Japanese Government Bonds: Navigating The Steep Yield Curve

Table of Contents

Understanding the Steepening Yield Curve in the JGB Market

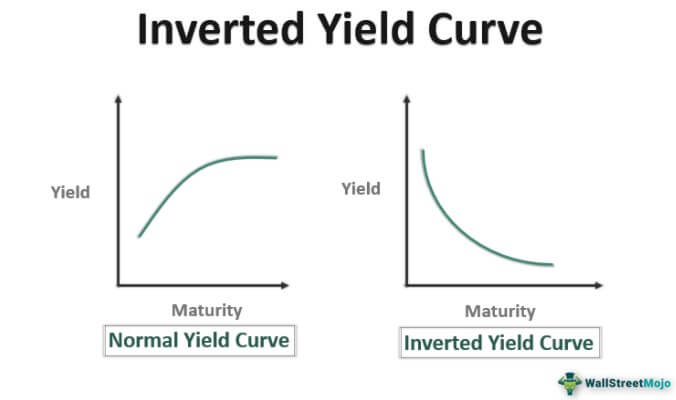

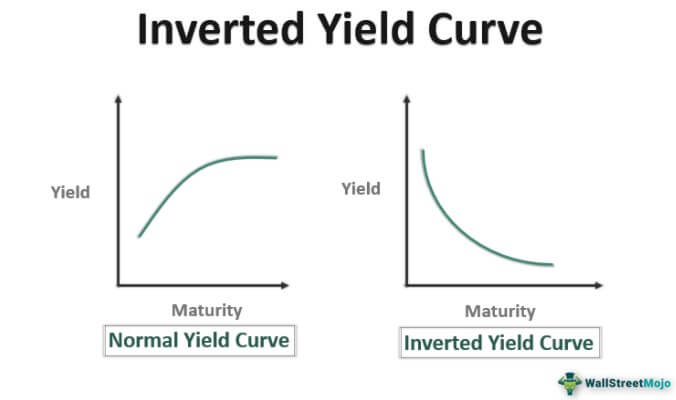

A yield curve illustrates the relationship between the yields (returns) of bonds with different maturities. A steep yield curve indicates a significant difference between short-term and long-term bond yields, often suggesting expectations of future interest rate increases. The recent steepening of the JGB yield curve is a noteworthy development with profound implications for investors.

Several factors are driving this steepening:

- Increased Inflationary Pressures: Global inflationary pressures, and a gradual increase in inflation within Japan itself, are prompting investors to demand higher yields to compensate for the erosion of purchasing power. This increased demand pushes up longer-term JGB yields.

- Bank of Japan (BOJ) Monetary Policy Adjustments: The BOJ's recent adjustments to its ultra-loose monetary policy, including a shift away from yield curve control, have significantly impacted JGB yields. Market participants are closely watching for further policy changes and their potential effects on the yield curve. The BOJ's actions, or lack thereof, directly impact JGB prices and yields.

- Increased Global Demand for Higher-Yielding Assets: With interest rates rising globally, investors are seeking higher returns, leading to increased demand for longer-term JGBs, thus steepening the yield curve. This global appetite for yield competes with the historically low-yield environment associated with JGBs.

- Impact of Rising US Treasury Yields: The rise in US Treasury yields influences global bond markets, including JGBs. Higher US yields can attract international investors away from JGBs, potentially putting upward pressure on JGB yields to remain competitive.

The implications of a steepening yield curve for JGB investors are significant:

- Increased Interest Rate Risk: A steeper curve indicates greater sensitivity to interest rate changes. Rising interest rates can lead to capital losses on existing JGB holdings.

- Opportunities for Higher Returns: While riskier, the steepening curve presents opportunities for higher returns on longer-term JGBs. Careful selection of maturity dates is crucial.

- Need for Careful Risk Management: Investors must implement robust risk management strategies to mitigate the increased volatility associated with a steepening yield curve.

Strategies for Investing in JGBs with a Steep Yield Curve

The current market conditions necessitate a nuanced approach to JGB investing. Several strategies can be employed:

- Short-term JGBs: These offer lower risk and less sensitivity to yield curve shifts. They are ideal for investors prioritizing capital preservation.

- Long-term JGBs: These offer the potential for higher returns but carry significantly increased interest rate risk. Careful consideration of duration risk is crucial.

- JGB ETFs (Exchange-Traded Funds): These provide diversification and easy access to the JGB market. They offer exposure to a basket of JGBs, reducing the impact of individual bond price fluctuations.

- JGB Futures: These offer hedging and speculation opportunities. They allow investors to manage risk or bet on future price movements.

Specific Considerations:

- Short-term JGBs: Focus on liquidity and minimal duration risk.

- Long-term JGBs: Thoroughly assess duration risk and potential capital losses due to interest rate hikes.

- JGB ETFs: Consider expense ratios and the ETF's underlying holdings.

- JGB Futures: Requires a sophisticated understanding of derivatives trading.

Diversification within a JGB portfolio is essential to mitigate risk. Consider a mix of maturities and potentially other asset classes to balance your portfolio. For complex strategies, seeking professional financial advice is highly recommended.

Risk Management in the JGB Market

Investing in JGBs during a steepening yield curve necessitates a comprehensive understanding and management of several key risks:

- Interest Rate Risk: Changes in interest rates directly impact bond prices. Rising rates generally lead to falling bond prices.

- Inflation Risk: Inflation erodes the real return on bonds. Higher inflation necessitates higher yields to compensate investors.

- Currency Risk: Fluctuations in the Yen exchange rate can impact the returns for international investors.

- Reinvestment Risk: The risk that future coupon payments cannot be reinvested at the same or a higher rate.

Strategies for mitigating these risks include:

- Diversification across maturities: Spreading investments across different bond maturities reduces overall portfolio sensitivity to interest rate changes.

- Hedging techniques: Employing strategies like interest rate swaps can help protect against adverse interest rate movements.

- Careful monitoring of market conditions: Staying informed about macroeconomic factors and BOJ policy changes is critical.

- Understanding your risk tolerance: Only invest in JGBs aligned with your risk profile and investment goals.

The Role of the Bank of Japan (BOJ)

The BOJ plays a pivotal role in shaping JGB yields. Its monetary policy decisions, including potential future adjustments to its yield curve control policy, will significantly impact the future trajectory of the yield curve. Analysts and economists offer varying forecasts on future BOJ actions, and monitoring these opinions is crucial for informed investment decisions. The BOJ's influence on JGBs is undeniable, and its future moves should be closely monitored by investors.

Conclusion

The steepening yield curve in the Japanese Government Bond market presents a dynamic and potentially lucrative environment for investors. Successfully navigating this landscape requires a thorough understanding of the factors influencing the curve, the implementation of appropriate risk management strategies, and the careful selection of diverse investment approaches. Whether your strategy focuses on short-term or long-term JGBs, ETFs, or futures, carefully considering interest rate risk, inflation, and currency fluctuations is paramount. By diligently analyzing market trends and seeking professional advice when needed, investors can effectively capitalize on the opportunities presented by the evolving world of Japanese Government Bonds. Start exploring the potential of JGBs today and make informed decisions to enhance your investment portfolio.

Featured Posts

-

Stock Market Valuations Bof As Analysis And Reasons For Investor Calm

May 17, 2025

Stock Market Valuations Bof As Analysis And Reasons For Investor Calm

May 17, 2025 -

Knicks Mitchell Robinson Injury Latest Update And Implications

May 17, 2025

Knicks Mitchell Robinson Injury Latest Update And Implications

May 17, 2025 -

Local News Sports And Jobs Check The Latest Austintown And Boardman Police Blotter

May 17, 2025

Local News Sports And Jobs Check The Latest Austintown And Boardman Police Blotter

May 17, 2025 -

Managing Student Loan Debt Expert Financial Planning Advice

May 17, 2025

Managing Student Loan Debt Expert Financial Planning Advice

May 17, 2025 -

Luxury And Tranquility Soundproof Apartments And Salons In Tokyos Real Estate Market

May 17, 2025

Luxury And Tranquility Soundproof Apartments And Salons In Tokyos Real Estate Market

May 17, 2025

Latest Posts

-

Understanding The Gops Proposed Student Loan Repayment Plan

May 17, 2025

Understanding The Gops Proposed Student Loan Repayment Plan

May 17, 2025 -

Parents Less Worried About College Costs New Survey Reveals Shift In Attitudes

May 17, 2025

Parents Less Worried About College Costs New Survey Reveals Shift In Attitudes

May 17, 2025 -

Rep Crocketts Criticism Of Trumps Economic Policies Inflation And Wages

May 17, 2025

Rep Crocketts Criticism Of Trumps Economic Policies Inflation And Wages

May 17, 2025 -

Gops Student Loan Plan What Pell Grant And Repayment Changes Mean For You

May 17, 2025

Gops Student Loan Plan What Pell Grant And Repayment Changes Mean For You

May 17, 2025 -

Crockett Accuses Trump Of Raising Grocery Prices And Threatening Paychecks

May 17, 2025

Crockett Accuses Trump Of Raising Grocery Prices And Threatening Paychecks

May 17, 2025