Government Crackdown On Delinquent Student Loan Borrowers: What You Need To Know

Table of Contents

Understanding the Government's Approach to Delinquent Student Loans

The government's approach to delinquent student loans is becoming increasingly assertive. This means borrowers need to be proactive in managing their debt to avoid severe penalties.

Increased Enforcement Actions

The government is employing more aggressive strategies to recover delinquent student loan debt, leading to a significant increase in enforcement actions. These include:

- Increased wage garnishment: A larger percentage of wages may be garnished to repay the debt.

- More frequent tax refund offsets: The government is more aggressively seizing tax refunds to apply towards outstanding student loan balances.

- More aggressive referral to collection agencies: Delinquent borrowers are more likely to be referred to private collection agencies, which can pursue aggressive collection tactics.

- Potential impact on credit scores: Delinquency significantly damages credit scores, making it harder to obtain loans, mortgages, or even rent an apartment in the future. This negative impact can last for years.

Types of Delinquent Student Loan Debt Targeted

The crackdown targets various types of federal student loans, including:

- Direct Subsidized Loans: Loans where the government pays the interest while the borrower is in school.

- Direct Unsubsidized Loans: Loans where the borrower is responsible for interest payments from the time the loan is disbursed.

- Direct PLUS Loans: Loans available to parents of undergraduate students and graduate students.

- FFEL Program Loans (Federally-guaranteed): These loans were issued before 2010 and are now typically held by private lenders but guaranteed by the federal government.

Defining "Delinquency"

Understanding what constitutes a delinquent student loan is crucial. Generally, a loan is considered delinquent after 90 days of missed payments. However, this can vary slightly depending on the loan servicer. Staying informed about your payment due dates and contacting your servicer immediately if you anticipate difficulty making a payment is essential.

Consequences of Delinquent Student Loan Debt

The consequences of neglecting delinquent student loans can be severe and far-reaching, impacting both your finances and your overall well-being.

Financial Penalties

Failing to repay your student loans on time can lead to substantial financial penalties, including:

- Late fees and accruing interest: These significantly increase the total debt owed, making repayment even more challenging.

- Damage to credit score: A poor credit score severely impacts your ability to access credit in the future, affecting mortgages, auto loans, and even credit cards.

- Wage garnishment: A portion of your paycheck can be legally seized to repay the debt.

- Tax refund offset: Your tax refund can be applied to your student loan debt, leaving you with nothing.

Legal Ramifications

Beyond financial penalties, the legal ramifications of delinquent student loans can be serious:

- Lawsuits from collection agencies: Collection agencies can sue you to recover the debt, leading to additional costs and judgments.

- Potential legal judgments: Court judgments can result in wage garnishment, bank account levies, and property liens.

- Difficulty obtaining government benefits or clearances: Delinquent student loans can impact your eligibility for certain government benefits or security clearances.

Emotional and Psychological Stress

The weight of delinquent student loan debt can cause significant emotional and psychological stress, leading to anxiety, depression, and even impacting personal relationships. It's crucial to address the issue proactively to minimize this burden.

Available Options for Delinquent Student Loan Borrowers

There are several options available to help borrowers manage and resolve their delinquent student loans. Exploring these options can significantly improve your financial situation.

Rehabilitation Programs

Rehabilitation programs allow you to reinstate your loans to good standing by making a series of on-time payments. This can help repair your credit and avoid further penalties.

Income-Driven Repayment Plans

These plans adjust your monthly payments based on your income and family size, making repayment more manageable:

- Revised Pay As You Earn (REPAYE)

- Income-Based Repayment (IBR)

- Income-Contingent Repayment (ICR)

- Pay As You Earn (PAYE)

Deferment and Forbearance

These options temporarily postpone your payments, offering short-term relief. However, interest may still accrue, so it's crucial to understand the implications.

Loan Consolidation

Consolidating multiple loans into a single loan can simplify repayment and potentially lower your monthly payment.

Seeking Professional Help

Contacting a non-profit credit counseling agency or a student loan attorney can provide valuable guidance and support in navigating your options.

Conclusion

The government's crackdown on delinquent student loans is a serious matter. Understanding the potential consequences, from damaged credit to wage garnishment, is vital for preventing further financial hardship. However, numerous options exist to manage and resolve delinquent student loan debt. By exploring income-driven repayment plans, rehabilitation programs, or seeking professional assistance, borrowers can work towards resolving their delinquent student loans and avoid further complications. Don't ignore your delinquent student loan debt; take action today to explore your options and regain control of your financial future. Learn more about managing your delinquent student loans and find solutions that fit your circumstances.

Featured Posts

-

St Johns Basketball Success Earns High Praise From Knicks Coach Tom Thibodeau

May 17, 2025

St Johns Basketball Success Earns High Praise From Knicks Coach Tom Thibodeau

May 17, 2025 -

Angel Reeses Bold New Reebok Ss 25 Capsule Collection

May 17, 2025

Angel Reeses Bold New Reebok Ss 25 Capsule Collection

May 17, 2025 -

Delhi And Mumbai Get Uber Pet Services Convenient Pet Travel

May 17, 2025

Delhi And Mumbai Get Uber Pet Services Convenient Pet Travel

May 17, 2025 -

How Will Trumps Student Loan Changes Affect Black Students

May 17, 2025

How Will Trumps Student Loan Changes Affect Black Students

May 17, 2025 -

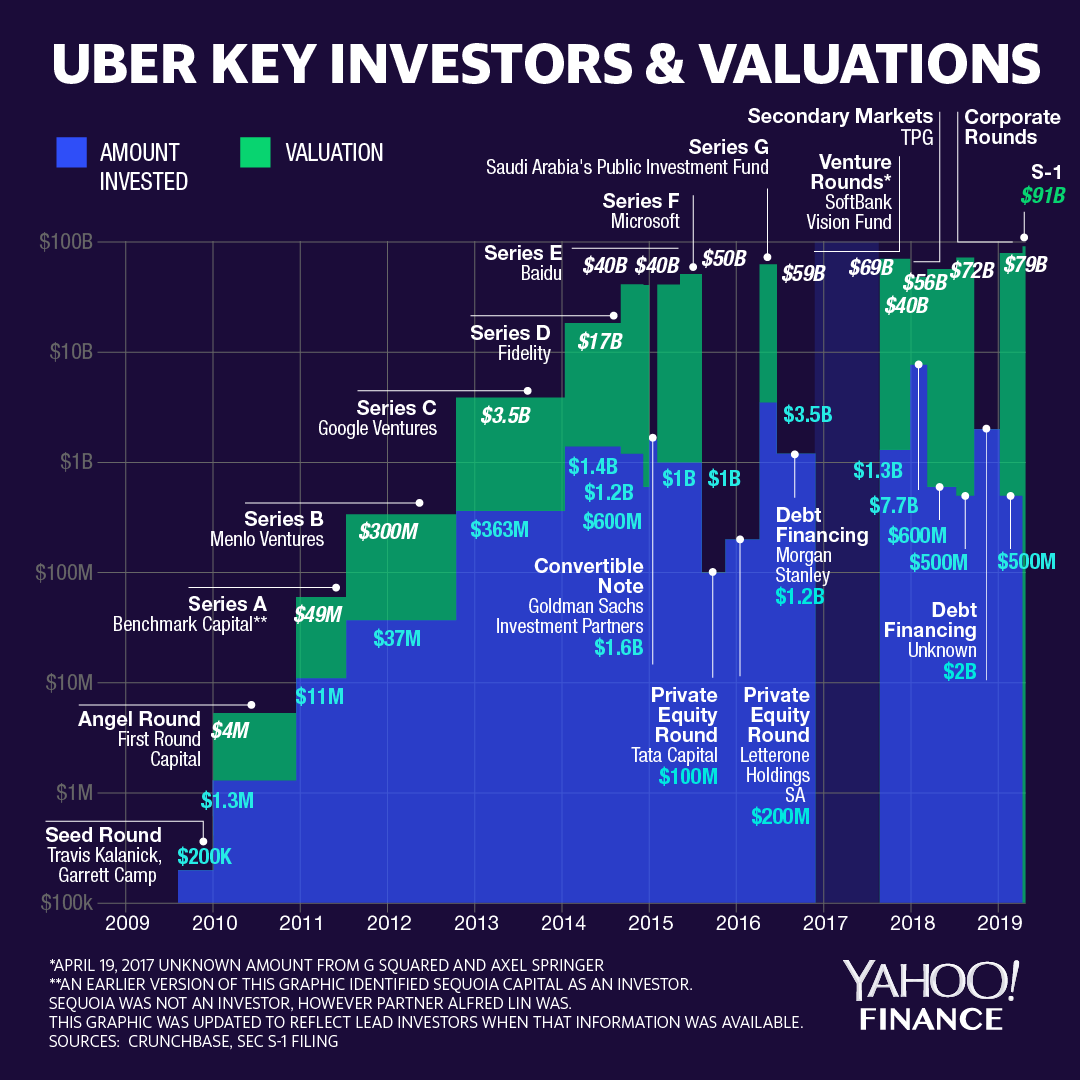

Assessing The Investment Potential Of Uber Uber Stock

May 17, 2025

Assessing The Investment Potential Of Uber Uber Stock

May 17, 2025

Latest Posts

-

Fortnite Cowboy Bebop Bundle Price And Details For Faye Valentine And Spike Spiegel Skins

May 17, 2025

Fortnite Cowboy Bebop Bundle Price And Details For Faye Valentine And Spike Spiegel Skins

May 17, 2025 -

Cowboy Bebop Faye Valentine And Spike Spiegel Fortnite Skin Bundle Price Check

May 17, 2025

Cowboy Bebop Faye Valentine And Spike Spiegel Fortnite Skin Bundle Price Check

May 17, 2025 -

Fortnites Cowboy Bebop Skins How Much Does The Faye Valentine And Spike Spiegel Bundle Cost

May 17, 2025

Fortnites Cowboy Bebop Skins How Much Does The Faye Valentine And Spike Spiegel Bundle Cost

May 17, 2025 -

Fortnite Cowboy Bebop Skins Faye Valentine And Spike Spiegel Bundle Price Revealed

May 17, 2025

Fortnite Cowboy Bebop Skins Faye Valentine And Spike Spiegel Bundle Price Revealed

May 17, 2025 -

Fortnite The Return Of Beloved Skins After 1000 Days In The Item Shop

May 17, 2025

Fortnite The Return Of Beloved Skins After 1000 Days In The Item Shop

May 17, 2025