IMF To Review $1.3 Billion Pakistan Package: Current Economic Climate And Geopolitical Factors

Table of Contents

Pakistan's Current Economic Crisis: A Deep Dive

Pakistan's economy is grappling with a multifaceted crisis, characterized by soaring inflation, a rapidly depreciating currency, and a crippling energy crisis. These interwoven challenges threaten the country's financial stability and the well-being of its citizens.

Inflation and Currency Depreciation

Inflation has skyrocketed, eroding purchasing power and pushing millions into poverty. The Pakistani Rupee (PKR) has experienced significant devaluation against major currencies, further exacerbating the economic woes.

- Inflation Rate: Annual inflation has reached double digits, impacting the cost of essential goods and services.

- Currency Exchange Fluctuations: The PKR has significantly weakened against the US dollar, making imports more expensive and fueling inflation.

- Impact on Population: The rising cost of living has severely impacted the most vulnerable segments of the population, leading to widespread hardship.

- Economic Indicators: Data from the State Bank of Pakistan and other sources illustrate the severity of the situation, with declining foreign exchange reserves and negative growth projections.

Energy Crisis and Fiscal Deficit

Pakistan faces severe energy shortages, impacting industries and daily life. This crisis, coupled with inefficient revenue collection, has contributed to a widening fiscal deficit.

- Causes of Energy Crisis: Limited domestic energy production, coupled with reliance on costly fuel imports, has created a chronic energy shortfall. Inefficient power generation and transmission further exacerbate the problem.

- Consequences: Power outages disrupt businesses, limit industrial output, and affect essential services. This adds to inflationary pressures.

- Impact on Government Finances: The energy crisis necessitates substantial government subsidies, further straining already stretched public finances and increasing the fiscal deficit.

- Borrowing: The widening fiscal deficit forces Pakistan to rely heavily on domestic and external borrowing, increasing its debt burden.

Debt Sustainability and External Financing

Pakistan's burgeoning debt burden poses a significant challenge to its economic stability. The country needs substantial external financing to meet its debt obligations and fund essential imports.

- Sources of Debt: Pakistan's debt comprises multilateral loans (e.g., from the IMF, World Bank), bilateral loans from various countries, and commercial debt.

- Debt-to-GDP Ratio: The country's debt-to-GDP ratio is alarmingly high, indicating a high level of vulnerability to economic shocks.

- Repayment Schedules: Meeting the stringent repayment schedules for its existing debt obligations adds to the pressure on the country's finances.

- Role of International Financial Institutions: The IMF, along with other international financial institutions, plays a crucial role in providing much-needed external financing and supporting crucial reforms.

Geopolitical Factors Influencing the IMF Review

The IMF's decision to release the $1.3 billion package is not solely based on Pakistan's domestic economic situation. Geopolitical factors significantly influence the review process.

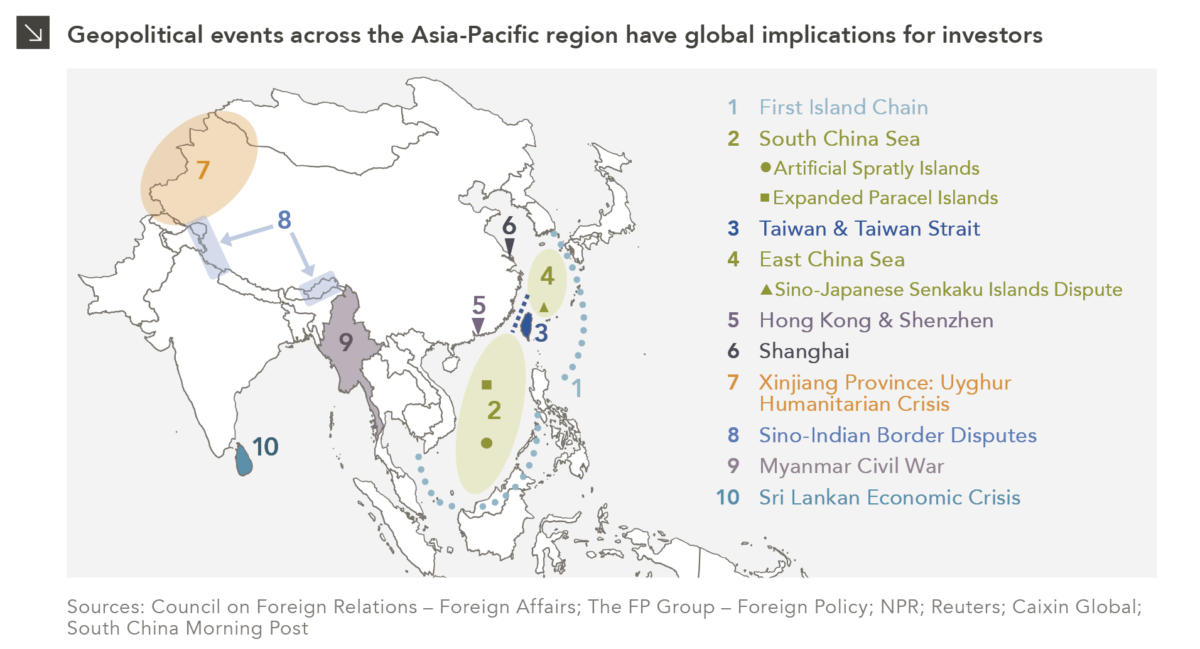

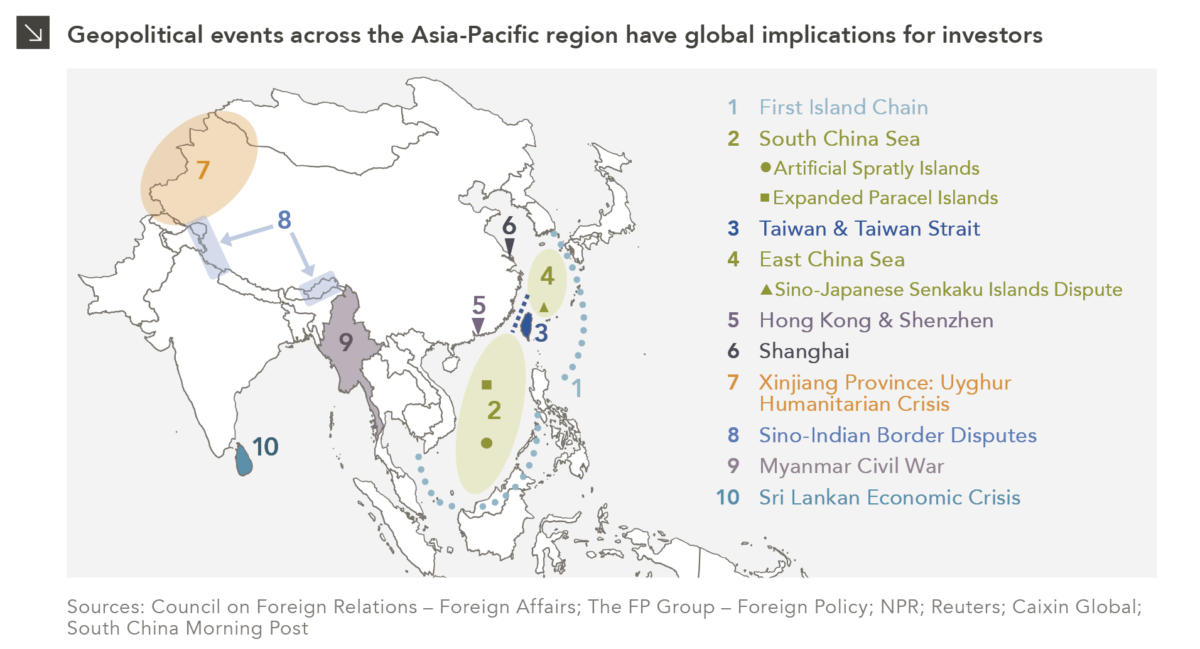

Regional Instability and Security Concerns

Regional conflicts and security concerns directly impact investor confidence and economic stability, making the IMF cautious in its approach.

- Impact on Investor Confidence: Geopolitical instability discourages foreign investment, reducing the flow of much-needed capital into the country.

- Economic Stability: Security concerns can lead to disruptions in trade, tourism, and other economic activities.

- Regional Conflicts: Tensions in the region can further complicate Pakistan's efforts to secure financial assistance.

International Relations and Diplomatic Ties

Pakistan's relationships with other countries, particularly its major trading partners and creditors, play a vital role in the IMF's assessment.

- Influence on IMF Loan Release: Positive diplomatic relations can positively influence the disbursement of IMF funds, while strained relationships can create hurdles.

- Diplomatic Relations: Strong alliances and diplomatic efforts can secure support from other countries, further facilitating the IMF's decision.

- Financial Aid: International support and collaboration are crucial for the success of any bailout package.

Global Economic Conditions and Uncertainty

Global economic factors, such as inflation, recession risks, and commodity price volatility, significantly impact the IMF's decision-making.

- Global Inflation: High global inflation increases the cost of imports and exacerbates Pakistan's inflationary pressures.

- Recession Risks: Global recessionary trends can further reduce demand for Pakistani exports and limit the availability of international financial support.

- Commodity Price Volatility: Fluctuations in commodity prices, especially energy prices, can severely impact Pakistan's economy.

The IMF's Conditions and Expectations

The IMF typically attaches strict conditions to its loan packages, demanding specific structural reforms and policy adjustments.

Structural Reforms and Policy Adjustments

The IMF will likely demand significant structural reforms and policy adjustments as conditions for releasing the funds.

- Fiscal Consolidation: This involves measures to reduce the fiscal deficit, such as cutting government spending and improving revenue collection.

- Monetary Policy Adjustments: This might include measures to control inflation, such as increasing interest rates.

- Structural Reforms: These reforms aim to enhance the efficiency of the economy, improve governance, and boost investor confidence. This could involve privatization, deregulation, and improvements to the business environment.

- Impact on Economy and Society: The implementation of these conditions will have significant implications for the Pakistani economy and society, impacting various sectors and potentially leading to short-term pain for long-term gain.

Transparency and Accountability

The IMF will also emphasize transparency and accountability in Pakistan's financial management to ensure the effective use of the funds.

- Transparency in Financial Matters: Openness and transparency in financial transactions are essential for gaining and maintaining international confidence.

- Accountability Measures: Strong accountability mechanisms will help ensure responsible use of funds and prevent corruption.

- Institutional Reforms: Strengthening institutions and improving governance structures are vital for sustainable economic development.

Conclusion: The Future of the IMF Package and Pakistan's Economic Outlook

Pakistan's economic future hinges on the successful completion of the IMF review and the implementation of the necessary reforms. The $1.3 billion package is crucial for mitigating the immediate crisis, but it's just a short-term solution. Geopolitical factors, while complicating the situation, also highlight the importance of international cooperation. The outcome of the IMF review will determine whether Pakistan can navigate this economic turmoil and embark on a path towards sustainable growth. The conditions imposed by the IMF, including structural reforms and improved transparency, will be critical for long-term stability. Stay informed about the IMF to Review $1.3 Billion Pakistan Package and its implications by following reputable news sources such as [link to a relevant news source, e.g., the IMF website or a major news outlet].

Featured Posts

-

Palantir Stock Forecast Revised A Deep Dive Into The Market Rally

May 09, 2025

Palantir Stock Forecast Revised A Deep Dive Into The Market Rally

May 09, 2025 -

Credit Suisse Whistleblower Case 150 Million Settlement Imminent

May 09, 2025

Credit Suisse Whistleblower Case 150 Million Settlement Imminent

May 09, 2025 -

Bondi Announces Record Breaking Fentanyl Seizure In Us History

May 09, 2025

Bondi Announces Record Breaking Fentanyl Seizure In Us History

May 09, 2025 -

Almdkhnwn Fy Ealm Krt Alqdm Tathyr Altdkhyn Ela Aladae

May 09, 2025

Almdkhnwn Fy Ealm Krt Alqdm Tathyr Altdkhyn Ela Aladae

May 09, 2025 -

Masshtabnoe Otklyuchenie Sveta V Sverdlovskoy Oblasti Posle Snegopada

May 09, 2025

Masshtabnoe Otklyuchenie Sveta V Sverdlovskoy Oblasti Posle Snegopada

May 09, 2025