Highway 407 East Tolls And Ontario Gas Tax: Potential For Permanent Changes

Table of Contents

Current State of Highway 407 East Tolls

Toll Rates and Their Variability

The Highway 407 East toll system is notorious for its variable pricing. The cost of your journey fluctuates based on several factors:

- Time of day: Peak hour travel (typically during rush hour) commands significantly higher tolls.

- Distance traveled: The further you drive, the more expensive the toll.

- Traffic congestion: Heavier traffic often leads to higher tolls.

For example:

- A short trip during off-peak hours might cost $2-$5.

- The same trip during rush hour could easily reach $10-$20 or more.

- Longer commutes can result in daily tolls exceeding $30.

Recent years have seen several toll increases on the 407ETR, and further increases are anticipated in the coming years, adding to the financial burden for drivers. Compared to other toll highways in Ontario, the 407 East often commands the highest rates, making it a significant expense for regular users.

Methods of Payment and Potential for Changes

Drivers can currently pay Highway 407 East tolls via various methods:

- 407 ETR transponder: Offers the most convenient and often the cheapest method of payment.

- Online payment: Allows for convenient payment after travel, but often involves higher administrative fees.

- Mail-in payment: Least convenient and usually the most expensive option.

Potential future changes could involve:

- Integration of new technologies, such as automatic license plate readers for seamless toll collection.

- The introduction of flexible payment plans or subscription services for frequent users.

- Further development of the online payment portal with improved functionality and features.

Ontario Gas Tax: Current Rates and Potential for Increases

Current Gas Tax Structure

Ontario's gas tax contributes significantly to provincial revenue. It's comprised of:

- A provincial component: This rate is subject to change based on government decisions.

- A federal component: This portion is determined by the federal government.

Recent years have witnessed several increases to the gas tax, adding to the cost of fueling vehicles. The fluctuating price of gasoline itself further exacerbates the financial impact on drivers, particularly those with longer commutes or fuel-intensive vehicles.

Political Considerations and Future Projections

The political climate significantly influences potential gas tax changes. Several factors could drive future increases or reductions:

- Funding for infrastructure projects: Government initiatives often rely on increased tax revenue.

- Budget deficits: Addressing fiscal shortfalls might involve raising taxes, including the gas tax.

- Public pressure: Significant public opposition to tax increases could sway government decisions.

Government pronouncements and policy changes need to be carefully monitored to understand the likely direction of future gas tax adjustments.

Combined Impact on Drivers: Highway 407 Tolls and Gas Tax

Financial Burden on Commuters and Businesses

The combined effect of Highway 407 tolls and gas tax places a significant financial strain on drivers and businesses:

- A daily commute on the 407, coupled with the cost of gasoline, can quickly consume a substantial portion of a driver's budget. For example, a daily round-trip on the 407 costing $20, combined with $50 in fuel, adds up to $70 per day, or over $1750 per month.

- Small businesses that rely on vehicles for deliveries or transportation face increased operational costs, potentially impacting profitability.

Alternative Transportation Options and Their Feasibility

To mitigate the escalating costs of driving, drivers may consider alternative transportation methods:

- Public transit: This is often a more affordable option, but its accessibility and convenience vary depending on location.

- Cycling: A cost-effective and environmentally friendly choice, but not always practical for longer distances or inclement weather.

- Carpooling: Sharing rides can reduce individual costs and lessen traffic congestion.

However, these alternatives might not be feasible for all commuters due to factors like distance, schedule constraints, or lack of adequate public transit infrastructure.

Conclusion

The potential for permanent changes to both Highway 407 East tolls and the Ontario gas tax presents a considerable concern for drivers. The combined impact on personal budgets and business expenses is undeniable. While alternative transportation methods offer some relief, their limitations prevent them from being a universally viable solution. Staying informed about upcoming changes to "Highway 407 East Tolls and Ontario Gas Tax" is crucial. Follow relevant news sources and government websites, and consider contacting your elected officials to express your concerns and opinions. The future of transportation costs in Ontario requires sustainable solutions that balance the needs of drivers with the financial realities of the province.

Featured Posts

-

Pagkypria Sygkrisi Timon Kaysimon Breite To Fthinotero Pratirio

May 15, 2025

Pagkypria Sygkrisi Timon Kaysimon Breite To Fthinotero Pratirio

May 15, 2025 -

Analyzing The Secondary Impacts Of Reciprocal Tariffs On India

May 15, 2025

Analyzing The Secondary Impacts Of Reciprocal Tariffs On India

May 15, 2025 -

Pimbletts Fiery Response To Doubters After Triumphant Ufc 314 Fight

May 15, 2025

Pimbletts Fiery Response To Doubters After Triumphant Ufc 314 Fight

May 15, 2025 -

Dodgers Left Handed Hitters A Slump And The Road To Recovery

May 15, 2025

Dodgers Left Handed Hitters A Slump And The Road To Recovery

May 15, 2025 -

Seriya Pley Off N Kh L Karolina Dominiruet Nad Vashingtonom

May 15, 2025

Seriya Pley Off N Kh L Karolina Dominiruet Nad Vashingtonom

May 15, 2025

Latest Posts

-

Firstposts First Up Breaking News From Bangladesh China And The Caribbean

May 15, 2025

Firstposts First Up Breaking News From Bangladesh China And The Caribbean

May 15, 2025 -

Dzho Bayden Ta Dzhill Na Vistavi Otello Porivnyannya Z Inavguratsiyeyu Trampa

May 15, 2025

Dzho Bayden Ta Dzhill Na Vistavi Otello Porivnyannya Z Inavguratsiyeyu Trampa

May 15, 2025 -

Yunus In China Rubios Caribbean Visit Your Daily First Up News Summary

May 15, 2025

Yunus In China Rubios Caribbean Visit Your Daily First Up News Summary

May 15, 2025 -

First Up Bangladesh Yunus In China Rubios Caribbean Trip And More Top News

May 15, 2025

First Up Bangladesh Yunus In China Rubios Caribbean Trip And More Top News

May 15, 2025 -

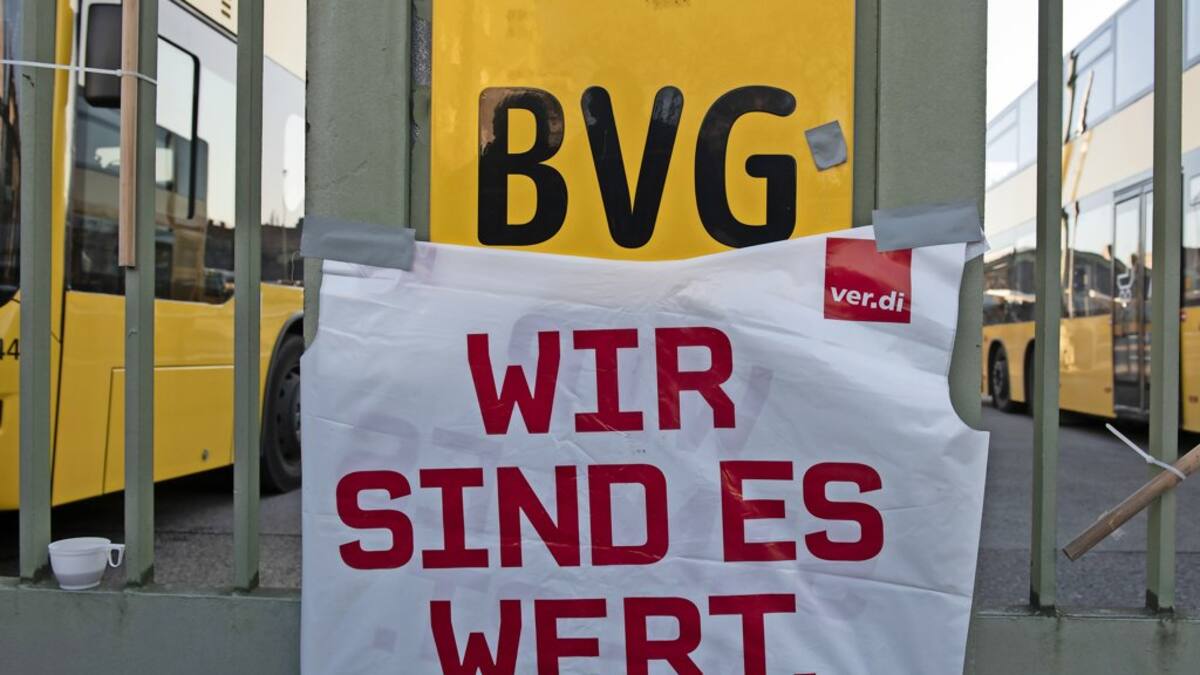

Endgueltige Einigung Im Bvg Tarifstreit Keine Streiks Mehr

May 15, 2025

Endgueltige Einigung Im Bvg Tarifstreit Keine Streiks Mehr

May 15, 2025