GPB Capital Founder Sentenced: 7 Years For Ponzi-Like Scheme

Table of Contents

Details of the GPB Capital Ponzi-Like Scheme

GPB Capital, once a prominent private equity firm, allegedly operated a sophisticated Ponzi-like scheme that defrauded numerous investors. The scheme's mechanics involved misrepresenting the performance of its investment vehicles, primarily focused on alternative assets like waste management and automotive dealerships. Instead of genuine investment returns, new investor funds were allegedly used to pay earlier investors, a classic characteristic of a Ponzi scheme.

- Fraudulent Investment Strategies: GPB Capital employed deceptive marketing materials and provided falsified financial statements to lure investors. They overstated the value of their assets and promised unrealistically high returns.

- Targeted Investors: The scheme targeted a wide range of investors, including high-net-worth individuals, institutional investors, and retirement funds seeking alternative investment options. The promise of high yields attracted significant capital.

- Scale of the Fraud: The total amount of money involved in the scheme is estimated to be in the hundreds of millions of dollars, affecting thousands of investors who suffered substantial financial losses.

- Misrepresentation and Misleading Information: Investors were consistently given false information about the performance of their investments. This included fabricated financial reports and misleading statements about the underlying assets.

The Role of David Gentile in the Scheme

David Gentile, as the founder and CEO of GPB Capital, played a central role in orchestrating the alleged Ponzi-like scheme. While the investigation implicated others, Gentile was the driving force behind the fraudulent activities.

- Gentile's Position: As the head of GPB Capital, Gentile had ultimate control over the firm's operations and financial reporting.

- Charges Against Gentile: He faced numerous charges, including securities fraud, wire fraud, and conspiracy to commit fraud. These charges reflected the gravity of his actions and their impact on investors.

- Evidence Presented: The prosecution presented substantial evidence during the trial, including financial records, emails, and witness testimonies, demonstrating Gentile's direct involvement in the fraudulent activities.

- Gentile's Statements: While the specifics of Gentile's statements during the trial remain a matter of public record, the sentencing itself demonstrates the court's acceptance of the evidence against him.

The SEC Investigation and Legal Proceedings

The Securities and Exchange Commission (SEC) launched a comprehensive investigation into GPB Capital following numerous investor complaints and concerns about the firm's financial practices. This investigation led to extensive legal proceedings.

- Timeline of the SEC Investigation: The SEC investigation spanned several years, meticulously gathering evidence and building a case against GPB Capital and its key figures.

- Key Findings: The investigation revealed widespread fraud, including the consistent misrepresentation of investment performance and the fraudulent use of investor funds.

- Criminal Charges: Following the SEC investigation, criminal charges were filed against David Gentile and others involved in the scheme.

- Outcome of the Trial and Sentencing: The trial resulted in Gentile's conviction, leading to the seven-year prison sentence.

- Ongoing Legal Proceedings: While Gentile's sentencing concludes a significant chapter, related legal proceedings concerning GPB Capital and other involved parties may continue.

Impact and Consequences of the GPB Capital Scandal

The GPB Capital scandal has far-reaching consequences for investors, the financial industry, and regulatory oversight.

- Financial Losses: Investors suffered significant financial losses, impacting their retirement savings and financial stability.

- Impact on Investor Confidence: The scandal eroded investor confidence in alternative investment products and the financial industry as a whole.

- Changes in Regulatory Practices: The scandal is likely to lead to increased regulatory scrutiny of private equity firms and alternative investment strategies, potentially prompting changes in regulatory practices.

- Potential for Future Legal Actions: The possibility of future legal actions against other individuals involved in the GPB Capital scheme remains.

Conclusion

David Gentile's seven-year prison sentence for his role in the GPB Capital Ponzi-like scheme serves as a stark reminder of the devastating consequences of investment fraud. The scale of the fraud, the number of victims, and the length of the sentence highlight the critical need for investor due diligence and robust regulatory oversight. This case underscores the importance of understanding the risks involved in any investment opportunity and thoroughly researching the individuals and firms behind those opportunities. Protect yourself from GPB Capital-style schemes by carefully vetting investments, understanding the risks involved, and reporting any suspicious activities to the SEC or other relevant authorities. Learn how to identify a Ponzi scheme and understand the risks of investment fraud by visiting the SEC website () and other consumer protection agencies. The GPB Capital case should serve as a cautionary tale for all investors.

Featured Posts

-

Oilers Vs Kings Series Betting Odds And Predictions

May 10, 2025

Oilers Vs Kings Series Betting Odds And Predictions

May 10, 2025 -

White House Cocaine Found Secret Service Investigation Concludes

May 10, 2025

White House Cocaine Found Secret Service Investigation Concludes

May 10, 2025 -

Indian Stock Market Update Sensex Nifty Performance

May 10, 2025

Indian Stock Market Update Sensex Nifty Performance

May 10, 2025 -

Transgender Girls Banned From Ihsaa Sports Following Trumps Order

May 10, 2025

Transgender Girls Banned From Ihsaa Sports Following Trumps Order

May 10, 2025 -

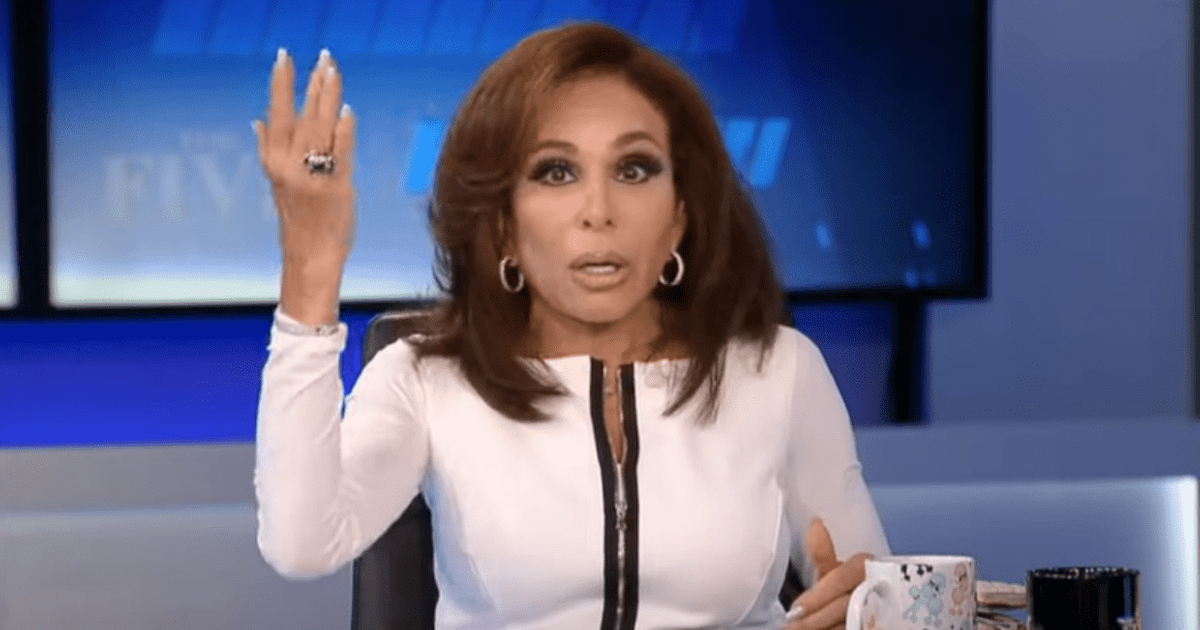

Jessica Tarlovs Sharp Rebuke Of Jeanine Pirro Over Canada Trade Dispute

May 10, 2025

Jessica Tarlovs Sharp Rebuke Of Jeanine Pirro Over Canada Trade Dispute

May 10, 2025