Projects: Iwi are increasingly involved in infrastructure development projects, contributing to improved infrastructure throughout the country. This benefits not only Iwi communities but the wider New Zealand population.

-

Contribution to Regional Development and Economic Growth: Iwi investments stimulate economic growth in regional areas, particularly in rural communities. This helps to reduce regional disparities and fosters more balanced economic development.

-

Support for Māori Businesses and Entrepreneurship: Iwi investments provide crucial support for Māori businesses and entrepreneurs, fostering innovation and creating economic opportunities within the Māori community.

Future Outlook for Iwi Assets

The future outlook for Iwi assets remains positive, with significant potential for continued growth:

-

Potential for Continued Asset Growth: Based on current trends, Iwi assets are projected to experience continued growth in the coming years. This growth will be driven by strategic investments, successful partnerships, and effective resource management.

-

Emerging Investment Opportunities: Emerging opportunities in renewable energy and technology present exciting prospects for Iwi investment. These sectors are poised for significant growth, offering substantial returns and contributing to a more sustainable future.

-

Challenges Related to Managing Complex Asset Portfolios: Managing increasingly complex asset portfolios presents challenges, including the need for sophisticated risk management strategies and skilled professionals. This necessitates continuous investment in expertise and technological capabilities.

-

Focus on Sustainable and Responsible Investment Practices: Iwi are increasingly emphasizing sustainable and responsible investment practices. This approach ensures long-term value creation while minimizing environmental impact and promoting social equity.

Conclusion:

The remarkable growth of Iwi assets, reaching a combined value of $8.2 billion, demonstrates the effectiveness of Iwi investment strategies and their growing contribution to the New Zealand economy. Strategic diversification, strong governance, and effective resource management are key factors driving this success. The impact extends beyond financial gains, significantly contributing to job creation, infrastructure development, regional growth, and the empowerment of Māori businesses. This remarkable success story highlights the power of combining traditional knowledge with modern financial expertise, shaping the future of both the Māori economy and the broader New Zealand economic landscape.

Call to Action: Learn more about the impressive growth of Iwi assets and the opportunities for future investment by accessing the full report [link to report]. Discover how Iwi investment is shaping the future of the New Zealand economy and explore the impact of these significant Māori assets.

Featured Posts

-

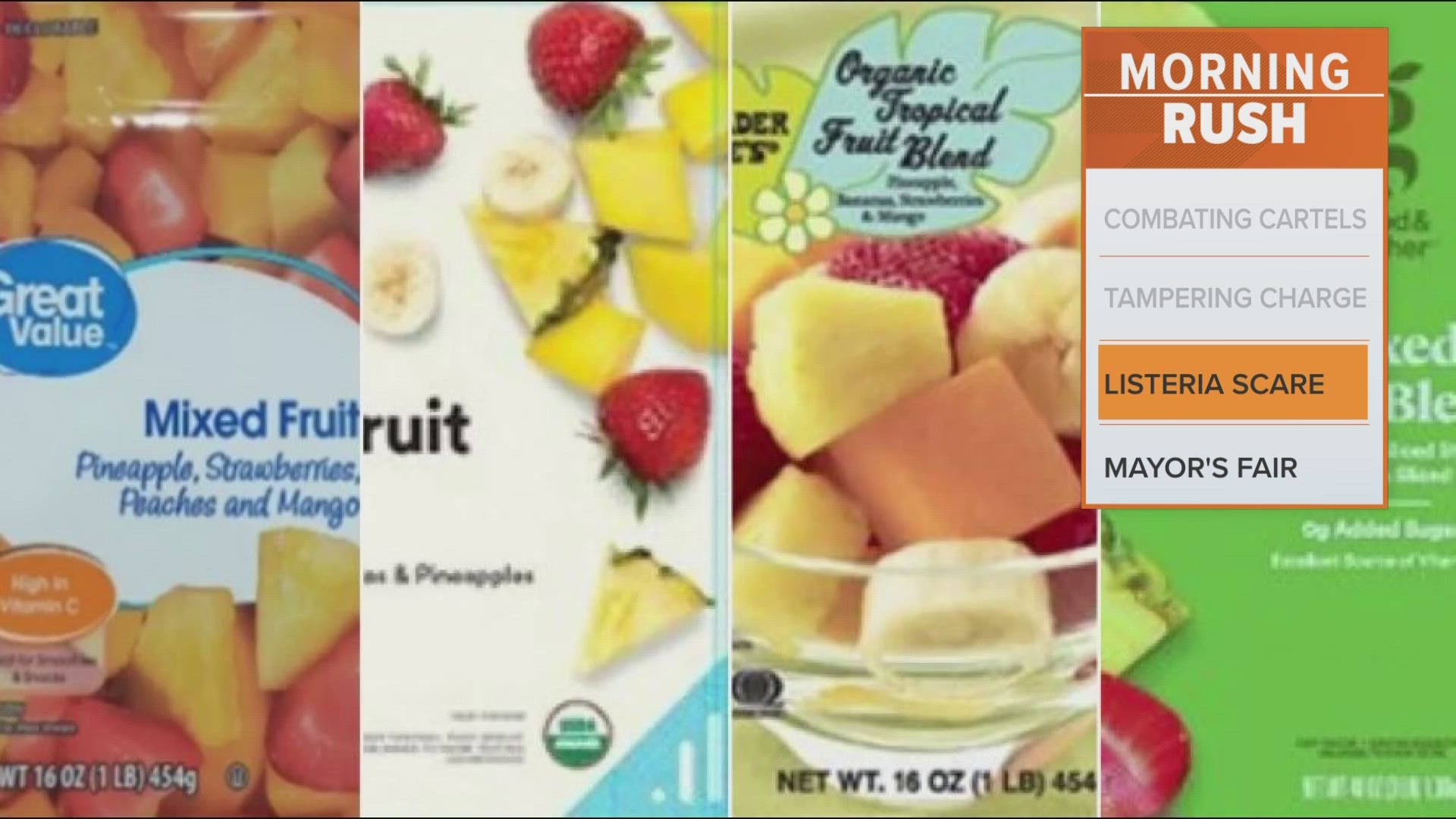

Urgent Recall Alert Great Value Item Pulled From Michigan Shelves

May 14, 2025

Urgent Recall Alert Great Value Item Pulled From Michigan Shelves

May 14, 2025 -

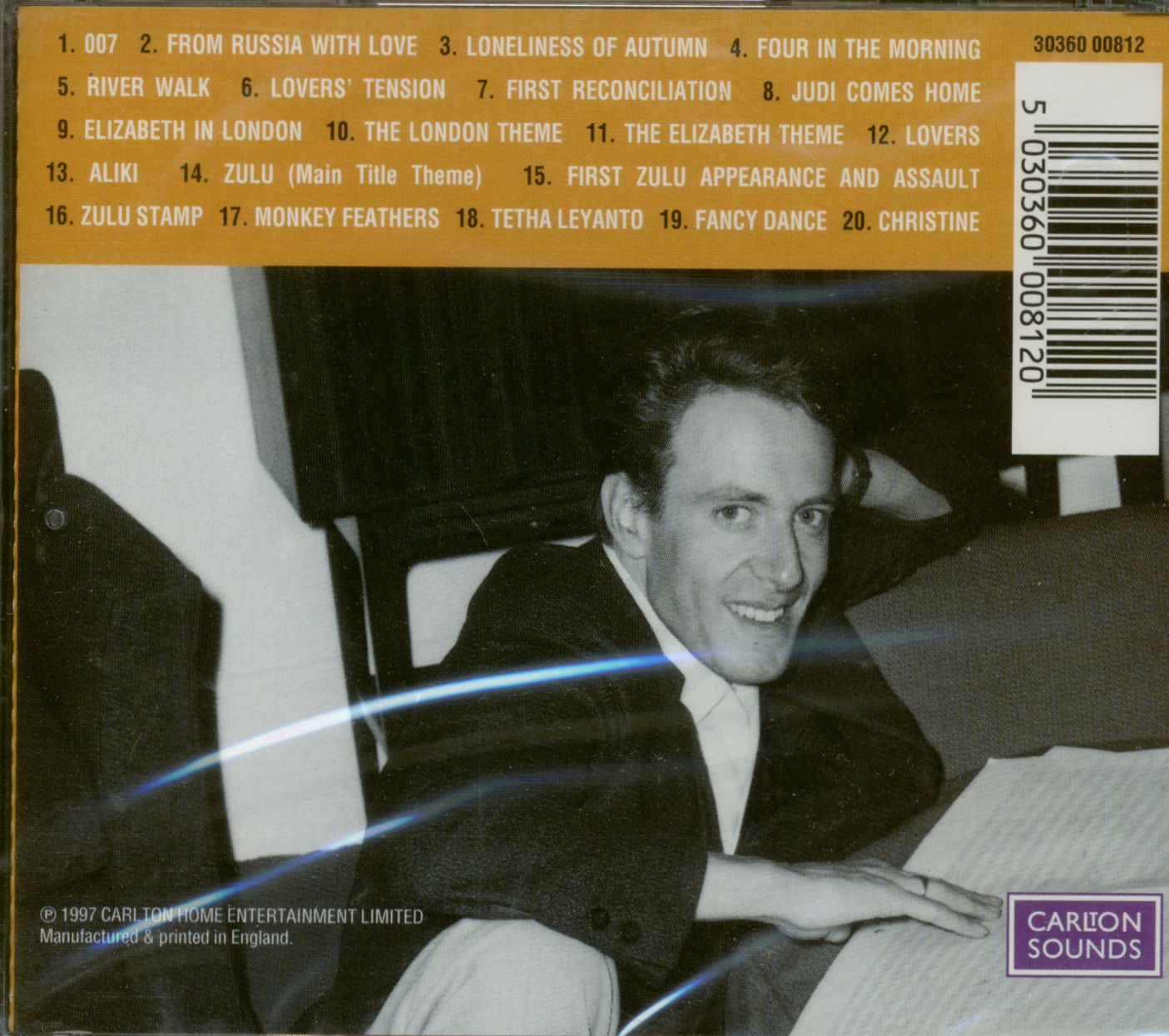

Experience John Barrys From York With Love At Your Local Everyman

May 14, 2025

Experience John Barrys From York With Love At Your Local Everyman

May 14, 2025 -

Barry Bonds Vs Shohei Ohtani A Generational Talent Comparison

May 14, 2025

Barry Bonds Vs Shohei Ohtani A Generational Talent Comparison

May 14, 2025 -

Wta Austin Open Peyton Stearns Upset Loss

May 14, 2025

Wta Austin Open Peyton Stearns Upset Loss

May 14, 2025 -

Tommy Fury Vs Jake Paul Rematch Furys U Turn After Fight

May 14, 2025

Tommy Fury Vs Jake Paul Rematch Furys U Turn After Fight

May 14, 2025

Latest Posts

-

Ice Parent Nyse Exceeds Q1 Profit Expectations On Strong Trading Volume

May 14, 2025

Ice Parent Nyse Exceeds Q1 Profit Expectations On Strong Trading Volume

May 14, 2025 -

Beyond The Ipo A Forerunners Guide To Long Term Startup Success

May 14, 2025

Beyond The Ipo A Forerunners Guide To Long Term Startup Success

May 14, 2025 -

The Forerunners Long Game Navigating The Post Startup Landscape

May 14, 2025

The Forerunners Long Game Navigating The Post Startup Landscape

May 14, 2025 -

Chime Launches Fast 500 Loan Program For Direct Deposit Accounts

May 14, 2025

Chime Launches Fast 500 Loan Program For Direct Deposit Accounts

May 14, 2025 -

Startup Stalemate Exploring Alternatives To The Ipo In The Long Game

May 14, 2025

Startup Stalemate Exploring Alternatives To The Ipo In The Long Game

May 14, 2025