Greene Advocates For Reduced QE Scale In Future Economic Crises

Table of Contents

Greene's Critique of Large-Scale QE Programs

Representative Greene argues against the expansive QE programs employed during previous economic downturns, citing several key concerns. She believes the massive injections of liquidity, while offering short-term relief, have created significant long-term risks.

-

Increased Inflation Risks: Large-scale money printing, a central feature of QE, fuels inflation by increasing the money supply without a corresponding increase in goods and services. Greene argues that the current inflationary pressures are a direct consequence of the expansive QE programs implemented in the past. Keywords: inflation risk, money supply, monetary policy.

-

Potential for Asset Bubbles and Market Distortions: QE can artificially inflate asset prices, creating bubbles in sectors like real estate and equities. This distorts market signals and creates vulnerabilities to future shocks. Greene emphasizes the importance of maintaining market efficiency and preventing unsustainable asset growth. Keywords: asset bubbles, market distortion, market efficiency.

-

Concerns about the Long-Term Impact on Economic Efficiency: Greene questions the long-term efficiency of QE, arguing that it can lead to misallocation of capital and hinder productivity growth. By artificially lowering borrowing costs, QE may incentivize unproductive investments, rather than fostering innovation and efficient resource allocation. Keywords: economic efficiency, capital allocation, productivity growth.

-

Inequitable Distribution of QE Benefits: The benefits of QE often disproportionately accrue to wealthier individuals and institutions, exacerbating economic inequality. Greene advocates for policies that promote a more equitable distribution of economic gains. Keywords: economic inequality, wealth distribution, social equity.

Proposed Alternatives to Large-Scale QE

Instead of relying on large-scale QE, Greene proposes a multi-pronged approach to managing future economic downturns.

-

Targeted Fiscal Stimulus: Rather than broad-based monetary interventions, Greene suggests targeted fiscal stimulus focusing on specific sectors or demographics most affected by the crisis. This approach aims to maximize the effectiveness of government spending while minimizing inflationary pressures. Keywords: fiscal stimulus, targeted spending, fiscal policy.

-

Emphasis on Structural Reforms: Greene emphasizes the importance of long-term structural reforms to improve the resilience of the economy. This includes addressing issues such as labor market inflexibility, regulatory burdens, and inadequate infrastructure investment. Keywords: structural reforms, economic resilience, long-term growth.

-

Smaller, More Carefully Calibrated QE Programs: Where QE is deemed necessary, Greene advocates for smaller, more precisely targeted programs focused on specific market segments rather than broad-based liquidity injections. This approach aims to minimize the risk of asset bubbles and inflation. Keywords: targeted QE, calibrated monetary policy, precision monetary policy.

-

Increased Focus on Regulatory Measures: Greene stresses the need for stronger financial regulations to prevent future crises. This includes measures to enhance financial stability, reduce systemic risk, and prevent excessive risk-taking. Keywords: financial regulation, systemic risk, financial stability.

Potential Benefits of a Reduced QE Approach

Adopting Greene's proposed approach could yield several significant benefits.

-

Mitigation of Inflation Risks: By reducing the scale of QE, the risk of fueling inflation would be significantly lessened, promoting price stability and protecting consumers' purchasing power. Keywords: inflation control, price stability, monetary policy.

-

Reduced Potential for Asset Bubbles and Market Distortions: Smaller, more targeted interventions would reduce the likelihood of creating asset bubbles and distorting market signals, promoting healthier and more sustainable economic growth. Keywords: market stability, sustainable growth, asset price stability.

-

Improved Long-Term Economic Stability and Sustainability: Focusing on structural reforms and fiscal prudence alongside smaller-scale QE could foster long-term economic stability and sustainability. Keywords: long-term economic stability, sustainable economic growth, economic resilience.

-

More Equitable Distribution of Economic Benefits: Targeted fiscal measures and a focus on equitable growth could lead to a fairer distribution of economic benefits, reducing income inequality. Keywords: economic equity, income distribution, social welfare.

Potential Drawbacks and Challenges

While Greene's proposal offers compelling advantages, it also presents potential challenges.

-

Risk of Insufficient Economic Stimulus: A more cautious approach to QE might risk insufficient stimulus during a severe economic downturn, potentially prolonging the crisis and increasing unemployment. Keywords: economic downturn, insufficient stimulus, economic recovery.

-

Difficulty in Predicting the Appropriate Scale of Intervention: Accurately predicting the appropriate scale of intervention is challenging, requiring careful analysis and potentially leading to errors in policy decisions. Keywords: policy effectiveness, economic forecasting, policy uncertainty.

-

Political Challenges in Implementing Alternative Policies: Implementing alternative policies like targeted fiscal stimulus and structural reforms often faces significant political hurdles and resistance. Keywords: policy implementation, political challenges, policy resistance.

-

Potential for Slower Economic Recovery: A more restrained approach to economic intervention could potentially result in a slower economic recovery compared to large-scale QE programs. Keywords: economic recovery speed, economic growth, policy impact.

Re-evaluating Quantitative Easing in Light of Greene's Proposal

Representative Greene's core argument centers on the long-term risks associated with large-scale QE and advocates for a more nuanced, targeted approach to managing future economic crises. While large-scale QE can provide immediate relief, it carries the risks of increased inflation, asset bubbles, and unequal distribution of benefits. Greene’s proposed alternatives—targeted fiscal stimulus, structural reforms, and carefully calibrated, smaller-scale QE—offer a potential path toward mitigating these risks and fostering more sustainable economic growth. However, the transition to this approach presents challenges, including the risk of insufficient stimulus and political hurdles in policy implementation. A balanced perspective requires careful consideration of both the potential benefits of reducing the scale of QE and the potential drawbacks. The debate surrounding Quantitative Easing demands further discussion and analysis. We encourage readers to engage with this crucial conversation, exploring the merits of scaled-back QE, targeted QE, and alternative approaches to managing future economic crises, and forming their own informed opinions on the best path forward.

Featured Posts

-

Public Confrontation Rep Nancy Mace And A South Carolina Constituent

Apr 23, 2025

Public Confrontation Rep Nancy Mace And A South Carolina Constituent

Apr 23, 2025 -

Keider Monteros Struggles In Tigers Series Finale Loss To Brewers

Apr 23, 2025

Keider Monteros Struggles In Tigers Series Finale Loss To Brewers

Apr 23, 2025 -

Exec Office365 Breach Millions Made Feds Say

Apr 23, 2025

Exec Office365 Breach Millions Made Feds Say

Apr 23, 2025 -

Generating A Poop Podcast How Ai Processes Repetitive Scatological Documents

Apr 23, 2025

Generating A Poop Podcast How Ai Processes Repetitive Scatological Documents

Apr 23, 2025 -

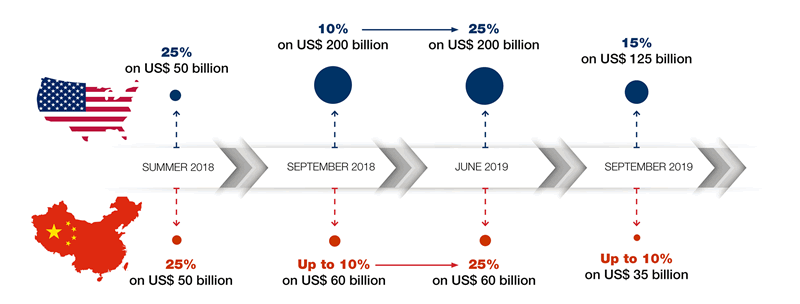

Impact Of Us China Trade War Chinas Increased Canadian Oil Imports

Apr 23, 2025

Impact Of Us China Trade War Chinas Increased Canadian Oil Imports

Apr 23, 2025

Latest Posts

-

Dakota Johnsons Role Choices The Chris Martin Factor

May 10, 2025

Dakota Johnsons Role Choices The Chris Martin Factor

May 10, 2025 -

Pakistans Stock Market Plunges Website Outage And Growing Concerns

May 10, 2025

Pakistans Stock Market Plunges Website Outage And Growing Concerns

May 10, 2025 -

Market Instability In Pakistan Stock Exchange Portal Downtime

May 10, 2025

Market Instability In Pakistan Stock Exchange Portal Downtime

May 10, 2025 -

Pakistan Stock Exchange Outage Amidst Market Volatility And Rising Tensions

May 10, 2025

Pakistan Stock Exchange Outage Amidst Market Volatility And Rising Tensions

May 10, 2025 -

Dakota Johnson And Chris Martin A Look At Her Career Choices

May 10, 2025

Dakota Johnson And Chris Martin A Look At Her Career Choices

May 10, 2025