Indian Insurers Advocate For Simplified Bond Forward Regulations

Table of Contents

Current Challenges Faced by Insurers in the Bond Forward Market

Navigating the current bond forward regulations in India presents significant hurdles for insurance companies. The intricate and often ambiguous rules create operational difficulties and substantially increase compliance costs. This stifles investment in the burgeoning Indian bond market and limits the ability of insurers to effectively manage their risk profiles.

The difficulties faced include:

- High transaction costs due to complex processes: The labyrinthine procedures involved in bond forward transactions lead to significantly higher transaction costs than in more streamlined markets.

- Limited access to hedging instruments: The restrictive regulatory environment limits the range of hedging instruments available to insurers, making it challenging to mitigate risks associated with their bond investments.

- Increased regulatory reporting burdens: Insurers are burdened with extensive and often redundant reporting requirements, diverting resources away from core business activities.

- Difficulty in forecasting regulatory changes: The lack of transparency and predictability in regulatory changes makes long-term investment planning extremely difficult for insurance companies. This uncertainty further discourages investment in the bond market.

The Insurers' Argument for Simplification

Indian insurers are strongly advocating for simplification of bond forward regulations, arguing that it's crucial for the health of both the insurance sector and the broader economy. Their arguments center around the significant benefits of a more streamlined regulatory framework.

Simpler regulations would:

- Improve risk management capabilities: With easier access to hedging instruments and clearer regulations, insurers can better manage their interest rate and credit risks, leading to greater financial stability.

- Increase investment in the Indian bond market: Reduced complexities and costs will encourage greater investment by insurance companies in Indian bonds, boosting liquidity and deepening the market.

- Enhance competitiveness of Indian insurance companies globally: A more efficient regulatory environment will place Indian insurers on a more level playing field with their global counterparts.

- Stimulate economic growth: Increased investment in the bond market will provide much-needed capital for Indian businesses, thereby stimulating economic growth and job creation.

Proposed Changes and Recommendations

To address the current challenges, Indian insurers are proposing several key regulatory changes. These suggestions, often echoed by industry bodies like IRDAI (Insurance Regulatory and Development Authority of India), aim to create a more transparent and efficient environment.

Specific recommendations include:

- Streamlining of documentation and reporting processes: Reducing the paperwork and simplifying reporting procedures would significantly reduce transaction costs and free up resources.

- Clarification of ambiguous regulatory provisions: Addressing the ambiguities within existing regulations will provide greater clarity and predictability for insurers.

- Harmonization of regulations with international best practices: Aligning Indian regulations with international standards will improve the integration of the Indian bond market with global financial markets.

- Increased transparency and predictability of regulatory changes: Greater transparency in the regulatory process would enable better long-term planning by insurers and boost investor confidence.

Potential Impact of Simplified Regulations

The potential benefits of simplified bond forward regulations are substantial, not just for the insurance sector but for the entire Indian economy. A more streamlined regulatory framework is expected to:

- Increase foreign investment in Indian bonds: A simpler and more transparent regulatory environment will attract greater foreign investment, deepening the Indian bond market.

- Improve access to capital for Indian businesses: Increased investment will provide businesses with greater access to affordable capital, fostering growth and innovation.

- Enhance stability of the Indian financial system: A more efficient and robust bond market will contribute to the overall stability of the Indian financial system.

- Greater participation of Indian insurers in global markets: Improved efficiency and competitiveness will enable Indian insurers to participate more effectively in global markets.

Conclusion

In conclusion, Indian Insurers Advocate for Simplified Bond Forward Regulations because the current complexities hinder efficient risk management, limit investment opportunities, and stifle the growth of the Indian insurance sector and broader economy. Simplifying regulations, as proposed by insurers and industry bodies, would lead to improved risk management, increased investment in the bond market, and enhanced competitiveness. Understanding the need for simplified bond forward regulations is crucial for the growth of the Indian insurance sector. Stay informed about developments in this area and support the advocacy efforts of Indian insurers for a more streamlined regulatory environment. The future of the Indian bond market and the insurance sector depends on it.

Featured Posts

-

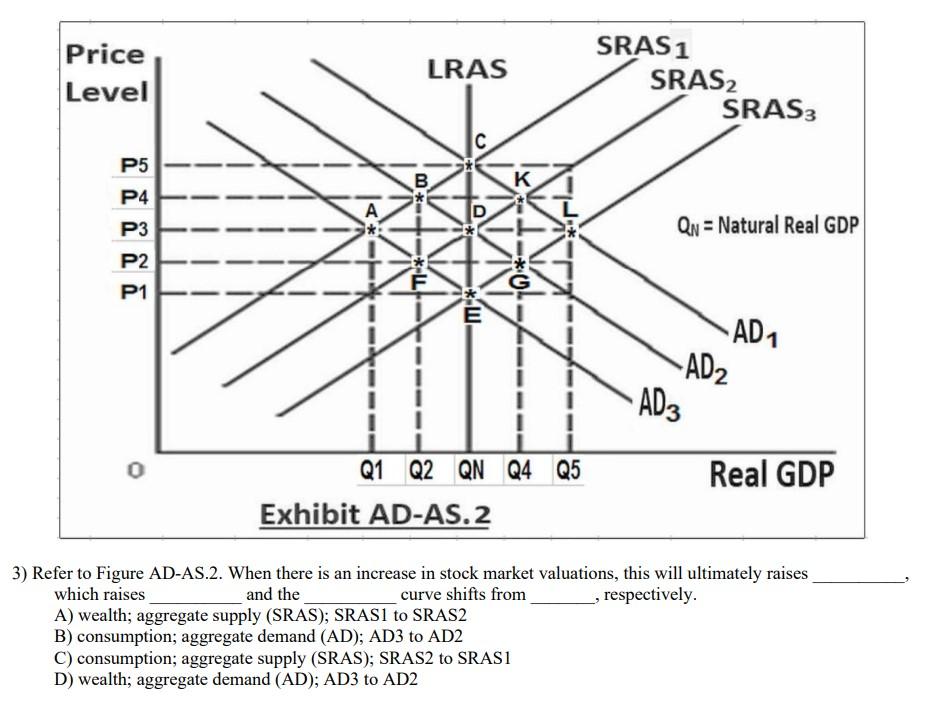

Stock Market Valuations Bof As Case For Investor Calm

May 10, 2025

Stock Market Valuations Bof As Case For Investor Calm

May 10, 2025 -

Nyt Strands Hints And Answers Game 403 Thursday April 10

May 10, 2025

Nyt Strands Hints And Answers Game 403 Thursday April 10

May 10, 2025 -

Palantir Stock A Comprehensive Look Before The May 5th Earnings

May 10, 2025

Palantir Stock A Comprehensive Look Before The May 5th Earnings

May 10, 2025 -

Concarneau Bat Dijon 0 1 Compte Rendu De La 28e Journee De National 2

May 10, 2025

Concarneau Bat Dijon 0 1 Compte Rendu De La 28e Journee De National 2

May 10, 2025 -

Solve Nyt Strands Game 403 Hints For Thursday April 10th

May 10, 2025

Solve Nyt Strands Game 403 Hints For Thursday April 10th

May 10, 2025