Indian Insurers Push For Relaxed Bond Forward Regulations

Table of Contents

Current Bond Forward Regulations Hampering Investment Strategies

Current regulations governing bond forwards for Indian insurers impose significant limitations on their investment choices. These restrictions significantly impact investment returns and overall profitability, hindering the growth potential of the sector. The existing regulatory framework includes several key constraints:

- Limits on exposure to bond forwards: Insurers face strict caps on the proportion of their investment portfolios that can be allocated to bond forward contracts. This limits their ability to effectively manage risk and capitalize on market opportunities.

- Restrictions on specific types of bonds: Regulations often restrict investment in certain types of bonds, narrowing the range of options available to insurers and potentially missing out on higher yield opportunities.

- Complex compliance requirements: The current regulatory framework is characterized by complex and often burdensome compliance requirements, diverting resources from core investment activities.

- Higher capital adequacy requirements: Insurers holding bond forwards often face higher capital adequacy ratios, tying up more capital and reducing their capacity for other investments.

These restrictions collectively stifle innovation and limit the ability of Indian insurers to optimize their investment strategies for maximum returns, placing them at a disadvantage compared to their global counterparts.

Arguments for Relaxation: Increased Investment Flexibility and Returns

The core argument for relaxing bond forward regulations centers on the significant benefits this would bring to the Indian insurance sector. Insurers contend that relaxed regulations would unlock:

- Better risk management through hedging strategies: Bond forwards provide crucial hedging tools to mitigate interest rate risk. Relaxed regulations would allow insurers to better manage their liabilities and protect policyholder interests.

- Increased investment returns by accessing a wider range of investment opportunities: Removing restrictions would open up access to a broader spectrum of investment opportunities, leading to potentially higher returns and improved portfolio performance.

- Improved portfolio diversification: Increased flexibility would allow insurers to diversify their portfolios more effectively, reducing overall risk exposure and enhancing stability.

- Enhanced competitiveness with global insurance players: Relaxed regulations would bring the Indian insurance sector in line with global best practices, enabling it to compete more effectively on the international stage.

"The current regulatory environment is stifling our ability to compete," says Mr. X, CEO of a leading Indian insurance company (replace with actual quote if available). "Relaxed regulations would allow us to optimize our investment strategies and better serve our policyholders."

Concerns and Counterarguments: Potential Risks and Regulatory Oversight

While the arguments for relaxation are compelling, concerns remain regarding potential risks associated with increased leverage and market volatility. Maintaining robust regulatory oversight is paramount. The key to successful reform lies in striking a balance between promoting growth and mitigating risk. This requires:

- Strengthened risk assessment frameworks: More sophisticated risk assessment models and stress testing methodologies are needed to accurately gauge potential risks associated with increased exposure to bond forwards.

- Enhanced regulatory monitoring: Increased scrutiny and monitoring of insurers' bond forward activities are essential to ensure compliance and prevent excessive risk-taking.

- Increased transparency and reporting requirements: More detailed and transparent reporting requirements would enhance regulatory oversight and public accountability.

- Stricter capital adequacy norms: While potentially reducing investment capacity, adjusted capital adequacy norms could act as a crucial safeguard against excessive leverage.

The Impact of Relaxed Regulations on the Indian Economy

Relaxing bond forward regulations could have a significant positive impact on the Indian economy. The potential benefits include:

- Stimulated economic growth: Increased investment by insurers in various sectors would stimulate economic activity and boost overall GDP growth.

- Increased contribution to GDP by the insurance sector: A more profitable and competitive insurance sector would contribute more significantly to India's GDP.

- Positive impact on the broader financial market: Greater participation by insurers in the bond market would enhance liquidity and efficiency.

- Job creation and foreign investment: A thriving insurance sector attracts foreign investment and creates numerous employment opportunities.

Conclusion

The debate surrounding the relaxation of bond forward regulations for Indian insurers is complex. While current regulations hinder investment strategies and profitability, concerns exist regarding potential risks associated with deregulation. A balanced approach is essential—one that promotes growth and competitiveness while mitigating risks through strengthened risk management frameworks and robust regulatory oversight. The Indian insurance sector's future hinges on finding a solution that benefits all stakeholders. Stay informed on the developments in the Indian insurance sector and the ongoing dialogue surrounding the relaxation of bond forward regulations. The future of investment strategies within the Indian insurance industry depends on a balanced approach to regulatory reform.

Featured Posts

-

Black Rock Etf Poised For 110 Growth Why Billionaires Are Investing

May 09, 2025

Black Rock Etf Poised For 110 Growth Why Billionaires Are Investing

May 09, 2025 -

Chief Justice Roberts Shares Anecdote About Being Mistaken For Former Gop House Leader

May 09, 2025

Chief Justice Roberts Shares Anecdote About Being Mistaken For Former Gop House Leader

May 09, 2025 -

Adae Markw Fyraty Me Alerby Alqtry Thlyl Bed Andmamh Mn Alahly

May 09, 2025

Adae Markw Fyraty Me Alerby Alqtry Thlyl Bed Andmamh Mn Alahly

May 09, 2025 -

Indias Stock Market Today Sensex Nifty 50 Close Flat Amidst Uncertainty

May 09, 2025

Indias Stock Market Today Sensex Nifty 50 Close Flat Amidst Uncertainty

May 09, 2025 -

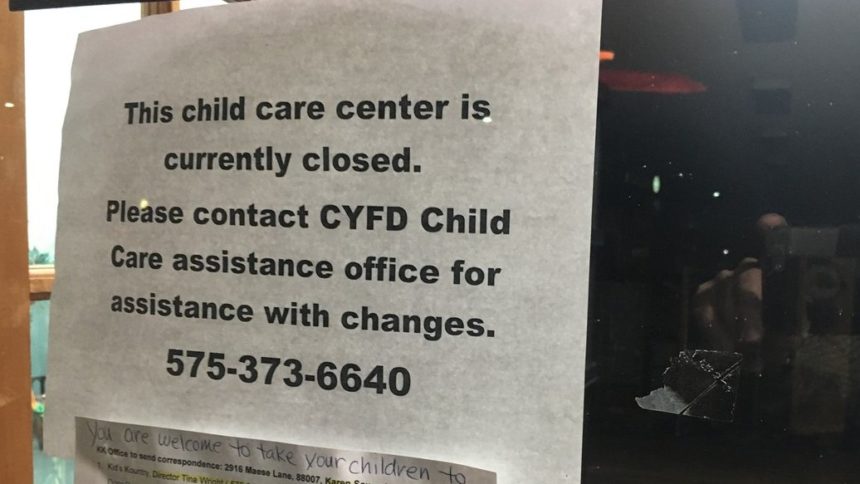

Nc Daycare Suspended State Action And Investigation Details

May 09, 2025

Nc Daycare Suspended State Action And Investigation Details

May 09, 2025