Indian Real Estate: Q1 2024 Investment Figures Show Significant Increase

Table of Contents

Analysis of Q1 2024 Investment Figures

Q1 2024 witnessed a substantial upswing in Indian real estate investment, exceeding projections and outperforming previous quarters. While precise figures vary depending on the source, preliminary data suggests a double-digit percentage increase compared to Q1 2023 and a considerable jump compared to the average quarterly investment over the past few years. This growth is not uniform across all sectors; however, it’s widely distributed.

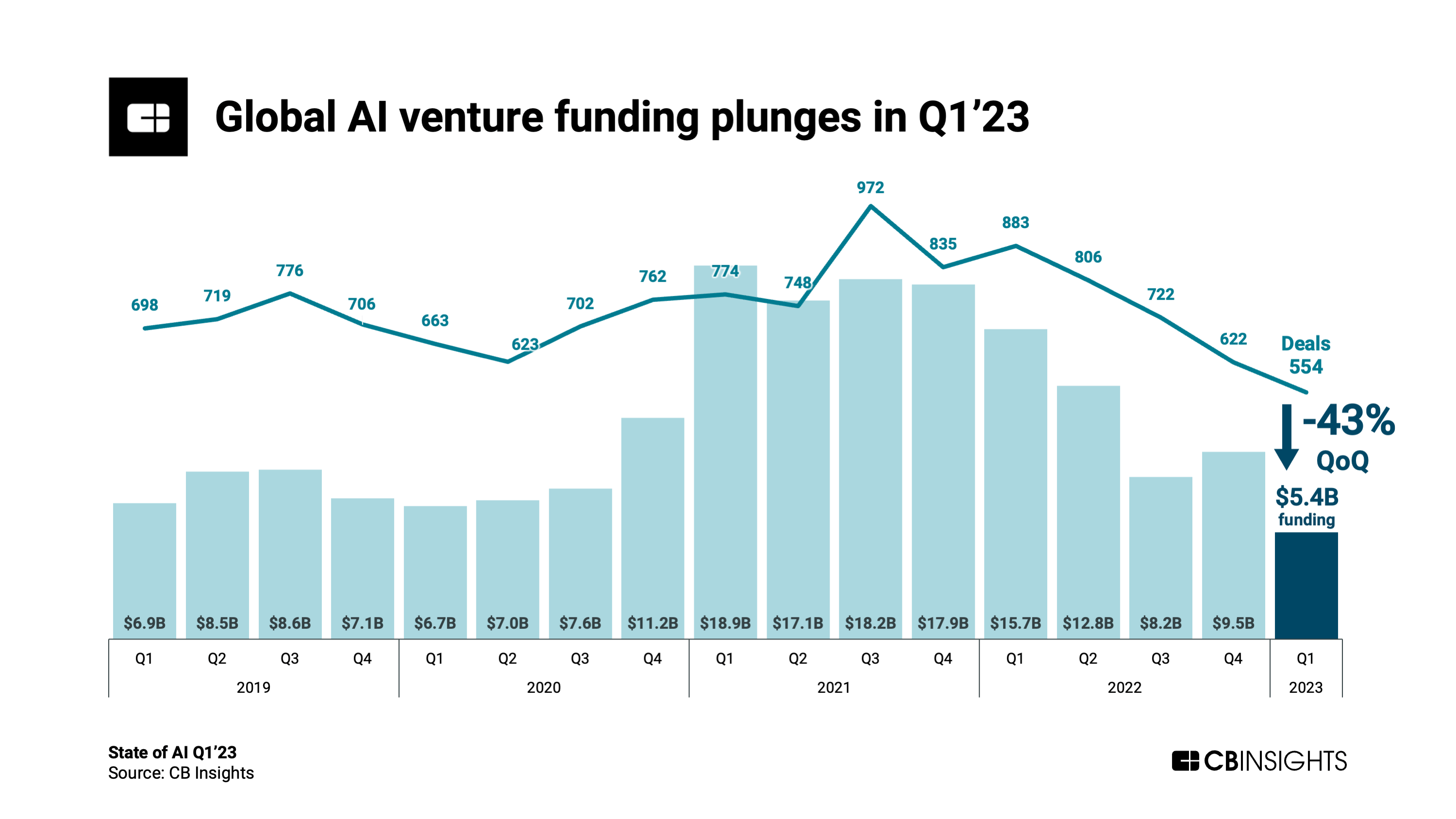

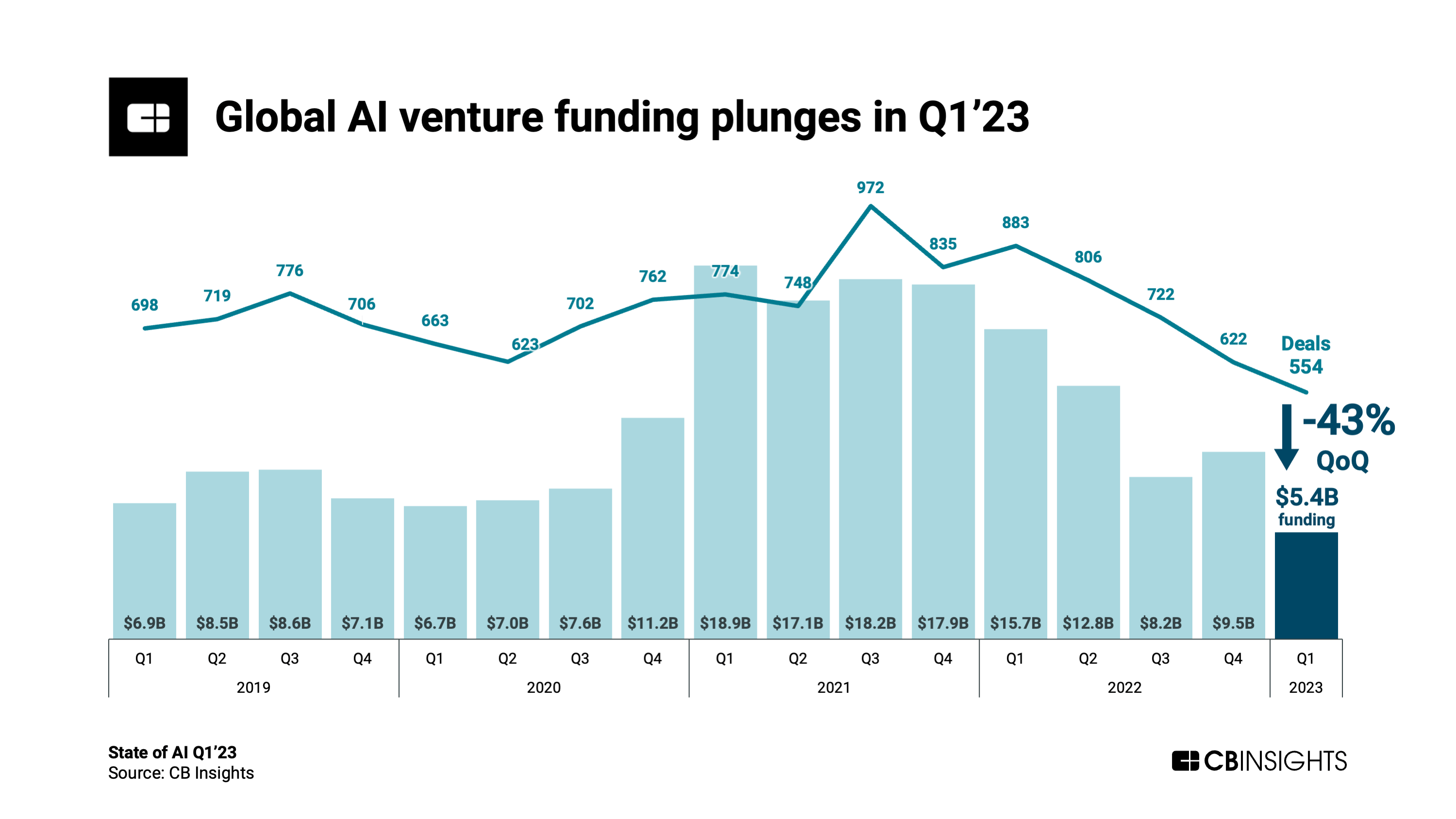

[Insert Chart/Graph here showing Q1 2024 investment figures compared to previous quarters/years]

The data reveals a strong performance across various property types:

- Residential: This segment continues to dominate, driven by increased demand from both first-time homebuyers and investors. The rise in affordable housing projects has further fueled this growth.

- Commercial: Office spaces in major metropolitan areas saw significant investment, reflecting the ongoing expansion of businesses and tech companies. Retail spaces also showed healthy growth, indicating a revival in consumer spending.

- Industrial & Logistics: This sector experienced a notable surge, fueled by the growth of e-commerce and the expanding manufacturing sector.

Geographically, major metropolitan areas like Mumbai, Bengaluru, and Delhi NCR demonstrated exceptionally strong growth, attracting substantial investment in both residential and commercial properties. These cities continue to be magnets for both domestic and international investors. Strong growth was also observed in Tier-2 cities, signifying a diversification of investment beyond the major metros.

Factors Driving the Investment Boom

Several interconnected factors have converged to create this favorable climate for Indian real estate investment.

Economic Recovery and Growth

India's robust economic growth has played a pivotal role in boosting real estate investment. The improved economic outlook has led to:

- Increased Disposable Income: Higher incomes have translated into greater purchasing power, allowing more individuals to invest in property.

- Improved Consumer Confidence: Positive economic indicators have instilled confidence in consumers, making them more willing to make significant investments like buying a home or commercial property.

- Lower Interest Rates (Historically): While interest rates have fluctuated, relatively lower interest rates on home loans have made property more accessible and affordable.

Government Policies and Initiatives

Government initiatives have significantly impacted the Indian real estate sector, creating a more investor-friendly environment. Key policy interventions include:

- Affordable Housing Schemes: Government schemes aimed at providing affordable housing have stimulated demand and increased investment in this segment.

- Infrastructure Development Projects: Massive investments in infrastructure development, such as improved roads, transportation, and utilities, have enhanced property values and attracted investment.

- Tax Benefits for Investors: Tax benefits and incentives for investors have further encouraged participation in the real estate market.

Increased Affordability and Financing Options

Improved accessibility to home loans and innovative financing schemes have played a significant role in driving demand. Factors contributing to increased affordability include:

- Lower Interest Rates on Home Loans (Historically): As mentioned previously, lower interest rates have made homeownership more attainable.

- Attractive Payment Plans: Developers are offering flexible payment plans and options, making property acquisition more manageable for buyers.

- Government Subsidies: Government subsidies and schemes have made homeownership more affordable for specific segments of the population.

Future Outlook and Investment Opportunities

Experts predict a sustained positive outlook for the Indian real estate market, although with some caveats. While the sector is expected to continue its growth trajectory, several factors need consideration.

The forecast suggests continued strong growth in the residential segment, particularly in affordable housing and mid-segment properties. Commercial real estate, particularly in technology hubs and major cities, is also anticipated to perform well. However, challenges remain, including potential interest rate hikes and the need for sustainable development practices.

Potential investment opportunities lie in:

- Tier-2 and Tier-3 cities: These cities offer relatively lower property prices and higher growth potential compared to major metros.

- Affordable housing projects: This segment is expected to see continuous growth, driven by strong demand and government support.

- Commercial real estate in technology hubs: Cities with a strong IT sector are expected to attract significant investment in office spaces.

However, it's crucial to remember potential risks, including regulatory changes, market fluctuations, and economic downturns. Thorough due diligence and professional advice are essential before making any significant investment decisions.

Conclusion: Investing in Indian Real Estate – A Promising Future

The significant increase in Indian real estate investment during Q1 2024 reflects a robust and dynamic market. Driven by a recovering economy, supportive government policies, and enhanced affordability, the sector presents promising opportunities for investors. While challenges exist, the overall outlook remains positive, suggesting a bright future for those seeking to explore Indian real estate investment opportunities. Before investing, conduct thorough research, consult with financial advisors, and utilize reputable property portals to identify suitable investment options. Don't miss out on the potential of the flourishing Indian real estate market!

Featured Posts

-

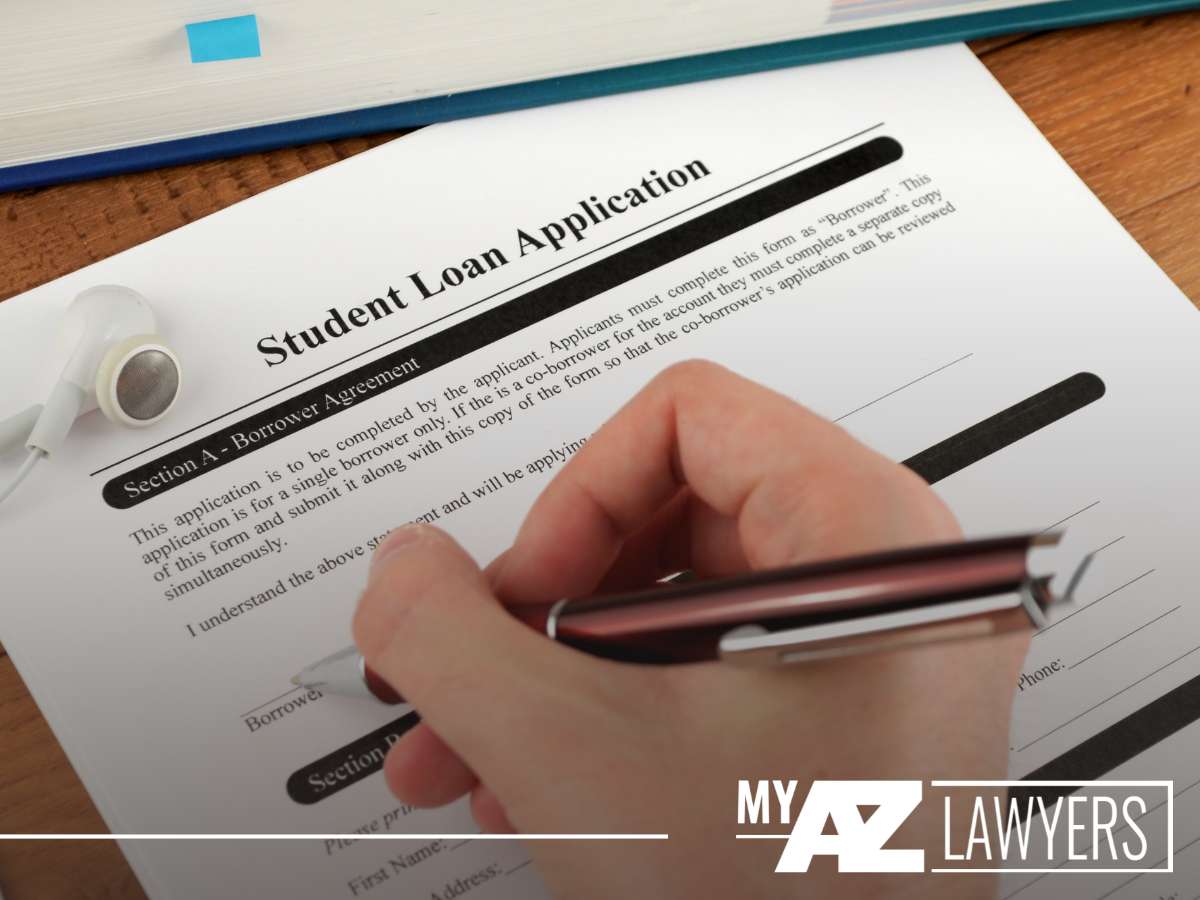

Student Loan Debt And Homeownership A Realistic Look

May 17, 2025

Student Loan Debt And Homeownership A Realistic Look

May 17, 2025 -

Los Angeles Wildfires And The Gambling Industry A Growing Concern

May 17, 2025

Los Angeles Wildfires And The Gambling Industry A Growing Concern

May 17, 2025 -

Crude Oil Market Analysis Key Developments On May 16

May 17, 2025

Crude Oil Market Analysis Key Developments On May 16

May 17, 2025 -

Stanovi U Inostranstvu Za Srbe Vodic Za Kupovinu

May 17, 2025

Stanovi U Inostranstvu Za Srbe Vodic Za Kupovinu

May 17, 2025 -

Nba Teisejas Pripazino Klaida Nulemusia Pistons Ir Knicks Rungtyniu Baigti

May 17, 2025

Nba Teisejas Pripazino Klaida Nulemusia Pistons Ir Knicks Rungtyniu Baigti

May 17, 2025

Latest Posts

-

The Proxy Statement Form Def 14 A Content Compliance And Best Practices

May 17, 2025

The Proxy Statement Form Def 14 A Content Compliance And Best Practices

May 17, 2025 -

Magic Johnsons Knicks Pistons Prediction Who Will Win

May 17, 2025

Magic Johnsons Knicks Pistons Prediction Who Will Win

May 17, 2025 -

Eid Al Fitr 2025 Dubai Issues Travel Alert Airlines Brace For High Passenger Volume At Dxb

May 17, 2025

Eid Al Fitr 2025 Dubai Issues Travel Alert Airlines Brace For High Passenger Volume At Dxb

May 17, 2025 -

Ta Zeygaria Ton Playoffs Nba And Oi Imerominies Ton Agonon 2024

May 17, 2025

Ta Zeygaria Ton Playoffs Nba And Oi Imerominies Ton Agonon 2024

May 17, 2025 -

Dubais Eid Al Fitr 2025 Travel Advisory Dxb Terminal 3 Passenger Increase Anticipated

May 17, 2025

Dubais Eid Al Fitr 2025 Travel Advisory Dxb Terminal 3 Passenger Increase Anticipated

May 17, 2025