Home Depot's Earnings: Disappointing Results, Tariff Guidance Maintained

Table of Contents

Disappointing Q[Quarter] Earnings: A Deeper Dive into the Numbers

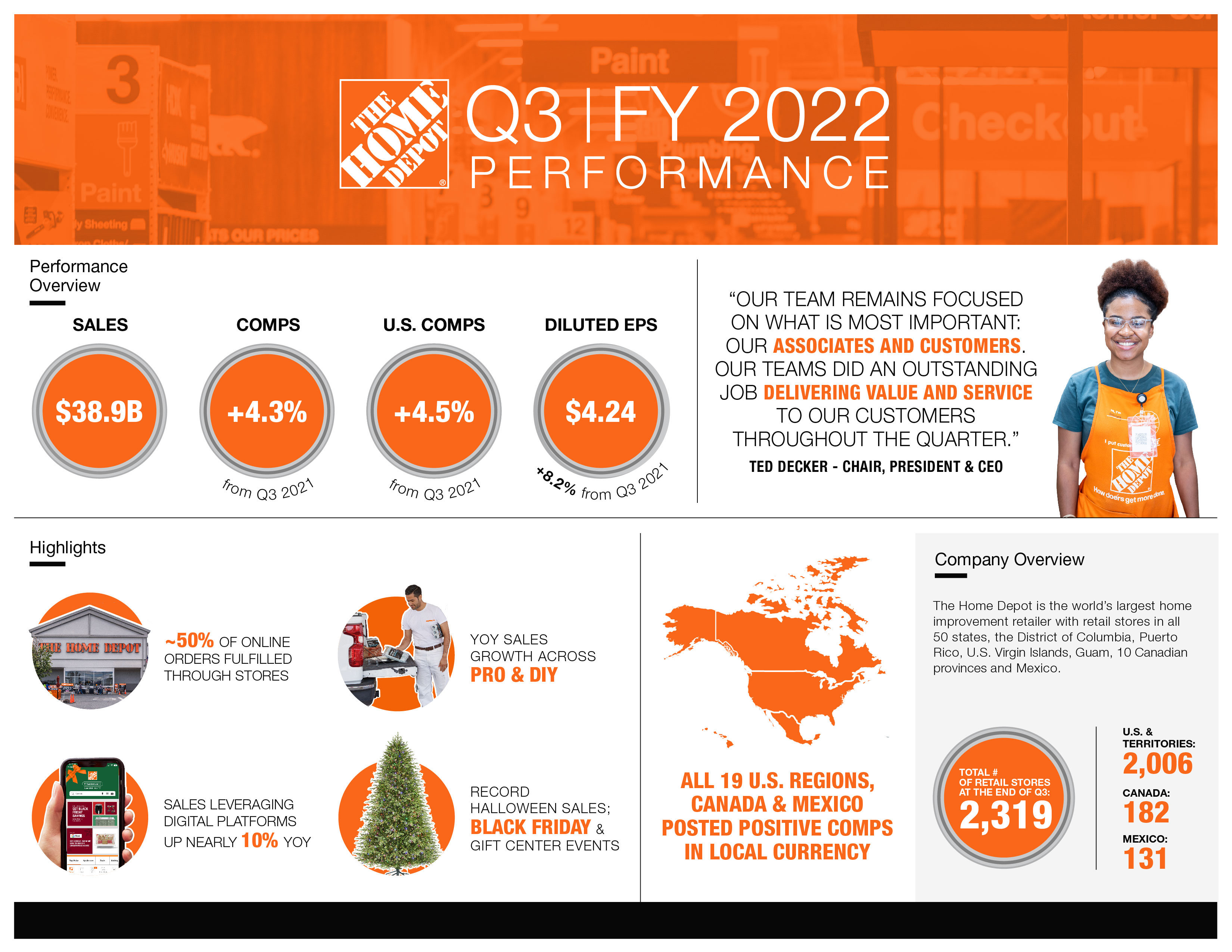

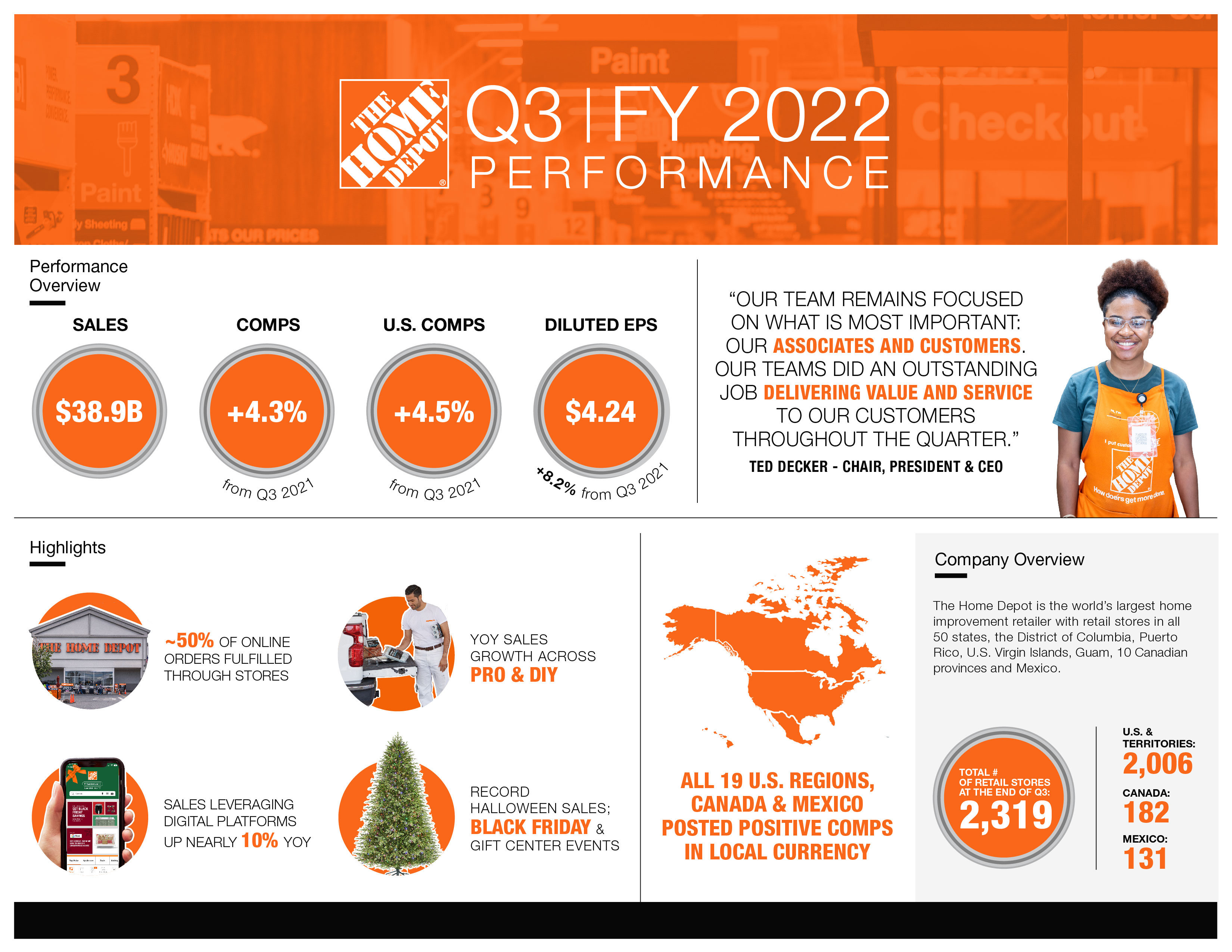

Home Depot's Q[Quarter] financial results painted a less-than-rosy picture for the home improvement retail giant. The Home Depot financial results showcased a clear divergence from analyst projections across several key metrics. Let's break down the numbers:

-

Revenue: Revenue fell short of analyst estimates by [Percentage]%, signaling a slowdown in sales growth compared to previous quarters. This miss reflects a weakening demand or a struggle to offset increased costs. The shortfall in Home Depot revenue is a significant concern for investors.

-

Earnings Per Share (EPS): EPS came in at [Number], significantly below the consensus forecasts of [Number]. This indicates a decline in profitability, impacting Home Depot stock and investor confidence. Analyzing Home Depot EPS is crucial to understanding the overall financial health.

-

Same-Store Sales Growth: Same-store sales growth, a key indicator of a retailer's performance, slowed to [Percentage]%. This sluggish growth suggests challenges in attracting customers and driving sales within existing stores. The decline in Home Depot same-store sales highlights broader economic concerns within the home improvement sector.

These deviations from projections highlight a significant challenge for Home Depot, requiring a deeper examination of underlying factors influencing performance.

The Persistent Impact of Tariffs on Home Depot's Operations

The ongoing trade tensions and persistent tariffs continue to significantly impact Home Depot's operations. The company's struggles are directly linked to the increased costs of imported goods. This section will examine how tariffs are affecting Home Depot's supply chain and pricing strategies.

-

Increased Costs: Tariffs on lumber and other crucial building materials have driven up costs, squeezing profit margins and impacting Home Depot's ability to compete effectively. The increase in lumber prices, specifically, has presented a major hurdle.

-

Mitigation Strategies: Home Depot has actively sought to mitigate the impact of tariffs through various strategies. These include sourcing materials from alternative regions and exploring cost-saving measures within their supply chain. However, these efforts have yet to fully offset the impact of the ongoing trade war.

-

Future Earnings Uncertainty: The continued uncertainty surrounding tariffs poses a significant risk to Home Depot's future earnings. Predicting future performance becomes increasingly difficult under these conditions, leading to a cautious outlook. The effect of Home Depot tariffs is a key factor that will continue shaping the company’s performance.

Home Depot's Guidance for Future Quarters – Cautious Outlook

Home Depot's guidance for the remaining quarters of the year reflects a cautious outlook. The company's forecast acknowledges the persistent challenges posed by tariffs and other macroeconomic factors. The maintained tariff guidance suggests that these challenges will continue to impact future earnings and the Home Depot forecast needs to consider this ongoing issue. The economic outlook remains uncertain, further adding to the complexity of predicting future performance.

Investor Reaction and Stock Performance Following the Earnings Announcement

The market's reaction to the Home Depot earnings announcement was largely negative. The Home Depot stock price experienced a [Percentage]% drop immediately following the release of the report, reflecting investor concerns about the company's performance and future prospects. Investor sentiment shifted towards caution, with some analysts issuing downgrades. The market reaction underscores the significance of the earnings miss and the impact on Home Depot stock price.

Home Depot Earnings Report – A Cautious Path Forward

Home Depot's Q[Quarter] earnings report reveals a challenging environment marked by the persistent impact of tariffs on its operations. The revenue shortfall, decreased EPS, and slowing same-store sales growth underscore the difficulties the company faces. The cautious outlook for the remainder of the year further reinforces the challenges ahead. Understanding the ongoing impact of tariffs and their influence on Home Depot's performance is crucial for investors and stakeholders.

To stay informed about Home Depot’s performance and the evolving impact of tariffs on the home improvement retail sector, continue to follow future Home Depot earnings reports and analyses. You can also find additional resources and insights into Home Depot stock and the broader market trends by researching reputable financial news sources and analyst reports. Staying informed is critical for understanding the intricacies of Home Depot's financial health and its position in the ever-changing economic landscape.

Featured Posts

-

Musique Live Hellfest Au Noumatrouff De Mulhouse

May 22, 2025

Musique Live Hellfest Au Noumatrouff De Mulhouse

May 22, 2025 -

3 Billion Spending Cut By Sse Analysis And Implications For Investors

May 22, 2025

3 Billion Spending Cut By Sse Analysis And Implications For Investors

May 22, 2025 -

Javier Baez Luchando Por La Salud Y La Productividad

May 22, 2025

Javier Baez Luchando Por La Salud Y La Productividad

May 22, 2025 -

Antiques Roadshow Couples Unknowing Role In National Treasure Crime Results In Jail Sentence

May 22, 2025

Antiques Roadshow Couples Unknowing Role In National Treasure Crime Results In Jail Sentence

May 22, 2025 -

Nantes Et Ses Tours Opportunites Et Enjeux Pour Les Professionnels De La Corde

May 22, 2025

Nantes Et Ses Tours Opportunites Et Enjeux Pour Les Professionnels De La Corde

May 22, 2025

Latest Posts

-

Susquehanna Valley Storm Damage Resources For Homeowners And Businesses

May 22, 2025

Susquehanna Valley Storm Damage Resources For Homeowners And Businesses

May 22, 2025 -

Recent Susquehanna Valley Storm Damage Extent Of The Destruction And Ongoing Efforts

May 22, 2025

Recent Susquehanna Valley Storm Damage Extent Of The Destruction And Ongoing Efforts

May 22, 2025 -

Understanding Susquehanna Valley Storm Damage Prevention Mitigation And Insurance

May 22, 2025

Understanding Susquehanna Valley Storm Damage Prevention Mitigation And Insurance

May 22, 2025 -

Susquehanna Valley Storm Damage A Comprehensive Guide To Repair And Restoration

May 22, 2025

Susquehanna Valley Storm Damage A Comprehensive Guide To Repair And Restoration

May 22, 2025 -

Dauphin County Apartment Building Fire Residents Evacuated

May 22, 2025

Dauphin County Apartment Building Fire Residents Evacuated

May 22, 2025