Indian Stock Market Update: Sensex, Nifty Performance

Table of Contents

Sensex Performance Analysis

Recent Trends and Fluctuations

The Sensex, a benchmark index of 30 of the largest and most actively traded Indian companies, has experienced a period of [describe recent trend - e.g., moderate growth, significant decline, consolidation]. (Insert chart showing Sensex performance over the last month/quarter/year).

- Significant Highs and Lows: [Mention specific dates and values of significant highs and lows, explaining the context e.g., "On [Date], the Sensex reached a high of [Value] driven by positive investor sentiment following [Event]." "Conversely, a low of [Value] was observed on [Date] due to concerns over [Event]."]

- Major Influencing Factors: Recent performance has been influenced by factors such as [List key factors, e.g., global inflation concerns, positive domestic economic data, changes in interest rates, geopolitical uncertainties].

Sectoral Performance within the Sensex

Analyzing Sensex sectors reveals a mixed bag. (Insert chart/table showing sectoral performance).

- Top Performing Sectors: The [Sector Name] sector has outperformed others, driven by [Reasons, e.g., strong earnings, increased demand]. Similarly, the [Sector Name] sector has shown robust growth due to [Reasons].

- Bottom Performing Sectors: Conversely, the [Sector Name] sector has lagged, impacted by [Reasons, e.g., supply chain disruptions, regulatory changes]. The [Sector Name] sector also underperformed, affected by [Reasons].

Nifty Performance Analysis

Recent Trends and Fluctuations

The Nifty 50 index, representing 50 of the largest Indian companies listed on the National Stock Exchange (NSE), has mirrored some of the Sensex's movements, although with [mention nuances - e.g., slightly higher/lower volatility, different sectoral weightings]. (Insert chart showing Nifty performance)

- Key Performance Indicators: [Mention key indicators like daily/weekly/monthly returns, volatility, trading volume].

- Significant Events: Key events impacting Nifty’s performance include [mention significant events and their impact].

Comparison with Sensex Performance

While generally correlated, the Sensex and Nifty show some divergences. (Insert chart comparing Sensex and Nifty performance).

- Reasons for Divergence: These differences can be attributed to [Reasons e.g., varying sectoral composition, different weighting methodologies, market sentiment variations]. For example, a stronger performance in specific sectors heavily weighted in one index but not the other can lead to divergence.

Factors Influencing Sensex and Nifty

Global Economic Factors

The Indian stock market is not immune to global events.

- Impact of Global Events: The recent [Global Event, e.g., increase in US interest rates] has led to [Impact on Indian Market e.g., increased volatility, foreign portfolio investment outflows]. Geopolitical tensions also significantly influence investor sentiment.

- US Fed Decisions: Decisions by the US Federal Reserve concerning interest rates directly affect capital flows into and out of emerging markets like India.

Domestic Economic Indicators

Domestic economic indicators significantly shape the Sensex and Nifty trends.

- Impact of Domestic Indicators: [Describe the impact of key indicators e.g., rising inflation can dampen investor confidence, strong GDP growth can boost market sentiment]. The recent [Economic Data Release e.g., inflation figures] has [Impact on market e.g., caused a temporary correction].

- RBI Policy: Decisions made by the Reserve Bank of India (RBI) on monetary policy, including interest rate changes, have a substantial effect on stock market performance.

Conclusion: Staying Informed on Indian Stock Market Updates: Sensex and Nifty

In summary, both the Sensex and Nifty have exhibited [Summarize overall trend]. Understanding the interplay of global and domestic factors is crucial for navigating the Indian stock market. While we've analyzed recent trends, predicting future Sensex and Nifty trends with certainty is impossible. However, by regularly monitoring these indices and staying informed about economic indicators and global events, investors can make more informed decisions.

To stay updated on the latest Indian stock market performance, we encourage you to regularly check our website for updates on Sensex and Nifty. Remember, it's always wise to consult with a financial advisor before making any investment decisions. Subscribe to our newsletter to receive future updates on Sensex and Nifty performance directly to your inbox!

Featured Posts

-

Can Canh Nhan Sac Thang Hang Cua Lynk Lee Sau Chuyen Gioi

May 10, 2025

Can Canh Nhan Sac Thang Hang Cua Lynk Lee Sau Chuyen Gioi

May 10, 2025 -

Slovenska Dakota Johnson Podoba Je Neuveritelna

May 10, 2025

Slovenska Dakota Johnson Podoba Je Neuveritelna

May 10, 2025 -

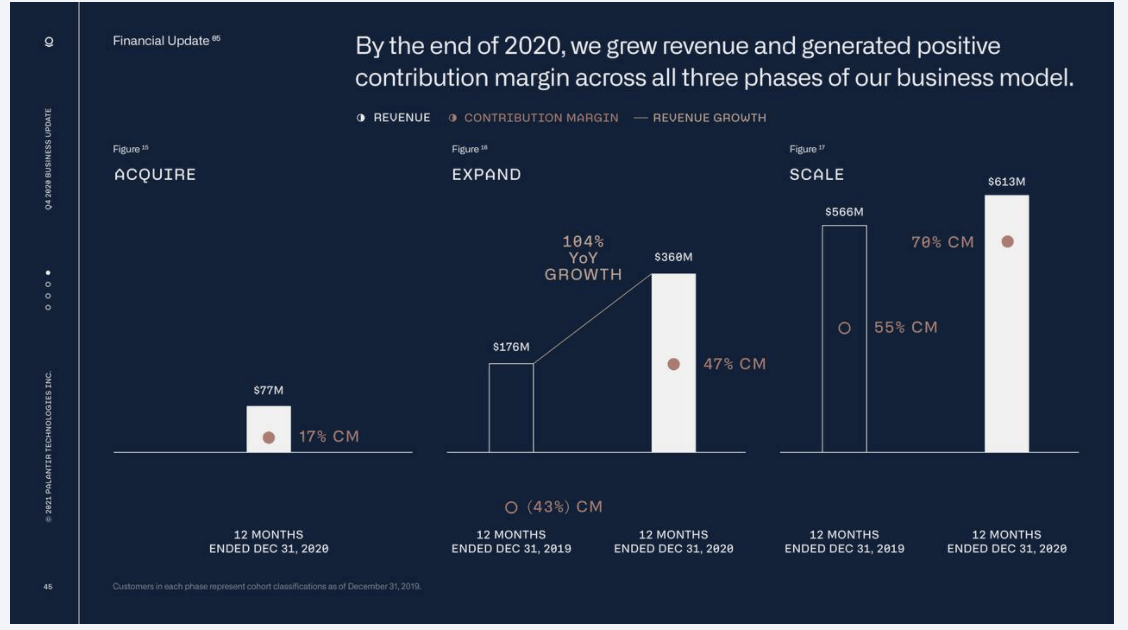

Should Investors Buy Palantir Stock Ahead Of May 5th Earnings

May 10, 2025

Should Investors Buy Palantir Stock Ahead Of May 5th Earnings

May 10, 2025 -

Le Modem Et Renaissance Elisabeth Borne Prepare Une Fusion Gouvernementale

May 10, 2025

Le Modem Et Renaissance Elisabeth Borne Prepare Une Fusion Gouvernementale

May 10, 2025 -

Living Legends Of Aviation Awards Ceremony Recognizes Bravery And Service

May 10, 2025

Living Legends Of Aviation Awards Ceremony Recognizes Bravery And Service

May 10, 2025