Trade War Fallout: Amsterdam Stock Market Experiences 7% Initial Drop

Table of Contents

Immediate Impact on Key Sectors of the Amsterdam Stock Market

The initial 7% drop in the Amsterdam Stock Market reflects significant losses across several key sectors, primarily those heavily reliant on international trade. This immediate impact underscores the interconnectedness of the global economy and the vulnerability of export-oriented businesses.

Decline in Export-Oriented Industries

The trade war's tariffs and restrictions directly impact the profitability and stock prices of export-oriented industries. This initial 7% drop is a clear signal of this impact.

- Affected Sectors: Technology, agriculture (particularly flowers and horticultural products), and manufacturing are among the most affected sectors. The reliance on global supply chains makes these industries particularly susceptible to disruptions.

- Specific Examples: Companies heavily reliant on exports to the US or China, for example, are experiencing reduced demand and increased costs due to tariffs. This leads to decreased profit margins and subsequent declines in their stock prices, contributing to the overall AEX index decline.

- Consequences: Reduced export volumes, increased production costs, and decreased competitiveness in global markets directly translate into losses for these businesses, impacting their stock valuations and investor confidence in the Amsterdam Stock Market.

Investor Sentiment and Market Volatility

The uncertainty surrounding the trade war has triggered significant volatility in the Amsterdam Stock Market, characterized by panic selling and a flight to safety.

- Panic Selling: Investors, fearing further declines, are rushing to sell their holdings, exacerbating the downward pressure on stock prices.

- Decreased Investor Confidence: The trade war uncertainty creates a climate of fear and uncertainty, prompting investors to become more risk-averse.

- Flight to Safety: Investors are moving their funds into safer assets, such as government bonds, further decreasing demand for stocks in the Amsterdam Stock Market. This contributes to the overall market volatility and the sharp decline observed in the AEX index.

- Data: Analyzing trading volumes and price fluctuations during this period reveals the extent of the panic selling and the significant market volatility. The increased trading volume reflects the heightened activity driven by fear and uncertainty.

Impact on Foreign Investment in the Netherlands

The trade war's negative impact on the global economy negatively impacts foreign direct investment (FDI) in the Netherlands.

- Reduced FDI: Uncertainty surrounding future trade policies discourages foreign companies from investing in the Netherlands. This is because businesses are hesitant to commit significant capital in a volatile global environment.

- Consequences for Dutch Economic Growth: Reduced FDI translates into decreased capital investment, job creation, and overall economic growth in the Netherlands. The decrease in FDI further dampens the already affected Amsterdam Stock Market.

- Long-Term Effects: The long-term impact on economic growth and the attractiveness of the Netherlands as an investment destination could be substantial. The Amsterdam Stock Market is likely to reflect this decreased economic growth in the long term.

Long-Term Consequences for the Amsterdam Stock Market and the Dutch Economy

The 7% initial drop signals a potential economic slowdown in the Netherlands, with significant implications for the Amsterdam Stock Market and the broader Dutch economy.

Potential for Economic Slowdown

The ripple effect of the stock market decline extends beyond the financial sector.

- GDP Growth: The decreased investor confidence and reduced business activity can lead to slower GDP growth, directly impacting the nation's economic health and the overall performance of the Amsterdam Stock Market.

- Employment Rates: Companies facing reduced demand and profitability may resort to layoffs, increasing unemployment rates. This further weakens consumer confidence and economic growth.

- Consumer Spending: Decreased consumer confidence and potential job losses can impact consumer spending, creating a vicious cycle of economic slowdown. Government policies to counteract this are crucial to monitor.

Adaptation Strategies for Dutch Businesses

Dutch companies need to implement robust adaptation strategies to navigate the evolving trade environment.

- Market Diversification: Reducing reliance on specific export markets by diversifying into new regions and customer bases can mitigate the risks associated with trade disputes.

- Cost Reduction: Implementing efficient cost-cutting measures, streamlining operations, and improving productivity are essential to maintaining profitability in a challenging environment.

- Innovation and Technology: Investing in research and development to enhance competitiveness and explore new opportunities can create resilience in the face of trade uncertainties. This can positively affect the Amsterdam Stock Market.

- Government Support: Government policies aimed at supporting businesses, such as tax incentives and investment subsidies, can be crucial to promoting adaptation and resilience.

Geopolitical Implications and Future Outlook

The trade war's implications extend beyond mere economics, impacting international relations and geopolitical stability.

- Further Escalation: The potential for further escalation of trade disputes poses a significant threat to global economic stability and the Amsterdam Stock Market.

- International Relations: The trade war is straining relationships between countries, creating uncertainty and instability in the international system. This can have a lasting impact on the performance of the Amsterdam Stock Market.

- Future Outlook: The long-term trajectory of the Amsterdam Stock Market depends heavily on the resolution of the trade war and the broader global economic environment. Various scenarios need to be considered to predict a realistic outlook.

Conclusion

The 7% initial drop in the Amsterdam Stock Market following the escalating trade war underscores the significant impact of global trade disputes on even robust economies. The immediate consequences include decreased investor confidence, market volatility, and losses in export-oriented sectors. The long-term implications could encompass an economic slowdown, necessitating adaptation strategies from Dutch businesses. Understanding the fallout of this trade war on the Amsterdam Stock Market is crucial for investors and businesses alike. Stay informed on the evolving situation and develop effective strategies to navigate this turbulent period. Monitor the Amsterdam Stock Market closely for further updates and potential recovery. Analyzing the performance of the AEX index and related key economic indicators will provide valuable insights into the future trajectory of the Amsterdam Stock Market and the Dutch economy.

Featured Posts

-

Rehabilitation Of Dreyfus French Parliament Debates 130th Anniversary

May 24, 2025

Rehabilitation Of Dreyfus French Parliament Debates 130th Anniversary

May 24, 2025 -

Sejarah Porsche 356 Evolusi Dari Pabrik Zuffenhausen Jerman

May 24, 2025

Sejarah Porsche 356 Evolusi Dari Pabrik Zuffenhausen Jerman

May 24, 2025 -

Seattles Parks Providing Refuge During The Early Days Of The Pandemic

May 24, 2025

Seattles Parks Providing Refuge During The Early Days Of The Pandemic

May 24, 2025 -

Mystery Us Band Teases Glastonbury Appearance Fans React To Unsanctioned Reveal

May 24, 2025

Mystery Us Band Teases Glastonbury Appearance Fans React To Unsanctioned Reveal

May 24, 2025 -

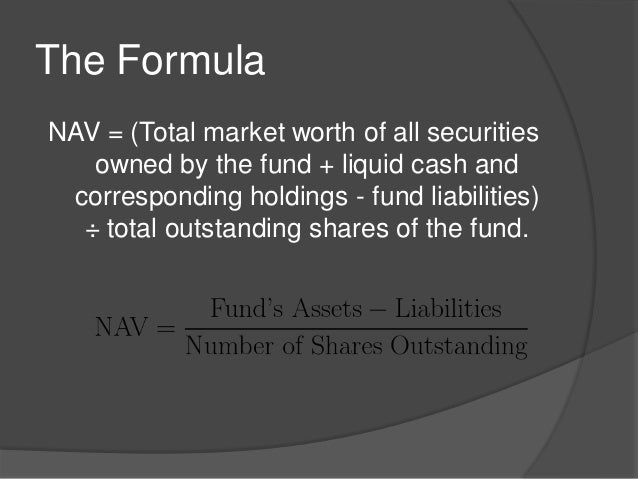

How To Interpret The Net Asset Value Nav For The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

How To Interpret The Net Asset Value Nav For The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

Latest Posts

-

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025 -

Understanding Frank Sinatras Four Marriages Wives Love And Legacy

May 24, 2025

Understanding Frank Sinatras Four Marriages Wives Love And Legacy

May 24, 2025 -

The Four Women Who Married Frank Sinatra Their Stories And Impact

May 24, 2025

The Four Women Who Married Frank Sinatra Their Stories And Impact

May 24, 2025 -

Mia Farrow On Trump Deportations Of Venezuelan Gang Members Warrant Arrest

May 24, 2025

Mia Farrow On Trump Deportations Of Venezuelan Gang Members Warrant Arrest

May 24, 2025 -

Frank Sinatra And His Four Wives A Retrospective On His Marriages

May 24, 2025

Frank Sinatra And His Four Wives A Retrospective On His Marriages

May 24, 2025