How Climate Risk Affects Your Creditworthiness When Buying A Home

Table of Contents

A recent study showed that climate-related disasters cost the US economy billions of dollars annually. This isn't just an environmental issue; it's a financial one deeply impacting individual economic stability. Climate risk affects creditworthiness, and understanding this connection is crucial for anyone considering a home purchase. This article explores the various ways climate change is reshaping the mortgage landscape and how it can influence your ability to secure a loan. We'll delve into the increasing impact of climate risk on your creditworthiness during the home-buying process.

H2: Increased Insurance Premiums & Difficulty Obtaining Coverage

H3: Higher Risk = Higher Premiums

Properties located in high-risk climate zones – areas prone to flooding, wildfires, hurricanes, or extreme weather events – face dramatically increased homeowners insurance premiums. Insurers are increasingly factoring climate change projections into their risk assessments, leading to significant price hikes for those in vulnerable locations. This is because climate risk is now being directly linked to increased financial liability for insurance companies.

-

Insurer Risk Assessment: Insurers analyze numerous factors, including location, property type (e.g., proximity to waterways, building materials), and climate models predicting future risks to determine premiums. Properties in floodplains, for example, will automatically attract higher flood insurance premiums.

-

Coverage Denial: In some high-risk areas, insurers may deny coverage altogether, leaving homeowners uninsured and facing significant financial vulnerability. This lack of insurance directly impacts mortgage approval.

-

DTI Impact: High insurance premiums significantly inflate a borrower's Debt-to-Income ratio (DTI), a key metric lenders use to assess loan risk. A higher DTI reduces the likelihood of mortgage approval, showcasing how climate risk insurance is impacting creditworthiness.

H2: Property Value Depreciation Due to Climate Change

H3: The Impact of Climate-Related Damage

Climate-related events like flooding, wildfires, and hurricanes can cause significant property damage, leading to substantial depreciation in value. This directly impacts your ability to secure a mortgage or refinance. The collateral for your loan – your home – is now worth less, making you a riskier borrower in the eyes of lenders.

-

Lender Collateral Assessment: Lenders carefully evaluate property value as collateral. A decrease in value due to climate-related damage might lead to loan denial or stricter lending terms.

-

Mortgage Difficulty: Securing a mortgage or refinancing becomes exponentially more difficult if your property value has decreased significantly due to climate-related damage, a clear demonstration of how climate-related property damage affects credit.

-

Long-Term Impact: The long-term effects of climate change on property values in certain regions are predicted to be severe, with some areas becoming increasingly uninsurable and losing significant value over time. This significantly affects your future financial prospects, especially concerning property value depreciation and credit.

H2: Increased Vulnerability to Natural Disasters and Loan Defaults

H3: The Financial Strain of Disaster Recovery

Climate-related disasters can cause significant financial hardship, potentially leading to mortgage defaults. The costs associated with recovery – repairs, temporary housing, replacing belongings – can quickly overwhelm household budgets.

-

Credit Score Impact: The financial strain of disaster recovery often results in missed mortgage payments, negatively impacting credit scores. This directly affects your future creditworthiness.

-

Displacement and Defaults: Displacement due to a disaster can also contribute to mortgage defaults as individuals struggle to maintain their financial obligations while dealing with the immediate aftermath of the event. This explains the link between natural disaster and credit score.

-

Future Creditworthiness: A mortgage default due to a climate-related disaster will severely damage your credit history, making it challenging to secure loans or other forms of credit in the future, underscoring the link between mortgage default and climate change.

H2: Accessing Resources and Mitigation Strategies

H3: Proactive Steps to Mitigate Risk

Prospective homebuyers can take proactive steps to mitigate climate risks and protect their creditworthiness.

-

Climate Risk Assessment: Utilize online tools and resources, like FEMA flood maps, to assess the climate risks associated with specific locations before making an offer. This allows for informed decision-making.

-

Property Resilience: Invest in climate-resilient improvements to your property, such as flood mitigation systems or wildfire-resistant landscaping, to reduce your risk and potential financial losses.

-

Transparency with Lenders: Be transparent with your lender about potential climate risks associated with your chosen property. Open communication can foster understanding and potentially influence loan terms. This showcases the importance of climate risk assessment in home buying.

Conclusion:

Climate change significantly impacts insurance costs, property values, and the likelihood of loan defaults, ultimately affecting your creditworthiness when buying a home. Understanding how climate risk affects creditworthiness is crucial for responsible home buying. Increased insurance premiums, property value depreciation due to climate-related damage, and the potential for loan defaults caused by natural disasters all contribute to a heightened level of financial risk. By researching climate risks thoroughly, implementing climate resilience strategies, and maintaining open communication with lenders, you can mitigate potential financial setbacks. Start your climate risk assessment today to protect your financial future!

Featured Posts

-

Semeynoe Popolnenie Mikhael Shumakher Stal Dedushkoy

May 20, 2025

Semeynoe Popolnenie Mikhael Shumakher Stal Dedushkoy

May 20, 2025 -

Todays Nyt Mini Crossword March 18 Solutions

May 20, 2025

Todays Nyt Mini Crossword March 18 Solutions

May 20, 2025 -

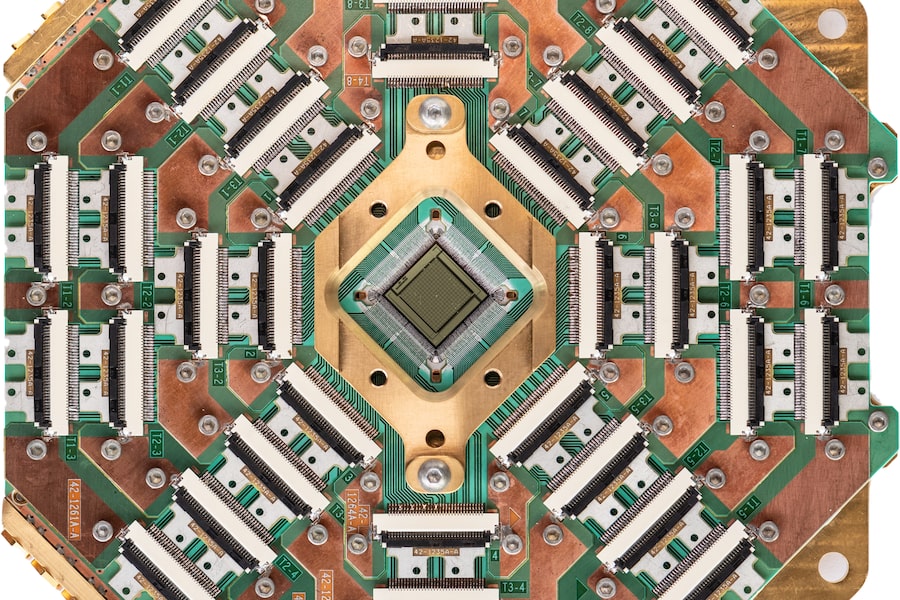

The D Wave Quantum Qbts Stock Market Plunge On Monday Causes And Consequences

May 20, 2025

The D Wave Quantum Qbts Stock Market Plunge On Monday Causes And Consequences

May 20, 2025 -

France Eurovision 2024 Devoilement De La Chanson De Louane

May 20, 2025

France Eurovision 2024 Devoilement De La Chanson De Louane

May 20, 2025 -

Urgent Hmrc Correspondence And What You Need To Do

May 20, 2025

Urgent Hmrc Correspondence And What You Need To Do

May 20, 2025

Latest Posts

-

Understanding The D Wave Quantum Qbts Stock Price Surge

May 20, 2025

Understanding The D Wave Quantum Qbts Stock Price Surge

May 20, 2025 -

D Wave Quantum Inc Qbts Stock Is It A Smart Investment In Quantum Computing

May 20, 2025

D Wave Quantum Inc Qbts Stock Is It A Smart Investment In Quantum Computing

May 20, 2025 -

D Wave Quantum Qbts Stock Jump Analyzing Todays Increase

May 20, 2025

D Wave Quantum Qbts Stock Jump Analyzing Todays Increase

May 20, 2025 -

Investing In Quantum Computing Should You Buy D Wave Quantum Qbts Stock

May 20, 2025

Investing In Quantum Computing Should You Buy D Wave Quantum Qbts Stock

May 20, 2025 -

Big Bear Ai Bbai Stock A Buy Rating Despite Market Volatility

May 20, 2025

Big Bear Ai Bbai Stock A Buy Rating Despite Market Volatility

May 20, 2025