Managing Student Loan Debt: Expert Financial Planning Advice

Table of Contents

Understanding Your Student Loan Debt

Before you can effectively tackle your student loan debt, you need a clear understanding of what you owe. This involves identifying your loan types and interest rates, and creating a comprehensive loan inventory.

Identifying Loan Types and Interest Rates

Understanding the type of loans you hold (federal vs. private) and their associated interest rates is crucial for effective repayment planning.

- Federal Loans: These loans are offered by the U.S. government and typically come with more borrower protections and repayment options. Types include:

- Subsidized Loans: The government pays the interest while you're in school (under certain conditions).

- Unsubsidized Loans: Interest accrues while you're in school, adding to your total loan balance.

- PLUS Loans: Loans for parents or graduate students, often with higher interest rates.

- Private Loans: These loans are offered by banks and other private lenders. They often have higher interest rates and fewer repayment options than federal loans.

- Interest Rates: The interest rate determines how much interest you'll pay over the life of your loan. A higher interest rate means you'll pay more overall. Interest rates can be:

- Fixed: Remains constant throughout the loan term.

- Variable: Fluctuates based on market conditions. This can lead to unpredictable monthly payments.

Creating a Comprehensive Loan Inventory

Organizing all your loan details in one place is essential for clear visibility and effective debt management.

- Use a spreadsheet or a dedicated debt tracking app to record the following for each loan:

- Lender name

- Loan servicer (the company managing your loan)

- Loan type (federal or private)

- Interest rate (fixed or variable)

- Loan balance

- Minimum monthly payment

- Due date

Developing a Realistic Budget and Repayment Plan

Creating a realistic budget and choosing the right repayment plan are cornerstones of effective student loan repayment.

Tracking Your Income and Expenses

Accurate budgeting is paramount. You need to understand where your money is going before you can create a plan to pay down your debt.

- Use budgeting tools and techniques:

- 50/30/20 Rule: Allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment.

- Zero-Based Budgeting: Assign every dollar of your income to a specific expense category, ensuring your income equals your expenses.

- Identify areas for expense reduction: Analyze your spending habits to identify areas where you can cut back. This could involve reducing dining out, entertainment expenses, or subscriptions.

Exploring Repayment Options

Several repayment options cater to different financial situations. Choose the one that best suits your current circumstances.

- Standard Repayment: Fixed monthly payments over 10 years.

- Extended Repayment: Lower monthly payments spread over a longer period (up to 25 years for federal loans). You'll pay more in interest overall.

- Graduated Repayment: Payments start low and gradually increase over time.

- Income-Driven Repayment (IDR) Plans: Your monthly payment is based on your income and family size. These plans can lead to loan forgiveness after 20 or 25 years, depending on the plan.

- Forbearance and Deferment: These options temporarily postpone your payments, but interest usually continues to accrue (except for subsidized federal loans during deferment). Use these cautiously as they can increase your overall loan cost.

Automating Payments

Automating your student loan payments helps avoid late fees and maintains a good credit score, a crucial factor for future financial decisions, such as refinancing.

- Setting up automatic payments simplifies the process and ensures on-time payments consistently. This demonstrates responsible financial behavior and helps you build a strong credit history.

Strategies for Reducing Your Student Loan Debt

Beyond basic repayment, several strategies can help you pay off your student loans faster and reduce your overall cost.

Debt Consolidation

Combining multiple loans into one can simplify repayment and potentially lower your monthly payments, improving your debt management.

- Pros: Easier to manage, potentially lower interest rates.

- Cons: You might lose certain benefits associated with federal loans (like IDR plans). Carefully weigh the pros and cons before consolidating.

- Options: Federal Direct Consolidation Loan or private loan consolidation.

Refinancing Your Student Loans

Refinancing involves replacing your existing loans with a new loan from a private lender, often at a lower interest rate.

- Pros: Lower monthly payments and reduced total interest paid.

- Cons: You'll lose federal loan benefits (like IDR plans and potential forgiveness programs). Requires good credit. Carefully compare offers from multiple lenders.

Exploring Loan Forgiveness Programs

Certain professions or circumstances may qualify you for student loan forgiveness programs.

- Public Service Loan Forgiveness (PSLF): Forgives the remaining balance on Direct Loans after 120 qualifying monthly payments while working full-time for a qualifying government or non-profit organization.

- Teacher Loan Forgiveness: Forgives a portion of your federal student loans if you teach full-time for five consecutive academic years in a low-income school or educational service agency.

- Research other programs to see if you qualify. Eligibility requirements vary.

Seeking Professional Financial Advice

Navigating student loan debt can be challenging. A financial advisor can provide invaluable support and personalized guidance.

The Value of a Financial Advisor

A financial advisor can help you:

- Create a personalized budget and repayment plan.

- Explore different debt management strategies.

- Develop a long-term financial plan.

- Understand your options for student loan forgiveness and debt consolidation.

Conclusion

Effectively managing student loan debt requires a strategic and proactive approach. By understanding your loan details, creating a realistic budget, exploring various repayment options, and considering strategies like consolidation and refinancing, you can significantly reduce your financial burden. Remember, seeking professional financial advice can provide invaluable support in navigating this complex process. Don't let student loan debt overwhelm you; take control of your finances and build a secure financial future. Start planning your student loan repayment strategy today!

Featured Posts

-

Family First Angel Reeses Message To Mom After Brothers Ncaa Win

May 17, 2025

Family First Angel Reeses Message To Mom After Brothers Ncaa Win

May 17, 2025 -

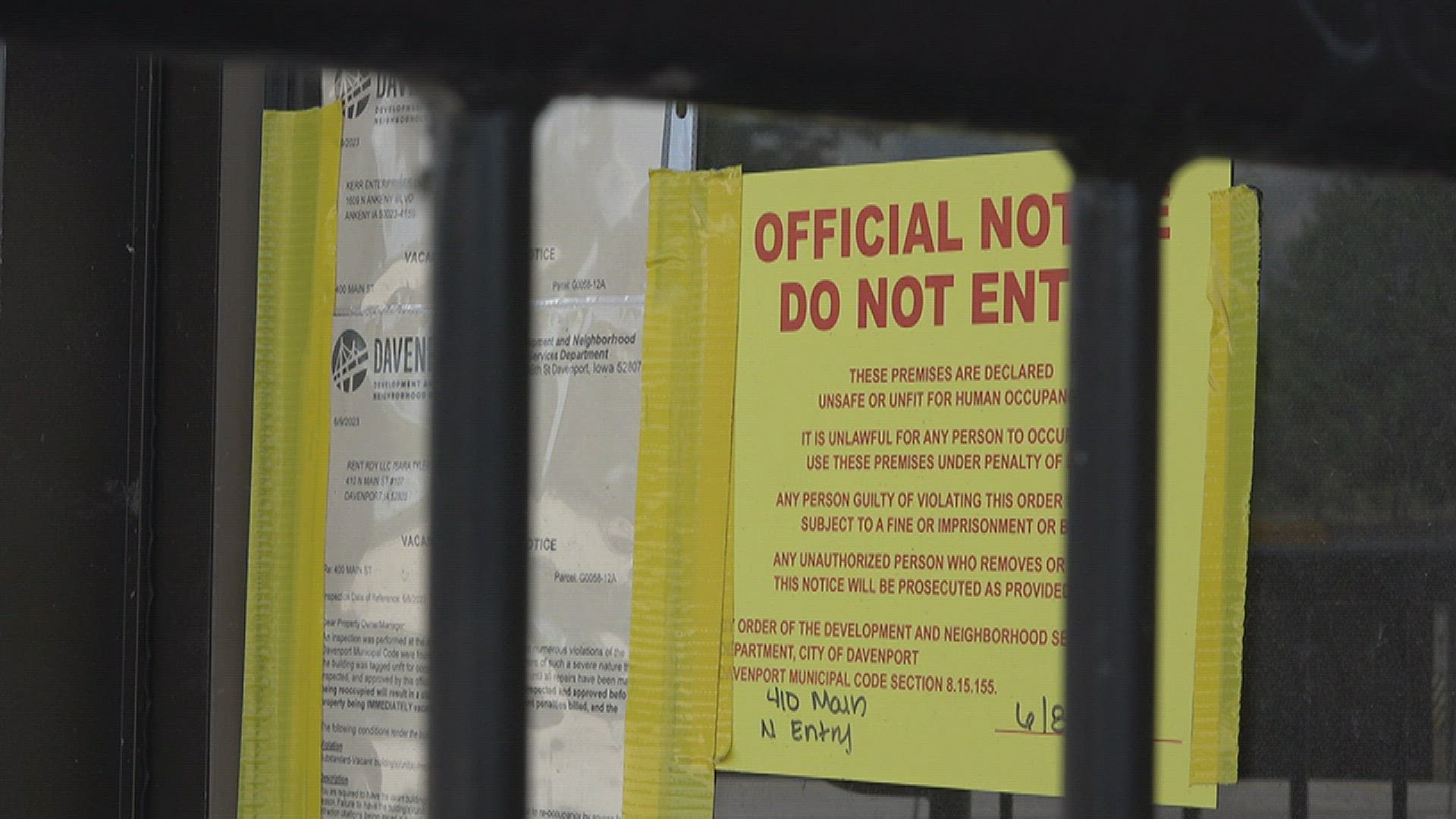

Davenport Council Votes To Demolish Apartment Building

May 17, 2025

Davenport Council Votes To Demolish Apartment Building

May 17, 2025 -

May 16 Oil Market Report News And In Depth Analysis

May 17, 2025

May 16 Oil Market Report News And In Depth Analysis

May 17, 2025 -

Nba Referees Face Backlash After Costly Pistons Foul Call

May 17, 2025

Nba Referees Face Backlash After Costly Pistons Foul Call

May 17, 2025 -

Pga Championship Upset In Round One As Unlikely Leader Emerges

May 17, 2025

Pga Championship Upset In Round One As Unlikely Leader Emerges

May 17, 2025

Latest Posts

-

Fortnite Refund Implications For Future Cosmetic Sales

May 17, 2025

Fortnite Refund Implications For Future Cosmetic Sales

May 17, 2025 -

Fortnite Cosmetic Policy Update Refund Indicates Potential Changes

May 17, 2025

Fortnite Cosmetic Policy Update Refund Indicates Potential Changes

May 17, 2025 -

Fortnite Issues Refunds A Sign Of Cosmetic Policy Changes

May 17, 2025

Fortnite Issues Refunds A Sign Of Cosmetic Policy Changes

May 17, 2025 -

Fortnite Refund Signals Potential Cosmetic Policy Shift

May 17, 2025

Fortnite Refund Signals Potential Cosmetic Policy Shift

May 17, 2025 -

Fortnite In Game Store Practices Under Scrutiny In New Lawsuit Against Epic Games

May 17, 2025

Fortnite In Game Store Practices Under Scrutiny In New Lawsuit Against Epic Games

May 17, 2025