How US Policy Changes Impact Elon Musk's Billions: The Tesla Connection

Table of Contents

Tax Credits and Incentives

The Impact of the Clean Vehicle Tax Credit

The Clean Vehicle Tax Credit has been a cornerstone of US policy aimed at promoting electric vehicle adoption. Its history is marked by several changes in eligibility requirements, credit amounts, and phase-out timelines, all of which directly affect Tesla's sales and profitability. Initially offering generous incentives, the credit has faced modifications, including limitations based on manufacturer sales volume and changes in the definition of a "qualified" EV.

For example, adjustments to the credit amount or eligibility criteria have demonstrably impacted Tesla's sales figures. Periods of higher tax credits often corresponded with increased consumer demand and boosted Tesla's sales, while reductions or stricter eligibility requirements have had the opposite effect.

- Impact on Tesla's affordability: Tax credits directly reduce the purchase price, making Tesla vehicles more accessible to a broader range of consumers.

- Effect on consumer demand: Higher credits stimulate demand, leading to increased sales and production.

- Influence on Tesla's production targets: Tesla's production plans are often influenced by anticipated demand, heavily impacted by the current tax credit landscape.

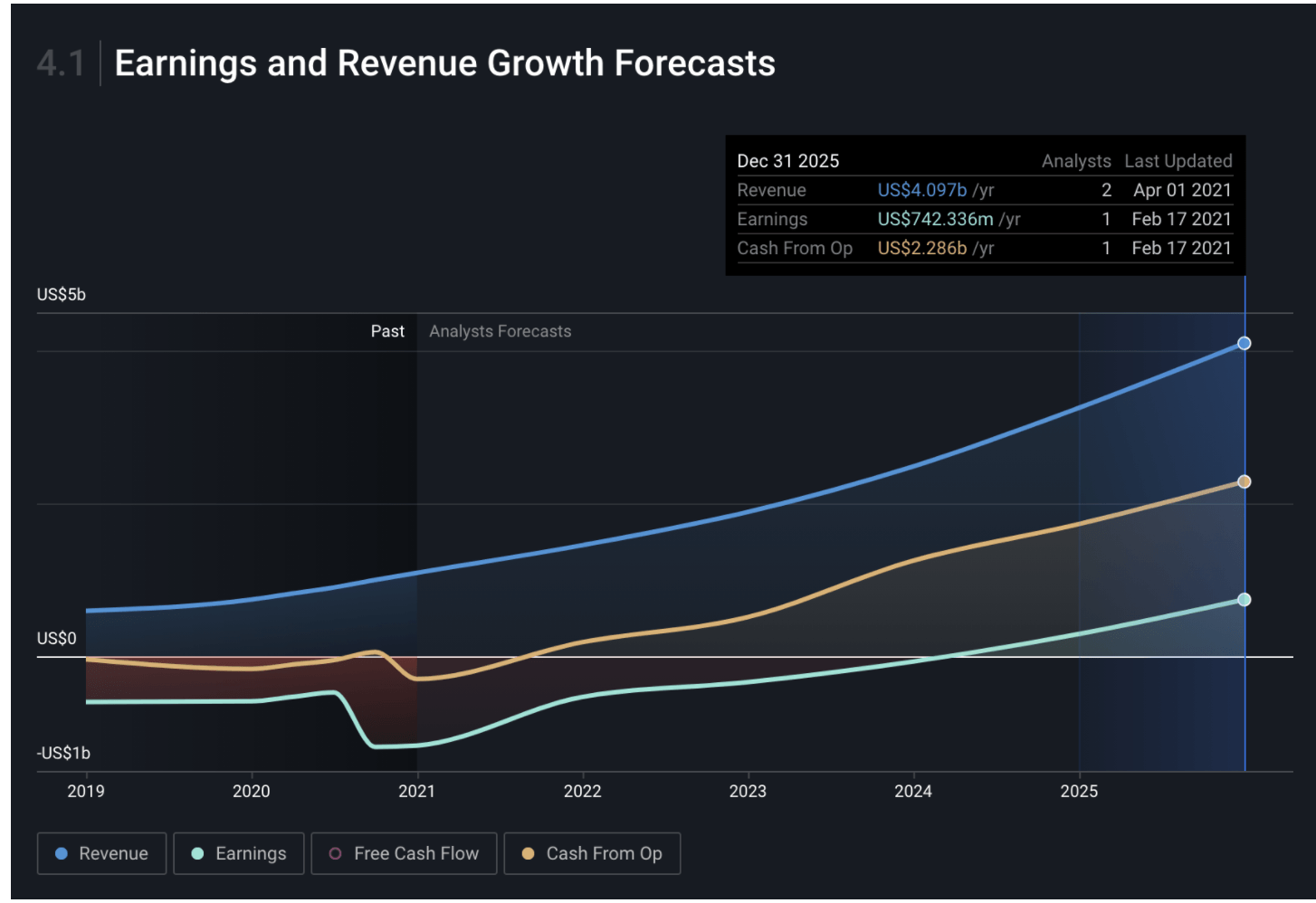

- Changes in Tesla's stock price correlated with tax credit adjustments: Announcements regarding changes to the tax credit often cause immediate fluctuations in Tesla's stock price, reflecting investor sentiment.

Environmental Regulations and Emission Standards

Navigating the Complexities of EPA Regulations

Meeting stringent emission standards is paramount for Tesla's continued success. The Environmental Protection Agency (EPA) regulations significantly influence Tesla's production costs and innovation strategies. Changes in fuel efficiency standards and emission regulations directly impact the design and manufacturing processes of Tesla vehicles.

Potential rollbacks or stricter enforcement of these regulations could profoundly affect Tesla's profitability and market share. Stricter standards necessitate increased investment in research and development (R&D) to meet future compliance requirements.

- Cost of compliance with stricter regulations: Meeting tighter emissions standards requires investment in new technologies and manufacturing processes, increasing production costs.

- Investment in R&D to meet future standards: Tesla needs to continually invest in R&D to ensure its vehicles meet evolving environmental regulations.

- Potential for competitive advantage or disadvantage: Companies that can efficiently and cost-effectively meet stringent standards gain a competitive advantage.

- Lobbying efforts by Tesla and related industry groups: Tesla, along with other automakers, actively engages in lobbying efforts to influence environmental regulations.

Infrastructure Investments and Charging Network Development

Government Funding and its Role in Tesla's Expansion

Government investments in charging infrastructure are crucial for Tesla's expansion and the wider adoption of electric vehicles. Initiatives like the Biden administration's plans for nationwide charging infrastructure significantly impact Tesla's market reach and customer adoption. The availability and accessibility of charging stations are critical factors influencing consumer confidence in EVs.

Government subsidies for charging network development can further enhance Tesla's competitiveness, but also create opportunities for competitors. This necessitates strategic planning for Tesla’s Supercharger network to maintain its market leadership.

- Government grants and incentives for charging station installation: Government funding accelerates the deployment of charging stations, benefiting all EV manufacturers, including Tesla.

- Competition from other EV manufacturers in the charging infrastructure space: Tesla faces competition from other automakers investing in their own charging networks.

- Long-term implications for the scalability of electric vehicle adoption: Widespread charging infrastructure is essential for mass EV adoption.

- Impact on Tesla's Supercharger network expansion: Government support can either complement or compete with Tesla's Supercharger network strategy.

Trade Policies and Global Market Access

Tariffs and Trade Wars Impacting Tesla's International Growth

Changes in international trade agreements and tariffs significantly influence Tesla's export capabilities and global competitiveness. Trade disputes and tariffs on imported vehicles directly impact Tesla's pricing strategies and profitability in different markets. Furthermore, trade restrictions can complicate Tesla's supply chain and increase production costs.

Tesla's global manufacturing strategy must account for these geopolitical risks and trade policy uncertainties. Adaptability and strategic location choices become critical for navigating these challenges.

- Import tariffs on Tesla vehicles in specific countries: Tariffs increase the price of Tesla vehicles in certain markets, impacting sales.

- Impact on Tesla's pricing strategy in different markets: Tesla must adjust pricing to remain competitive despite tariffs and other trade barriers.

- Challenges in sourcing raw materials due to trade restrictions: Trade disputes can disrupt the supply chain for critical components.

- Geopolitical risks affecting Tesla's international operations: Uncertainties in international relations can affect Tesla's ability to operate seamlessly across borders.

Conclusion

US policy changes have a profound and multifaceted impact on Elon Musk's billions, largely through their influence on Tesla. From tax credits and environmental regulations to infrastructure investments and trade policies, government actions shape Tesla's profitability, market share, and global expansion. Understanding this complex interplay is crucial for investors, policymakers, and anyone interested in the future of electric vehicles. Stay informed about upcoming US policy changes and their impact on Elon Musk and the electric vehicle industry to stay ahead of the curve.

Featured Posts

-

Nyt Strands Game 402 Hints And Solutions For April 9th

May 09, 2025

Nyt Strands Game 402 Hints And Solutions For April 9th

May 09, 2025 -

Investment Opportunity Palantir Stock Falls 30

May 09, 2025

Investment Opportunity Palantir Stock Falls 30

May 09, 2025 -

Situatsiya Vokrug Zelenskogo 9 Maya Bez Gostey

May 09, 2025

Situatsiya Vokrug Zelenskogo 9 Maya Bez Gostey

May 09, 2025 -

West Hams 25m Financial Gap How The Hammers Can Plug The Hole

May 09, 2025

West Hams 25m Financial Gap How The Hammers Can Plug The Hole

May 09, 2025 -

High Stock Valuations And Investor Concerns A Bof A Analysis

May 09, 2025

High Stock Valuations And Investor Concerns A Bof A Analysis

May 09, 2025