House Passes Trump Tax Bill: Final Changes & Impact

Table of Contents

Key Changes in the Final Trump Tax Bill Version

The final version of the Trump Tax Bill included several key alterations to the existing tax code. Understanding these changes is crucial for assessing its overall impact.

Corporate Tax Rate Reductions

The most significant change was the dramatic reduction in the corporate tax rate. The bill slashed the rate from 35% to a flat 21%, a move proponents argued would stimulate business investment, boost job creation, and increase overall economic competitiveness.

- Specific Changes: Elimination of certain deductions and credits previously available to corporations. Simplification of the corporate tax code.

- Impact on Businesses: While large corporations likely benefited most from the lower rate, the impact on small businesses was more nuanced. Some smaller businesses benefited from the simplified tax code, while others found the loss of certain deductions detrimental.

- Data & Statistics: While initial projections suggested significant economic growth, the actual impact on job creation and investment remained a subject of debate among economists. Studies yielded varying results, some showing a positive correlation, others suggesting a more muted effect.

Individual Tax Bracket Adjustments

The Trump Tax Bill also altered individual income tax brackets, standard deductions, and exemptions. These changes aimed to provide tax relief to individuals and families, but the distribution of benefits was uneven.

- Tax Bracket Changes: The bill compressed the seven individual income tax brackets into four, generally lowering rates for many taxpayers. However, some higher earners saw less significant reductions.

- Deduction Changes: The standard deduction was significantly increased, benefiting many taxpayers, particularly those who previously didn't itemize. However, the bill also limited or eliminated several itemized deductions, including the state and local tax (SALT) deduction, impacting taxpayers in high-tax states.

- Examples: A single filer earning $50,000 might have seen a noticeable tax decrease due to the combined effect of lower rates and increased standard deduction. However, a high-income earner in a high-tax state could have experienced a net tax increase due to SALT limitations.

Changes to Itemized Deductions

The changes to itemized deductions were a significant aspect of the Trump Tax Bill. The reduction or elimination of certain deductions had a substantial influence on the overall tax liability of many taxpayers.

- Mortgage Interest Deduction: While retained, the deduction was subject to a $750,000 limit on new mortgages, impacting high-value home purchases.

- Charitable Contributions: The deduction for charitable contributions remained, but its value was reduced for many taxpayers due to the increased standard deduction. Many taxpayers found it more advantageous to take the standard deduction, rendering the charitable contribution deduction less beneficial.

- State and Local Taxes (SALT): The limitation on the SALT deduction was a highly contentious element. It disproportionately affected taxpayers in high-tax states, particularly those in the Northeast and California, increasing their tax burdens. The political implications were significant, with accusations of favoring certain states over others.

Economic Impact of the Trump Tax Bill

The Trump Tax Bill's economic effects have been debated extensively. While proponents predicted robust economic growth, critics warned of increased national debt and income inequality.

Projected GDP Growth

Initial projections suggested the tax cuts would lead to increased GDP growth. However, the actual impact varied across studies and models.

- Economic Forecasts: Some forecasts predicted a temporary boost in GDP growth, followed by a slower rate of growth in the long run. Others remained skeptical, suggesting that the positive impacts were overestimated.

- Short-Term vs. Long-Term: The short-term effects were more apparent, with increased consumer spending and business investment. However, the long-term consequences, particularly regarding the national debt, remained uncertain.

- Criticisms: Critics argued that the projected GDP growth was overly optimistic and that the tax cuts would primarily benefit corporations and high-income earners, exacerbating income inequality.

Impact on Employment and Investment

The bill's impact on employment and investment was a major point of contention.

- Positive Impacts: Proponents argued that the corporate tax cut would incentivize businesses to invest more, leading to increased job creation and higher wages.

- Negative Impacts: Critics countered that the benefits were largely confined to large corporations, leaving smaller businesses and workers with limited gains. Additionally, they argued that the increased national debt resulting from the tax cuts could stifle future economic growth.

- Relevant Studies: Empirical studies on the bill's impact on employment and investment yielded mixed results, making it difficult to reach a definitive conclusion.

National Debt Implications

The tax cuts significantly increased the national debt and the federal budget deficit.

- Projected Deficits: The Congressional Budget Office projected substantial increases in the national debt over the following decade due to the tax cuts.

- Long-Term Consequences: The long-term consequences of a larger national debt include higher interest rates, reduced government spending on other programs, and potential economic instability.

- Sustainability: Debates arose over the sustainability of the tax cuts in the long term, with questions raised about the need for future tax increases or spending cuts to offset the increased debt.

Political Fallout and Public Opinion

The Trump Tax Bill sparked intense political debate and divided public opinion.

- Political Party Divisions: The bill largely followed party lines, with Republicans generally supporting it and Democrats overwhelmingly opposing it.

- Public Opinion Polls: Polls showed mixed public sentiment, with varying levels of support and opposition across different demographics and political affiliations.

- Arguments For and Against: Supporters emphasized job creation, economic growth, and tax relief for individuals and families. Opponents highlighted increased income inequality, the expansion of the national debt, and the disproportionate benefits for corporations and high-income earners.

Conclusion

The Trump Tax Bill significantly altered the US tax code, introducing substantial changes to corporate and individual tax rates, deductions, and exemptions. While proponents touted potential benefits like increased economic growth and job creation, critics warned of rising national debt and increased income inequality. The actual economic and social impacts remain a subject of ongoing debate and analysis. The bill's legacy continues to be shaped by its long-term consequences on the economy and the nation's fiscal position.

Call to Action: Stay informed about the implications of the Trump Tax Bill and plan your taxes accordingly. Use resources like [link to IRS website] to learn more about the changes and how they affect you. Understanding the Trump tax bill's impact is crucial for effective financial planning.

Featured Posts

-

Lancashire Radio Pays Respects Andy Bayes Remembers Andy Peebles

May 23, 2025

Lancashire Radio Pays Respects Andy Bayes Remembers Andy Peebles

May 23, 2025 -

Netflix Movies And Shows Coming In May 2025

May 23, 2025

Netflix Movies And Shows Coming In May 2025

May 23, 2025 -

Jonathan Groffs Show Name Opening Night A Star Studded Affair

May 23, 2025

Jonathan Groffs Show Name Opening Night A Star Studded Affair

May 23, 2025 -

Fratii Tate Detalii Despre Sosirea Si Deplasarea Lor In Bucuresti

May 23, 2025

Fratii Tate Detalii Despre Sosirea Si Deplasarea Lor In Bucuresti

May 23, 2025 -

Review Succession Sky Atlantic Hds Gripping Family Drama

May 23, 2025

Review Succession Sky Atlantic Hds Gripping Family Drama

May 23, 2025

Latest Posts

-

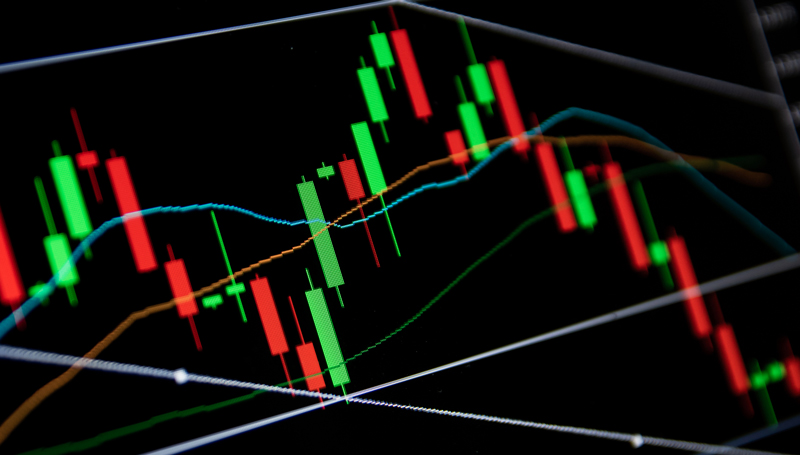

Todays Frankfurt Stock Market Close Dax Below 24 000

May 24, 2025

Todays Frankfurt Stock Market Close Dax Below 24 000

May 24, 2025 -

Removal Men And A New Chapter Lauryn Goodmans Move To Italy Explained

May 24, 2025

Removal Men And A New Chapter Lauryn Goodmans Move To Italy Explained

May 24, 2025 -

Walker Peters Crystal Palaces Free Transfer Pursuit

May 24, 2025

Walker Peters Crystal Palaces Free Transfer Pursuit

May 24, 2025 -

End Of Trading Frankfurt Stock Market Experiences Losses

May 24, 2025

End Of Trading Frankfurt Stock Market Experiences Losses

May 24, 2025 -

Lauryn Goodmans Relocation To Italy A Bizarre Twist Following Kyle Walkers Transfer

May 24, 2025

Lauryn Goodmans Relocation To Italy A Bizarre Twist Following Kyle Walkers Transfer

May 24, 2025