May 16 Oil Market Report: News And In-depth Analysis

Table of Contents

H2: Global Crude Oil Price Movements

H3: Brent Crude and WTI Crude Price Analysis:

On May 16th, the global oil market experienced [insert actual data for May 16th – e.g., moderate volatility]. Brent crude, the international benchmark, opened at [opening price], reached a high of [high], a low of [low], and closed at [closing price]. Similarly, WTI crude, the US benchmark, opened at [opening price], reached a high of [high], a low of [low], and closed at [closing price]. (Insert chart/graph illustrating price movements)

- Opening prices: [Specific numbers for Brent and WTI]

- Closing prices: [Specific numbers for Brent and WTI]

- Daily highs and lows: [Specific numbers for Brent and WTI]

- Trading volume: [Specific numbers for Brent and WTI – mention if volume was higher or lower than usual and why].

- Comparison to previous day's performance: [Percentage change for both Brent and WTI compared to the previous day's closing price. Explain the reasons behind the changes – e.g., market sentiment, news events].

- Significant price changes and their potential causes: [Highlight any significant price jumps or drops and link them to specific news or events, such as unexpected supply disruptions or changes in demand forecasts].

H3: Factors Influencing Price Volatility:

Several factors contribute to the volatility observed in oil prices. These include intricate interactions between supply and demand, decisions made by OPEC+, geopolitical instability, and the overall health of the global economy.

- Specific examples of geopolitical events: The ongoing conflict in [mention specific region] continues to create uncertainty in global oil supply, potentially leading to price increases. [Mention any other relevant geopolitical factors].

- Analysis of OPEC+ production quotas: The recent OPEC+ meeting resulted in [summarize the decision on production quotas]. This decision is expected to [explain the market's anticipated reaction to the decision – e.g., impact on supply, potential price changes].

- Impact of economic data releases on market sentiment: Positive economic data from major economies like the US or China can boost oil demand and push prices higher. Conversely, negative data can dampen demand and lead to price decreases.

- Inventory levels and their influence: Current oil inventories in [mention key storage locations] are [describe inventory levels – high, low, or stable]. This influences market sentiment, with high inventories potentially leading to price pressure.

H2: OPEC+ and its Impact on the Oil Market

H3: Recent OPEC+ Meetings and Decisions:

The recent OPEC+ meeting on [date] concluded with a decision to [summarize the key decision, including production adjustments].

- Key decisions made: [List the main points of the OPEC+ decision, including any changes to production targets].

- Any disagreements among member states: [Note if there were any disagreements or challenges in reaching a consensus during the meeting].

- Projected production levels for the coming months: [State the projected oil production levels based on the OPEC+ decision].

- Market reaction to the OPEC+ decisions: The market reacted to this announcement by [describe the immediate market reaction – e.g., price increase, decrease, or stability].

H3: Geopolitical Risk Assessment:

Geopolitical risks significantly impact oil prices. Tensions in various regions create uncertainty in supply chains, leading to price fluctuations.

- Specific regions/countries affected: [Mention specific regions or countries experiencing geopolitical instability and their impact on oil supply].

- Analysis of potential supply disruptions: [Analyze potential supply disruptions arising from geopolitical events and their potential impact on global oil prices].

- Speculation on future price movements related to geopolitical risks: [Offer a cautious outlook on future price movements, considering the ongoing geopolitical risks].

H2: Alternative Energy Sources and Their Influence

H3: Growth of Renewable Energy:

The increasing adoption of renewable energy sources, such as solar and wind power, is gradually reducing the world's reliance on fossil fuels.

- Statistics on renewable energy growth: [Provide relevant statistics showcasing the growth of renewable energy adoption globally].

- Government policies promoting renewables: Many governments are implementing policies to incentivize renewable energy adoption, including subsidies, tax breaks, and stricter emission regulations.

- Impact of technological advancements in renewable energy: Technological advancements are making renewable energy more efficient and cost-effective, further accelerating its adoption.

- The shifting energy landscape: The increasing share of renewable energy in the global energy mix is gradually reshaping the energy landscape, posing both challenges and opportunities for the oil industry.

H3: The Transition to a Low-Carbon Economy:

The global transition to a low-carbon economy is a significant long-term factor impacting the oil market.

- Government regulations and carbon pricing mechanisms: Governments worldwide are implementing regulations such as carbon taxes and emissions trading schemes to curb greenhouse gas emissions.

- Corporate sustainability initiatives: Many companies are adopting sustainability initiatives to reduce their carbon footprint and invest in renewable energy sources.

- Investor interest in green energy: Investors are increasingly directing their capital towards green energy projects, signaling a shift in market sentiment.

- Long-term forecasts for oil demand: Long-term forecasts predict a decline in oil demand as the world transitions to cleaner energy sources, though the timeline for this transition remains uncertain.

3. Conclusion:

This May 16 oil market report has highlighted the key factors influencing global crude oil prices, including the decisions of OPEC+, geopolitical instability, and the growing influence of alternative energy sources. We analyzed Brent and WTI crude oil price movements, providing insights into current market dynamics. The interplay between these factors creates a complex and ever-evolving oil market landscape.

Call to Action: Stay informed about daily fluctuations and in-depth analysis by regularly checking our website for the latest updates on the oil market and subscribe to our newsletter for timely delivery of future oil market reports. Understanding the intricacies of the oil market is crucial for navigating the current energy landscape. For continuous insights into crude oil prices and energy market trends, make sure to follow our regular reports.

Featured Posts

-

Fc Barcelona Espanyol Match Accidental Car Crash Leaves 13 Injured

May 17, 2025

Fc Barcelona Espanyol Match Accidental Car Crash Leaves 13 Injured

May 17, 2025 -

Tokyos Quiet Revolution Soundproof Real Estate For A Peaceful Urban Lifestyle

May 17, 2025

Tokyos Quiet Revolution Soundproof Real Estate For A Peaceful Urban Lifestyle

May 17, 2025 -

Watch How A Cybersecurity Expert Beat A Deepfake Detector On Cnn Business

May 17, 2025

Watch How A Cybersecurity Expert Beat A Deepfake Detector On Cnn Business

May 17, 2025 -

Can Modular Homes Solve Canadas Housing Crisis Speed Cost And Affordability

May 17, 2025

Can Modular Homes Solve Canadas Housing Crisis Speed Cost And Affordability

May 17, 2025 -

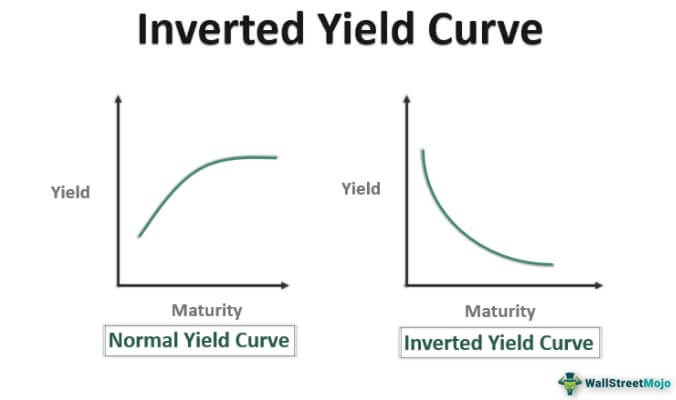

Japanese Government Bonds Navigating The Steep Yield Curve

May 17, 2025

Japanese Government Bonds Navigating The Steep Yield Curve

May 17, 2025

Latest Posts

-

Mitchell Robinson Injury Update Good News For The Knicks After Recent Defeats

May 17, 2025

Mitchell Robinson Injury Update Good News For The Knicks After Recent Defeats

May 17, 2025 -

New York Knicks Mitchell Robinsons Post Surgery Return Season Debut Achieved

May 17, 2025

New York Knicks Mitchell Robinsons Post Surgery Return Season Debut Achieved

May 17, 2025 -

St Johns Basketball Success Earns High Praise From Knicks Coach Tom Thibodeau

May 17, 2025

St Johns Basketball Success Earns High Praise From Knicks Coach Tom Thibodeau

May 17, 2025 -

Mitchell Robinsons Season Debut New York Knicks See Return After Ankle Injury

May 17, 2025

Mitchell Robinsons Season Debut New York Knicks See Return After Ankle Injury

May 17, 2025 -

Thibodeaus Response To Bridges Concern Regarding Knicks Starters Playing Time

May 17, 2025

Thibodeaus Response To Bridges Concern Regarding Knicks Starters Playing Time

May 17, 2025