Easing College Costs: Survey Highlights Shifting Parental Attitudes And Loan Dependence

Table of Contents

The Evolving Role of Parents in Funding College

The traditional model of parents shouldering the majority of college expenses is rapidly changing. A recent survey highlights a significant shift in parental involvement, influenced by several key factors.

Decreased Parental Financial Capacity

Economic factors are significantly impacting parents' ability to contribute substantially to their children's college education. Many families face significant financial burdens, making it difficult to meet the ever-increasing cost of tuition, fees, room, and board.

- Job insecurity: The prevalence of contract work and economic downturns has left many parents with less disposable income.

- Rising cost of living: Inflation and increased housing costs are squeezing household budgets, leaving less room for college savings.

- Multiple children in college: Families with several children attending college simultaneously face a magnified financial strain, making it difficult to adequately support each child's education.

The survey data revealed that 60% of parents reported a decrease in their ability to contribute to college expenses compared to previous generations, highlighting the growing parental financial burden and the impact of college affordability on families.

Shifting Parental Expectations and Student Responsibility

In response to the economic realities, parents are increasingly emphasizing student responsibility in financing their education. This shift involves encouraging students to actively participate in securing financial aid and supplementing family contributions.

- Increased emphasis on scholarships: Parents are actively guiding their children in the application process for merit-based and need-based scholarships.

- Part-time jobs and summer employment: Students are encouraged to work part-time during the academic year and pursue summer jobs to help cover their expenses.

- Financial literacy education: Parents are increasingly emphasizing the importance of budgeting and financial planning, equipping their children with the necessary skills to manage their finances effectively.

The survey indicates that 75% of parents expect their children to contribute to their college expenses, reflecting a growing trend of shared financial responsibility. This emphasis on student responsibility fosters financial literacy and prepares students for managing their finances post-graduation.

The Growing Reliance on Student Loans

As parental contributions decrease, students are increasingly turning to student loans to finance their education. This reliance, however, comes with substantial implications.

Increased Loan Amounts and Debt Burden

The survey data shows a concerning trend of escalating student loan amounts and a growing burden of student loan debt.

- Average loan amounts: The average amount borrowed for college has increased significantly over the past decade.

- Repayment challenges: Many graduates face significant difficulties in repaying their loans, leading to financial strain and delayed life milestones.

- Impact on future financial planning: High levels of student loan debt can hinder long-term financial planning, impacting saving for a home, retirement, and other significant life goals.

The weight of student loan debt is significantly impacting the financial well-being of recent graduates and delaying their entry into key life stages.

Understanding the Implications of Increased Student Loan Dependence

The long-term consequences of high student loan debt extend beyond immediate repayment challenges.

- Delayed homeownership: High debt burdens can postpone homeownership, a significant milestone for many young adults.

- Reduced savings: Repaying loans often leaves less room for saving, impacting retirement planning and financial security in later life.

- Impact on career choices: Graduates may be forced to prioritize higher-paying jobs over career paths they find more fulfilling, impacting overall job satisfaction.

The survey highlighted that 80% of graduates feel the weight of student loan debt significantly impacts their long-term financial planning and life choices, emphasizing the need for proactive financial strategies.

Strategies for Easing College Costs

Addressing the challenge of rising college costs requires a multifaceted approach encompassing various financial strategies and planning.

Exploring Alternative Funding Options

Beyond parental contributions and loans, several alternative financing options can help ease the burden of college expenses.

- Grants: Federal and state grants offer need-based financial aid that doesn’t require repayment.

- Scholarships: Merit-based and need-based scholarships can significantly reduce college costs.

- Community college transfer programs: Starting at a community college and then transferring to a four-year institution can save money on tuition.

- Vocational training: Trade schools and vocational programs offer focused training leading to high-demand jobs, often at a lower cost than traditional four-year colleges.

The Importance of Financial Planning and Literacy

Proactive financial planning and strong financial literacy are crucial for managing college expenses effectively.

- Budgeting: Creating a realistic budget is essential for tracking expenses and managing finances effectively.

- Saving strategies: Starting to save early, even small amounts, can make a significant difference in reducing reliance on loans.

- Understanding financial aid applications: Completing the FAFSA (Free Application for Federal Student Aid) and understanding eligibility for financial aid is critical for securing funding.

Conclusion: Navigating the Path to Affordable Higher Education

The survey reveals a significant shift in how college is funded, with decreasing parental contributions and increasing reliance on student loans creating a considerable financial burden for students and families. The implications of rising college costs and high student loan debt are substantial, potentially delaying major life milestones and limiting career choices. However, by exploring alternative funding options like grants and scholarships, embracing proactive financial planning, and developing strong financial literacy skills, students and families can effectively navigate the path to affordable higher education. Discover more effective strategies for easing college costs by exploring available scholarships, grants, and financial aid options. Don't let the rising cost of higher education hold you back – take control of your financial future today!

Featured Posts

-

13 Analyst Assessments Of Principal Financial Group Pfg Key Insights For Investors

May 17, 2025

13 Analyst Assessments Of Principal Financial Group Pfg Key Insights For Investors

May 17, 2025 -

Twm Krwz Wana Dy Armas Qst Hb Mthyrt Lljdl

May 17, 2025

Twm Krwz Wana Dy Armas Qst Hb Mthyrt Lljdl

May 17, 2025 -

Yankees Vs Mariners Tonights Mlb Game Prediction Picks And Odds

May 17, 2025

Yankees Vs Mariners Tonights Mlb Game Prediction Picks And Odds

May 17, 2025 -

Tuerkiye Nin Subat 2024 Doenemi Uluslararasi Yatirim Pozisyonu Oenemli Gelismeler

May 17, 2025

Tuerkiye Nin Subat 2024 Doenemi Uluslararasi Yatirim Pozisyonu Oenemli Gelismeler

May 17, 2025 -

Fox Sports 550 Giants Vs Mariners Injury News Ahead Of April 4 6 Series

May 17, 2025

Fox Sports 550 Giants Vs Mariners Injury News Ahead Of April 4 6 Series

May 17, 2025

Latest Posts

-

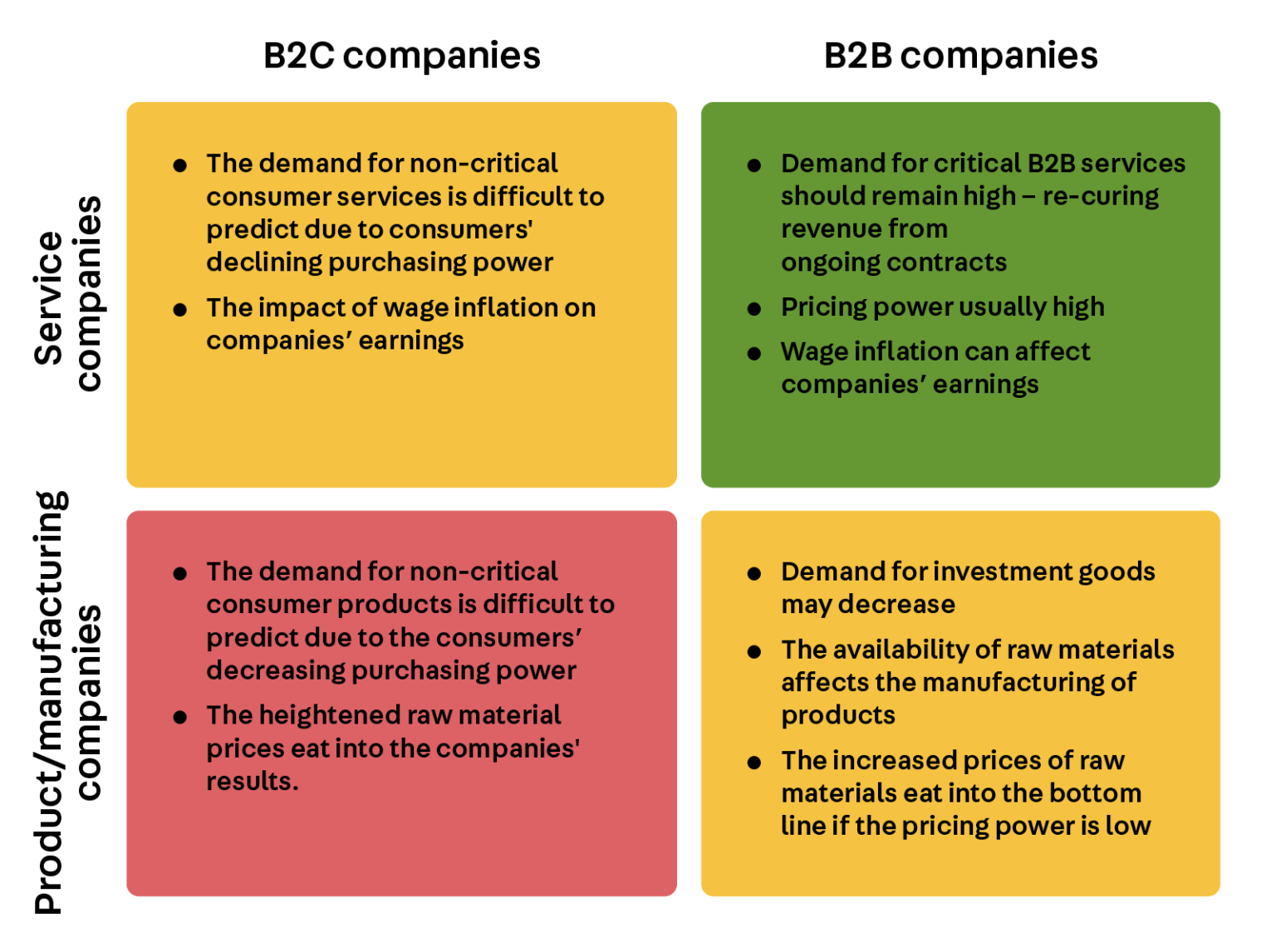

Uber Stock A Recession Resistant Investment Expert Analysis

May 17, 2025

Uber Stock A Recession Resistant Investment Expert Analysis

May 17, 2025 -

Is Uber Recession Proof Analyzing The Stocks Resilience

May 17, 2025

Is Uber Recession Proof Analyzing The Stocks Resilience

May 17, 2025 -

Uber Stock And Recession Why Analysts Remain Bullish

May 17, 2025

Uber Stock And Recession Why Analysts Remain Bullish

May 17, 2025 -

Real Money Online Casinos New Zealand 7 Bit Casino And Other Top Choices

May 17, 2025

Real Money Online Casinos New Zealand 7 Bit Casino And Other Top Choices

May 17, 2025 -

Could These Etfs Profit From Ubers Autonomous Vehicle Technology

May 17, 2025

Could These Etfs Profit From Ubers Autonomous Vehicle Technology

May 17, 2025