HMRC Letter Received? Important Information For UK Taxpayers

Table of Contents

Receiving a letter from HMRC (HM Revenue & Customs) can be daunting. Understanding what the letter means and how to respond is crucial to avoid penalties and maintain a healthy tax record. This guide provides essential information for UK taxpayers who have received correspondence from HMRC. We'll break down different types of HMRC letters, explain your obligations, and guide you on how to respond effectively.

Identifying the Type of HMRC Letter

HMRC sends various letters to taxpayers throughout the year. Knowing what type of HMRC correspondence you've received is the first step in understanding your next actions. Different letters require different responses. Failing to respond appropriately to an HMRC tax letter can lead to penalties.

-

Tax Return Reminders: If you haven't filed your self-assessment tax return by the deadline (usually 31 January), you'll receive a reminder from HMRC. These letters usually state the outstanding deadline. Ignoring these HMRC tax return reminders can result in significant penalties. Act promptly and file your return online through the HMRC website.

-

Payment Demands: An HMRC payment demand letter means you owe tax. The letter will specify the amount due and the payment deadline. Understanding your payment options is crucial. You can pay online, by phone, or by post. If you can't afford to pay the full amount by the deadline, contact HMRC immediately to discuss payment plans or arrangements. Ignoring a payment demand will result in further charges and potential debt collection action.

-

Tax Investigation Notices: These letters indicate that HMRC is investigating your tax affairs. This can be concerning, but it's important to remain calm and gather all relevant documentation. You have specific rights and obligations when responding to a tax investigation. Seeking professional advice from a tax advisor or accountant is highly recommended in such situations. Responding properly to an HMRC tax investigation is crucial to minimizing potential penalties.

-

Other Correspondence: HMRC may contact you about changes to your tax code, requests for additional information, or updates to your account. Always read these letters carefully and respond as instructed. This could involve providing supporting evidence or updating your personal details.

Understanding Your Obligations as a UK Taxpayer

Promptly responding to HMRC correspondence is a legal obligation for all UK taxpayers. Ignoring HMRC letters is not an option.

-

Legal Requirements: The UK tax system is based on self-assessment, meaning you are responsible for accurately reporting your income and tax liabilities. Failing to comply with HMRC's requests can lead to severe consequences.

-

Penalties for Non-Compliance: Late filing, inaccurate reporting, and non-payment of taxes will result in penalties that can be substantial. These penalties can significantly increase over time if the issues are not addressed promptly.

-

Importance of Keeping Accurate Tax Records: Maintaining meticulous records of your income, expenses, and tax payments is essential to avoid problems with HMRC. Good record keeping simplifies the process of responding to HMRC correspondence and reduces the likelihood of errors.

Responding to HMRC Correspondence

Effectively responding to HMRC correspondence requires a methodical approach.

-

Gathering Necessary Documents and Information: Before responding, gather all relevant documentation, such as payslips, bank statements, invoices, and receipts. This will help you provide accurate and complete information to HMRC.

-

Contacting HMRC Directly: If you have questions or need clarification on any aspect of an HMRC letter, contact them directly through their online services or telephone helpline. Don't hesitate to seek clarification if you're unsure about anything.

-

Understanding Your Rights and Options: You have rights as a taxpayer, and it's important to understand them. If you disagree with HMRC's assessment, you can appeal their decision through the appropriate channels.

-

Using HMRC's Online Services: HMRC provides a range of online services that allow you to manage your tax affairs, view correspondence, and communicate with them easily. Utilizing these services can streamline your communication with HMRC.

Seeking Professional Help

Navigating complex tax issues can be challenging. It's advisable to seek professional help under certain circumstances.

-

Complex Tax Situations: If you have a complex tax situation, such as running a business with multiple income streams or dealing with international tax implications, consulting a tax advisor or accountant is strongly recommended.

-

Difficulties Understanding HMRC Correspondence: If you find the HMRC letter confusing or unclear, seeking professional guidance can help you understand your obligations and respond appropriately.

-

Concerns about Tax Investigations: A tax investigation can be stressful. Engaging a tax advisor experienced in dealing with HMRC investigations can provide crucial support and guidance.

Conclusion

Receiving an HMRC letter can be stressful, but understanding your obligations and how to respond appropriately is key. Remember to act promptly, gather the necessary information, and don't hesitate to seek professional help when needed. Properly addressing HMRC correspondence can prevent potential penalties and maintain your good standing with HMRC.

Call to Action: Have you received an HMRC letter and need help understanding it? Don't delay! Contact a qualified tax professional today or explore HMRC's online resources for further assistance. Learn more about navigating your HMRC correspondence efficiently and effectively.

Featured Posts

-

Prezzo Basso Gioco Hercule Poirot Ps 5 Meno Di 10 E Su Amazon

May 20, 2025

Prezzo Basso Gioco Hercule Poirot Ps 5 Meno Di 10 E Su Amazon

May 20, 2025 -

Miami Hedge Fund Manager Detained Immigration Deception Claims

May 20, 2025

Miami Hedge Fund Manager Detained Immigration Deception Claims

May 20, 2025 -

El Viaje De Schumacher De Mallorca A Suiza En Helicoptero

May 20, 2025

El Viaje De Schumacher De Mallorca A Suiza En Helicoptero

May 20, 2025 -

Formula 1 Star Charles Leclercs New Collaboration With Chivas Regal

May 20, 2025

Formula 1 Star Charles Leclercs New Collaboration With Chivas Regal

May 20, 2025 -

Arsenals Pursuit Of 17m Rated Premier League Star Intensifies

May 20, 2025

Arsenals Pursuit Of 17m Rated Premier League Star Intensifies

May 20, 2025

Latest Posts

-

Dubai Holdings Reit Ipo A 584 Million Investment Opportunity

May 20, 2025

Dubai Holdings Reit Ipo A 584 Million Investment Opportunity

May 20, 2025 -

Dubai Reit Ipo Holding Boosts Offering To 584 Million

May 20, 2025

Dubai Reit Ipo Holding Boosts Offering To 584 Million

May 20, 2025 -

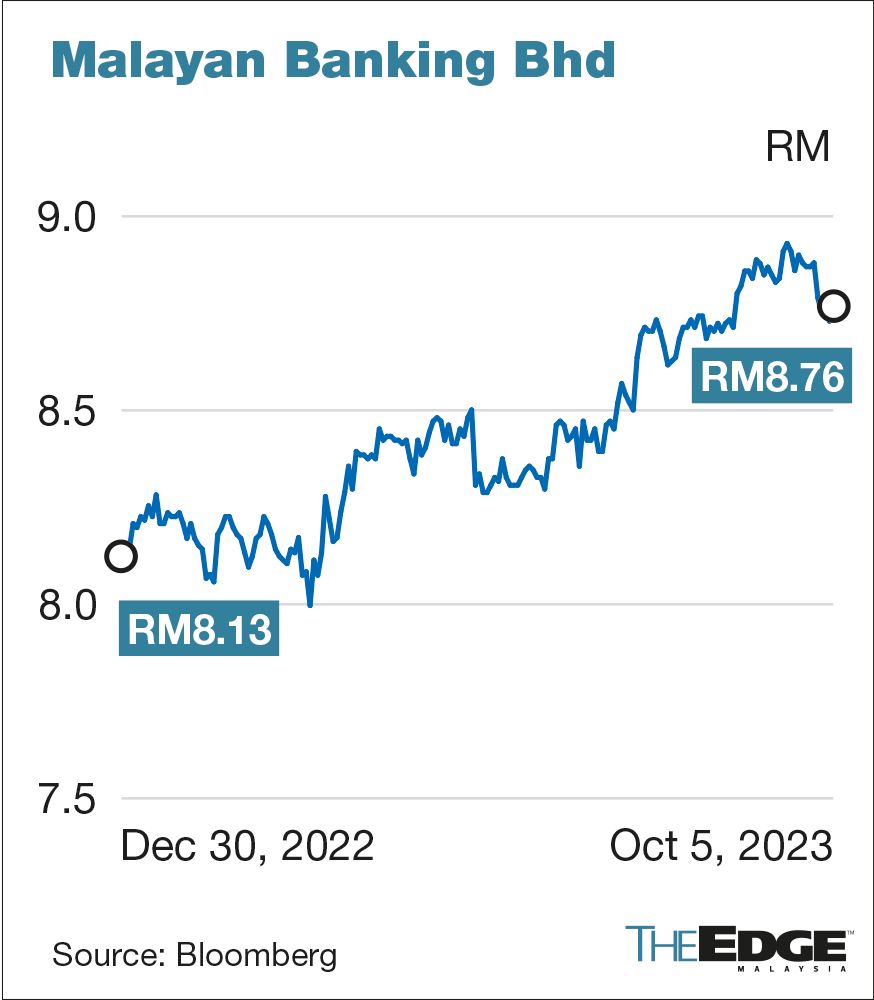

545 Million Economic Zone Investment Facilitated By Maybank

May 20, 2025

545 Million Economic Zone Investment Facilitated By Maybank

May 20, 2025 -

Dubai Holding Increases Reit Ipo Size To 584 Million

May 20, 2025

Dubai Holding Increases Reit Ipo Size To 584 Million

May 20, 2025 -

Maybanks 545 Million Boost To Economic Zone Development

May 20, 2025

Maybanks 545 Million Boost To Economic Zone Development

May 20, 2025