Impact Of US-China Trade War: China's Increased Canadian Oil Imports

Table of Contents

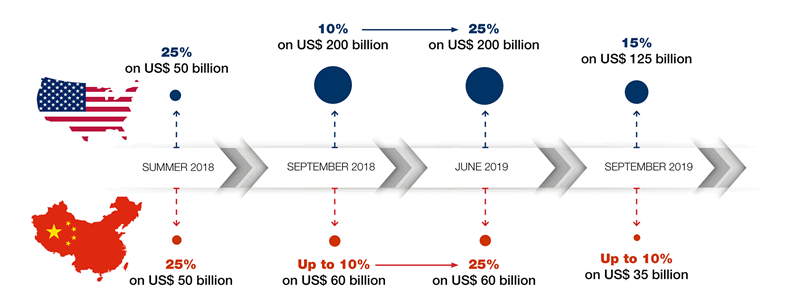

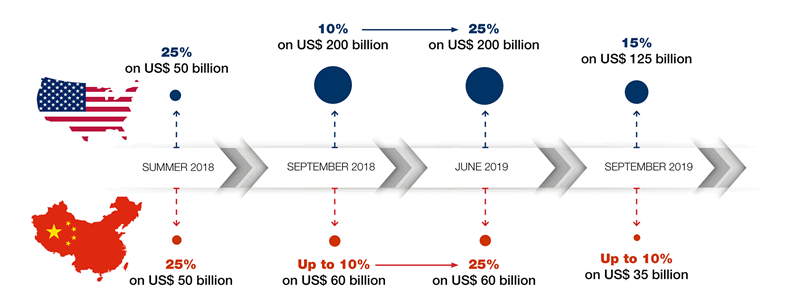

The US-China Trade War as a Catalyst

The US-China trade war, beginning in 2018, significantly disrupted established energy trade relationships. US tariffs on Chinese goods prompted retaliatory measures, impacting various sectors, including energy. This disruption forced China to seek alternative energy sources to reduce its reliance on the US. This created an opportune moment for Canadian oil producers to increase their market share in China.

- US tariffs on Chinese goods led to retaliatory measures: These tariffs increased the cost of Chinese goods in the US market and triggered counter-tariffs from China, affecting energy imports.

- Disruption of established US-China energy trade relationships: The trade war created uncertainty and instability, prompting China to diversify its energy supply sources.

- China seeking alternative energy sources to reduce reliance on the US: Diversification became a key strategic objective for China's energy security.

This strategic shift opened the door for Canadian oil. While precise pre- and post-trade war import statistics require deeper analysis from official sources, anecdotal evidence and reports from energy analysts strongly suggest a significant increase in Canadian oil shipments to China following the escalation of trade tensions.

Geopolitical Advantages of Canadian Oil for China

Canada presents several geopolitical advantages as an oil supplier to China. Its reputation as a politically stable and reliable partner significantly reduces the geopolitical risks associated with sourcing oil from other, potentially less stable, regions.

- Canada's reputation as a stable and reliable energy partner: Canada's democratic institutions and consistent regulatory environment offer predictability and trust to international partners.

- Reduced geopolitical risk compared to other potential sources: This contrasts with regions experiencing political instability or conflict, which can disrupt oil supplies and prices.

- Strong diplomatic ties between Canada and China: While complex at times, the existence of established diplomatic channels facilitates smoother trade negotiations and dispute resolution.

In contrast, oil from certain Middle Eastern or South American nations carries inherent political risks due to internal conflicts or volatile political landscapes. These risks can translate into price volatility and supply disruptions, making Canadian oil a more attractive alternative.

Economic Factors Driving Increased Imports

The price competitiveness of Canadian oil played a pivotal role in China's increased imports. While precise price comparisons fluctuate with global market conditions, Canadian crude often offered a competitive alternative to other sources.

- Comparison of Canadian oil prices with those from other sources: At various times, Canadian oil prices proved more attractive than those from the US or the Middle East, depending on global supply and demand dynamics.

- Impact of fluctuating global oil prices on China's import decisions: China's import strategy is heavily influenced by shifts in the global oil market. Price fluctuations make cost-effective options more appealing.

- The role of refining capacity and infrastructure in China's import choices: China's refining capabilities and infrastructure influence the types of crude oil they can efficiently process, impacting their import decisions.

The increased demand for Canadian oil has positively impacted the Canadian economy, boosting job creation in the oil and gas sector, as well as related industries like transportation and logistics.

Long-Term Implications and Future Prospects for China's Canadian Oil Imports

The sustainability of this trend is subject to several factors. While the current trajectory points toward continued imports, long-term prospects depend on various influences.

- Projected growth in China's energy demand: China's ongoing economic growth and industrialization will continue to drive energy demand, potentially increasing the reliance on Canadian oil.

- Potential challenges, including pipeline capacity and transportation costs: Increasing pipeline capacity and efficient transportation remain crucial to sustaining the flow of Canadian oil to China.

- The influence of climate change policies and renewable energy development on future demand: China's commitment to reducing carbon emissions and developing renewable energy sources could eventually moderate the demand for fossil fuels, including Canadian oil.

The long-term impact on the global oil market will depend on the interplay between these factors. Increased China's Canadian oil imports could shift the global balance of power and energy security, impacting other oil-producing nations.

Conclusion

The US-China trade war acted as a catalyst for a significant increase in China's Canadian oil imports. This shift was driven by a combination of geopolitical factors, economic considerations, and the desire for reliable energy sources. The long-term implications remain to be seen, but this relationship is likely to continue evolving. Understanding the dynamics of China's Canadian oil imports is crucial for navigating the complex landscape of global energy markets. Further research into the long-term implications of this relationship is necessary to fully grasp its impact. Stay informed about the developments impacting China's Canadian oil imports to understand the future of energy trade.

Featured Posts

-

Hudsons Bay Closures Impact On Brands And Inventory Relocation

Apr 23, 2025

Hudsons Bay Closures Impact On Brands And Inventory Relocation

Apr 23, 2025 -

Review Lg C3 77 Inch Oled Pros Cons And Verdict

Apr 23, 2025

Review Lg C3 77 Inch Oled Pros Cons And Verdict

Apr 23, 2025 -

Arizona Diamondbacks Secure 5 2 Win Against Milwaukee Brewers

Apr 23, 2025

Arizona Diamondbacks Secure 5 2 Win Against Milwaukee Brewers

Apr 23, 2025 -

Millions Stolen Insider Reveals Office365 Executive Breach

Apr 23, 2025

Millions Stolen Insider Reveals Office365 Executive Breach

Apr 23, 2025 -

Greene Advocates For Reduced Qe Scale In Future Economic Crises

Apr 23, 2025

Greene Advocates For Reduced Qe Scale In Future Economic Crises

Apr 23, 2025

Latest Posts

-

Harry Styles Debuts Retro Mustache In London

May 10, 2025

Harry Styles Debuts Retro Mustache In London

May 10, 2025 -

Reframing The Narrative Mental Illness And Violent Crime

May 10, 2025

Reframing The Narrative Mental Illness And Violent Crime

May 10, 2025 -

Nottingham Police Under Scrutiny Following Attacks Misconduct Meeting

May 10, 2025

Nottingham Police Under Scrutiny Following Attacks Misconduct Meeting

May 10, 2025 -

Investigation Into Police Conduct Nottingham Attacks

May 10, 2025

Investigation Into Police Conduct Nottingham Attacks

May 10, 2025 -

Misconduct Allegations Against Officers Nottingham Attacks Investigation

May 10, 2025

Misconduct Allegations Against Officers Nottingham Attacks Investigation

May 10, 2025