Uber Stock And Recession: Why Analysts Remain Bullish

Table of Contents

Uber's Resilience During Economic Downturns

Uber has proven remarkably resilient during past economic downturns. While consumer spending inevitably decreases during recessions, Uber's adaptability has allowed it to weather the storms relatively well.

- Past Recessions and Uber's Performance: During the 2008 financial crisis, ride-sharing was still nascent. However, Uber's subsequent growth demonstrates an inherent ability to capture market share even in challenging times. The pandemic, while initially impacting ridership, spurred growth in Uber Eats, showcasing the company's flexibility.

- Data Points Illustrating Adaptability: Uber's user base has consistently grown, even during periods of economic weakness. While ride volumes might dip temporarily, the company has demonstrated an ability to offset losses through other revenue streams and cost-cutting measures. Data showcasing consistent growth in active users and overall revenue, even during challenging economic periods, would bolster this point.

- Strategic Responses to Economic Challenges: Uber has historically implemented strategic responses such as optimized pricing strategies, targeted marketing campaigns focused on value propositions, and aggressive cost-cutting measures to navigate difficult economic conditions. This proactive approach has helped maintain profitability and investor confidence.

Factors contributing to Uber's resilience include its diversified revenue streams, its ability to quickly implement cost-cutting measures, and the increasingly essential nature of its services for many people.

The Strength of Uber's Diversified Business Model

Uber's strength lies not just in its ride-hailing service but also in its diversified business model. This diversification is crucial in mitigating recessionary risks.

- Growth Potential of Each Segment: Uber's portfolio includes ride-sharing, Uber Eats (food delivery), Uber Freight (logistics), and other emerging services. Even during a recession, some segments, like food delivery, often see increased demand as people opt for more affordable dining options at home.

- Offsetting Potential Losses: A decline in ride-hailing demand during a recession could be offset by growth in Uber Eats or Uber Freight. This diversification reduces reliance on any single revenue stream, making the company more resistant to economic shocks.

- Market Share and Competitive Landscape: Uber holds significant market share across its various segments, giving it a competitive advantage. Analyzing the competitive landscape and Uber's position within each sector further solidifies its resilience.

This strategic diversification is a key factor in the positive analyst outlook on "Uber Stock and Recession."

Long-Term Growth Prospects for Uber

Looking beyond the immediate economic climate, Uber's long-term growth prospects are compelling.

- Expansion into New Markets and Services: Uber continues to expand geographically and into new service areas, offering potential for future revenue growth. This expansion into untapped markets minimizes reliance on existing, potentially volatile markets.

- Technological Advancements and Innovations: Investments in autonomous driving technology and other innovations represent significant long-term growth potential. The successful integration of such technologies could dramatically reduce operational costs and enhance efficiency.

- Increased Profitability and Market Penetration: As Uber achieves greater scale and efficiency, its profitability is expected to increase. Increased market penetration in existing and new markets further strengthens its financial position.

Uber's position at the forefront of technological innovation within the transportation and logistics sectors offers significant long-term growth potential.

Analyst Predictions and Valuation of Uber Stock

Prominent financial analysts largely maintain a bullish outlook on Uber stock, despite recessionary concerns.

- Analyst Quotes and Price Targets: [Insert specific analyst quotes and price targets here, citing reputable sources]. These projections often highlight Uber's resilient business model and long-term growth opportunities.

- Reasoning Behind Bullish Outlook: Analysts often point to Uber's diversification, technological advancements, and cost-cutting measures as key justifications for their positive predictions. The ability to adapt to changing economic conditions is a major factor in their projections.

- Comparison to General Market Sentiment: While general market sentiment might be bearish, the specific outlook on Uber stock stands out due to its perceived resilience and growth potential.

Analysts utilize a variety of valuation metrics, including discounted cash flow analysis and comparable company analysis, to assess Uber's stock.

Addressing Concerns About Recessionary Impact on Uber

While a recession could negatively impact Uber, several factors mitigate these concerns.

- Potential Negative Effects: Reduced consumer spending could lead to lower ride volumes and reduced demand for Uber Eats.

- Mitigating Risks: Uber can implement cost-cutting measures, adjust pricing strategies, and focus marketing on value-oriented offerings to counter reduced demand.

- Maintaining Profitability: Strategic diversification allows Uber to shift resources and focus on more resilient segments, ensuring profitability even during a downturn.

These strategies directly address potential concerns surrounding "Uber Stock and Recession."

Uber Stock and Recession - A Bullish Outlook Remains

In conclusion, analysts' bullish outlook on Uber stock, despite recessionary fears, stems from several key factors: Uber's historical resilience, its highly diversified business model, and its strong long-term growth potential. Considering the long-term perspective, the opportunities for significant returns from investing in Uber remain compelling. Learn more about Uber stock and recession and consider adding Uber stock to your portfolio. Invest wisely in Uber stock.

Featured Posts

-

Gops Student Loan Plan What Pell Grant And Repayment Changes Mean For You

May 17, 2025

Gops Student Loan Plan What Pell Grant And Repayment Changes Mean For You

May 17, 2025 -

Crockett Accuses Trump Of Raising Grocery Prices And Threatening Paychecks

May 17, 2025

Crockett Accuses Trump Of Raising Grocery Prices And Threatening Paychecks

May 17, 2025 -

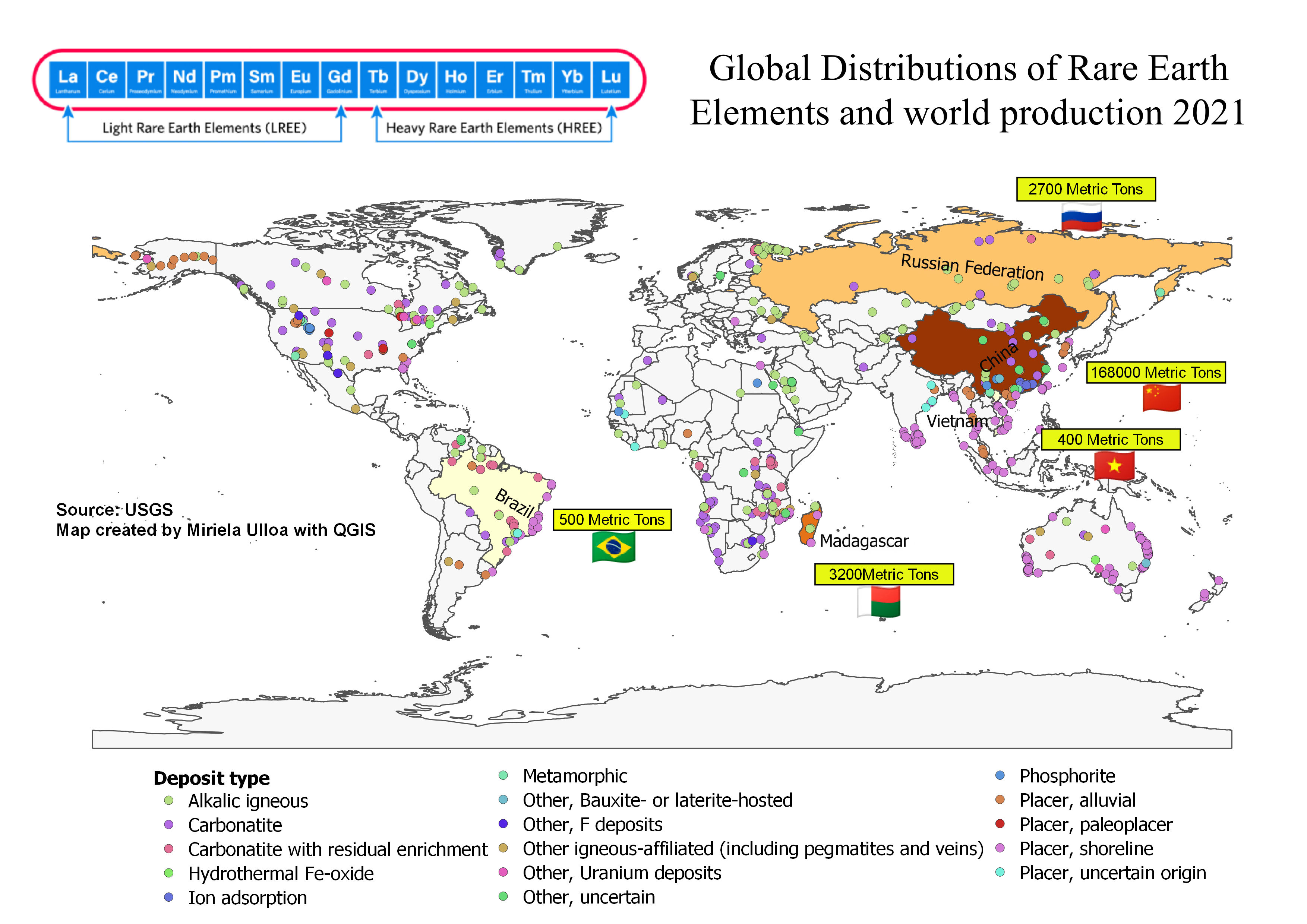

Global Heavy Rare Earths Market Lynass Rise As A Major Player

May 17, 2025

Global Heavy Rare Earths Market Lynass Rise As A Major Player

May 17, 2025 -

Ontarios 14 6 Billion Deficit Tariff Impacts And Economic Outlook

May 17, 2025

Ontarios 14 6 Billion Deficit Tariff Impacts And Economic Outlook

May 17, 2025 -

Trump Tariffs And The Price Of Phone Repairs A Consumers Dilemma

May 17, 2025

Trump Tariffs And The Price Of Phone Repairs A Consumers Dilemma

May 17, 2025

Latest Posts

-

Analyzing The Knicks Near Miss In Overtime

May 17, 2025

Analyzing The Knicks Near Miss In Overtime

May 17, 2025 -

The Knicks Nail Biting Overtime Loss A Look Back

May 17, 2025

The Knicks Nail Biting Overtime Loss A Look Back

May 17, 2025 -

Solid Earnings Boost Rockwell Automation And Peers Fuel Wednesdays Market Rise

May 17, 2025

Solid Earnings Boost Rockwell Automation And Peers Fuel Wednesdays Market Rise

May 17, 2025 -

Knicks Overtime Defeat Avoiding A Catastrophe

May 17, 2025

Knicks Overtime Defeat Avoiding A Catastrophe

May 17, 2025 -

Stock Market Movers Rockwell Automation Leads The Charge

May 17, 2025

Stock Market Movers Rockwell Automation Leads The Charge

May 17, 2025