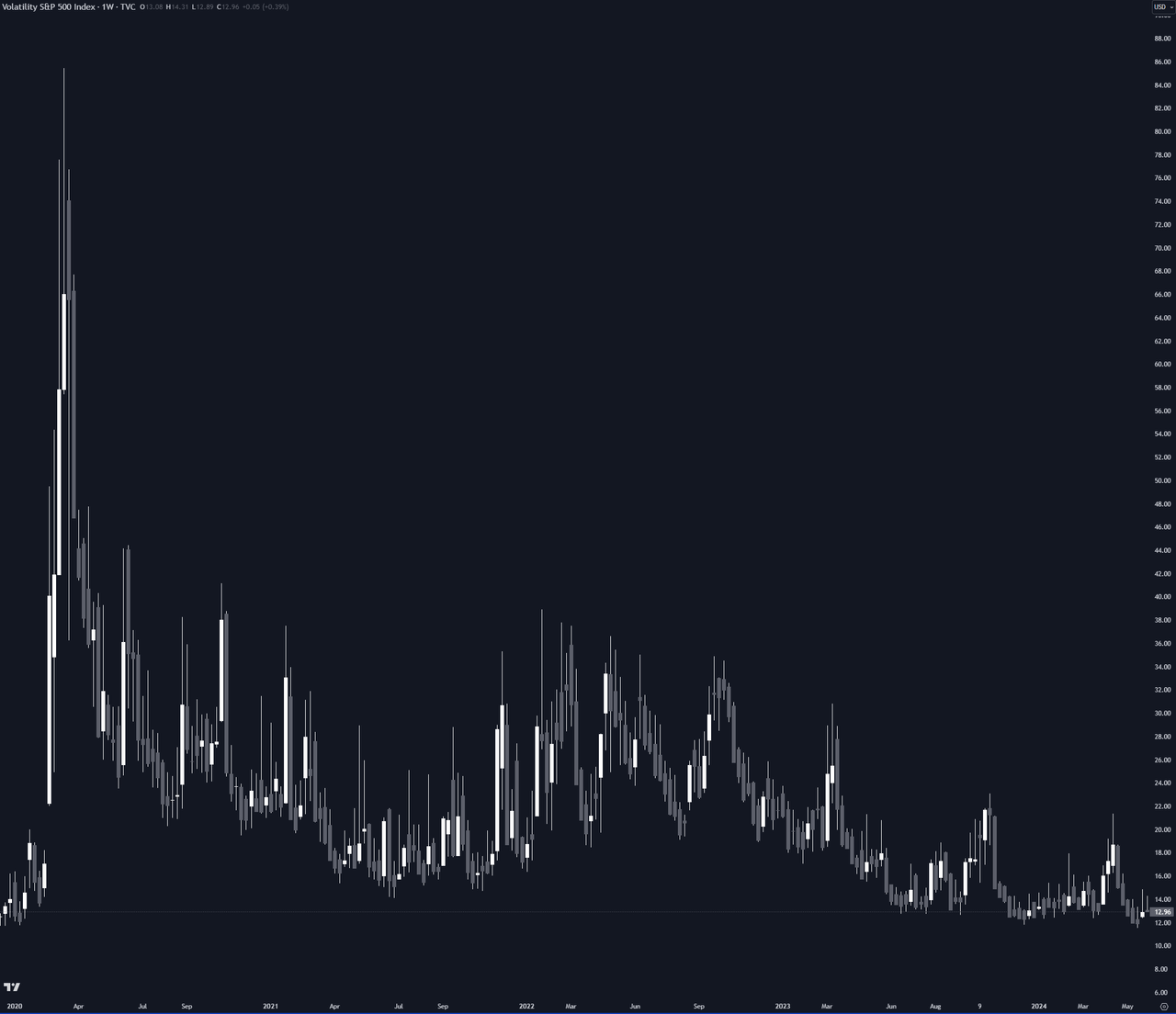

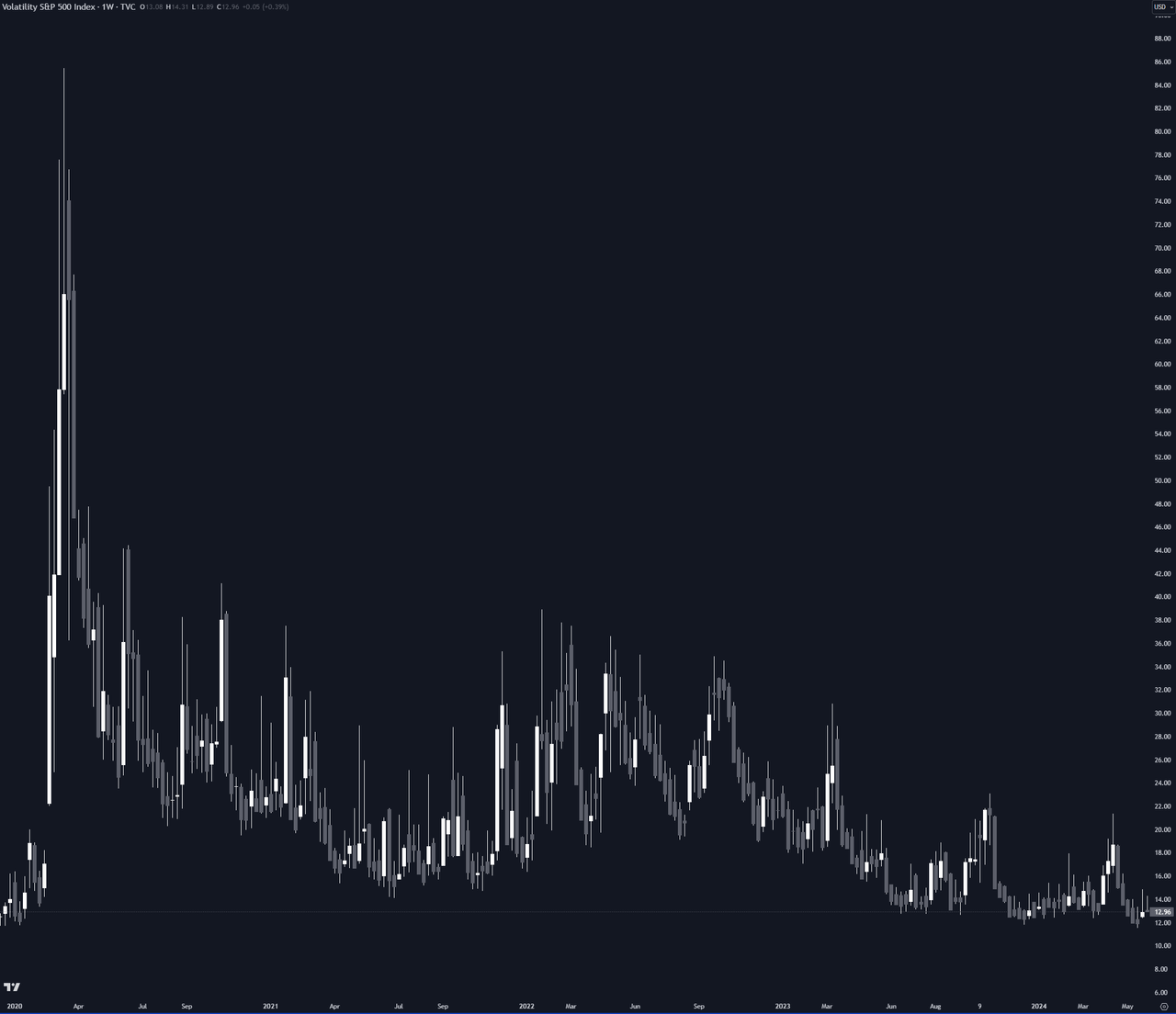

High Stock Market Valuations: Why BofA Says Investors Shouldn't Panic

Table of Contents

BofA's Rationale: Why High Valuations Aren't Necessarily a Red Flag

BofA's argument against immediate panic selling centers on several key factors. They contend that the current high stock market valuations are not solely indicative of an impending crash. Instead, they point to a confluence of factors that justify, at least partially, the current pricing.

-

Low Interest Rates Supporting Higher Valuations: Historically low interest rates have made borrowing cheaper for companies, boosting investment and fueling economic growth. This, in turn, supports higher valuations for stocks as investors seek higher returns in a low-yield environment. The low cost of capital allows companies to invest more aggressively, leading to higher earnings and justifying higher price-to-earnings (P/E) ratios.

-

Strong Corporate Earnings Justifying Current Prices: Despite concerns, many companies continue to report strong corporate earnings, demonstrating resilience and underlying strength in the economy. These robust earnings provide a foundation for the current stock prices, even at seemingly elevated valuation levels. BofA likely analyzed various earnings reports and industry trends to reach this conclusion.

-

Long-Term Growth Potential Outweighing Short-Term Risks: BofA's analysis likely focuses on long-term growth potential. They argue that focusing solely on short-term market fluctuations ignores the potential for sustained growth in the coming years, particularly considering technological advancements and global economic expansion in certain sectors.

-

Price-to-Earnings Ratio (P/E Ratio) Analysis: BofA probably employed a thorough P/E ratio analysis, comparing current ratios to historical averages and industry benchmarks. While acknowledging elevated P/E ratios in some sectors, their analysis likely suggests that these are not necessarily unsustainable, especially considering the low interest rate environment and expected future earnings growth.

Understanding the Factors Contributing to High Stock Market Valuations

Several economic and market factors contribute to the current high stock market valuations. Understanding these is crucial for making informed investment decisions.

-

Increased Market Liquidity: Abundant liquidity, fueled by central bank policies and government stimulus packages, has increased the availability of capital for investment, driving up asset prices, including stocks.

-

Technological Advancements Boosting Company Valuations: Rapid technological innovation is transforming industries, creating new opportunities and boosting the valuations of companies at the forefront of these advancements. Companies leveraging artificial intelligence, cloud computing, and other cutting-edge technologies often command premium valuations.

-

Government Stimulus Packages: Government stimulus efforts, designed to mitigate the economic impact of various crises, have injected significant capital into the market, increasing demand and supporting higher stock prices.

-

Global Economic Growth (or Specific Regional Growth): While global economic growth may be uneven, strong growth in specific regions or sectors can fuel higher valuations for companies operating within those areas. This uneven growth creates opportunities and challenges for investors.

Strategies for Navigating High Stock Market Valuations

Navigating high stock market valuations requires a strategic approach. Investors should consider the following:

-

Portfolio Diversification: Diversifying your investment portfolio across different asset classes (stocks, bonds, real estate, etc.) and sectors can mitigate risk associated with high valuations in specific areas. This diversification strategy reduces the impact of potential market corrections.

-

Focus on Long-Term Investment Horizons: High stock market valuations should not deter long-term investors. A long-term perspective allows investors to ride out short-term market volatility and benefit from the long-term growth potential of the market.

-

Consider Value Investing Strategies: Value investing focuses on identifying undervalued companies with strong fundamentals. In a market with high valuations, this approach can be particularly valuable in finding opportunities to potentially benefit from future growth while avoiding overpaying.

-

Regular Portfolio Review and Adjustments: Regularly reviewing and adjusting your portfolio based on market conditions and your investment goals is essential for effective risk management. This enables you to adapt to changing circumstances and maintain a balance.

-

Consult with a Financial Advisor: Seeking advice from a qualified financial advisor can provide valuable insights tailored to your individual circumstances and risk tolerance. A financial advisor will help you craft a personalized investment strategy suitable for your needs and goals.

Addressing Potential Risks and Counterarguments

While BofA's perspective offers a reassuring counterpoint to widespread panic, it's crucial to acknowledge potential risks and counterarguments.

-

Market Corrections Are Inevitable: Market corrections are a natural part of the market cycle. Even with strong fundamentals, periods of decline are inevitable, and high valuations increase the potential magnitude of a correction.

-

Overvaluation Can Lead to Significant Losses: High valuations, if not justified by underlying fundamentals, can lead to significant losses if the market corrects. This risk cannot be ignored.

-

Geopolitical Uncertainties Impacting Market Stability: Geopolitical events and uncertainties can significantly impact market stability and investor sentiment. These external factors are difficult to predict but carry substantial risk.

-

Inflationary Pressures: Sustained inflationary pressures can erode purchasing power and negatively impact stock valuations. This presents an important risk for investors.

Conclusion: High Stock Market Valuations: A Balanced Perspective and Call to Action

BofA's analysis suggests that while high stock market valuations exist, panic selling might not be the optimal response. The factors supporting these valuations, such as low interest rates and strong corporate earnings in many sectors, warrant consideration. However, the potential for market corrections and the impact of geopolitical risks and inflation cannot be dismissed. Informed decision-making, based on a thorough understanding of your risk tolerance and a well-diversified investment strategy, is crucial for navigating these high stock market valuations effectively. Conduct further research, consult with a financial professional, and develop a well-informed investment strategy to manage your investments effectively during this period of high stock market valuations.

Featured Posts

-

Alcaraz Wins Monte Carlo Masters First Title Musettis Injury Impacts Final

May 30, 2025

Alcaraz Wins Monte Carlo Masters First Title Musettis Injury Impacts Final

May 30, 2025 -

Laurent Jacobelli Actions Et Positions Politiques A L Assemblee Nationale

May 30, 2025

Laurent Jacobelli Actions Et Positions Politiques A L Assemblee Nationale

May 30, 2025 -

Navigating Economic Uncertainty Inflation And Unemployment Challenges

May 30, 2025

Navigating Economic Uncertainty Inflation And Unemployment Challenges

May 30, 2025 -

El Futuro De Bts El Impacto Del Servicio Militar En Su Carrera Musical

May 30, 2025

El Futuro De Bts El Impacto Del Servicio Militar En Su Carrera Musical

May 30, 2025 -

Mlb Commissioner Rob Manfred Faces Ownership Challenges A Madden Angle

May 30, 2025

Mlb Commissioner Rob Manfred Faces Ownership Challenges A Madden Angle

May 30, 2025

Latest Posts

-

Supporting Manitoba Wildfire Victims Red Cross Aid And How To Donate

May 31, 2025

Supporting Manitoba Wildfire Victims Red Cross Aid And How To Donate

May 31, 2025 -

How The Canadian Red Cross Is Assisting Manitoba Wildfire Evacuees

May 31, 2025

How The Canadian Red Cross Is Assisting Manitoba Wildfire Evacuees

May 31, 2025 -

Cycling Team Victorious Ready To Conquer The Tour Of The Alps

May 31, 2025

Cycling Team Victorious Ready To Conquer The Tour Of The Alps

May 31, 2025 -

Canadian Red Cross Manitoba Wildfire Evacuee Support How You Can Help

May 31, 2025

Canadian Red Cross Manitoba Wildfire Evacuee Support How You Can Help

May 31, 2025 -

Vatican City To Host Giro D Italia Cyclists Pope Leo Xivs Expected Greeting

May 31, 2025

Vatican City To Host Giro D Italia Cyclists Pope Leo Xivs Expected Greeting

May 31, 2025