High-Yield Dividend Investing: A Simple, Effective Strategy

Table of Contents

Understanding Dividend Yields and Their Importance

Dividend yield is a crucial metric in high-yield dividend investing. It represents the annual dividend per share relative to the share price. The calculation is straightforward: Annual Dividend / Share Price * 100 = Dividend Yield (%). A higher dividend yield indicates a potentially larger return on your investment in the form of dividends.

It's essential to differentiate between dividend yield and dividend growth. While dividend yield reflects the current return, dividend growth measures the rate at which the dividend payments increase over time. Companies with a history of consistent dividend growth are often more attractive to long-term investors.

The sustainability of dividend payouts is paramount. Analyze a company's payout ratio – the percentage of earnings paid out as dividends – and its overall financial health. A high payout ratio, coupled with declining earnings, could signal an unsustainable dividend, posing a risk to your investment.

- Why a high yield isn't always better: A very high yield might indicate financial distress and an imminent dividend cut. Always investigate the reason behind a high yield.

- The significance of researching a company's dividend history: A track record of consistent dividend payments is a positive indicator of financial stability and management's commitment to returning value to shareholders.

- The impact of market fluctuations on dividend yields: Market price changes directly affect dividend yields. A drop in share price increases the yield, while a price rise decreases it.

Identifying High-Yield Dividend Stocks

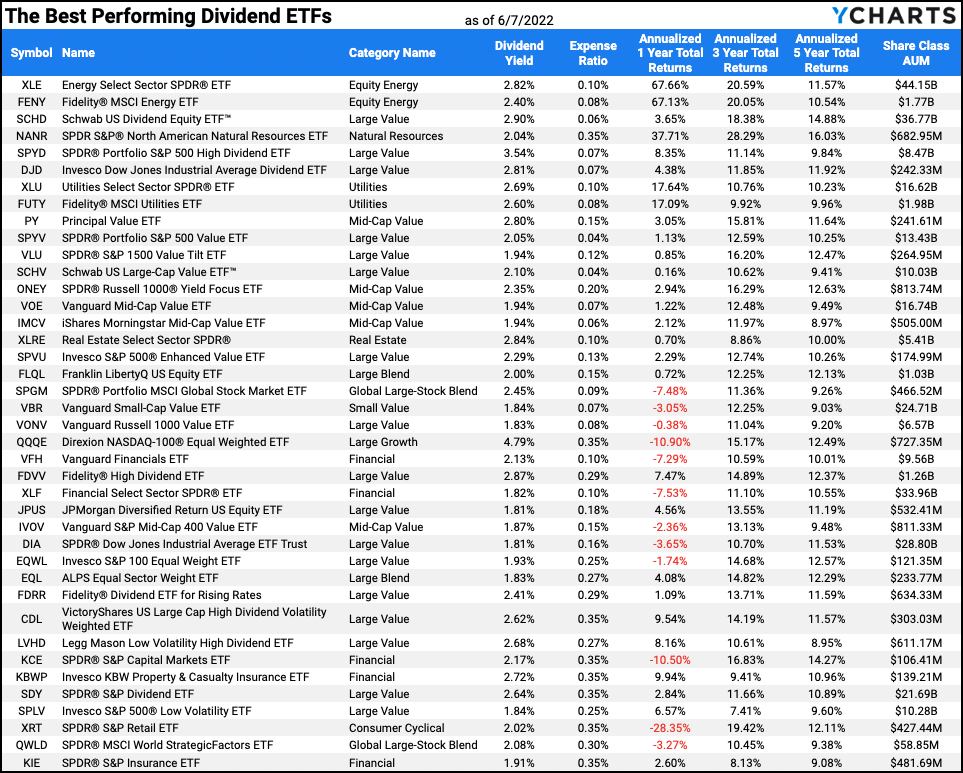

Finding suitable high-yield dividend stocks requires a strategic approach. Utilize online tools and brokerage platforms offering stock screeners to filter stocks based on dividend yield, payout ratio, and other financial metrics. Many brokerage accounts provide built-in screening capabilities.

Several sectors are known for their higher-than-average dividend payouts. Real Estate Investment Trusts (REITs), utilities, and consumer staples often offer attractive yields. However, remember that this isn't a guarantee, and thorough due diligence is always necessary.

Fundamental analysis is crucial. Review a company's financial statements, including its income statement, balance sheet, and cash flow statement. Assess its debt levels, profitability, and management quality. A company with strong financials and a sustainable business model is more likely to maintain its dividend payments.

- Examples of websites and tools for screening dividend-paying stocks: Many financial websites (such as Yahoo Finance, Google Finance) offer stock screeners. Your brokerage platform likely has its own screening tools.

- Key financial metrics to consider: Payout ratio, Price-to-Earnings (P/E) ratio, debt-to-equity ratio, and return on equity (ROE) are crucial metrics to assess a company's financial health.

- Risks of focusing solely on high yield without considering other factors: Prioritizing yield alone can lead to overlooking critical factors like financial stability and future growth prospects.

Building a Diversified High-Yield Dividend Portfolio

Diversification is essential to mitigate risk in high-yield dividend investing. Spread your investments across different sectors and companies to reduce the impact of any single stock's underperformance. This protects against sector-specific downturns and reduces overall portfolio volatility.

Consider various portfolio strategies, such as value investing (focusing on undervalued companies), growth investing (prioritizing companies with high growth potential), or a blend of both. High-yield dividend investing often leans towards value investing due to the focus on established, profitable companies.

Diversify across market capitalizations as well. Include a mix of large-cap, mid-cap, and small-cap stocks to further reduce risk and increase potential returns.

- The benefits of spreading investments across multiple high-yield stocks: This minimizes the risk of significant losses from any single poor-performing investment.

- How to determine an appropriate asset allocation based on risk tolerance: Your risk tolerance should guide your asset allocation. More risk-averse investors might opt for a more conservative approach with fewer stocks and a focus on established companies.

- The role of regular portfolio rebalancing: Periodically rebalance your portfolio to maintain your desired asset allocation. This involves selling some overperforming assets and buying underperforming ones.

Managing Your High-Yield Dividend Portfolio

Active portfolio management is crucial for success. Regularly monitor your investments, tracking their performance, dividend payouts, and any news affecting the companies you've invested in. Adjust your portfolio as needed, based on changing market conditions and company performance.

Consider dividend reinvestment plans (DRIPs). DRIPs allow you to automatically reinvest your dividend payments into additional shares of the same company. This accelerates wealth growth through compounding, but requires careful consideration of tax implications.

Stay updated on relevant news, economic trends, and company announcements to make informed decisions and respond appropriately to potential risks or opportunities.

- How often to review your portfolio performance: Aim for at least a quarterly review of your portfolio, and more frequently if significant market events or company news impact your holdings.

- The advantages and disadvantages of DRIPs: Advantages include automatic reinvestment and compounding; disadvantages include limitations on the number of shares you can buy, and potential tax implications.

- The importance of staying updated on news affecting your investments: Being informed helps you anticipate changes, react quickly, and make better investment decisions.

Reap the Rewards of High-Yield Dividend Investing

High-yield dividend investing offers a path to sustainable passive income and long-term wealth creation. This strategy involves understanding dividend yields and their significance, identifying strong dividend-paying companies through thorough research, diversifying your portfolio for risk mitigation, and actively managing your investments. Remember that high yield should not be the sole focus; fundamental strength and sustainability are crucial.

High-yield dividend investing offers a relatively lower-risk approach compared to some other investment strategies, providing a steady stream of income even during market volatility. It's a powerful tool for building financial security and achieving your long-term financial goals.

Begin your journey towards financial freedom with a strategic high-yield dividend investing plan today! Explore the world of high-yield dividend investing and start building your passive income stream!

Featured Posts

-

Aaron Judge At 1 000 Games His Legacy And Hall Of Fame Prospects

May 11, 2025

Aaron Judge At 1 000 Games His Legacy And Hall Of Fame Prospects

May 11, 2025 -

A Simple Path To High Dividend Returns The Most Profitable Strategy

May 11, 2025

A Simple Path To High Dividend Returns The Most Profitable Strategy

May 11, 2025 -

Decoding Aaron Judges Push Up Count A 2025 Season Prediction

May 11, 2025

Decoding Aaron Judges Push Up Count A 2025 Season Prediction

May 11, 2025 -

Huge Crowd Expected At Bristol Manfreds Prediction

May 11, 2025

Huge Crowd Expected At Bristol Manfreds Prediction

May 11, 2025 -

Le Divorce D Eric Antoine Et La Naissance De Son Enfant Avec Sa Nouvelle Compagne

May 11, 2025

Le Divorce D Eric Antoine Et La Naissance De Son Enfant Avec Sa Nouvelle Compagne

May 11, 2025