Hengrui Pharma's Hong Kong Share Sale Approved By Chinese Regulator

Table of Contents

Regulatory Approval Details

The approval for Hengrui Pharma's Hong Kong share offering was granted by the relevant Chinese regulatory body, [Insert Name of Regulatory Body Here], on [Insert Date of Approval Here]. While the specific details of the approval remain subject to official announcements, it's understood that the share sale, likely a [Specify: Secondary Offering or Initial Public Offering], has received the necessary clearances, potentially with certain conditions attached. These conditions may include stipulations regarding disclosure requirements, investor protection measures, and compliance with Hong Kong’s listing rules.

- Regulatory Body: [Insert Name of Regulatory Body Here]

- Approval Date: [Insert Date of Approval Here]

- Share Sale Type: [Specify: Secondary Offering or Initial Public Offering] [Insert size of offering if available]

- Conditions: [Insert any known conditions attached to the approval. If unavailable, state "Details regarding specific conditions are yet to be publicly released."]

Implications for Hengrui Pharma

The successful Hengrui Pharma Hong Kong IPO offers numerous strategic advantages for the company. Access to a broader pool of international investors will significantly enhance its capital-raising capabilities, allowing for increased investment in research and development (R&D). This expansion beyond the domestic Chinese market will also bolster Hengrui Pharma's global brand recognition and investor appeal, potentially attracting strategic partnerships with international pharmaceutical companies.

- Increased R&D Funding: The influx of capital from the Hong Kong listing will fuel Hengrui Pharma's R&D efforts, potentially leading to the development of innovative new drugs and therapies.

- Enhanced Global Brand Recognition: Listing on the Hong Kong Stock Exchange will provide greater visibility to international investors and enhance Hengrui Pharma's reputation as a leading player in the global pharmaceutical industry.

- Strategic Partnerships: The increased profile will attract potential collaborations and strategic partnerships with multinational pharmaceutical firms, fostering technological advancements and market expansion.

- Diversified Funding Sources: Reducing dependence on the domestic market minimizes risks associated with fluctuating economic conditions in China.

Impact on the Chinese Pharmaceutical Market

Hengrui Pharma's successful Hong Kong share sale is a significant development for the Chinese pharmaceutical market as a whole. This event is likely to attract increased foreign investment into the sector, fostering greater international recognition and trust in Chinese pharmaceutical companies. It may also lead to increased competition and innovation, stimulating further development within the Chinese pharmaceutical industry and improving its global standing. This success story serves as a strong example for other Chinese pharmaceutical companies considering similar international expansion strategies.

- Increased Foreign Investment: The success of the Hengrui Pharma IPO could encourage other Chinese pharmaceutical companies to pursue similar listings, leading to a surge in foreign direct investment.

- Enhanced Global Reputation: A successful listing strengthens the global perception of Chinese pharmaceutical companies and their capabilities.

- Increased Competition & Innovation: The increased competition resulting from greater international engagement is likely to drive innovation and improvement within the sector.

- Case Study for Expansion: Hengrui Pharma's experience serves as a valuable case study for other Chinese pharmaceutical companies aiming for global reach.

Comparison to other Chinese Pharmaceutical IPOs

Hengrui Pharma's Hong Kong share sale can be compared to other notable Chinese pharmaceutical IPOs, both successful and unsuccessful. [Insert names of other comparable companies and briefly compare their IPOs in terms of size, reception and overall success. Highlight the unique aspects of the Hengrui Pharma IPO – perhaps a larger offering, favorable market conditions, or a stronger brand reputation].

- Successful Examples: [List successful examples and briefly explain their success]

- Unsuccessful Examples: [List unsuccessful examples and briefly explain their shortcomings]

- Market Conditions: [Analyze the current market conditions that contributed to the success of Hengrui Pharma's IPO]

Conclusion

The approval of Hengrui Pharma's Hong Kong share sale is a pivotal moment for both the company and the broader Chinese pharmaceutical landscape. It signals a significant step towards global integration, and its success will undoubtedly encourage further investment and innovation within the sector. The implications of this Hengrui Pharma Hong Kong IPO extend far beyond the company itself, shaping the future trajectory of the Chinese pharmaceutical industry on the world stage. Other Chinese pharmaceutical companies considering international expansion will be closely watching the outcome of this landmark event.

Call to Action: Stay informed about the latest developments surrounding the Hengrui Pharma Hong Kong IPO and its impact on the global pharmaceutical industry. Follow our updates for continued insights into this significant event and its broader implications for the Chinese pharmaceutical market.

Featured Posts

-

Mets Starting Pitcher Prospects Pitchers Name S Chances

Apr 29, 2025

Mets Starting Pitcher Prospects Pitchers Name S Chances

Apr 29, 2025 -

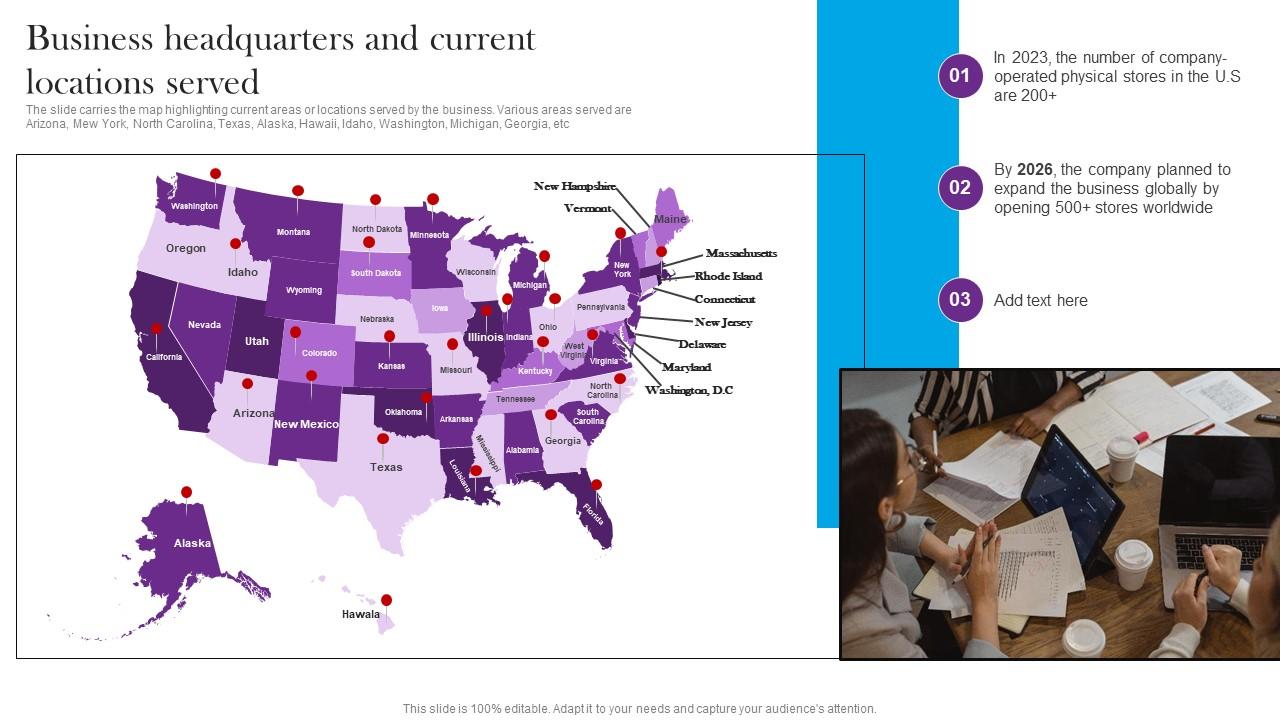

Discover The Countrys Top New Business Locations

Apr 29, 2025

Discover The Countrys Top New Business Locations

Apr 29, 2025 -

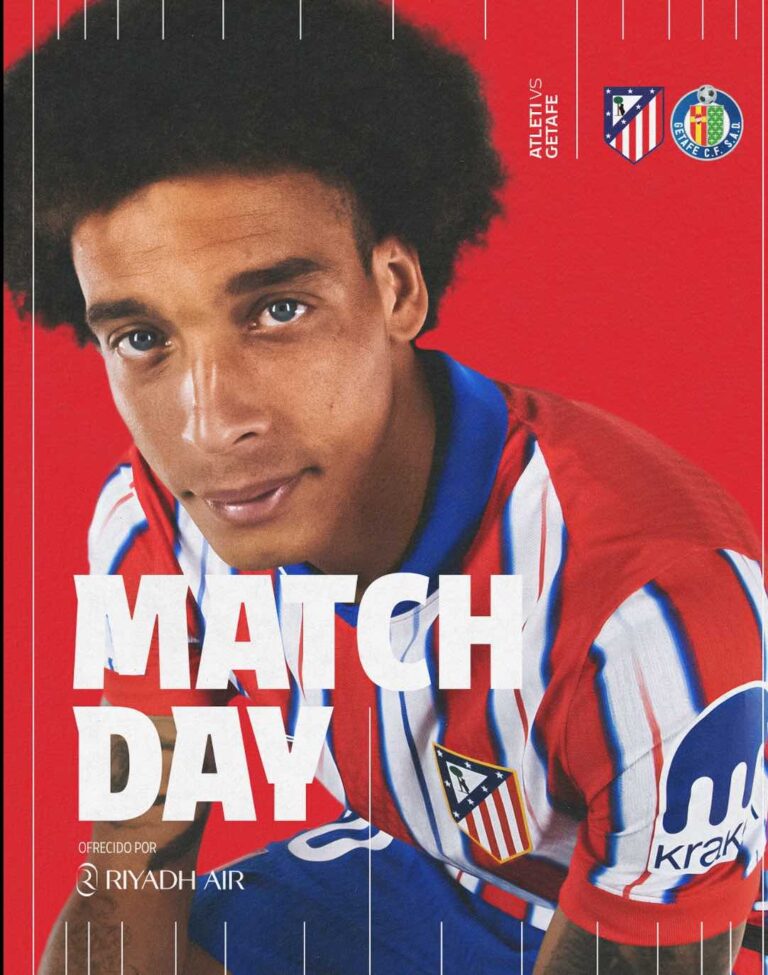

Alberto Ardila Olivares Consistencia Y Garantia De Gol

Apr 29, 2025

Alberto Ardila Olivares Consistencia Y Garantia De Gol

Apr 29, 2025 -

Cancer Drug Setback Sends Akeso Shares Into Freefall

Apr 29, 2025

Cancer Drug Setback Sends Akeso Shares Into Freefall

Apr 29, 2025 -

Pw Cs Withdrawal From 9 African Nations Reasons And Consequences

Apr 29, 2025

Pw Cs Withdrawal From 9 African Nations Reasons And Consequences

Apr 29, 2025

Latest Posts

-

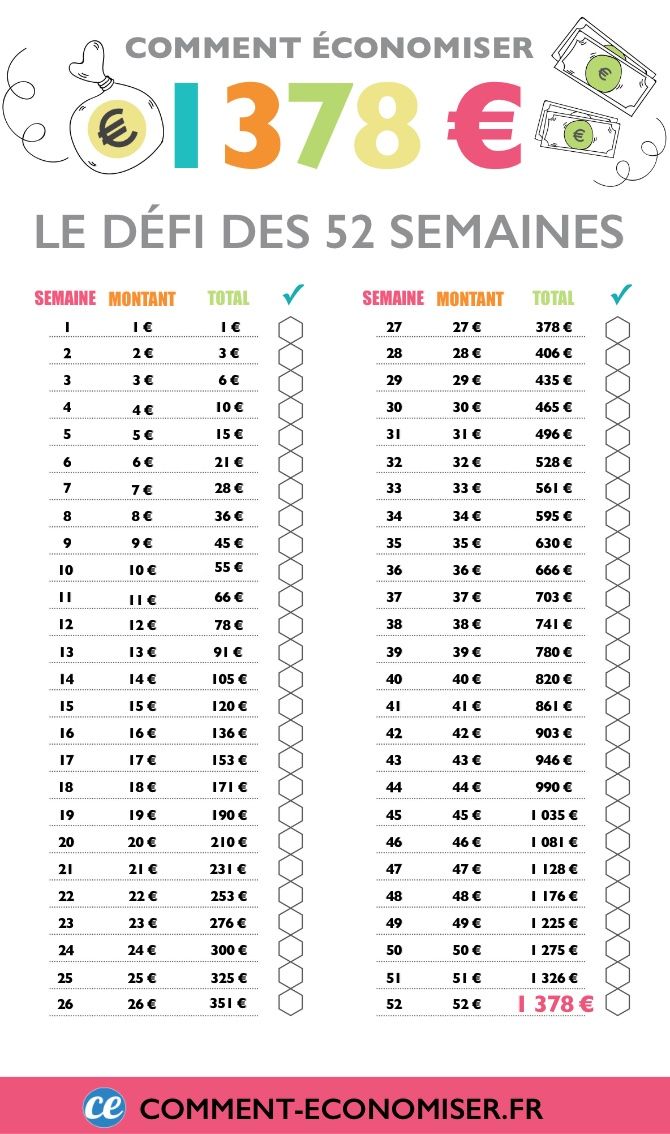

Dans Quoi Investir Facilement Solutions Simples Et Accessibles

May 12, 2025

Dans Quoi Investir Facilement Solutions Simples Et Accessibles

May 12, 2025 -

Economiser Intelligemment Conseils Pour Un Budget Equilibre

May 12, 2025

Economiser Intelligemment Conseils Pour Un Budget Equilibre

May 12, 2025 -

Mes Investissements Comment Diversifier Et Optimiser Son Portefeuille

May 12, 2025

Mes Investissements Comment Diversifier Et Optimiser Son Portefeuille

May 12, 2025 -

Reussir Son Budget Guide Complet Pour Economiser Efficacement

May 12, 2025

Reussir Son Budget Guide Complet Pour Economiser Efficacement

May 12, 2025 -

Ou Investir Guide Pratique Pour Choisir Les Bons Placements

May 12, 2025

Ou Investir Guide Pratique Pour Choisir Les Bons Placements

May 12, 2025