Indonesia's Falling Reserves: Analyzing The Impact Of The Weakening Rupiah

Table of Contents

The Weakening Rupiah: A Primary Driver

Understanding the Rupiah's Depreciation

The Rupiah's depreciation against major currencies, particularly the US dollar, is a central factor in Indonesia's falling foreign exchange reserves. Several factors contribute to this:

- Global Economic Uncertainty: Global economic instability, including recessionary fears in major economies, creates a flight to safety, driving investors towards stronger currencies like the US dollar. This reduces demand for the Rupiah.

- US Interest Rate Hikes: The Federal Reserve's interest rate hikes increase the attractiveness of US dollar-denominated assets, pulling investment away from emerging markets like Indonesia and further weakening the Rupiah.

- Capital Outflows: Uncertainty often leads to capital flight, as foreign investors withdraw their investments from Indonesia, putting downward pressure on the Rupiah.

The consequences of a weaker Rupiah are significant:

- Increased Import Costs: A weaker Rupiah makes imports more expensive, contributing to inflation.

- Reduced Purchasing Power: Indonesians find that their money buys less, impacting their standard of living.

- Impact on Debt Servicing: Indonesian companies with foreign currency loans face higher debt servicing costs, potentially straining their finances.

The Role of Global Economic Conditions

Global economic headwinds significantly exacerbate the Rupiah's weakness. Factors such as:

- Inflation in Developed Nations: High inflation in developed countries forces central banks to raise interest rates, impacting global capital flows and further weakening emerging market currencies.

- Energy Price Volatility: Fluctuations in global energy prices, particularly oil, heavily impact Indonesia's trade balance, as it is a net importer of oil. This volatility contributes to Rupiah depreciation.

The impact of global recessionary fears cannot be overstated. A global slowdown reduces demand for Indonesian exports, worsening the trade balance and placing additional pressure on the Rupiah and foreign exchange reserves. Increased commodity prices, while potentially benefiting some Indonesian exporters, are often outweighed by the negative impact of higher import costs.

Impact on Indonesia's Foreign Exchange Reserves

Declining Reserves and their Implications

The weakening Rupiah directly impacts Indonesia's foreign exchange reserves. As the Rupiah depreciates, the value of Indonesia's reserves in US dollar terms decreases. Bank Indonesia, the central bank, intervenes in the foreign exchange market to support the Rupiah, often selling its reserves to buy Rupiah. However, continuous intervention can deplete reserves rapidly.

This decline in reserves has several implications:

- Reduced Ability to Defend the Rupiah: Lower reserves limit the central bank's ability to effectively manage currency fluctuations.

- Potential for Increased Volatility: Reduced reserves increase the risk of sharp and unpredictable fluctuations in the Rupiah's value.

- Impact on Import Capacity: Lower reserves constrain Indonesia's ability to finance imports, potentially impacting economic activity.

- Vulnerability to External Shocks: Lower reserves make Indonesia more vulnerable to external economic shocks and crises.

The Current Account Deficit and its Contribution

Indonesia's persistent current account deficit, where imports exceed exports, contributes significantly to the pressure on foreign exchange reserves. A deficit necessitates the purchase of foreign currency to finance the difference, putting downward pressure on the Rupiah and depleting reserves.

Addressing this requires a multi-pronged approach:

- Diversifying Exports: Indonesia needs to diversify its export base to reduce reliance on a few key commodities and increase export earnings.

- Strategies to Reduce Import Dependence: Implementing policies to promote domestic production and reduce reliance on imported goods is crucial for long-term sustainability.

- Impact on Long-Term Sustainability: A persistent current account deficit is unsustainable in the long run, necessitating structural reforms to improve the trade balance.

Consequences for the Indonesian Economy

Inflationary Pressures

A weaker Rupiah directly fuels inflation. Increased import costs translate into higher prices for consumer goods, impacting purchasing power and potentially leading to wage-price spirals.

- Impact on Consumer Prices: Higher import prices lead to higher consumer prices, reducing disposable income.

- Potential for Wage Increases: To compensate for inflation, workers may demand higher wages, further pushing up prices.

- Measures to Mitigate Inflationary Pressure: The government and Bank Indonesia must implement appropriate monetary and fiscal policies to manage inflation effectively.

Impact on Foreign Investment

Currency volatility significantly impacts foreign investment. Uncertainty about the Rupiah's future value can deter investors, leading to capital flight and hindering economic growth.

- The Role of Investor Sentiment: Investor confidence is crucial; volatility negatively impacts sentiment and reduces investment flows.

- Potential for Capital Flight: Investors may withdraw their investments to avoid losses due to currency fluctuations.

- Strategies to Attract Foreign Investment: Indonesia needs to implement policies to maintain investor confidence and attract foreign direct investment despite currency fluctuations, focusing on long-term growth prospects.

Government Policies and Responses

The Indonesian government and Bank Indonesia are implementing various measures to address the weakening Rupiah and declining reserves.

- Monetary Policy Adjustments: Bank Indonesia may adjust interest rates to manage inflation and attract foreign investment.

- Fiscal Policy Measures: The government may implement fiscal policies to stimulate economic growth and improve the trade balance.

- Potential Reforms to Strengthen the Economy: Structural reforms to improve the investment climate and boost productivity are essential for long-term economic resilience.

Conclusion

Indonesia's falling foreign exchange reserves are largely driven by the weakening Rupiah, exacerbated by global economic uncertainty and a persistent current account deficit. This trend has significant consequences for the Indonesian economy, including inflationary pressures, reduced foreign investment, and increased vulnerability to external shocks. Understanding the dynamics of Indonesia's falling reserves and the weakening Rupiah is crucial for navigating the current economic landscape. Further research into the effectiveness of government policies and the future economic outlook is necessary. Stay informed about developments in Indonesia’s foreign exchange reserves and the Rupiah’s performance to make informed decisions regarding investment and economic planning.

Featured Posts

-

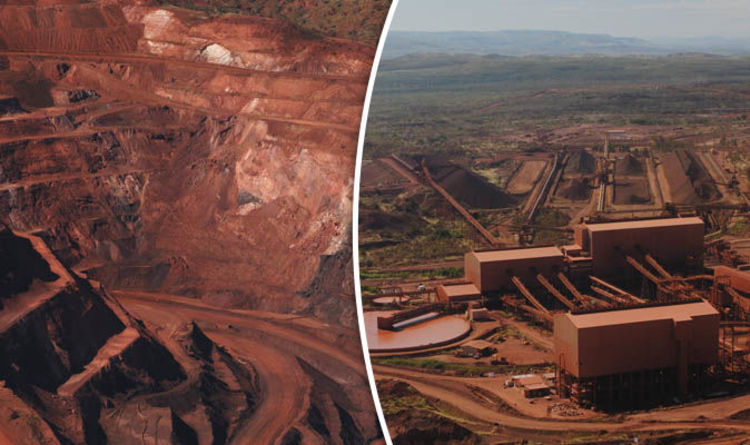

Iron Ore Price Drop Analysis Of Chinas Steel Industry Restrictions

May 10, 2025

Iron Ore Price Drop Analysis Of Chinas Steel Industry Restrictions

May 10, 2025 -

Jeanine Pirros North Idaho Trip What To Expect From The Conservative Talk Show Host

May 10, 2025

Jeanine Pirros North Idaho Trip What To Expect From The Conservative Talk Show Host

May 10, 2025 -

Jeanine Pirros Dc Attorney Bid The Impact Of A Past Drunk Episode

May 10, 2025

Jeanine Pirros Dc Attorney Bid The Impact Of A Past Drunk Episode

May 10, 2025 -

Uterus Transplantation A Pathway To Parenthood For Transgender Women

May 10, 2025

Uterus Transplantation A Pathway To Parenthood For Transgender Women

May 10, 2025 -

Understanding The Potential Trump Uk Trade Agreement

May 10, 2025

Understanding The Potential Trump Uk Trade Agreement

May 10, 2025