High Stock Market Valuations: A BofA Analysis For Investors

Table of Contents

BofA's Current Assessment of High Stock Market Valuations

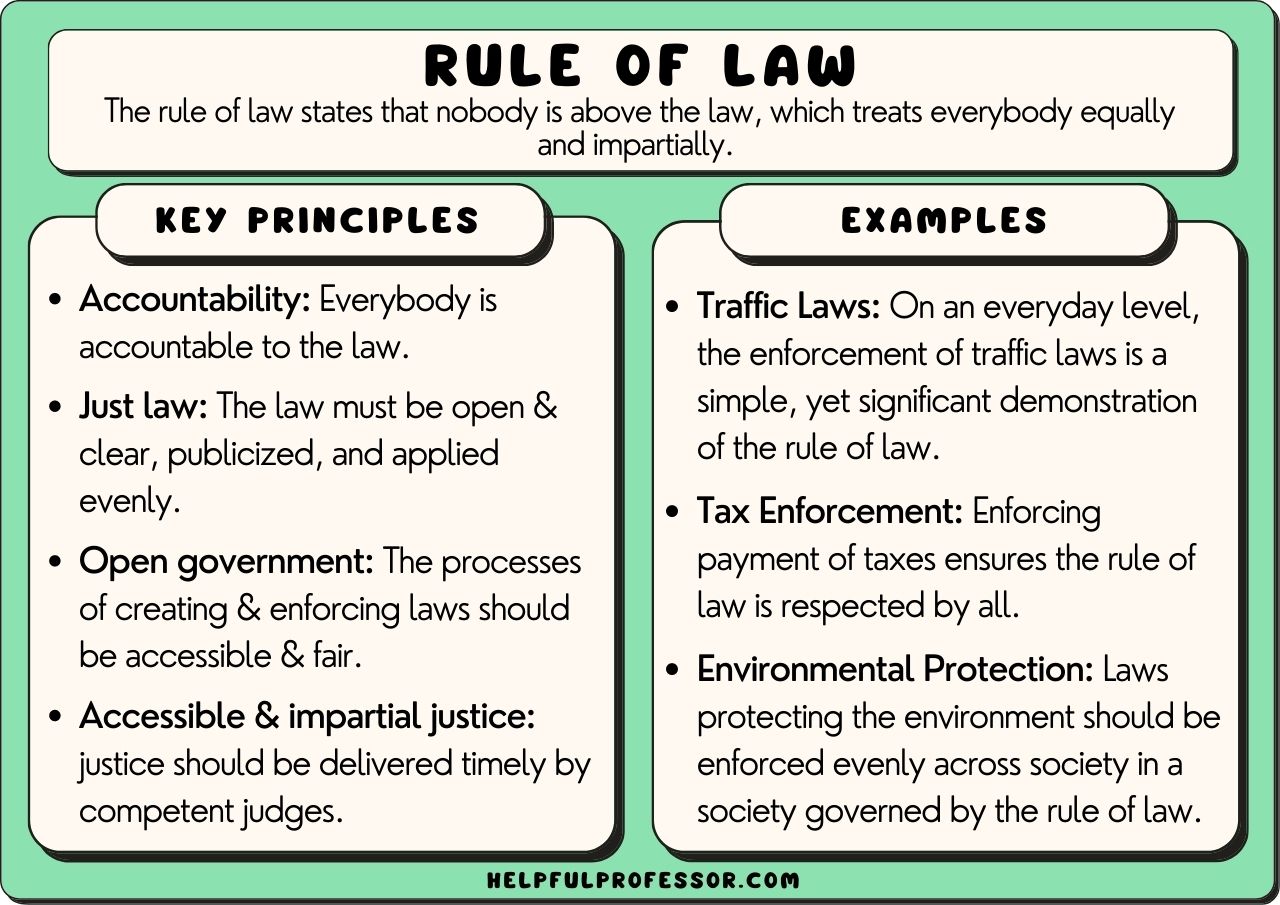

BofA utilizes a range of key valuation metrics to assess the overall health and potential risks within the stock market. Understanding these metrics is crucial for interpreting their analysis and forming your own investment strategy.

Metrics Used by BofA

BofA, like many other financial analysts, employs several key metrics to gauge market valuation. These include:

-

Price-to-Earnings ratio (P/E): This compares a company's stock price to its earnings per share (EPS). A high P/E ratio can suggest that a stock is overvalued, as investors are paying a premium for each dollar of earnings.

-

Shiller P/E (CAPE): Also known as the cyclically adjusted price-to-earnings ratio, this metric smooths out earnings fluctuations over a 10-year period, providing a more stable measure of valuation than the standard P/E ratio. It's particularly useful for assessing long-term valuations.

-

Other Metrics: BofA may also consider other valuation metrics such as the Price-to-Sales ratio (P/S), Price-to-Book ratio (P/B), and dividend yield, depending on the specific analysis. These offer additional perspectives on a company's or market's valuation.

BofA's Valuation Compared to Historical Data

BofA's assessment of current valuations is typically compared to historical averages to determine whether the current market is overvalued, undervalued, or trading within a historical range. This comparison provides context and helps identify potential risks or opportunities.

-

Visual Representation: [Insert a chart or graph here visually representing historical valuations versus current valuations based on BofA's data or publicly available data from reputable sources. Clearly label the axes and include a source citation.]

-

Deviations from Historical Trends: Any significant deviation from historical trends needs careful consideration. High valuations sustained over a long period might indicate a market bubble, raising concerns about a potential correction.

-

Caveats of Historical Comparisons: It's crucial to remember that past performance is not necessarily indicative of future results. Economic conditions, technological advancements, and regulatory changes can all impact market dynamics and valuation multiples.

Factors Contributing to High Stock Market Valuations

Several factors can contribute to high stock market valuations, even in the face of potential economic headwinds. Understanding these drivers is essential for navigating the market effectively.

Low Interest Rates

Low interest rates significantly influence stock valuations. When interest rates are low, bonds become less attractive investments, pushing investors towards equities in search of higher returns.

-

Quantitative Easing (QE): Central bank policies like QE, aimed at stimulating economic growth, often result in low interest rates, thereby increasing demand for stocks.

-

Rising Interest Rates: However, rising interest rates can have the opposite effect, potentially reducing stock valuations as investors shift back to bonds.

Strong Corporate Earnings

Robust corporate earnings can support high stock prices, even at high valuation multiples. Sustained earnings growth can justify premium valuations.

-

Earnings Growth and Valuation Multiples: A positive correlation exists between earnings growth and the P/E ratio. Strong earnings growth can justify a higher P/E ratio, while stagnant or declining earnings often lead to lower multiples.

-

Sustainability of Earnings Growth: The sustainability of earnings growth is paramount. Short-term spikes in earnings are not necessarily indicative of long-term value.

Investor Sentiment and Market Psychology

Investor sentiment, speculation, and market psychology play a significant role in influencing valuations. This "market sentiment" can sometimes drive valuations beyond fundamental justifications.

-

Fear of Missing Out (FOMO): FOMO can lead to investors chasing high-flying stocks, further inflating valuations and creating market bubbles.

-

Market Bubbles and Corrections: Market bubbles, characterized by unsustainable price increases, eventually correct themselves, often leading to sharp declines.

Investment Strategies in a High-Valuation Environment

Navigating a high-valuation market requires a thoughtful and adaptable investment strategy. The following approaches can help mitigate risk and potentially capitalize on opportunities.

Defensive Investing

A defensive investing strategy focuses on minimizing risk and preserving capital. This approach can be particularly relevant during periods of high valuations.

-

Diversification: Diversifying your portfolio across various asset classes and sectors reduces overall risk.

-

Value Investing: Value investing focuses on identifying undervalued companies with strong fundamentals, potentially offering better risk-adjusted returns in a high-valuation market.

Growth Stock Selection

Growth stocks, even in a high-valuation environment, can offer attractive returns if carefully selected.

-

Risks of Overvalued Growth Stocks: Investing in overvalued growth stocks carries significant risk; their valuations can fall sharply if growth expectations are not met.

-

Identifying High-Quality Growth Stocks: Thorough due diligence is crucial. Focus on companies with strong fundamentals, a wide economic moat, sustainable growth prospects, and a competent management team.

Considering Alternative Asset Classes

Diversifying beyond traditional stocks and bonds can be beneficial in a high-valuation market.

-

Real Estate, Precious Metals, etc.: Alternative asset classes like real estate and precious metals can offer diversification benefits and potentially act as a hedge against market volatility.

-

Incorporating Alternative Asset Classes: Carefully consider the risk-reward profile of each alternative asset class before incorporating it into your portfolio. Seek professional advice if needed.

Conclusion

BofA's analysis of high stock market valuations provides valuable insights for investors. Understanding the key valuation metrics, the factors contributing to high valuations, and employing a well-diversified investment strategy are crucial for navigating this complex market environment. While high valuations present challenges, opportunities still exist for long-term investors who adopt a disciplined and adaptable approach. Remember to conduct your own thorough due diligence and, if necessary, seek professional financial advice before making any investment decisions relating to high stock market valuations. Take control of your financial future by developing a robust investment plan suited to your individual risk tolerance and financial goals.

Featured Posts

-

Dsv Leoben Praesentiert Neues Trainerteam In Der Regionalliga Mitte

Apr 29, 2025

Dsv Leoben Praesentiert Neues Trainerteam In Der Regionalliga Mitte

Apr 29, 2025 -

The Uk Legal Definition Of Woman Implications For Transgender Rights And Sex Based Laws

Apr 29, 2025

The Uk Legal Definition Of Woman Implications For Transgender Rights And Sex Based Laws

Apr 29, 2025 -

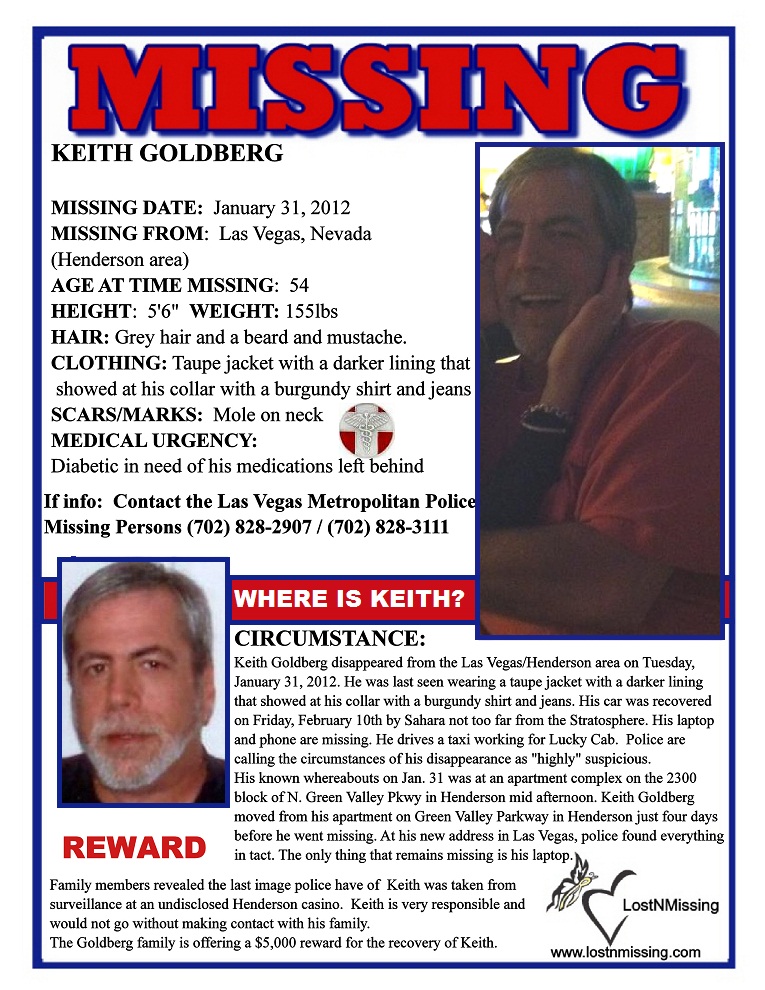

Update Paralympian Sam Ruddock Still Missing In Las Vegas

Apr 29, 2025

Update Paralympian Sam Ruddock Still Missing In Las Vegas

Apr 29, 2025 -

You Think You Have Adult Adhd Now What

Apr 29, 2025

You Think You Have Adult Adhd Now What

Apr 29, 2025 -

Chat Gpt Developer Open Ai Faces Ftc Probe A Deep Dive

Apr 29, 2025

Chat Gpt Developer Open Ai Faces Ftc Probe A Deep Dive

Apr 29, 2025

Latest Posts

-

Improving The Accuracy Of Automated Visual Inspection Systems For Lyophilized Vials

May 12, 2025

Improving The Accuracy Of Automated Visual Inspection Systems For Lyophilized Vials

May 12, 2025 -

Overcoming Hurdles In Automated Visual Inspection Of Lyophilized Drug Products

May 12, 2025

Overcoming Hurdles In Automated Visual Inspection Of Lyophilized Drug Products

May 12, 2025 -

The Next Papal Election Examining Potential Candidates And Their Platforms

May 12, 2025

The Next Papal Election Examining Potential Candidates And Their Platforms

May 12, 2025 -

Next Pope Speculation Analyzing The Leading Candidates For The Papacy

May 12, 2025

Next Pope Speculation Analyzing The Leading Candidates For The Papacy

May 12, 2025 -

Predicting The Next Pope Key Factors And Potential Successors To Pope Francis

May 12, 2025

Predicting The Next Pope Key Factors And Potential Successors To Pope Francis

May 12, 2025