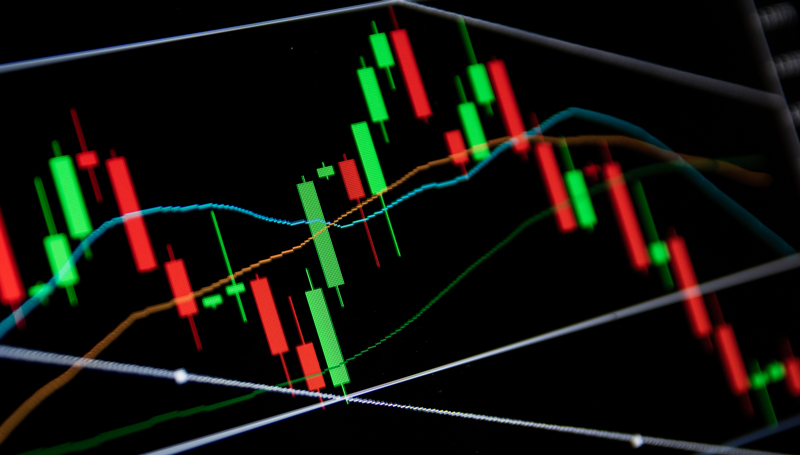

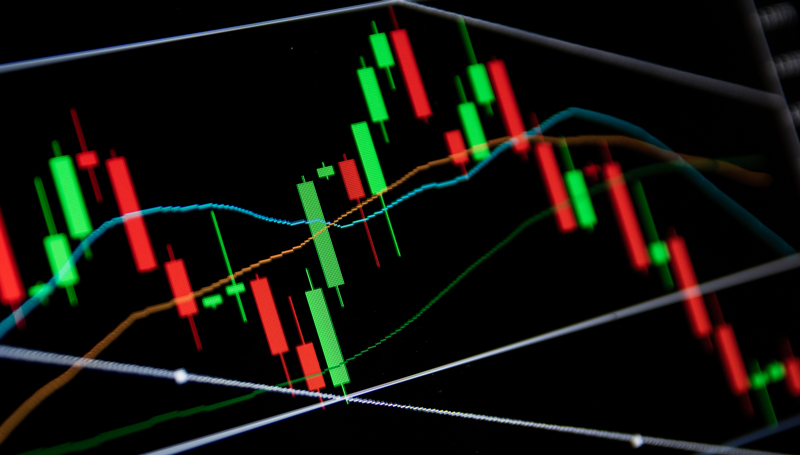

End Of Trading: Frankfurt Stock Market Experiences Losses

Table of Contents

Key Indices and Their Performance

The Frankfurt Stock Exchange's major indices all suffered significant losses today, reflecting a broader negative trend in the European market. Let's break down the performance of each:

-

DAX: The DAX, Germany's leading stock market index, closed down by 2.5%, ending the day at 15,200 points. This represents a substantial drop from yesterday's closing price of 15,500 and is significantly below its yearly high. The DAX losses reflect concerns across various sectors of the German economy.

-

MDAX: The MDAX, representing mid-sized companies, mirrored the DAX's downward trend, closing down 2.8% at 27,500 points. This shows that the losses weren't confined to only the largest German companies.

-

SDAX: The SDAX, focusing on smaller companies, experienced even steeper losses, falling by 3.1% to close at 13,800 points. This suggests a more widespread negative sentiment affecting smaller and mid-cap stocks.

-

TecDAX: The technology index, TecDAX, performed slightly better than the broader market but still finished with a loss of 1.9%, closing at 3,200 points. Even the relatively resilient tech sector felt the impact of today's downturn.

Sectors Hit Hardest

Several sectors were particularly hard hit by today's Frankfurt Stock Market losses. The automotive and energy sectors bore the brunt of the negative sentiment:

-

Automotive: The automotive sector experienced a 3.5% drop, largely attributed to ongoing supply chain disruptions and the global semiconductor shortage. Volkswagen, one of Germany's largest companies, saw its shares fall by 4%, contributing significantly to the sector's decline.

-

Energy: The energy sector saw a significant 4% decline due to continuing volatility in global energy prices and concerns about the ongoing energy crisis in Europe. Rising inflation and uncertainty surrounding future energy supplies added to the pressure.

-

Technology: Although slightly better than other sectors, the tech sector wasn't immune, with a 1.9% decline linked to global concerns about rising interest rates and potential economic slowdowns.

Potential Causes of the Losses

Several factors likely contributed to the significant Frankfurt Stock Market losses observed today. A confluence of global and regional issues appears to be at play:

-

Global Inflation and Recession Fears: Rising inflation globally and increasing fears of a potential recession are weighing heavily on investor sentiment, leading to risk aversion and selling pressure across markets.

-

Geopolitical Instability: The ongoing war in Ukraine and the resulting energy crisis in Europe continue to create uncertainty and negatively impact market confidence.

-

Interest Rate Hikes: Central banks around the world, including the European Central Bank, are raising interest rates to combat inflation. This increase in borrowing costs can dampen economic growth and reduce corporate profitability.

-

Company-Specific News: While not a dominant factor today, negative earnings reports or unexpected regulatory changes for specific companies could have contributed to sector-specific declines.

Investor Sentiment and Market Reaction

Investor sentiment following the market close is decidedly negative. Trading volume was unusually high, indicating significant investor activity and a desire to reduce exposure to risk. This points to a flight to safety, with investors seeking refuge in less volatile assets. Financial analysts are expressing caution, with many predicting further market volatility in the short term. The general consensus is that these Frankfurt Stock Market losses could be a precursor to a period of increased uncertainty.

Conclusion

Today's trading session concluded with significant Frankfurt Stock Market losses, impacting major indices and several key sectors. The automotive, energy, and technology sectors were particularly hard hit, driven by a combination of global inflationary pressures, geopolitical uncertainty, rising interest rates, and lingering supply chain issues. The negative investor sentiment and high trading volume suggest further market volatility may be on the horizon. Stay informed on the latest developments affecting the Frankfurt Stock Market and subscribe to our newsletter today! Don't miss out on crucial updates regarding Frankfurt Stock Market losses. Follow us for the latest news!

Featured Posts

-

Serious M56 Motorway Collision Car Overturn And Casualty Treatment

May 24, 2025

Serious M56 Motorway Collision Car Overturn And Casualty Treatment

May 24, 2025 -

Porsche 911 Es A 80 Millio Forintos Extrafelszereltseg

May 24, 2025

Porsche 911 Es A 80 Millio Forintos Extrafelszereltseg

May 24, 2025 -

Philips Future Health Index 2025 Ai And The Urgent Need For Healthcare Leadership

May 24, 2025

Philips Future Health Index 2025 Ai And The Urgent Need For Healthcare Leadership

May 24, 2025 -

Kyle And Teddis Heated Confrontation Dog Walker Dispute

May 24, 2025

Kyle And Teddis Heated Confrontation Dog Walker Dispute

May 24, 2025 -

M56 Motorway Traffic Current Conditions And Delays Following Accident

May 24, 2025

M56 Motorway Traffic Current Conditions And Delays Following Accident

May 24, 2025

Latest Posts

-

Philips Future Health Index 2025 Ai And The Urgent Need For Healthcare Leadership

May 24, 2025

Philips Future Health Index 2025 Ai And The Urgent Need For Healthcare Leadership

May 24, 2025 -

Amsterdam Residents Take Legal Action Against City Over Tik Tok Fueled Crowds At Popular Snack Bar

May 24, 2025

Amsterdam Residents Take Legal Action Against City Over Tik Tok Fueled Crowds At Popular Snack Bar

May 24, 2025 -

Initial Shock Amsterdam Stock Market Falls 7 Amidst Heightened Trade War Concerns

May 24, 2025

Initial Shock Amsterdam Stock Market Falls 7 Amidst Heightened Trade War Concerns

May 24, 2025 -

Philips Future Health Index 2025 Ais Transformative Potential In Global Healthcare

May 24, 2025

Philips Future Health Index 2025 Ais Transformative Potential In Global Healthcare

May 24, 2025 -

Trade War Fallout Amsterdam Stock Market Experiences 7 Initial Drop

May 24, 2025

Trade War Fallout Amsterdam Stock Market Experiences 7 Initial Drop

May 24, 2025