House Votes On Revised Trump Tax Bill: What You Need To Know

Table of Contents

Key Changes in the Revised Trump Tax Bill

The revised Trump Tax Bill incorporates several key changes compared to its initial iteration. While the exact details may vary depending on the final version passed, some significant revisions are expected. These alterations aim to improve certain aspects of the original bill and address criticisms concerning its fairness and economic impact. Here's a summary of some potential modifications:

-

Changes to Individual Income Tax Rates: The revised bill might adjust individual income tax rates, potentially lowering them for some brackets while leaving others unchanged or slightly increasing them. The specifics depend on the final legislative text.

-

Modifications to Deductions: Significant changes to deductions are anticipated. This could involve altering the standard deduction, modifying eligibility criteria for itemized deductions (such as those for state and local taxes), or potentially eliminating certain deductions altogether. Further clarification on the specifics is necessary.

-

Alterations to Corporate Tax Rates: The corporate tax rate, a central component of the original Trump Tax Bill, might undergo revisions. Possible changes could involve either a slight increase or decrease, depending on the ongoing negotiations and political considerations.

-

Impact on Specific Tax Credits: The revised bill could also impact various tax credits. Changes to the child tax credit and earned income tax credit are possibilities, affecting low-to-moderate-income families. The extent of these alterations is still unclear.

-

Changes to Tax Brackets: The tax brackets themselves might see adjustments, altering the thresholds at which different tax rates apply. These shifts could influence the tax liability for a broad range of taxpayers.

For the most up-to-date and accurate information, please refer to official government sources such as the IRS website and the Congressional website . Reputable news outlets such as the New York Times, Wall Street Journal, and Reuters also provide ongoing coverage of the bill's development.

Potential Impact on Different Income Groups

The revised Trump Tax Bill's impact will likely vary significantly across different income groups. While precise estimations require detailed analysis of the final legislation, we can explore potential scenarios:

-

Low-Income Earners: Changes to the earned income tax credit and standard deduction could significantly affect low-income taxpayers. A potential decrease in the EITC could disproportionately impact this group. For example, a family earning $25,000 annually might see a small increase or decrease depending on the specific changes.

-

Middle-Income Earners: The middle class may experience a mixed impact, with some benefiting from potential reductions in certain tax rates or increased standard deductions, while others might face increased tax burdens due to changes in deductions or credits. A family earning $50,000 might see a modest tax reduction or a minimal increase, depending on the specifics of the revised bill.

-

High-Income Earners: High-income earners might see varying impacts. Some adjustments might benefit them while others could lead to an increase in their tax liabilities, particularly if certain deductions are limited or eliminated. A high-income individual earning $200,000 might see a tax decrease or a slight increase depending on how the revised bill modifies high-income tax brackets and deductions.

It's crucial to remember these are potential scenarios. The actual impact will depend on the final version of the bill and the individual circumstances of each taxpayer.

Political Ramifications and Future of the Trump Tax Bill

The political landscape surrounding the Trump Tax Bill remains highly dynamic. Passage in the Senate faces significant hurdles, with potential opposition from Democrats and even some Republicans. Further revisions or amendments are entirely possible before the bill reaches its final form.

-

Senate Passage: The likelihood of Senate passage remains uncertain, depending on the level of bipartisan support or potential compromises required.

-

Further Revisions: Expect further revisions and amendments as the bill progresses through the legislative process. Lobbying efforts and public pressure could influence these changes.

-

Expert Opinions: Experts offer diverse opinions on the bill's potential long-term economic consequences, ranging from optimistic projections about economic growth to concerns about increased national debt and inequality.

-

Long-Term Economic Consequences: The long-term economic effects are a subject of intense debate, with differing perspectives on the potential for job creation, investment, and overall economic growth versus concerns about increased inequality and fiscal strain.

Where to Find More Information about the Revised Trump Tax Bill

Staying informed about this evolving legislation is crucial. Here are some resources to consult:

-

Official Government Websites: The IRS website () and the Congressional website () offer official information and documents related to the bill.

-

Reputable News Sources: Reputable news organizations like the New York Times, Wall Street Journal, and Reuters provide comprehensive coverage and analysis.

-

Tax Preparation Software and Financial Advisors: Tax preparation software and financial advisors can help you understand how the changes might affect your personal tax situation.

Conclusion

The revised Trump Tax Bill introduces several significant changes to individual and corporate tax rates, deductions, and credits. The potential impact on various income groups remains uncertain, with differing effects anticipated for low, middle, and high-income earners. The political future of the bill is also uncertain, with potential for further revisions and amendments before final passage. Understanding these changes is critical for informed financial planning.

Call to Action: Stay informed about the evolving situation surrounding the Trump Tax Bill. Consult with a tax professional to understand how these changes might personally affect your tax liability. Regularly check reputable news sources and official government websites for the latest updates on the Trump Tax Bill and its potential impact on your taxes. Don't delay in seeking professional guidance to effectively navigate the complexities of this important legislation.

Featured Posts

-

New Southwest Airlines Policy Limitations On Portable Chargers In Carry On Luggage

May 23, 2025

New Southwest Airlines Policy Limitations On Portable Chargers In Carry On Luggage

May 23, 2025 -

Honeywell International Inc Hon And Johnson Matthey Catalyst For A Merger

May 23, 2025

Honeywell International Inc Hon And Johnson Matthey Catalyst For A Merger

May 23, 2025 -

The Cricket Bat Maker Skill And Heritage Combined

May 23, 2025

The Cricket Bat Maker Skill And Heritage Combined

May 23, 2025 -

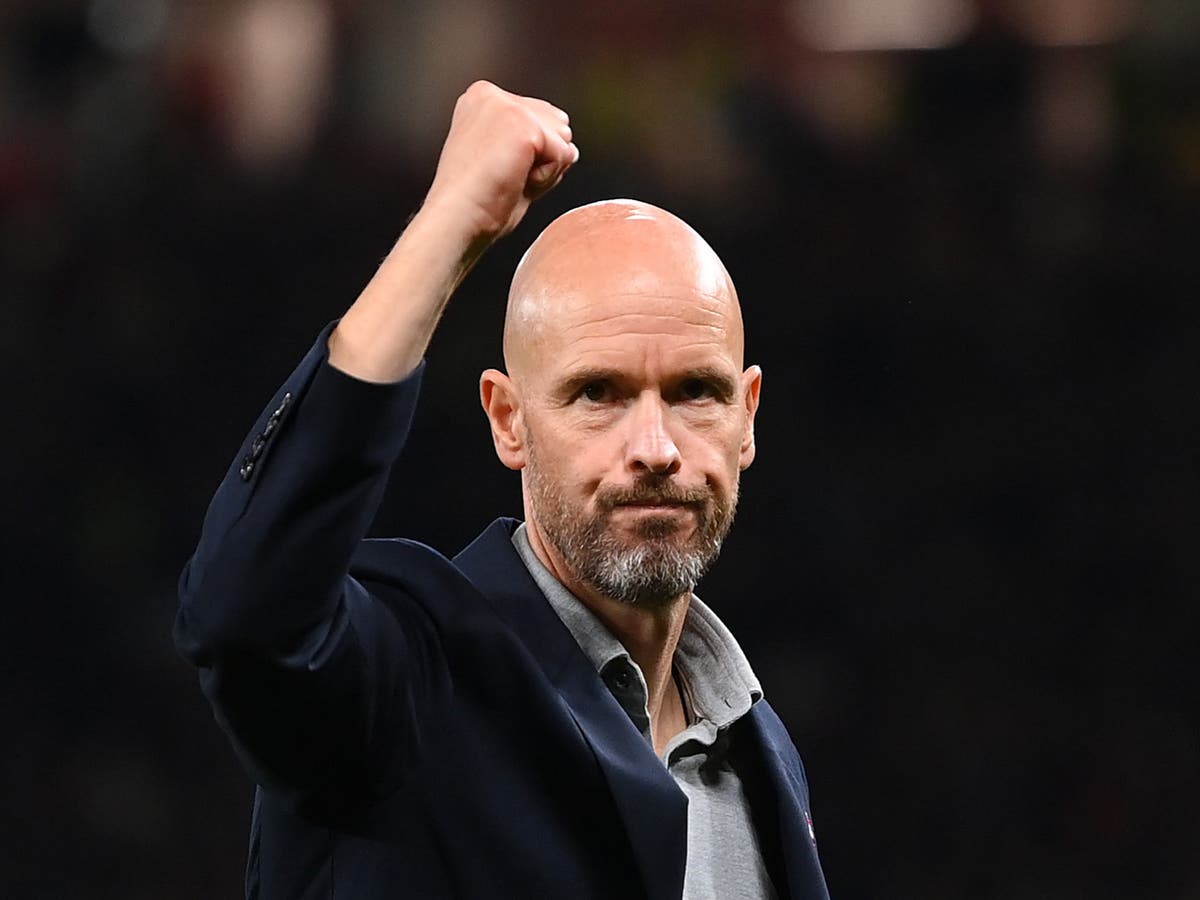

Erik Ten Hag Leverkusens Interest And The Implications For Manchester United

May 23, 2025

Erik Ten Hag Leverkusens Interest And The Implications For Manchester United

May 23, 2025 -

Relocating From Dubai To Sharjah A Mothers Experience With Rental Costs

May 23, 2025

Relocating From Dubai To Sharjah A Mothers Experience With Rental Costs

May 23, 2025

Latest Posts

-

Dc Legends Of Tomorrow A Comprehensive Guide

May 23, 2025

Dc Legends Of Tomorrow A Comprehensive Guide

May 23, 2025 -

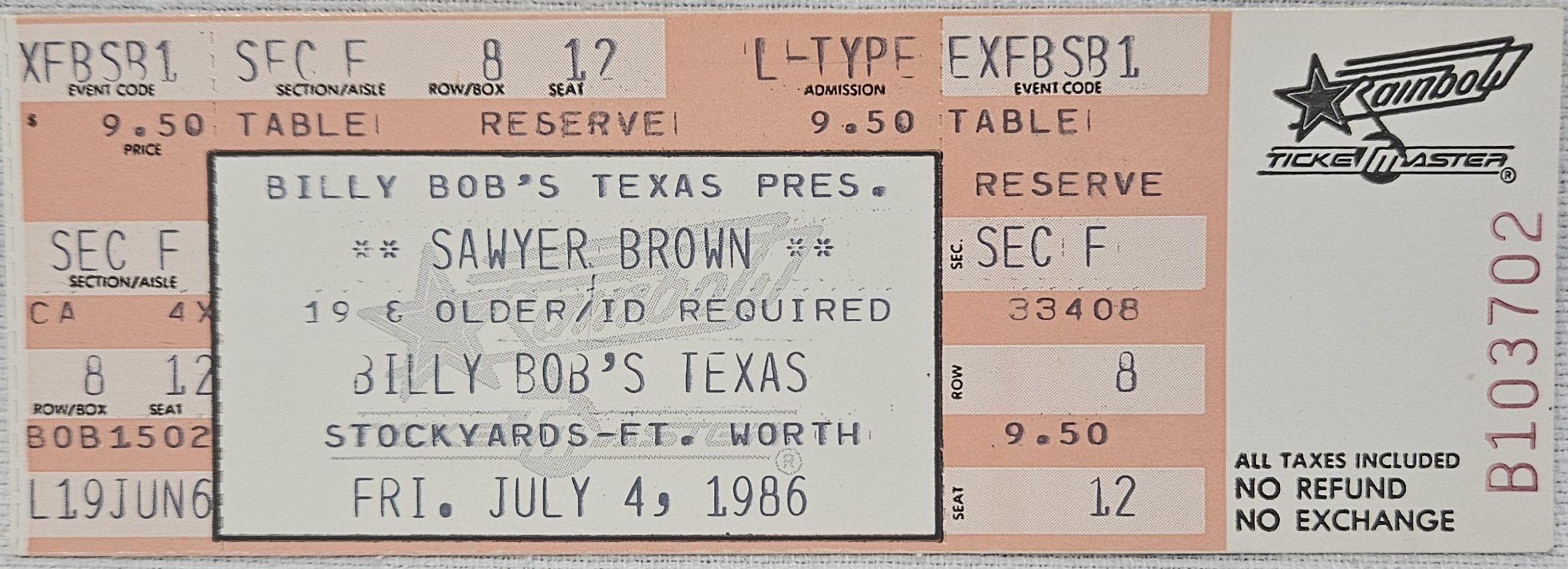

Unannounced Joe Jonas Concert Thrills Fort Worth Stockyards Crowd

May 23, 2025

Unannounced Joe Jonas Concert Thrills Fort Worth Stockyards Crowd

May 23, 2025 -

Score Big With These 2025 Memorial Day Sales And Deals

May 23, 2025

Score Big With These 2025 Memorial Day Sales And Deals

May 23, 2025 -

Fort Worth Stockyards Joe Jonas Delivers Unannounced Concert

May 23, 2025

Fort Worth Stockyards Joe Jonas Delivers Unannounced Concert

May 23, 2025 -

Memorial Day 2025 The Ultimate Guide To The Best Sales And Deals

May 23, 2025

Memorial Day 2025 The Ultimate Guide To The Best Sales And Deals

May 23, 2025