Dismissing Stock Market Valuation Worries: A BofA Analysis

Table of Contents

BofA's Counterarguments to High Stock Market Valuations

BofA's analysis challenges the prevailing narrative of overvalued markets by highlighting several key factors. Their perspective suggests that current valuations, while seemingly high, are justifiable when considering the broader economic landscape and long-term growth prospects.

The Role of Low Interest Rates

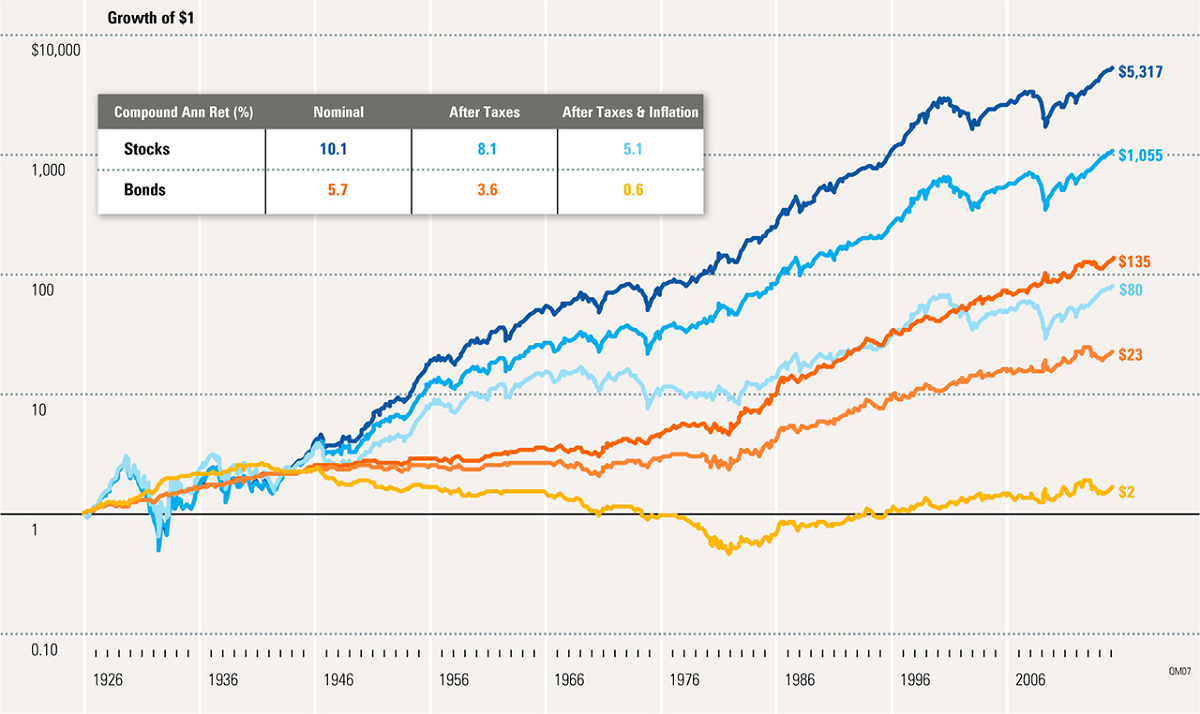

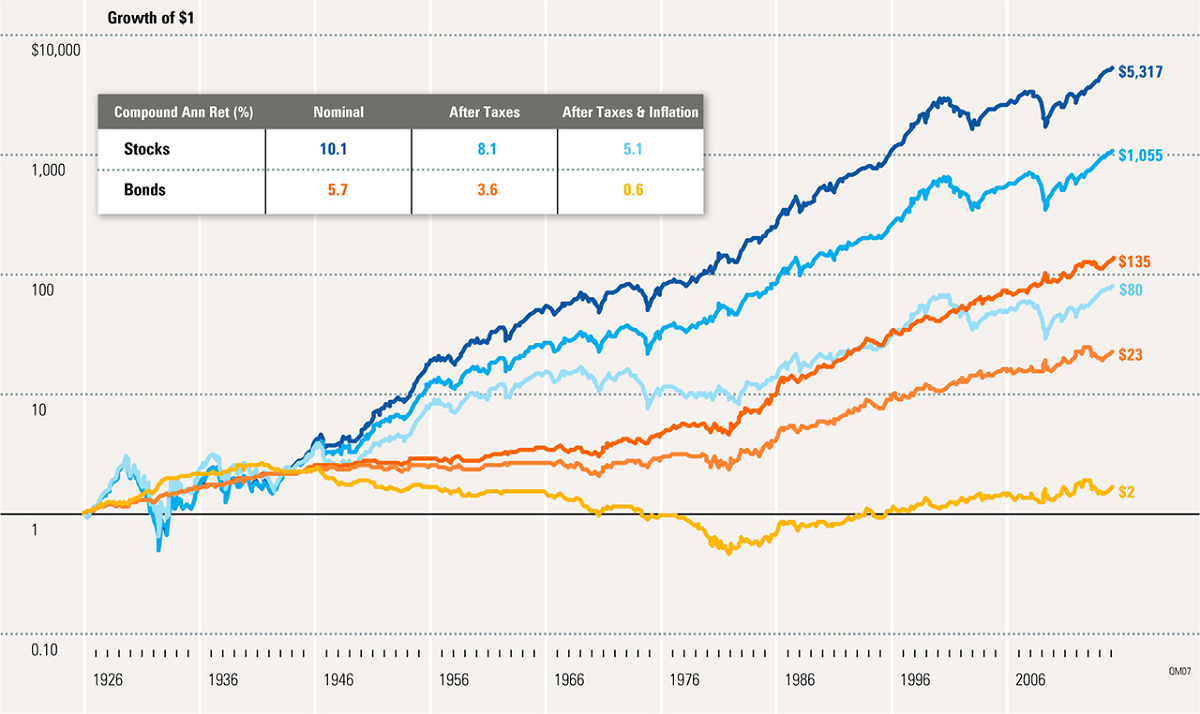

Historically low interest rates play a significant role in justifying higher Price-to-Earnings (P/E) ratios. Lower discount rates used in discounted cash flow (DCF) models lead to higher present values of future earnings, thus supporting higher valuations. BofA's analysis indicates a strong correlation between low interest rate environments and elevated P/E multiples.

- Impact on DCF Models: Lower discount rates directly increase the present value of future cash flows, leading to higher valuations.

- Impact on Valuation Multiples: Low interest rates make equities more attractive relative to bonds, pushing up demand and consequently valuation multiples.

- BofA Data: (Insert specific data points from BofA's report here, e.g., "BofA's analysis shows a historical correlation between 10-year Treasury yields below 2% and P/E ratios exceeding 20x.") This data should be presented visually, using charts or graphs where appropriate.

Keywords: Low interest rates, P/E ratio, discounted cash flow, stock valuation, BofA analysis, interest rate environment.

Strong Corporate Earnings Growth Projections

BofA forecasts robust corporate earnings growth in the coming years, providing a crucial justification for current valuations. This positive outlook suggests that the market's pricing reflects a realistic expectation of future profitability.

- BofA Earnings Forecast: (Insert BofA's specific earnings growth projections here, including details on specific sectors and timelines. Use visuals like bar charts to illustrate the data effectively.)

- Key Growth Sectors: (List specific sectors driving earnings growth, e.g., technology, healthcare, consumer staples. Provide examples of companies within these sectors expected to exhibit strong growth.)

- Impact on Valuation: Strong earnings growth directly supports higher valuations, as investors are willing to pay more for companies demonstrating consistent profitability and growth potential.

Keywords: Corporate earnings, earnings growth, stock market valuation, BofA report, financial forecasts, sector performance.

Technological Innovation and Future Growth Potential

Technological advancements are a major driver of long-term economic growth and contribute to potentially higher valuations. BofA identifies several sectors poised for significant expansion due to technological disruption.

- Disruptive Technologies: (Identify specific disruptive technologies, e.g., AI, cloud computing, biotechnology, and their impact on various industries.)

- Growth Sectors: (Highlight specific sectors benefiting from technological innovation, offering examples of companies at the forefront of these advancements.)

- Valuation Impact: Technological innovation creates new markets and opportunities, potentially leading to higher valuations for companies capitalizing on these advancements.

Keywords: Technological innovation, future growth, stock market valuation, disruptive technology, industry valuation, AI, cloud computing.

Addressing Specific Valuation Metrics

While acknowledging the significance of valuation metrics, BofA cautions against relying solely on single indicators like the Shiller P/E ratio (CAPE).

Analyzing the Shiller P/E Ratio (CAPE)

The Shiller P/E ratio, or CAPE, is a cyclically adjusted price-to-earnings ratio that smooths earnings over a ten-year period. While informative, BofA points out limitations in using CAPE as the sole measure of valuation, particularly in periods of significant technological change or low interest rates.

- BofA's Interpretation: (Present BofA's analysis of the CAPE ratio, highlighting its context and limitations within the current market conditions.)

- Counterarguments: (Address common concerns regarding high CAPE ratios, such as the impact of low interest rates, and provide BofA's counterarguments.)

Keywords: Shiller P/E ratio, CAPE ratio, stock market valuation, long-term valuation, market conditions.

Considering Other Valuation Metrics

BofA's analysis doesn't rely solely on one metric. They likely consider a range of valuation metrics, including price-to-sales (P/S) and price-to-book (P/B) ratios, to gain a more holistic understanding of market valuations. This multifaceted approach provides a more nuanced perspective.

Keywords: Price-to-Sales ratio, Price-to-Book ratio, stock market valuation, alternative valuation metrics, holistic approach.

Conclusion: Dismissing Stock Market Valuation Worries – A Call to Action

BofA's analysis suggests that current stock market valuation worries might be overstated. Their arguments, encompassing low interest rates, strong earnings growth projections, and the transformative power of technological innovation, paint a picture of a market supported by fundamental factors. While acknowledging the usefulness of valuation metrics, BofA emphasizes the need for a broader perspective, incorporating multiple factors and long-term growth potential. Don't let unfounded stock market valuation worries deter you. Review BofA's comprehensive analysis and make informed decisions about your investment strategy. Consider diversifying your portfolio and focusing on long-term growth rather than reacting to short-term market fluctuations.

Featured Posts

-

Knicks Redemption Thibodeaus Transformation And The Overcoming Of A Key Weakness

May 17, 2025

Knicks Redemption Thibodeaus Transformation And The Overcoming Of A Key Weakness

May 17, 2025 -

May 16 Oil Market Report News And In Depth Analysis

May 17, 2025

May 16 Oil Market Report News And In Depth Analysis

May 17, 2025 -

Where To Watch Seattle Mariners Vs Chicago Cubs Spring Training For Free

May 17, 2025

Where To Watch Seattle Mariners Vs Chicago Cubs Spring Training For Free

May 17, 2025 -

The Ultra Wealthy And The Luxury Real Estate Market Navigating Economic Uncertainty

May 17, 2025

The Ultra Wealthy And The Luxury Real Estate Market Navigating Economic Uncertainty

May 17, 2025 -

Easing College Costs Survey Highlights Shifting Parental Attitudes And Loan Dependence

May 17, 2025

Easing College Costs Survey Highlights Shifting Parental Attitudes And Loan Dependence

May 17, 2025

Latest Posts

-

Acidente Envolvendo Onibus Universitario Informacoes Preliminares

May 17, 2025

Acidente Envolvendo Onibus Universitario Informacoes Preliminares

May 17, 2025 -

Grave Acidente Com Onibus Universitario Atualizacao De Vitimas

May 17, 2025

Grave Acidente Com Onibus Universitario Atualizacao De Vitimas

May 17, 2025 -

Local Leader Appointed To Missouri State Board Of Education Former Springfield Councilman

May 17, 2025

Local Leader Appointed To Missouri State Board Of Education Former Springfield Councilman

May 17, 2025 -

Tragedia Onibus Universitario Se Envolve Em Grave Acidente

May 17, 2025

Tragedia Onibus Universitario Se Envolve Em Grave Acidente

May 17, 2025 -

Missouri State Board Of Education Welcomes Former Springfield Councilman

May 17, 2025

Missouri State Board Of Education Welcomes Former Springfield Councilman

May 17, 2025