High Stock Market Valuations: A BofA Perspective For Investors

Table of Contents

BofA's Assessment of Current Market Valuations

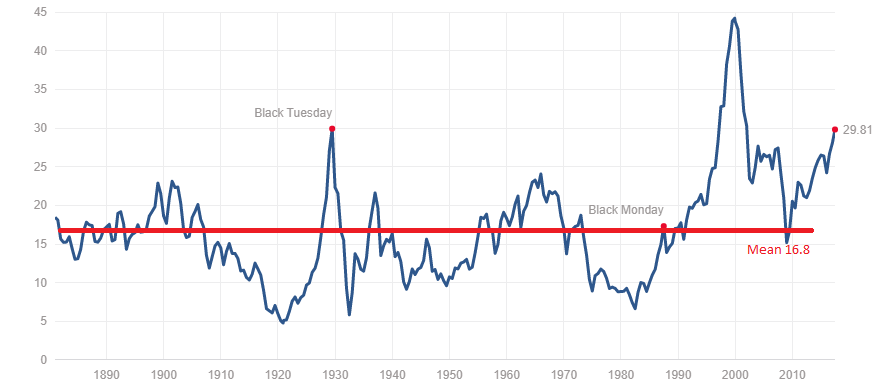

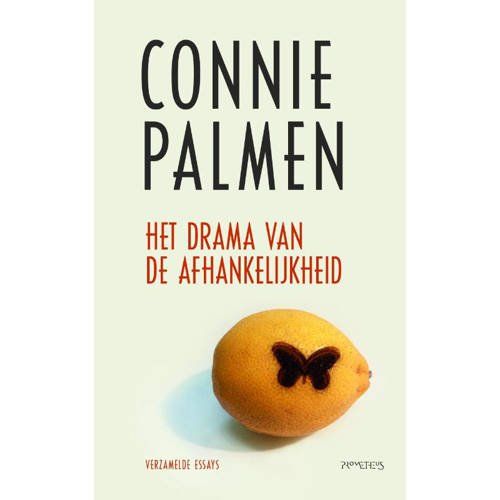

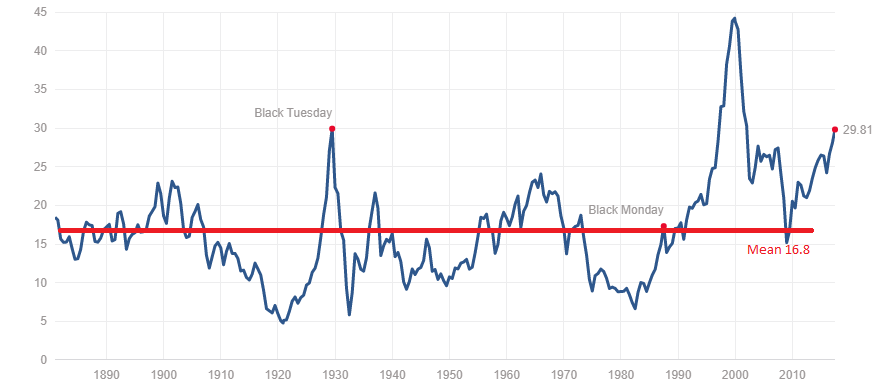

BofA employs a multi-faceted approach to assessing market valuations, utilizing a range of established metrics. Their analysis considers both short-term market fluctuations and long-term historical trends to provide a comprehensive overview. Key metrics include Price-to-Earnings ratios (P/E), the cyclically adjusted price-to-earnings ratio (Shiller PE), and various sector-specific valuation measures.

-

BofA's Findings: Recent BofA reports (please note: specific data requires referencing current BofA publications – insert link to relevant report here) often indicate that current market valuations are historically elevated compared to long-term averages. However, the degree of overvaluation varies across sectors and asset classes.

-

Overvalued and Undervalued Sectors: BofA's research frequently highlights specific sectors or asset classes that are considered overvalued based on their analysis (e.g., certain technology sub-sectors during periods of rapid growth). Conversely, they may identify undervalued sectors that offer potential opportunities for long-term growth (e.g., value stocks or sectors poised for cyclical recovery). (Note: Specific sector examples require referencing current BofA reports).

-

Visual Representation: [Insert relevant chart or graph from a BofA report here, with proper attribution]. This visual representation helps illustrate BofA's findings on valuation levels, providing a clearer picture of the market's current state relative to historical benchmarks.

Understanding the Factors Driving High Stock Market Valuations

Several macroeconomic factors contribute to high stock market valuations. Understanding these forces is crucial for investors seeking to make informed decisions.

-

Low Interest Rates: Prolonged periods of low interest rates, often a result of central bank policies like quantitative easing, lower discount rates. This makes future cash flows from stocks more valuable, driving up stock prices.

-

Technological Innovation: Rapid technological advancements fuel innovation and disrupt traditional industries, creating high growth potential in certain sectors, thereby boosting valuations. The rise of disruptive technologies often leads to premium valuations for companies at the forefront of innovation.

-

Investor Sentiment and Market Psychology: Market psychology plays a significant role. Periods of optimism and confidence can lead to increased demand for stocks, pushing valuations higher, even in the absence of substantial improvements in fundamental company performance. Conversely, fear and uncertainty can trigger sharp declines.

Potential Risks Associated with High Valuations

Investing in a highly valued market presents inherent risks that investors should carefully consider.

-

Increased Market Volatility: High valuations often correlate with increased market volatility. Small shifts in investor sentiment or unexpected economic news can lead to significant price swings.

-

Market Corrections: Markets experiencing high valuations are more susceptible to sharp corrections or even crashes. A sudden loss of investor confidence can trigger a rapid decline in stock prices.

-

Rising Interest Rates: A rise in interest rates can negatively impact stock valuations. Higher borrowing costs for companies can reduce profitability and make bonds a more attractive alternative for investors.

-

Diversification is Key: To mitigate the risks associated with high valuations, investors should diversify their portfolios across different asset classes, sectors, and geographies. This strategy helps reduce the impact of any single market downturn.

BofA's Recommended Investment Strategies for High Valuation Environments

BofA typically advocates for a cautious yet opportunistic approach to investing in high-valuation environments. Their recommendations often include:

-

Value Investing: Focus on companies trading below their intrinsic value. This strategy aims to identify undervalued opportunities within the market.

-

Defensive Stocks: Invest in companies that are less sensitive to economic downturns. These stocks offer relative stability during periods of market uncertainty.

-

Sector Rotation: Adjust your portfolio allocation based on market conditions and sector performance. This approach involves shifting investments from overvalued sectors to those perceived as having better growth prospects.

-

Long-Term Perspective: Maintain a long-term investment horizon. Short-term market fluctuations should not dictate long-term investment strategies.

Navigating High Stock Market Valuations with a BofA Perspective

BofA's analysis consistently highlights the importance of a nuanced approach to investing during periods of high stock market valuations. Their assessment indicates elevated valuations relative to historical averages, but also acknowledges the varying degrees of overvaluation across different sectors. The factors driving these high valuations – low interest rates, technological innovation, and investor sentiment – must be carefully considered. The potential risks, including increased volatility, potential market corrections, and the impact of rising interest rates, demand a cautious strategy. BofA's recommended strategies – value investing, defensive stocks, sector rotation, and maintaining a long-term horizon – provide a framework for navigating this complex environment.

Key Takeaways: Understand BofA's assessment of current valuations, the influencing factors, and the associated risks. Implement a diversified investment strategy aligned with BofA's recommendations to mitigate potential downsides and capitalize on opportunities.

Call to action: Understand the complexities of high stock market valuations and make informed investment decisions by reviewing BofA's complete analysis. Don't let high valuations deter you—learn how to navigate them effectively. [Link to relevant BofA reports and research papers here].

Featured Posts

-

Factors Influencing The Sharp Rise In D Wave Quantum Inc Qbts Stock

May 21, 2025

Factors Influencing The Sharp Rise In D Wave Quantum Inc Qbts Stock

May 21, 2025 -

Parcourir La Loire Nantes Et Son Estuaire A Velo 5 Circuits A Decouvrir

May 21, 2025

Parcourir La Loire Nantes Et Son Estuaire A Velo 5 Circuits A Decouvrir

May 21, 2025 -

Abn Amro Voedingsbedrijven En De Afhankelijkheid Van Goedkope Arbeidsmigranten

May 21, 2025

Abn Amro Voedingsbedrijven En De Afhankelijkheid Van Goedkope Arbeidsmigranten

May 21, 2025 -

The Goldbergs A Nostalgic Look Back At 1980s Family Life

May 21, 2025

The Goldbergs A Nostalgic Look Back At 1980s Family Life

May 21, 2025 -

High Stock Market Valuations A Bof A Perspective For Investors

May 21, 2025

High Stock Market Valuations A Bof A Perspective For Investors

May 21, 2025

Latest Posts

-

Borussia Dortmund Triumphs Beiers Double Seals Win Over Mainz

May 21, 2025

Borussia Dortmund Triumphs Beiers Double Seals Win Over Mainz

May 21, 2025 -

Bundesliga Leverkusen Delays Bayerns Title Festivities Kane Sidelined

May 21, 2025

Bundesliga Leverkusen Delays Bayerns Title Festivities Kane Sidelined

May 21, 2025 -

Maximilian Beiers Brace Leads Borussia Dortmund To Victory Against Mainz

May 21, 2025

Maximilian Beiers Brace Leads Borussia Dortmund To Victory Against Mainz

May 21, 2025 -

Leverkusen Thwarts Bayerns Bundesliga Party Kanes Absence Adds To Disappointment

May 21, 2025

Leverkusen Thwarts Bayerns Bundesliga Party Kanes Absence Adds To Disappointment

May 21, 2025 -

Nations League Final Four Germany Books Place After 5 4 Aggregate Win Against Italy

May 21, 2025

Nations League Final Four Germany Books Place After 5 4 Aggregate Win Against Italy

May 21, 2025