Gold Price Surge: XAUUSD Recovers On Weakening US Economic Indicators

Table of Contents

Weakening US Dollar (USD) and its Impact on XAUUSD

The relationship between the US dollar (USD) and gold prices is inversely correlated. A weaker USD typically leads to a rise in gold prices, and vice-versa. Recent economic data paints a picture of a weakening US dollar, creating a supportive environment for the surge in XAUUSD. Several indicators point to this trend:

- Lower-than-expected GDP growth: Slower-than-anticipated growth signals economic slowdown, putting downward pressure on the USD.

- Falling consumer confidence index: Decreased consumer confidence indicates reduced spending and economic uncertainty, further weakening the dollar.

- Decreased manufacturing activity: A decline in manufacturing output suggests a contraction in the US economy, impacting the USD's strength.

- Weakening US dollar index (DXY): The DXY, a measure of the USD against other major currencies, has shown a notable decline, confirming the overall weakening of the US dollar.

A weaker USD makes gold cheaper for investors holding other currencies, increasing the demand for XAUUSD and contributing to the recent price increase. This effect is amplified by the global nature of gold markets, where the price is influenced by multiple currencies.

Rising Inflation Concerns Fuel Gold Demand

Inflation erodes the purchasing power of fiat currencies like the USD. Gold, traditionally viewed as a hedge against inflation, becomes increasingly attractive during periods of rising inflation. The current economic climate shows signs of persistent inflationary pressures:

- Persistent high inflation rates: Stubbornly high inflation rates continue to erode the value of money, pushing investors toward inflation-resistant assets.

- Central bank actions and their impact on inflation: While central banks attempt to control inflation through monetary policy adjustments, the effectiveness of these actions remains a subject of debate and uncertainty, contributing to investor anxiety.

- Increased investor interest in inflation-resistant assets: Investors are increasingly seeking assets that maintain their value despite inflation, boosting demand for precious metals like gold.

These inflationary pressures drive investors towards gold as a safe haven, increasing demand and contributing to the XAUUSD price surge. Gold's historical performance during inflationary periods strengthens its appeal as a reliable investment.

Geopolitical Uncertainty and Safe-Haven Demand for Gold

Geopolitical instability and uncertainty often lead to increased market volatility, driving investors towards safe-haven assets like gold. Current global events contribute to this trend:

- Ongoing conflicts and their effect on global markets: International conflicts create uncertainty and disrupt supply chains, fueling demand for safe-haven investments.

- Increased political risk and uncertainty: Political instability in various regions introduces additional risk into the global economy, making gold a more attractive option for risk-averse investors.

- Safe-haven demand for gold as a stable asset: Gold's inherent stability and scarcity make it a preferred choice for investors seeking to preserve capital during turbulent times.

The combination of these geopolitical risks has directly contributed to the surge in XAUUSD, as investors seek refuge in the perceived stability of gold.

Technical Analysis of the XAUUSD Chart

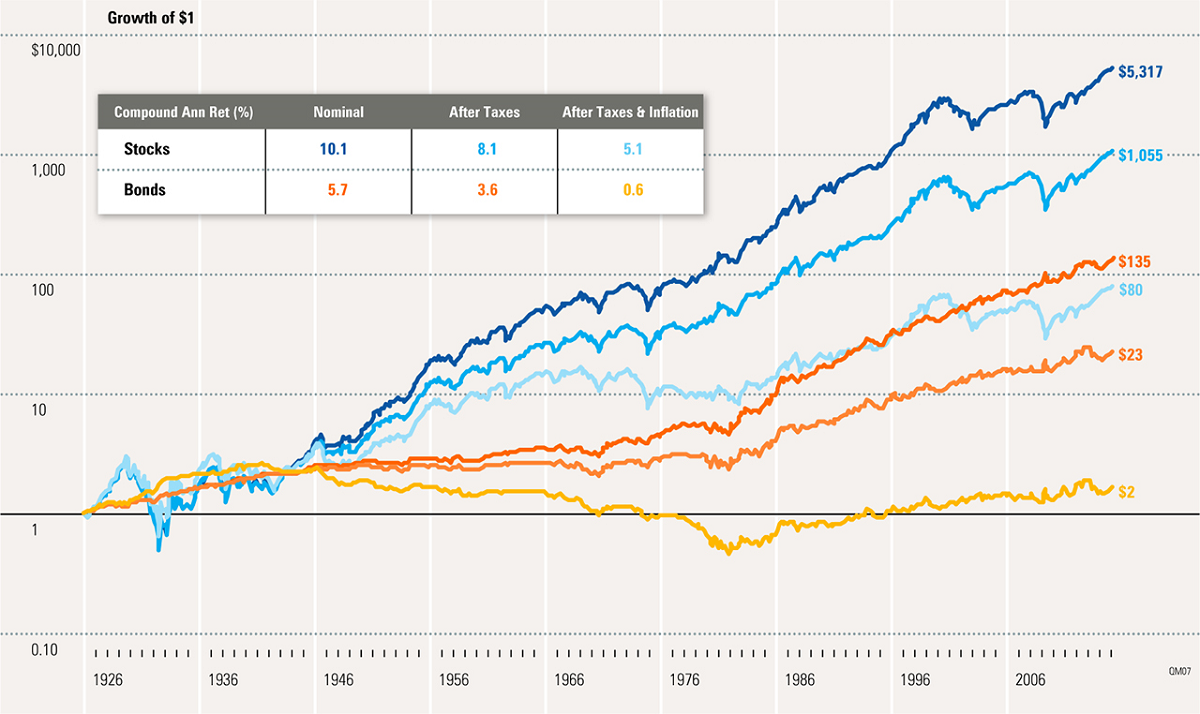

A brief look at the XAUUSD chart reveals several key technical indicators supporting the recent price surge. The break above significant resistance levels suggests a strong bullish momentum. While specific technical analysis requires detailed charting and expertise, observing support and resistance levels can offer insights into potential future price movements. (Optional: Include a chart here showing recent XAUUSD price movements)

Gold Price Surge: Investing in XAUUSD amidst Economic Uncertainty

In summary, the recent gold price surge (XAUUSD) is a result of a confluence of factors: a weakening US dollar, rising inflation concerns, and increased geopolitical uncertainty. These factors underscore the importance of gold as a safe-haven asset and its role in a well-diversified investment portfolio. While the future direction of XAUUSD remains subject to market dynamics, the current environment suggests that gold may continue to be an attractive investment option for those seeking to navigate economic uncertainties.

Considering the current market conditions, further research into gold investment and XAUUSD is recommended. However, before making any investment decisions related to XAUUSD or gold price movements, it is crucial to consult with a qualified financial advisor to assess your risk tolerance and investment goals. Don't hesitate to explore the world of gold investment and XAUUSD to understand how it might benefit your portfolio strategy.

Featured Posts

-

The Problem Of False Angel Reese Quotes Circulating On Social Media

May 17, 2025

The Problem Of False Angel Reese Quotes Circulating On Social Media

May 17, 2025 -

New York Knicks How To Handle The Landry Shamet Question

May 17, 2025

New York Knicks How To Handle The Landry Shamet Question

May 17, 2025 -

Trumps Proposed F 55 Fighter Jet A New Era In Air Power

May 17, 2025

Trumps Proposed F 55 Fighter Jet A New Era In Air Power

May 17, 2025 -

Giants Vs Mariners Updated Injury List For April 4 6 Games

May 17, 2025

Giants Vs Mariners Updated Injury List For April 4 6 Games

May 17, 2025 -

Dismissing Stock Market Valuation Worries A Bof A Analysis

May 17, 2025

Dismissing Stock Market Valuation Worries A Bof A Analysis

May 17, 2025

Latest Posts

-

Subat 2024 Tuerkiye Uluslararasi Yatirim Pozisyonu Aciklanan Rakamlar Ve Degerlendirme

May 17, 2025

Subat 2024 Tuerkiye Uluslararasi Yatirim Pozisyonu Aciklanan Rakamlar Ve Degerlendirme

May 17, 2025 -

Tuerkiye Subat Ayi Uluslararasi Yatirim Pozisyonu Verileri Detayli Analiz

May 17, 2025

Tuerkiye Subat Ayi Uluslararasi Yatirim Pozisyonu Verileri Detayli Analiz

May 17, 2025 -

El Colapso De Koriun Inversiones Como Funcionaba Su Esquema Ponzi

May 17, 2025

El Colapso De Koriun Inversiones Como Funcionaba Su Esquema Ponzi

May 17, 2025 -

Rossiya Ukreplyaet Pozitsii Krupneyshego Investora V Uzbekistane

May 17, 2025

Rossiya Ukreplyaet Pozitsii Krupneyshego Investora V Uzbekistane

May 17, 2025 -

Entendiendo El Fraude De Koriun Inversiones Un Analisis Del Esquema Ponzi

May 17, 2025

Entendiendo El Fraude De Koriun Inversiones Un Analisis Del Esquema Ponzi

May 17, 2025